Crypto.com’s prediction market platform offers a way for users to trade contracts on real-world event outcomes. Top features include market-driven pricing, low contract minimums, seamless transactions, and integration across the broader Crypto.com platform.

The event contracts are a derivatives product offered by Crypto.com | Derivatives North America (CDNA), a CFTC-regulated exchange. They are legal to trade in 49 U.S. states and Washington, D.C. New York is the lone outlier due to regulatory hurdles.

In this complete review of Crypto.com prediction markets, we have full details on how the platform works, including contract pricing and fees. We also take a look at what real traders are saying to give you further insight into Crypto.com prediction market trading.

Crypto.com quick facts

| Key Features | Details |

| Crypto.com promo code | Not available |

| Best feature | CFTC-regulated prediction market trading that’s available to US investors and is integrated with the Crypto.com ecosystem. |

| Regulator | Commodities Futures Trading Commission |

| Available states | 49 states (all but NY) + Washington D.C. |

| Minimum deposit | $1 |

| Cashout speed | Quick payments after event settlement. Withdrawals within the app are typically instant, but may take a few hours to an external wallet. Bank transfers for fiat currency could be up to 1 or more business days. |

| Mobile app | Available on iOS and Android |

| Liquidity | It can be high for major events. Real-time market-driven pricing is always visible. |

| Fees | The total fee per contract can range from zero to $0.20 ($0.10 exchange fee and $0.10 technology fee), depending on trade and settlement. |

Latest news and updates

- December 11, 2025 – Crypto.com, Kalshi, Robinhood, Coinbase, and Underdog announced the formation of the Coalition for Prediction Markets. The new trade group aims to defend federal regulation through the CFTC.

- November 21, 2025: Fanatics announced a partnership with Crypto.com to launch a prediction markets platform, with CEO Michael Rubin revealing the deal on CNBC. The platform is set to launch within weeks, though details about its features and scope remain unknown.

- November 20, 2025: Crypto.com signed an agreement to handle custody and trading services for VerifiedX, a Layer 1 blockchain and Bitcoin sidechain. The deal covers $1.5 billion in digital assets and includes over-the-counter trading support. This is the second collaboration this year, building on a payments integration from September.

- November 11, 2025: Crypto.com began providing trading, custody, and staking infrastructure for IP Strategy, a Nasdaq-listed company focused on intellectual property tokenization. The arrangement covers 52.5 million $IP tokens worth approximately $230 million.

- November 4, 2025: Crypto.com announced a partnership with Hollywood.com to roll out prediction markets centered on pop culture outcomes. Fans can now trade on outcomes tied to movies, TV, music, and award shows. The contracts run through CDNA, Crypto.com’s CFTC-registered derivatives exchange and clearinghouse. This expands Crypto.com’s prediction markets footprint beyond sports and politics into entertainment verticals.

Pros

- Regulated: Prediction market event contracts are a derivatives product offered by Crypto.com | Derivatives North America (CDNA), a CFTC-regulated exchange.

- Availability: You can trade Crypto.com prediction markets in 49 states (all but NY) and Washington, D.C.

- Options: Also offers trading of cryptocurrencies, stocks, ETFs, and more on one convenient platform.

- Platform: The mobile app is intuitive and user-friendly, making it a great option for both new and experienced traders.

Cons

- Access: You have to complete a multi-step sign-up process to get started, plus get approval for trading prediction markets.

- Fees: Will vary based on trading and settlement. Can be zero in certain cases, but could also be up to $0.20 per contract.

- Environment: While currently regulated, there has been state pushback along with questions on future CFTC status.

What is Crypto.com, and is it legal?

Crypto.com is a financial services company based in Singapore. Initially founded as Monaco Technologies in 2016 by Kris Marszalek, Rafael Melo, Gary Or, and Bobby Bao, the company has seen exponential growth, surpassing 100 million global users in May 2024. It remains privately held and is operated by Foris DAX Asia, with the founders holding key roles.

Featured offerings include a mobile app and exchange that supports trading of over 400 cryptocurrencies, with no added fees on deposits. In 2021, the company made global headlines with a massive naming rights deal that rebranded the Staples Center, home to the Los Angeles Lakers, as Crypto.com Arena.

Crypto.com’s first offering in the US was a Metropolitan Commercial Bank Visa prepaid card. In 2021, they acquired Nadex and Small Exchange, U.S.-based regulated exchanges for futures and options. The company launched an exchange for U.S. institutional and advanced traders in early 2025, followed by the introduction of stock and ETF trading services in the U.S.

Crypto.com enters prediction markets

Crypto.com entered the prediction markets space in December 2024. The launch followed submission of product filings to the Commodity Futures Trading Commission. Sports event contracts are regulated as derivative products under the Commodity Exchange Act.

They first launched yes/no contracts on NFL teams to win the Super Bowl. Crypto.com has steadily expanded its sports prediction markets to include additional events. Highlights have included NFL playoff games, college football bowl games, and March Madness.

The platform has also increased its offerings to include single games, such as the winner of an NBA Playoffs matchup. As derivative products, they are distinguished from traditional sports betting. However, there has been state pushback questioning its legality.

States, including Nevada and New Jersey, have sent cease and desist letters to Crypto.com, plus other leading prediction sites such as Kalshi. The markets offered by the company operate through Crypto.com | Derivatives North America (CDNA), a CFTC-regulated exchange.

In May 2025, Crypto.com further broadened its prediction market offerings by introducing contracts for political and economic events. The site also notes that culture and financial prediction trading are “coming soon.”

In Oct. 2025, Trump Media & Technology Group announced it had partnered with Crypto.com to develop a new product called “Truth Predict”.

How Crypto.com Works

Crypto.com provides a venue for users to forecast the outcome of real-world events. Prediction market contracts are available for trading on various outcomes, including happenings in sports, economics, and elections. Examples include:

- NBA Championship 2026 Winner

- Will the Fed cut rates?

- Democratic Primary for NYC Mayor Winner

To trade on these events, you purchase a “Yes” or “No” contract based on what you think is going to happen. The pricing reflects the market consensus and serves as an indicator of the probability of the outcome, but not a guarantee. Contracts are set with a value of $10 or $100. As an example, consider these two NBA markets:

- Minnesota Timberwolves vs. Oklahoma City Thunder

- Timberwolves: Yes, $2.70 (27%)

- Thunder: Yes, $7.80 (78%)

- NBA Championship 2025 Winner

- Thunder: Yes, $80.00 (80%)

- Thunder: No: $24.00 (24%)

Regardless of the pricing scale, the listings also include the percentage chance of the outcome to make shopping for appealing opportunities that much easier. The standard trading fee of $0.20 ($0.10 exchange fee and $0.10 technology fee) is attached to each contract, with a maximum position limit of 250,000. Fees will vary based on trade and settlement.

- If you open or close a contract before expiration, it’s $0.20 per contract.

- If your contract settles in-the-money (ITM) at expiration, the technology fee is waived for a total of $0.10 per contract.

- If your contract settles out-of-the-money (OTM) at expiration, no fees are charged.

For trading, orders are submitted as Market Orders with protection, or Immediate-or-Cancel. The latter calls for immediate execution or cancellation. The former provides protection in the form of slippage tolerance, allowing your order to go through if the price moves from trade to execution. It defaults to $0.50 per contract and can be adjusted on the order input screen.

Contracts are settled instantly once the event resolves. If you make the right call on a contract, your payout is based on the market value. Consider the following:

- Example 1:

- You buy one “Yes” contract on the Timberwolves to win the game at $2.70.

- The total outlay is $2.90: the price of the contract plus a $0.20 fee.

- If they win, you’re paid out $10 for making the correct call.

- Your profit is $7.20: the amount of your winnings ($10) less the total cost ($2.80 – technology fee waived for in-the-money settlement).

- Example 2:

- You buy one “Yes” contract on the Thunder to win the title at $80.

- The total outlay is $82: the price of the contract plus a $2 fee.

- If they win, you’re paid out $100 for making the correct call.

- Your profit is $19: the amount of your winnings ($100) less the total cost ($81 – technology fee waived for in-the-money settlement).

For US users, Crypto.com provides an easy way to get up and running with prediction market trading. After you tackle the sign-up process, you’ll find a smooth platform that’s easy to use and comparable to the experience you’ll have at Robinhood.

Crypto.com is slightly ahead in terms of available markets, but both have designs on expanding offerings in the future. One of the biggest differences to account for is fees. At Robinhood, it’s $0.02 per contract, while Crypto.com varies from zero to $0.20 depending on settlement.

The max is charged for trading in and out before expiration, while no fees apply on out-of-the-money settlements. For a winning trade, you’re looking at $0.10 per contract. To illustrate, if you have a winner on 100 contracts at Robinhood, it’s $2 in fees.

Over at Crypto.com, the fee would be $10. That’s quite the difference to account for, making Robinhood the winner here hands down. If the market you want to trade is available on both platforms, Robinhood provides a better value opportunity.

| Features | Crypto.com | Polymarket | Predictit | Sportsbooks |

|---|---|---|---|---|

| Value score | Medium: US-regulated, available in 49 states, variable fees. | Medium: No U.S. access, low fees, high liquidity | Low: High fees, limited markets, slow payout | Medium: Bonuses, but higher vig/fees |

| Market depth | Medium. Initially sports-focused, expanding into other areas. | High: Deep liquidity on global events | Low: Limited contract sizes, caps | High: Deep for popular sports, variable on props |

| Trading fees | Variable: $0.10 exchange fee + $0.10 technology fee per contract, depending on trading and settlement. | None | None | ~5-10% vig on bets |

| Profit fees | None beyond trading fees. No separate profit-taking fees | Intermediaries may charge transaction fees on withdrawals. | 10% on profits, 5% withdrawal fee | None (fees embedded in odds) |

| Resolution method | Independent oracle and third-party data sources. Contracts settle on official event outcomes. | Independent oracle, third-party sources | Market operator decision | Official league/event results |

| Tax reporting | Standard US tax reporting applies. Likely issuance of 1099 forms for taxable events | None (no U.S. access) | Limited; typically no tax forms issued | 1099 forms provided for U.S. users |

| Difficulty level | Medium: Understanding the nuances of trading and pricing. | Medium: Crypto required, more technical | Easy: Web-based, simple interface | Easy: App/web-based, familiar to most users |

Markets available for trading

Crypto.com offers prediction market trading on sports, elections, and economic markets. On the website’s predictions section, there are icons for financial and cultural trading, both of which are noted with “coming soon.” The table below has details on all of the contracts available for trading as of this writing, along with example pricing. Unfortunately, when you view available contracts, there’s no way to see the current volume or number of outcome positions held.

| Category | Market questions | Pricing Example |

| Tennis | French Open 2025 – Men’s Singles Winner | -Carlos Alcaraz. Yes: $4.60. No: $5.90 |

| Tennis | French Open 2025 – Women’s Singles Winner | -Aryna Sabalenka. Yes: $2.80. No: $7.90 |

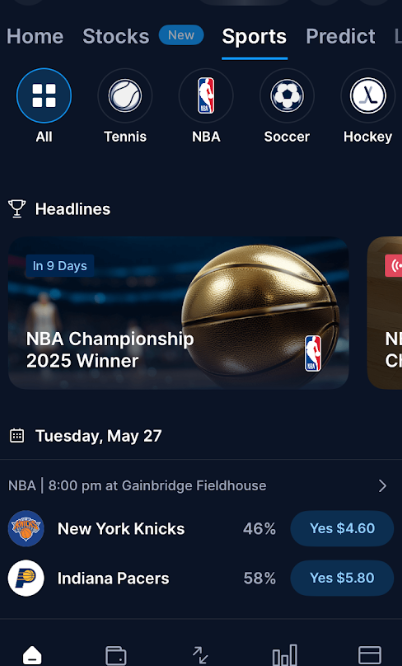

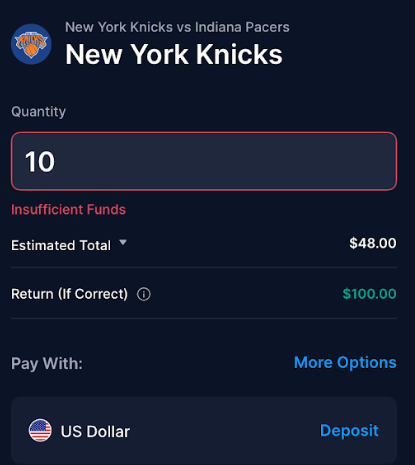

| NBA | New York Knicks vs. Indiana Pacers | -Knicks. Yes: $4.80-Pacers: Yes: $5.80 |

| NBA | NBA Championship 2025 Winner | -Oklahoma City Thunder. Yes: $78.75. No: $24.00 |

| NBA | NBA Western Conference Championship 2025 Winner | -Oklahoma City Thunder. Yes: $97.75. No: $5.25 |

| NBA | NBA Eastern Conference Championship 2025 Winner | -Indiana PacersYes: $66.25. No: $36.25 |

| Soccer | UEFA Champions League 2025 Winner | -Paris Saint-GermainYes: $64.25. No: $44.50 |

| NHL | Dallas Stars vs. Edmonton Oilers | -Stars. Yes: $4.30-Oilers. Yes: $6.00 |

| Formula 1 | F1 Drivers Championship Winner | -Oscar Piastri. Yes: $40.00. No: $65.00. |

| Formula 1 | F1 Constructors Championship Winner | -McLaren. Yes: $97.00. No: $8.00. |

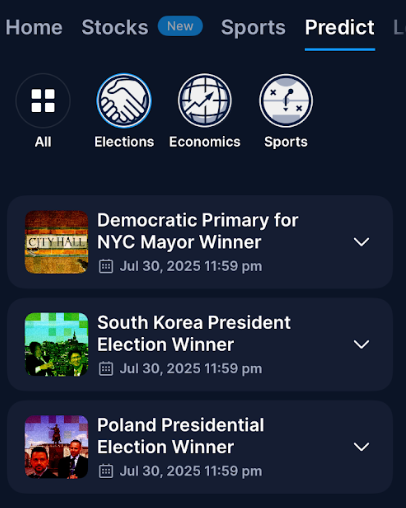

| Elections | Democratic Primary for NYC Mayor Winner | -Andrew Cuomo. Yes: $9.30. No: $1.10. |

| Elections | South Korea President Election Winner | -Lee Jae-myung. Yes: $9.40. No: $1.00. |

| Elections | Poland Presidential Election Winner | -Rafal Trzaskowski. Yes: $6.50. No: $4.10. |

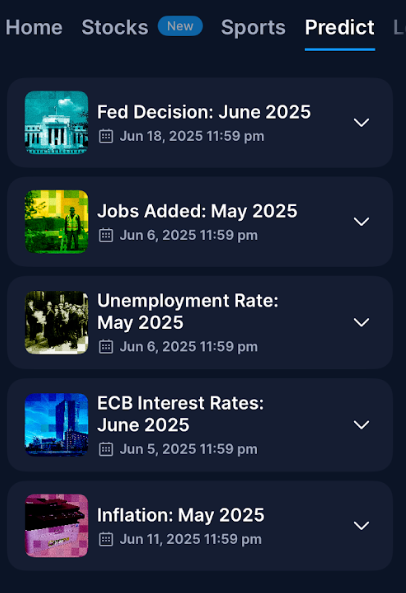

| Economics | Fed Decision Oct 2025 | -No change. Yes: $9.70. No: $0.80. |

| Economics | Jobs Added: May 2025 | -150k-200k. Yes: $4.40. No: $6.20. |

| Economics | Unemployment Rate: May 2025 | -4.3%. Yes: $3.80. No: $6.80. |

| Economics | ECB Interest Rates: June 2025 | -Cut <=25 bps. Yes: $9.80. No: $0.70. |

| Economics | Inflation: May 2025 | -0.2%. Yes: $4.20. No: $6.60. |

How to buy and sell contracts at Crypto.com

To trade prediction market contracts, you’ll need to have a Crypto.com account. You can sign up on the web or mobile. During our test run, we had to switch back and forth between devices. To make the process seamless without the need to do so, download the app and click on “create new account.”

You’ll be prompted to enter your email address. From there, it’s a several-step process.

- Email and mobile phone number verification.

- Create a six-digit passcode.

- Identity verification.

When you get to step three, you’ll see a notification that additional documentation may be required. After clicking continue, that was indeed the case. We were prompted to scan the front and back of our government-issued ID. Afterward, we had to complete biometric verification, which consisted of recording a short video while turning our head from side to side.

While the process takes just a few minutes from start to finish, there were numerous steps to tackle. Once that was all set, it was time to log in. When we entered our email address, we were then prompted to verify it once again, followed by another round of mobile verification, and another passcode entry.

It’s pretty clear that security is a priority here, but a video just to sign up and check out prediction markets, followed by three steps to log in seems a bit excessive. We clicked on “sports” and came across another step. To trade these markets, you need to be approved for a Crypto.com derivatives account.

Thankfully, this was as simple as proceeding through screens. Once that’s done, it has to go through an approval process, the results of which will be sent via email. We received our green light quickly. It was finally time to start checking out the prediction markets available for trading. Under sports, there are some in-season markets to consider, including the NBA.

Elections are limited to three markets for now:

The Economics section had five markets:

When you’re ready to make a trade, just click on your choice.

You’ll then head to another screen where you’ll enter the number of contracts you want to buy. If you haven’t done so already, you can make a deposit to add funds to trade with, and then process your transaction.

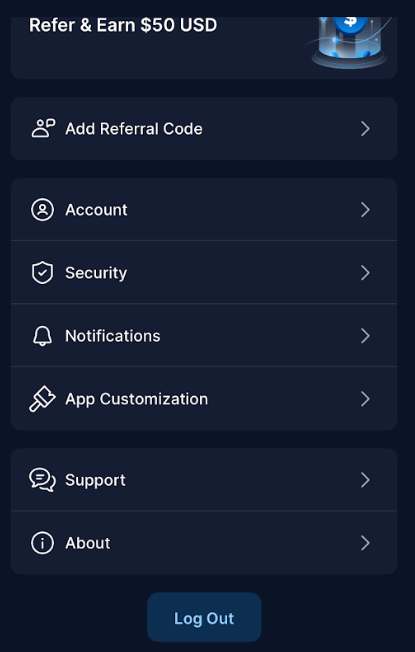

Once the sign-up process was complete, we found the Crypto.com app to be smooth and easy to use. Interestingly, it took some digging to figure out how to log out of the app. You have to go to the menu, look for the settings button, click through, and then scroll to the bottom to find the logout button.

Since there are several security hoops to jump through while signing up, it would only make sense to make logging out of the secure app that much easier.

Crypto.com vs. Other Prediction Market Apps

Here’s a closer look at how Crypto.com compares to other prediction market apps.

Crypto.com vs Polymarket:

- Crypto.com is a fully regulated U.S. platform offering prediction markets through its CFTC-regulated exchange, Crypto.com | Derivatives North America (CDNA).

- Polymarket is a decentralized, blockchain-based platform that’s unavailable to U.S. users.

- Crypto.com emphasizes regulatory compliance, accessibility, and supports both fiat and crypto payments. Market offerings are starting to expand, but there are fewer contracts here than you’ll find on Polymarket.

- Polymarket focuses on decentralization, using cryptocurrency for trading, and a broader market selection, but lacks formal U.S. regulatory oversight.

Crypto.com vs PredictIt:

- Crypto.com operates as a fully regulated platform under CFTC oversight, offering a broad range of prediction markets with transparent contract pricing.

- PredictIt operates under a limited CFTC exemption and is dealing with some regulatory uncertainty.

- Crypto.com offers more markets, including sports, economics, and politics, and focuses on widespread availability.

- PredictIt is mainly focused on U.S. political event contracts, imposes strict trading caps, and charges fees on deposits and withdrawals.

Crypto.com vs Legal Sportsbooks:

Contract pricing vs odds is similar but different. Here is a quick snapshot of how Crypto.com compares.

- Crypto.com uses market-based pricing with a derivatives-style trading system, allowing users to buy/sell positions and exit trades before event conclusion, covering sports and non-sports events.

- Legal sportsbooks offer fixed odds set by the house, focusing primarily on sports betting with limited non-sports markets in select states.

- Crypto.com operates under CFTC derivatives trading regulations and is available in 49 states, blending cryptocurrency trading with sports prediction markets.

- Sports betting is available in 38 states plus D.C. Eight of those markets allow for in-person wagering only.

| Features | Crypto.com | Polymarket | Predictit | Sportsbooks |

|---|---|---|---|---|

| Best for | U.S. traders seeking a regulated, user-friendly platform to trade prediction contracts with both USD and crypto options. | Global traders who are familiar with crypto and are looking for decentralized markets. | Casual U..S. traders, political research. | Sports bettors who are looking to wager on fixed odds. |

| Regulatory status | Fully CFTC-regulated | Decentralized platform that’s unregulated in the U.S. | Operating under a limited CFTC exemption. | Regulated by individual states. |

| Minimum deposit | $1 | No minimum. | $10 minimum. | Varies by sportsbook, typically $5-$10. |

| Payout/currency | USD, Crypto | USDC stablecoin | USD | USD |

| Available in | U.S. (Except for NY) | Global (not available in the U.S.) | U.S. | 38 U.S. states plus Washington, D.C. |

| Difficulty level | Medium. Users need some familiarity with contract trading and pricing. | Medium. An understanding of cryptos is helpful. Broad range of markets to choose from. | Easy. Web-based with limited markets. | Easy. There is an Initial learning curve for those unfamiliar with sports wagering. |

What others are saying about the app

During our extensive look at Crypto.com, we visited Trustpilot to see what users are saying. Overall, feedback is not favorable here, with the rating standing at 1.4 on 9,004. The majority of reviews are at two extremes: 16% give it five stars, 72% label it with one star, with the rest in the middle. Common complaints include customer service problems and issues with fees.

The reviews on Trustpilot focus on Crypto.com as a whole, and not necessarily on its prediction market offerings. We didn’t encounter any of the issues presented. After signing up, we were able to get around the platform easily and got assistance from customer support without issue.

The smoothness of the app is a huge plus, but there are downsides to address. The sign-up process requires multiple steps of verification. In our experience, the same applies every single time you log into the app. You have to verify through email, enter a mobile verification code, and then enter a passcode.

That’s a lot of hoops to jump through. In addition, if you have the app open but don’t interact with it for a minute or so or shift over to another function, you have to enter a passcode once again to get back in. We’re big fans of safety and security, but it all seems like overkill following a multi-step process for sign up and verification.

Crypto.com deposit and withdrawal options

You can make deposits on Crypto.com via bank transfer or debit card, as well as assorted cryptocurrencies. On withdrawals, you can go with a bank transfer or crypto. The table below provides a complete overview of what you can expect, including fees and minimums.

| Method | Fee | Min. deposit | Withdrawal options |

|---|---|---|---|

| Bank Transfer | Typically free, but bank charges may apply. | $1 | Yes. Within 24 hours up to a few business days. $100 minimum. |

| Debit Cards | 1.49% for deposits | $1 | N/A |

| Cryptocurrencies | Free for deposits. Network fees vary by coin for withdrawals. | $1 | Yes. Withdraw to an external wallet or the Crypto.com app. The minimum amount varies by method. |

How to contact customer support

Crypto.com offers multiple ways for users to contact customer support.

Options

- Phone: N/A

- Email: [email protected]

- Live chat: Available 24/7 via website and app

- Languages: Primarily English, with some support available in other major languages depending on the region.

- Social: X, Instagram, Threads, Facebook, Discord, LinkedIn, Reddit, Telegram

During our review, we dug into the support options. While many reviewers on Trustpilot have indicated a negative experience, we walked away with a different impression. For starters, many queries can be answered in the informative and searchable help center.

Contacting someone was easy, too. We went to settings, clicked on customer support, and then clicked another button to send a message. The app notes that a typical reply will happen in less than 10 minutes. It happened in about 10 seconds for us.

We got past the basic Q&A bot with a detailed query and were getting actual help quickly. Our questions were answered without issue in a prompt, courteous, and professional manner.

After seeing so many negative marks on the customer service front, we were pleasantly surprised and gave Crypto.com support a thumbs up. That said, the sheer number of bad reviews suggests there’s more than isolated incidents at play here. Direct phone support and confirming that all users are answered as quickly as we were could help improve feedback.

Who is Crypto.com best for?

Crypto.com’s prediction markets are well-suited for both hobbyists and financial traders who enjoy analyzing and forecasting outcomes of events. The platform offers a regulated and transparent environment where users can trade event contracts with clear options, using either USD or crypto to participate. It’s also great for data enthusiasts who want market-driven pricing and exposure to real-world event outcomes beyond traditional markets.

On the other hand, Crypto.com’s prediction markets are not the best fit for pure gamblers or casual bettors seeking quick results. The contracts are regulated derivatives with pricing based on market consensus, requiring some understanding of mechanics and risk. Those looking for simple fixed-odds betting or speculative gambling without market knowledge may find the learning curve steep and the experience less intuitive.

Final rating 4.0 out of 5.0

Crypto.com is a regulated and reputable trading platform that has seen explosive growth in a short period of time. An expansion of its offerings to U.S. users suggests that even more growth is on the way, thanks to the ability to trade stocks and cryptos in one smooth platform.

Interest has been heightened even further with the platform’s introduction of prediction markets. If you’re interested in trading these markets, Crypto.com is a solid option to consider. A few improvements could take it to the next level. Our rating would rise accordingly.

- More markets to trade: For now, it’s just sports, elections, and economics. There are plans to add more in the future, including financial and cultural.

- Fee structure: It could be up to $0.20 per contract, depending on trading and settlement. Perhaps a reduced fee that applies in all cases would make more sense.

- Platform access: Multiple steps for signing up are great for security. Having to hit the same steps every time you want to access the platform is a bit much.

- Market data: There’s no way to view volume or the number of positions held per contract. The addition of these data points would be more than welcome.

Interest in prediction market trading continues to soar. As one of the early leaders, Crypto.com is well-positioned to continue leading the charge. For both new and experienced traders, it’s a solid option when you’re ready to dive in and see what all of the fuss is about.

FAQs

Can you make a living on Crypto.com?

While it’s possible to make a profit from trading prediction market contracts at Crypto.com, consistent results are not guaranteed. Due to market volatility and risk, users should view this form of trading as speculation.

Is Crypto.com legit, and how do taxes and withdrawals work?

Crypto.com is a regulated platform, including CFTC oversight for its prediction markets in the U.S. Taxes on gains from trading or prediction markets are the user’s responsibility. Withdrawals can be made via standard banking options or crypto, and are subject to standard processing times and verification requirements.

How do limit orders work and can I cancel or edit after I submit?

Limit orders are not supported for Crypto.com prediction market trading. Only market orders with protection or immediate-or-cancel are supported. No post-submission editing or cancellation is possible. For market orders with protection, a slippage tolerance of $0.50 per contract is built in, meaning that the trade can execute if the price adjusts within that range. You can adjust the slippage tolerance on the order input screen.

Can I automate trades on Crypto.com?

Prediction market entries are manual and not automated. Automation is available on the app for cryptocurrencies, including target price orders and recurring buys.

Is Crypto.com available in all U.S. states?

Crypto.com’s prediction market features are available in 49 U.S. states. The exception is New York. The company has not met the state requirements for cryptocurrency companies to obtain a BitLicense from the New York Department of Financial Services.

Are Crypto.com sports odds comparable to sportsbook odds?

Prediction market pricing reflects the collective sentiment of traders and may differ from traditional sportsbook odds, which are set by bookmakers. Payouts are fixed per contract, not variable like sportsbook odds.

Who is on the other side when markets open?

In prediction markets, the other side consists of other Crypto.com users taking the opposite position (Yes/No) on an event. The platform acts as the intermediary for matching trades.