Update: New users can skip the Polymarket.us waitlist by registering with a phone number and entering the Polymarket promo code TWITTER to receive a $10 account credit. This promotion originated with the Twitter/X community but is available to all new users. Looking for more prediction market options? Check out our Kalshi referral code.

Polymarket is one of the largest prediction market apps in the world, is returning to the US in 2026. It’s a decentralized platform built on the Polygon blockchain. Market trading and payouts are denominated in USDC, but multiple cryptocurrencies and networks are supported for transactions.

Highly regarded for its speed and transparency, you’ll find a diverse range of markets available for trading. You simply choose “yes” or “no” on the outcomes of your choice. Prices will steadily evolve in response to market activity, and you can enter and exit positions at any time.

In this comprehensive review of Polymarket, we break down how it works, what you can trade, and how it compares to other platforms. We’ll cover the promo code, trading fees, how to enter and exit positions, actual insight from real users, and more to get you up to speed with trading on Polymarket.

Polymarket quick facts

| Key Features | Details |

| Promo code | TWITTER ($10 dollars + skip US waitlist) |

| Best feature | Decentralized, blockchain-based prediction market with global access. |

| Regulator | In the process of resuming operations in the US via QCX LLC (d/b/a Polymarket US), a CFTC-designated contract market (DCM) and clearinghouse acquired in 2025. |

| Available states | In beta mode for US users, preparing for full relaunch. |

| Minimum deposit | No fixed minimum. |

| Cashout speed | Instant settlement once the market resolves. Withdrawal times are typically within minutes. |

| Mobile app | Available for iOS and Android |

| Market Volume 7D | $1.7B |

| Liquidity | Significant liquidity in major markets, variable in other segments. |

| Fees | 1 basis point (0.01%) on the Total Contract Premium (US platform). |

Latest news and updates

- January 21: Portugal’s gaming regulators block access to Polymarket amid reports of large trading volumes on the country’s presidential election markets.

- January 19: Polymarket reaches a new all-time record of $1.76 million in weekly notional volume.

- January 12: Polymarket generated $1.503 billion in weekly notional volume, a new all-time high for the app.

- January 9: Polymarket announces a partnership with the Golden Globes, becoming the exclusive prediction market partner of the awards show.

- January 8: The New York Rangers and Polymarket announce an agreement that makes Polymarket the official prediction market partner of the team. The NHL became the first major U.S. sports league to embrace prediction market partnerships in October.

- January 7: The “Will the U.S. invade Venezuela by Dec. 31” prediction market as “No,” sparking controversy on a market that generated more than $10.5 million in volume on Polymarket.

- January 7: Polymarket announces a partnership with Dow Jones, The deal brings Polymarket’s real-time prediction market data to media outlets like The Wall Street Journal, MarketWatch, Barron’s, and Investor’s Business Daily.

- January 6: Polymarket implemented fees on 15-minute crypto up/down markets as a deterrent to bot trading, and the update is garnering positive reviews from users.

- January 5: Polymarket announces intentions to launch real estate prediction markets in partnership with on-chain real-time housing data platform Parci.

- January 5: Prediction markets platforms generate $5.3 billion in volume for the final full week of 2025, including all-time high volumes from Polymarket.

- December 6: MetaMask launched prediction markets via an exclusive partnership with Polymarket.

- November 25: Polymarket received an Amended Order of Designation from the CFTC, officially clearing its path to operate as a fully regulated exchange in the United States. The approval allows the platform to offer “intermediated access”—meaning users can trade through futures commission merchants and traditional brokerages. This marks Polymarket’s formal return to the U.S. after paying a $1.4 million fine and exiting in 2022. CEO Shayne Coplan praised the current administration, saying “this admin and commission are built different.”

- November 20: Per a Bloomberg report, Polymarket is in talks to raise additional funding at a $12 billion valuation, up 20% from its previous $10 billion round. The timing—following Kraken’s $800 million raise and confidential IPO filing—has sparked speculation that Polymarket may pursue a public listing. The platform now counts over 1.3 million traders and has processed more than $18 billion in cumulative trading volume.

- November 13 — Polymarket announced a multi-year exclusive deal with TKO Group Holdings to become the official prediction market for UFC and Zuffa Boxing. The integration will feature a real-time “Fan Prediction Scoreboard” during broadcasts showing shifting probabilities as fights unfold.

- November 12: Polymarket reopened to select US users in beta mode, with live trades on real contracts. The company acquired CFTC-licensed exchange QCX LLC for $112 million earlier this year, providing the regulatory foundation for re-entry.

- November 11: PrizePicks announced a multi-year deal to integrate Polymarket’s event contracts into its upcoming prediction markets platform. PrizePicks recently became the first DFS operator registered as a Futures Commission Merchant.

Pros

- Decentralized platform: Built on the Polygon blockchain, trade directly without intermediaries.

- Global access: Open to traders worldwide, preparing for a return to the US.

- Market diversity: Covers a broad range of interests, including crypto, economics, politics, and sports.

- Fast settlement: Markets resolve and settle quickly, with funds available instantly.

Cons

- US Relaunch Pending: Currently in beta made as it prepares for return to the US.

- Crypto-only: Deposits, trading, and withdrawals require USDC and a connected crypto wallet. No fiat support.

- Learning Curve: Prediction market trading is similar to futures markets. It may take time for new users to get up to speed.

- Variance: Price volatility can be higher in illiquid markets.

What is Polymarket, and is it legal?

Polymarket is a decentralized prediction market that allows users to trade on real-world events using cryptocurrency. Founded in 2020 by Shayne Coplan, the platform was built on the Polygon blockchain to make information markets accessible.

Users trade “Yes” or “No” shares on the likelihood of future outcomes in a variety of markets. After gaining traction following its debut, Polymarket exited the US market in 2022 after reaching a settlement with the CFTC on the offering of unregulated financial products.

Polymarket continued operating globally, emerging as the world’s largest prediction market platform. In 2025, the company acquired QCEX, a CFTC-registered exchange, and subsequently announced plans to return to the US.

Latest news on Polymarket’s growth & market expansion

Since its debut, Polymarket has grown into one of the largest and most liquid prediction markets in the world. The company’s early traction was derailed in 2022. It was forced to exit the US over allegations it was operating an unregistered derivatives trading platform

Polymarket has been operating globally since then, soaring in usage, with volume reportedly over $3 billion in October 2025 alone. The company completed its initial US relaunch in January 2026 debuting with sports markets only, after receiving a green light from the CFTC following its acquisition of a registered exchange.

Often viewed as the global leader in the prediction market space, Polymarket will face stiff competition from Kalshi, which has emerged as the dominant US platform.

How Polymarket works

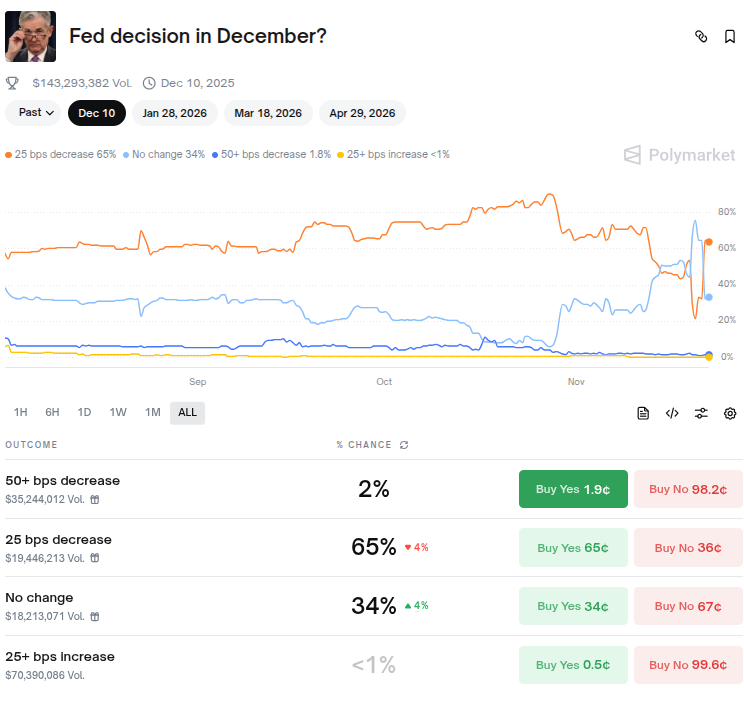

Polymarket is a decentralized prediction market that lets users trade on the outcome of real-world events. Each market centers on a topic that will be resolved in he future. Examples of markets available for trading include:

- Fed decision in January?

- What price will Bitcoin hit in 2026?

- Republican presidential nominee 2028?

- Heisman Trophy winner?

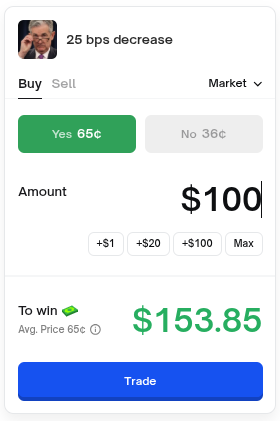

Each contract is priced between $0.01 and $0.99, reflecting the collective probability that the event will occur. For example:

- A “Yes” share priced at $0.72 signals a 72% market belief that the event will happen.

- A “No” share priced at $0.28 implies a 28% belief that it won’t.

When the event resolves, winning shares are paid out at $1 each, while losing shares settle at $0. The difference between your purchase price and payout determines your profit or loss. Consider the following scenario:

- You buy 100 “Yes” shares on “Bitcoin above $100,000 by December” at $0.45, for a total of $45.

- If the event resolves in your favor, your payout is $100. Your profit is $55, less fees.

- If Bitcoin fails to hit that mark, your contract expires worthless. You’re out $45.

Learn: How prediction markets work

Markets are resolved by independent on-chain oracles, which verify outcomes using publicly available data. You can enter or exit positions at any time before resolution, buying or selling shares based on how market sentiment shifts.

Polymarket’s decentralized model means pricing adjusts dynamically according to user demand rather than a central exchange operator. Open access and transparency have helped make it a standout option and a global leader in prediction market trading.

Polymarket’s global platform has traditionally not charged fees, but began introducing small taker-only fees on 15-minute crypto markets in early 2026. Polymarket US charges a flat 0.10% taker-only fee on total contract value, which is much lower than any rival regulated exchange.

| Feature | Polymarket | Kalshi | PredictIt | Sportsbooks |

| Value score | High: Low fees, transparent, fast on-chain settlement | High: Low fees, regulated, compliant US exchange | Low: High fees, limited markets, slow payout | Medium: Bonuses, but higher vig/fees |

| Market depth | High: Deep liquidity on global and crypto-driven events | Medium-High: Deep liquidity on macro and political events | Low: Limited contract sizes, caps | High: Deep for popular sports, variable on props |

| Trading fees | Minimum taker-only fees; minimal blockchain costs | $0.01–$0.02 per contract | None | ~5–10% vig on bets |

| Profit fees | None; traders keep full winnings | None; standard exchange fees only | 10% on profits, 5% withdrawal fee | None (fees embedded in odds) |

| Resolution method | Independent oracles, verified on-chain | CFTC-regulated, third-party sources | Market operator decision | Official league/event results |

| Tax reporting | Likely 1099 forms upon US return | 1099 forms provided for US users | Limited; typically no tax forms issued | 1099 forms provided for US users |

| Level of difficulty | Medium: Requires crypto wallet and blockchain familiarity | Easy: Regulated exchange with a clear interface | Easy: Web-based, simple interface | Easy: App/web-based, familiar to most users |

Markets available for trading

Polymarket offers a diverse range of markets for trading. No matter your interests, you can easily find a fit. Popular attractions include crypto, economics, politics, and sports. Below, you’ll find a sampling of what’s available in featured categories, along with examples of pricing.

| Category | Market Question | Example Pricing |

| Politics | Democratic Presidential Nominee 2028 | -Gavin Newsom, 38 cents |

| Sports | Pro football: Buffalo vs. Houston game winner | -Bills, 71 cents |

| Finance | Largest company end of November? | -Nvidia, 98 cents |

| Crypto | What price will Ethereum hit in November? | -2,600, 49 cents |

| Geoplitics | Xi Jinping out in 2025? | -No, 98 cents |

| Earnings | Will BJ’s Wholesale Club Holdings (BJ) beat quarterly earnings? | -Yes, 91 cents |

| Tech | Which company has best AI model end of November? | -Google, 98 cents |

| Culture | Which movie has biggest opening weekend in 2025? | -A Minecraft Movie, 68 cents |

| World | Will the EU impose new tariffs on US goods in 2025? | -Yes, 73 cents |

| Economy | How many Fed rate cuts in 2026? | -Zero, 3 cents |

| Elections | Portugal Presidential Election | -Luis Marques Mendes, 46 cents |

| Mentions | What will Keir Starmer say at the next Prime Minister’s Questions event? | -Emergency, 59 cents |

How to buy and sell contracts at Polymarket

To buy and sell contracts at Polymarket, you’ll need to register for an account. It’s a quick and painless process that takes just a few minutes. From there, head to your account section and add funds to trade with. You can transfer from an exchange or use MoonPay to purchase USDC. When your account is fully approved, deposits will process seamlessly and instantly.

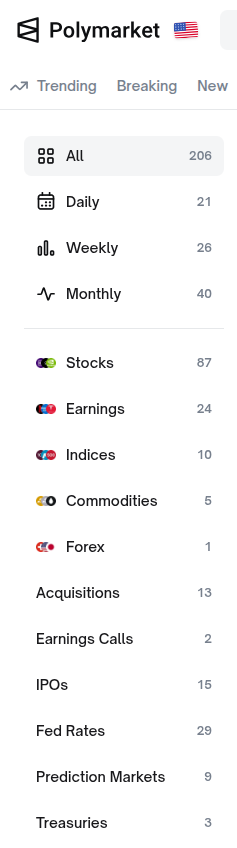

Once you’re all set up, you can start browsing the available markets to see what you want to trade. The default main screen will feature a selection of currently trending markets. There are also dedicated tabs for top categories that allow you to drill down further into a specific area of interest.

Once you see a trade that you’re interested in, tap it to expand the details.

You’ll see the complete details, including current trading volume and prices for each selection. When you’re ready to place the order, tap your choice and enter the amount that you want to trade.

Once you click trade, it’ll process instantly. You can easily track the progress of your open positions in your account section. Navigation is super smooth at Polymarket. From signing up to adding funds, placing trades, to monitoring your positions, the platform delivers a user-friendly experience.

Polymarket vs. Other Prediction Market Apps

Here’s a detailed look at how Polymarket compares to other leading prediction market apps.

Polymarket vs Kalshi:

- Polymarket is a decentralized, crypto-based prediction market that lets users trade on global events using USDC.

- The Kalshi app is a fully regulated US exchange operating under CFTC oversight, with USD-based trading and clear tax reporting.

- Polymarket emphasizes speed, market variety, and decentralization, while Kalshi prioritizes regulation, structure, and traditional accessibility.

- Polymarket continues to prepare for its return to the US.

Polymarket vs PredictIt:

- Polymarket offers significantly more liquidity, faster settlement, and a wider variety of markets than PredictIt.

- PredictIt operates under a limited exemption, with strict position caps and slower withdrawals.

- Polymarket supports global access and crypto-based trading, while PredictIt is limited to US political markets with tighter constraints.

- Users looking for scale, volume, and market diversity are better off at Polymarket, while PredictIt appeals to those focused specifically on US politics.

Polymarket vs Sportsbooks:

- Polymarket uses market-based pricing where traders buy and sell event shares directly with each other. Its markets cover politics, crypto, world events, entertainment, and some sports.

- Sportsbooks use fixed odds set by the house and are almost entirely focused on sports wagering.

- Polymarket offers global access through crypto, while sportsbooks are regulated state-by-state and operate in limited jurisdictions.

- Sportsbooks appeal to bettors who want traditional wagering, while Polymarket suits traders seeking fast-moving, peer-to-peer markets across a wider range of topics.

| Feature | Polymarket | Kalshi | PredictIt | Sportsbooks |

| Best for | Global traders who are familiar with crypto and are looking for decentralized markets. | US traders who want a fully regulated, USD-based event exchange | Casual U..S. traders, political research. | Sports bettors who are looking to wager on fixed odds. |

| Regulatory status | Decentralized platform that’s preparing for a CFTC-approved US return | Fully CFTC-regulated as a Designated Contract Market (DCM) | Operating under a limited CFTC exemption. | Regulated by individual states. |

| Minimum deposit | No minimum | $10 | $10 | Varies by sportsbook, typically $5-$10. |

| Payout/currency | USDC | USD | USD | USD |

| Available in | Global, US return soon | All 50 US. states | US | 39 US states plus Washington, D.C. |

| Difficulty level | Medium. An understanding of cryptos is helpful. Broad range of markets to choose from. | Easy to medium: simple yes/no markets, but resembles futures-style trading | Easy. Web-based with limited markets. | Easy. There is an Initial learning curve for those unfamiliar with sports wagering. |

What others are saying about the app

While reviewing Polymarket, we checked out the feedback across major review hubs. We found a mixed bag. On TrustPilot, it has a poor rating of 1.3. Common complaints include price moves based on “whale” trades, while a handful alleged they were trading against bots.

On the App Store, the platform has a much more favorable rating of 4.8, while it currently stands at 2.8 on Google Play. Positive reviewers touted the depth of markets and ease of use, while several complaints centered on the crypto-only banking options.

Polymarket does make it crystal clear that it’s a crypto-focused environment. Our experience aligned more with the iOS reviewers. During our test runs, we had a seamless and hassle-free experience. Polymarket deserves solid marks for its iOS and Android apps.

Polymarket deposit and withdrawal options

Polymarket is a crypto-only platform. All deposits and withdrawals are handled in USDC. To fund your account, you connect a compatible crypto wallet and transfer USDC on a supported network. Deposits are processed instantly on Polygon or other supported networks.

Withdrawals are equally fast, with users able to move USDC back to their wallets on the same network they deposited from. Polymarket does not charge fees upon withdrawal, but standard blockchain network fees may apply. Timing varies based on network congestion, but is generally fast.

| Method | Fees | Minimum | Withdrawal Supported |

| USDC (Polygon network) | Network fees only (low) | No platform minimum | Yes |

| USDC (Ethereum or other supported networks) | Network fees may vary | No platform minimum | Yes |

How to contact customer support

There are several ways for users to get help from Polymarket customer support.

Options

- Live chat: Available directly on the website through the support widget

- Discord: Active server with a dedicated ticketing system

- Email: [email protected]

- Social: Active presence on X: @polymarket

- Help Center: Extensive guides

While reviewing Polymarket, we found a mixed bag of feedback from users. Some reviewers had positive customer support experiences, while others were unhappy with both wait times and the helpfulness of the answers they received.

During our own test, we used the chat feature and received an answer within minutes. We also found the help center to be informative and useful. While we had a positive experience, numerous negative reviews suggest Polymarket has lots of room for improvement.

Who is Polymarket best for?

Polymarket is a great fit for traders who are comfortable using cryptocurrency. It’s especially appealing to users who value decentralization, low fees, and the ability to trade global events with deep liquidity. Data-driven traders will feel right at home on the platform.

It’s not the best match for beginners who prefer traditional banking or anyone unfamiliar with blockchain transactions. For those used to fixed odds environments or trading in other financial markets, know that there is a learning curve when getting started with prediction markets.

Final rating 4.5 out of 5.0

Polymarket has become one of the most influential prediction market platforms in the world. Its decentralized structure and deep liquidity have made it a hit. It’s a great fit for users who want speed, transparent trading, a wide range of markets, and global access.

The platform brings plenty to the table, and there should be more to come as its re-entry to the US market continues to play out. Our rating could rise even further as the platform continues to refine its user experience.

- Banking: If you only want to deal with crypto, you’ll be right at home here. Those who want the additional flexibility of leaning on traditional banking methods as needed will have to wait and see if any new options will be added.

- Support: Common customer complaints on major review platforms center around customer support, both helpfulness and wait times. Polymarket could benefit from a greater focus on improving the customer experience here.

- Data: The platform’s “breaking” section provides real insight into the biggest market movers, which is notably lacking at some competitors. Adding some additional simple volume tallies without the need for excessive filtering would help it stand out even more.

Prediction markets continue to evolve quickly. Polymarket has positioned itself as one of the clear leaders in the space. Whether you’re an experienced trader or completely new to the game, it’s more than deserving of a spot in your lineup.

FAQs

Can I withdraw my winnings to a bank account?

Indirectly. You withdraw USDC to your wallet, then use an exchange or off-ramp service to convert it to fiat. Polymarket itself does not handle bank withdrawals.

How does Polymarket determine market outcomes?

Outcomes are resolved through independent oracles and verified third-party data sources. Once resolved, winning shares pay out $1 and losing shares settle at $0.

Do I need crypto experience to use Polymarket?

Some, as you’ll need to understand how wallets work and be comfortable with transferring. New users may need a brief learning period before trading comfortably.

Is Polymarket good for beginners?

It can be, but only if you’re comfortable with crypto basics. For those new to wallets or stablecoins, Kalshi or another regulated platform may feel more familiar.

Can I cancel a trade after submitting it?

No. Once a trade executes on-chain, it’s final. You can exit by selling your shares before the market settles.

Can Polymarket markets be manipulated?

Large trades can move prices in low-liquidity markets, but outcomes cannot be manipulated. All contracts settle based on independent, verifiable data sources, not trader activity. Price swings reflect supply and demand, while settlement is locked to official results.

Does Polymarket limit how much I can trade?

There are no fixed position caps for most Polymarket markets. Your limits depend on available liquidity and how much USDC you choose to risk. High-volume markets can support large positions, while smaller markets may require more cautious sizing.