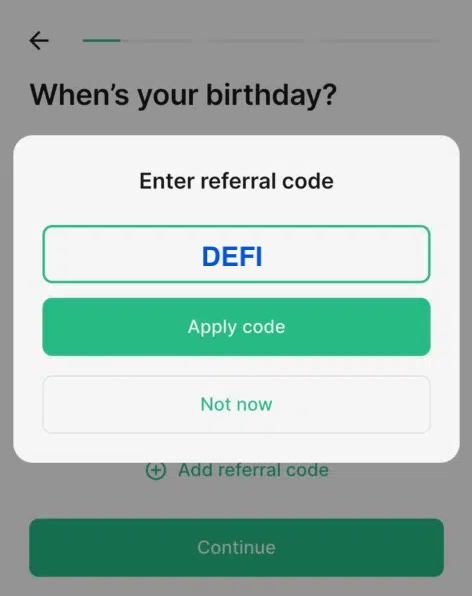

Sign up for Kalshi with promo code DEFI to get a $10 bonus after your first $10 in trades. The new referral code DEFI is valid through March 2026; terms and conditions apply.

Kalshi is a CFTC-regulated prediction market where you can trade on sports, politics, crypto, and culture events across all 50 states and in 140 countries. Unlike traditional sportsbooks, you’re trading against other users in an open market and not betting against Kalshi.

All prices reflect real-time market sentiment, and you can exit positions anytime before settlement. The Kalshi predictions app supports bank transfers, Venmo, PayPal, debit cards, and crypto deposits and pays 3.75–4% APY on your total balance.

Our Kalshi review breaks down how trading works, upcoming markets like March Madness, World Cup (available now), political betting, fee structures, and how to use the promo code DEFI.

If you’re looking for where to bet on gold medalists, Kalshi is definitely worth checking out and available in all 50 states.

Kalshi free $10 promo details

| Feature | Details |

|---|---|

| Kalshi welcome bonus | Trade $10, Get $10 |

| Kalshi promo code | DEFI |

| Valid through | March 2026 |

| Trading fees | ~$0.07/contract, capped at $1.75 per 100 contracts |

| Deposit fees | Free (bank/wire), 2% (debit card/Apple Pay) |

| Withdrawal options | ACH, crypto and debit (*fees and restrictions apply) |

| Interest on balance | 3.75-4% APY on cash and open positions |

| Market Volume (7d) | $1.5B |

| Deposit methods | Bank transfer, wire, debit card, Apple Pay, crypto (BTC, SOL, USDC) |

| Tax reporting | Issues 1099-INT (interest), 1099-MISC (bonuses); report net P&L as other income |

| Trading hours | Not 24/7 — exchange closes on some days (check schedule) |

| Eligibility | 18+, will require KYC check |

| Customer support | Email only ([email protected]) |

| Social | x.com/Kalshi · instagram.com/kalshi · tiktok.com/@kalshi_markets, discord.gg/kalshi |

| Regulation | CFTC Designated Contract Market |

| Also available via | Robinhood, Webull |

Kalshi referral code and sign up bonus

Kalshi offers all new accounts a $10 signup bonus with qualifying trades of $10 or more. This offer is exclusively for new accounts only. Here is how to use the Kalshi referral code and the steps needed to sign up, claim the bonus and start trading.

Step 1 – Create account and enter promo code:

Head over to Kalshi and click the “Sign Up” button”. You will need to provide your full name, email address, Social Security Number, phone number and date of birth. When you see the referral code, click the link and input the code operator_info operator=”1852″ field=”promo_code”] in the promo/referral field. This will give you the free $10 promo for new accounts. Kalshi uses Verify.com to complete the KYC process.

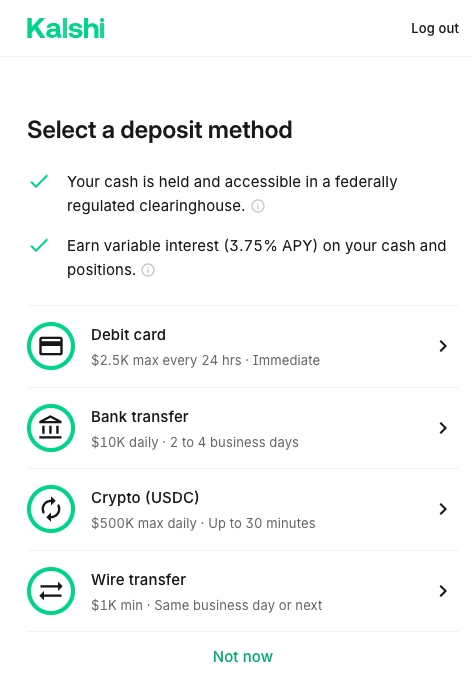

Step 2 – Fund your account:

Kalshi offers four ways to fund your account: debit card, bank transfer, crypto (USDC, BTC, SOL, WLD), and wire transfer. Debit cards are the fastest option with immediate availability, though capped at $2,500 per 24 hours. Bank transfers allow up to $10,000 daily but take 2-4 business days to process. For larger deposits, crypto supports up to $500,000 daily and settles in about 30 minutes, while wire transfers have a $1,000 minimum and typically clear the same or next business day.

Your cash is held in a federally regulated clearinghouse, and all cash and open positions earn you 3.75% APY.

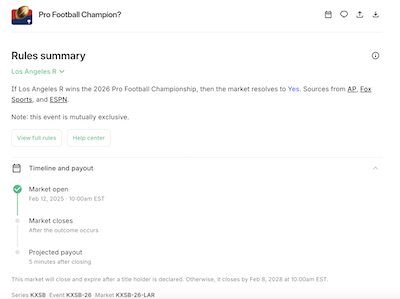

Step 2 – Find a contract and READ the rules:

Every Kalshi market has a rules summary that explains exactly how and when the contract settles. This matters more than you might think and is the biggest complaint among the “woulda coulda shoulda” winners.

Take the “Pro Football Champion?” market as an example. The rules specify that if the Los Angeles Raiders wins the 2026 Pro Football Championship, the market resolves to Yes. Sources are listed as AP, Fox Sports, and ESPN. This means Kalshi uses these outlets to confirm the outcome on this particular contract, not the league itself.

The timeline section shows when trading opens, when the market closes, and how quickly you get paid. In this case, projected payout is 5 minutes after closing. The market will close and expire after a title holder is declared, or by Feb. 8, 2028 at 10:00 am EST if no winner is determined.

All contracts contain a link to the full set of rules. Read it. Carefully.

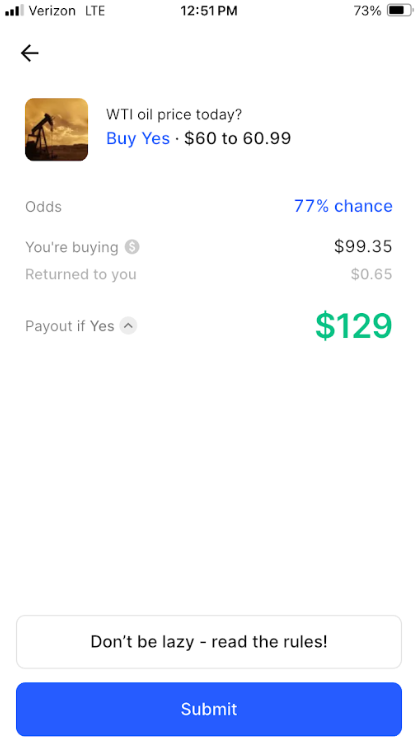

Step 3 – Select your trades:

When you find the event that interests you, tap it to bring the full menu into view. Select the price point you want to trade, choose Yes or No, and then enter the dollar amount for your order.

Next, verify that everything is correct, and click submit. Overall, it was easy enough to do, but it would be nice to see some additions to the mobile menu, such as overall volume leaders or most active contracts in the past 24 hours

Step 4 – Cashing out from Kalshi

To withdraw, make sure your funds are in your “Cash” balance. Only cash is eligible for withdrawal, not funds tied up in open positions. Go to “Transfers,” select “Withdraw Funds,” pick your method, and enter the amount.

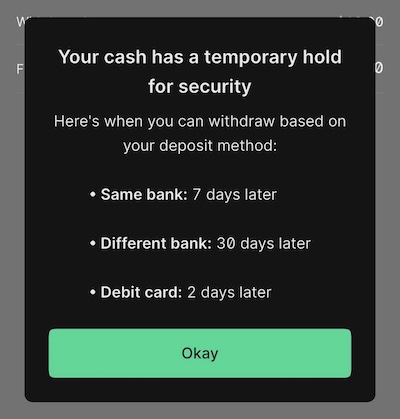

Withdrawal holds: It’s important to note that Kalshi places temporary holds on deposited funds before they’re available to withdraw. Debit card deposits clear after 3 days. Bank transfers clear after 7 days if withdrawing to the same bank, or 90 days if cashing out to a different bank.

Earning interest: As mentioned, you’ll earn 3.50% APY on your cash and open positions (variable, subject to change). Interest accrues daily based on your end-of-day portfolio value and pays out monthly. To qualify, you need a balance of at least $250.

Why is my code not working?

The most common reason your Kalshi referral code is not working is that you are an existing user (referral bonuses are for new users only) or you entered an invalid code. To fix this, ensure the code DEFI was entered during sign-up. This promo code is valid through March 2026. You can reach out to [email protected] if the code worked but the bonus was not applied.

Terms and conditions

The Kalshi promo code bonus requires new users to be at least 18, reside in the US, and pass identity verification. After depositing a minimum of $1 and placing $10 in trades, the bonus credits to your account must be rolled over once before withdrawal. This offer is not available in Arizona, Illinois, Maryland, Michigan, Montana, Nevada, New Jersey, and Ohio.

If you take advantage of the refer-a-friend promo, both you and your friend will qualify for the bonus ($40 by sharing the referral code) once your friend verifies their identity, funds their account, and completes 100 trades within 30 days. There’s no cap on how many friends you can refer.

Kalshi’s Volume and Liquidity Incentive Programs run through September 1, 2026 and reward trading activity and resting orders. All existing Kalshi traders qualify for this promo. Volume rewards max out at $0.005 per contract for trades priced between $0.03 and $0.97, while liquidity payouts range from $10 to $1,000 daily depending on order placement.

Is Kalshi legal?

Yes. Kalshi is legal and operates under full regulatory oversight from the U.S. Commodity Futures Trading Commission (CFTC) as a Designated Contract Market (DCM). The predictions market app has the same legal status held by traditional commodity exchanges. For sports contracts and election betting, CFTC jurisdiction preempts state gaming laws because these are classified as event contracts/derivatives, not gambling.

The app is legally available in over 140 countries through a single global liquidity pool, including major markets like Mexico, Brazil, Germany, India, Japan, and South Korea. However, the app restricts access in approximately 45 jurisdictions, including Canada, the United Kingdom, Australia, France, Poland, Russia, Singapore, Taiwan, Thailand, and Venezuela.

Within the United States, Kalshi operates across all states, though 11 states have issued cease-and-desist orders or restrictions making sports contracts unavailable.

Kalshi legal states and market status

Unlike traditional sportsbooks, Kalshi’s federal CFTC designation means it operates in states where sports betting isn’t legal—including California, where voters rejected legalization in 2022. A federal judge in California recently denied tribal efforts to block Kalshi’s sports contracts, ruling that CFTC jurisdiction applies and the platform doesn’t qualify as gambling under federal law.

| State | Status | Notes |

|---|---|---|

| Alabama | Available | All markets |

| Alaska | Available | All markets |

| Arizona | Restricted (no sports) | C&D issued |

| Arkansas | Available | All markets |

| California | Available | Tribal lawsuit dismissed |

| Colorado | Available | All markets |

| Connecticut | Available | Investigation pending |

| Delaware | Available | All markets |

| Florida | Available | All markets |

| Georgia | Restricted (no sports) | Cease-and-desist issued |

| Hawaii | Available | All markets |

| Idaho | Available | All markets |

| Illinois | Restricted (no sports) | Cease-and-desist issued |

| Indiana | Available | All markets |

| Iowa | Available | All markets |

| Kansas | Available | All markets |

| Kentucky | Restricted (no sports) | Cease-and-desist issued |

| Louisiana | Available | All markets |

| Maine | Available | All markets |

| Maryland | Restricted (no sports) | Injunction denied, litigation pending |

| Massachusetts | Available | AG lawsuit filed |

| Michigan | Restricted | State restrictions |

| Minnesota | Available | All markets |

| Mississippi | Available | All markets |

| Missouri | Available | All markets |

| Montana | Restricted (no sports) | Cease-and-desist issued |

| Nebraska | Available | All markets |

| Nevada | Restricted (no sports) | Injunction dissolved |

| New Hampshire | Available | All markets |

| New Jersey | Restricted (no sports) | Litigation pending in Third Circuit |

| New Mexico | Available | All markets |

| New York | Available | All markets |

| North Carolina | Available | All markets |

| North Dakota | Available | All markets |

| Ohio | Restricted (no sports) | C&D issued, lawsuit filed |

| Oklahoma | Available | All markets |

| Oregon | Available | All markets |

| Pennsylvania | Available | All markets |

| Rhode Island | Available | All markets |

| South Carolina | Restricted (no sports) | C&D issued |

| South Dakota | Available | All markets |

| Tennessee | Available | All markets |

| Texas | Available | All markets |

| Utah | Available | All markets |

| Vermont | Available | All markets |

| Virginia | Available | All markets |

| Washington | Available | All markets |

| Washington D.C. | Available | All markets |

| West Virginia | Available | All markets |

| Wisconsin | Available | Tribal lawsuit pending |

| Wyoming | Available | All markets |

| Note: Legal situation is fluid with multiple pending lawsuits |

How Kalshi works

Kalshi lets users trade on the outcome of real-world events through event contracts. In simple terms, you can think of it like making a bet with a friend—except you’re trading against other people on a regulated exchange, not against a sportsbook. The price reflects what the market (other people) thinks will happen, and you can sell your position anytime before the event settles.

Trading is available in a range of categories, including politics, sports, crypto, and economics. Examples include:

- Who will win the 2028 presidential election?

- Pro Football Champion?

- Will Bitcoin be above $100,000 on December 31?

- What will the Fed decision be in December?

- What will Tesla say during their next earnings call?

To participate, you buy a “Yes” or “No” contract that reflects what you think will happen. Each contract is priced between $0.01 and $0.99, representing the market’s consensus probability.

- A “Yes” contract priced at $0.65 implies a 65% market belief that the event will occur.

- A “No” contract priced at $0.35 implies a 35% belief that it will not.

Learn more: How to trade contracts

When the event settles, winning contracts are paid out at $1 each, while losing contracts expire at $0. Profits are simply the difference between your purchase price and the $1 payout, minus Kalshi’s trading fee. Consider the following example:

- You buy 100 “Yes” contracts on “Inflation above 3% in Q4” at $0.54, for a total cost of $54.

- If the event resolves in your favor, your position settles at $1 per contract, for a $100 total.

- Your profit is $46, less roughly $1.75 in fees, for a net gain of $44.25.

Kalshi charges a $0.01-$0.02 fee per contract, depending on the trade price, with caps in place for 100-contract trades. Trades settle automatically once an event’s outcome is confirmed by a designated third-party source.

The platform’s structure makes it one of the simplest ways for traders to participate in event-driven markets within a fully regulated framework. For active traders seeking a transparent and compliant option, Kalshi remains a good choice.

Can you bet on sports on Kalshi?

Kalshi lets you trade on sports markets with other sports fans. While different, the experience feels similar once you adjust to the different naming conventions and probability instead of the usual sportsbook odds. A key benefit to Kalshi: You can sell your position before the event settles if the market moves in your favor. You can’t do this at a sportsbook. There’s also no cap on winners.

How it works is pretty simple. You buy a contract with a simple Yes or No question priced between $0.01 and $0.99. Pricing is based on the market’s estimated probability. If your sports prediction is correct, the contract pays out $1.

As an example, if you buy a “Will Kansas City win the Pro Football Championship?” contract at $0.53 and they win, you profit $0.47 per contract.

Available sports markets and contracts

Kalshi is all over the news for rapidly expanding its sports offerings. The prediction market covers NFL, NBA, college football, college basketball, MLB, NHL, soccer, tennis, and esports. Kalshi is usually first to market with new contracts, including the World Cup and is the only prediction market to offer individual region contracts, like Spain. Beyond simple game winner contracts, Kalshi offers:

- Spread contracts: This is the spread. Questions like “Will the Chiefs win by more than 3.5 points?” covering point spreads for professional and college football.

- Totals contracts: This is the totals. Questions like “Will the game have over 47.5 total points?” with options for full game, quarter, or half totals.

- Touchdown contracts: This is your props. Player prop markets for anytime touchdown scorer, first touchdown, and multiple touchdowns. Note: passing touchdowns don’t count. Only the player who possesses the ball in the end zone.

- Player stat contracts: Passing, rushing, and receiving yards, plus sacks, interceptions, and other stats.

- Combo contracts – Kalshi’s version of parlays. The “Build Your Combo” feature lets you combine multiple contracts from the same game into a single position. One user reported receiving odds more than 25% higher on a three-leg combo at Kalshi compared to DraftKings.

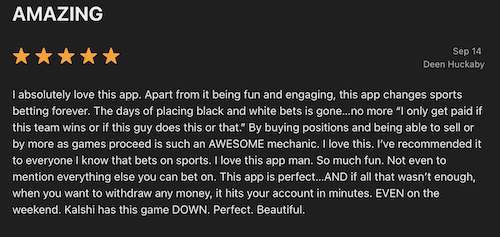

Feedback on the Kalshi app: What others are saying

Kalshi’s external reviews have mixed results. Mostly complaints about contracts settling (why it’s important to read) and bugs related to the app. The company is more more active on social channels than third-party sites.

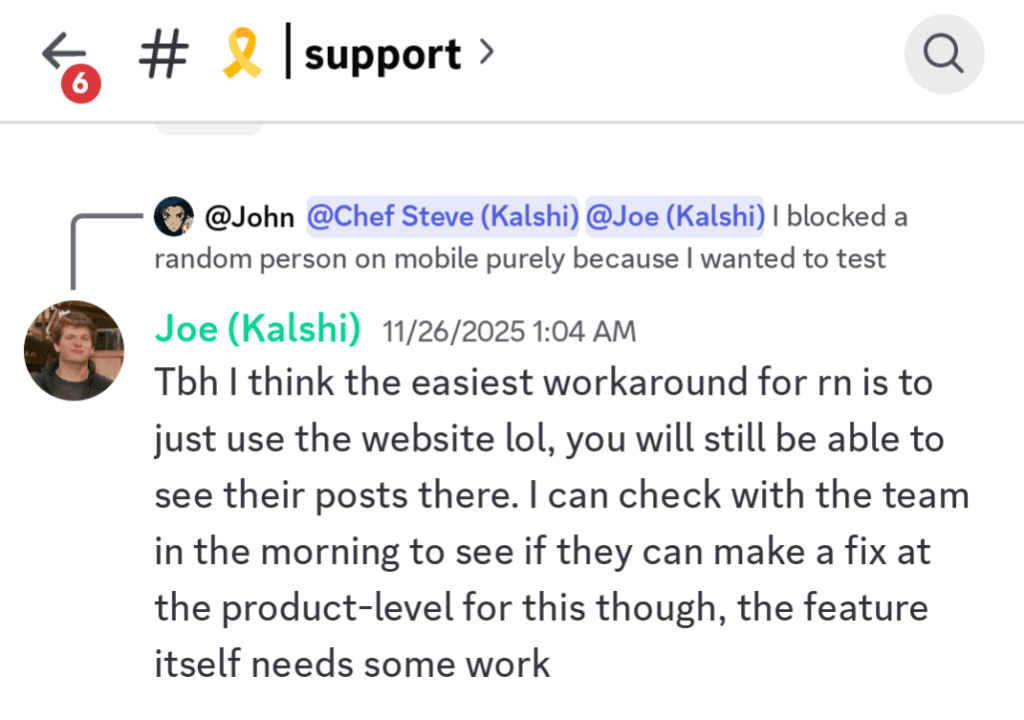

They do have an official presence on Reddit at r/Kalshi, though the team appears less active there compared to Discord. Some users have reported slow response times when raising issues through Reddit, with complaints about unanswered emails and support delays. Discord remains the better channel. Reddit is more of a community discussion space where users share experiences.

Apple store: 21K downloads with a 4/5 rating

TrustPilot: 68 reviews with a 3/5 rating

Discord.gg/Kalshi: 15K members

Kalshi’s top markets today

Kalshi has an extensive list of markets available for trading (391,362, as of this morning), covering sports, politics, crypto, economics, and more. While some might refer to it as “betting on Kalshi“, it’s technically event contract trading. The menu is organized by category, and you can browse trending, new, or all markets to find what’s active.

Most markets use a simple Yes/No format, but some offer multiple price points or outcomes. For example, you can trade on where Bitcoin’s price will land in 2026, or what the Coinbase CEO will say on the next earnings call.

So where should you start?

The tables below update daily and reflect the last 7 days of trading activity. What you see is today’s snapshot of what’s moving right now on Kalshi vs. Polymarket. Sports usually has the most volume, followed by politics and crypto. If you’re looking for the most liquid markets where spreads are tighter and orders fill faster, focus on the categories listed below.

How Kalshi trading fees work

Kalshi makes money by charging a small transaction fee on trades collected from both the buyer and seller. If you’re coming from sports betting, think of this as Kalshi’s version of the juice—except instead of being baked into the odds, it’s charged transparently on each trade like a brokerage commission.

Most markets on the platform have no fees, but certain event categories do carry a variable fee based on contract price and quantity (100 contracts). The fee formula is: 0.07 × C × P × (1-P), with C being your contract count and P being the price (a 50¢ contract would be 0.5). Because of the P × (1-P) component, fees are highest on contracts priced near 50¢ and lowest near the extremes (1¢ or 99¢). This reflects Kalshi’s approach of charging based on potential profit. A 50/50 contract has the most upside, so it carries the highest fee.

There are two fee types: taker fees kick in when you match an order already on the book, while maker fees (which are lower) apply when your order sits and waits for someone else to fill it. Some markets also have a multiplier that adjusts the standard rate.

Here’s a breakdown of markets with non-standard fees based on our February update:

| Market | Examples | Multiplier | Taker Fees (100 contracts) | Maker Fees (100 contracts) |

|---|---|---|---|---|

| Sports (NFL) | Super Bowl, MVP, division/conference winners, player awards, game lines, and more | 1 | $0.07 – $1.75 | $0.02 – $0.44 |

| Sports (NBA) | Championship, conference titles, MVP, awards, game lines | 1 | $0.07 – $1.75 | $0.02 – $0.44 |

| Sports (College) | NCAAF/March Madness champions, conference winners (SEC, Big Ten, ACC, Big 12), playoff qualifiers | 1 | $0.07 – $1.75 | $0.02 – $0.44 |

| Sports (Soccer) | EPL, La Liga, Bundesliga, Ligue 1, Serie A, Champions League, 2026 World Cup, game lines | 1 | $0.07 – $1.75 | $0.02 – $0.44 |

| Sports ( Other) | NHL, F1, golf (Solheim Cup), Heisman Trophy | 1 | $0.07 – $1.75 | $0.02 – $0.44 |

| Economics | Fed rate decisions, CPI, inflation, GDP, jobs, unemployment, gas prices, egg prices | 1 | $0.07 – $1.75 | $0.02 – $0.44 |

| Finance | S&P 500, Nasdaq, Bitcoin price targets | 0.5 | $0.04 – $0.88 | $0.01 – $0.22 |

| Politics/Policy | Trump presidency, DOE elimination, Greenland/Panama/Canada, ballot measures (California wealth tax) | — | No fees | No fees |

| Tech | IPOs, AI/LLM rankings | 1 | $0.07 – $1.75 | $0.02 – $0.44 |

Kalshi vs. other prediction market apps

Kalshi currently has the edge in the prediction markets. The combination of interest on balances, sports categories and high position limits makes it the strongest all-around. This is especially true for sports bettors looking to trade significant capital. We expect this to change in 2026 when the market expands for more entries. Here is a breakdown of how Kalshi compares right now to Polymarket, Crypto.com and PredictIt.

- Polymarket offers zero trading fees and the deepest liquidity on political and crypto markets, but US users now have to access it through intermediaries rather than directly. If you’re outside the US or comfortable with the extra steps, it’s hard to beat no fees.

- PredictIt pioneered political prediction markets and still has a loyal user base, but the $850 position cap and 10% profit fee make it impractical for anyone trading more than small amounts. It’s best suited for casual political junkies who want skin in the game.

| Feature | Kalshi | Crypto.com | Polymarket | PredictIt |

|---|---|---|---|---|

| Regulation | CFTC Designated Contract Market | CFTC-registered (CDNA) | CFTC Designated Contract Market | Limited CFTC exemption |

| Trading fees | ~$0.07/contract (capped at $1.75/100) | $0.10-0.20/contract | None | None |

| Profit fees | None | None | None | 10% on winnings |

| Withdrawal fees | None | Network fees only | Network gas only | 5% |

| Interest on cash | 3.75-4% APY | 0% | 0% | 0% |

| Position limits | Up to $7M per market | 2.5M contracts per event | Unlimited | $850 per contract |

| Crypto deposits | BTC, SOL, USDC | 350+ tokens | USDC only | No |

| US availability | All 50 states | All 50 states | Via FCMs/brokerages only | All 50 states |

| Best for | Sports bettors and serious traders who want regulatory protection, yield on deposits, and room to scale | Crypto.com users who want prediction markets integrated with their existing exchange account | Global traders and U.S. users comfortable with intermediated access who prioritize zero fees and deep political/crypto liquidity | Casual political bettors with small bankrolls who don’t mind position caps and profit fees |

Kalshi deposit and withdrawal options

Getting money into Kalshi is easy with five deposit options. If you want to avoid additional fees, I suggest you go with bank transfer or crypto. Both options are free, though bank transfers take a few days to clear. Debit cards and mobile have a 2% transaction fee. Wire transfers are available for larger deposits starting at $1,000. For crypto users, you can use SOL, USDC, BTC and WLD.

Deposit options

| Method | Fee | Speed | Minimum |

| Google / Apple Pay | 2% | Instant | $1 |

| Debit Card | 2% | Instant | $1 |

| Bank Transfer | None | 1-4 days | $10 |

| Crypto (USDC, BTC, SOL, WLD) | Network or provider fees may apply. | Instant | $10 |

| Wire Transfer | None | 2-3 days | $1,000 |

How to cash out

Once a contract settles, your payout is available within two hours. Crypto is the fastest and cheapest way to cash out. Debit cards can arrive in under an hour but carry a $2 fee. Kalshi holds withdrawals based on how you deposited: 3 days for debit, 7 days for same-bank ACH, and 30 days if withdrawing to a different bank. Daily debit withdrawals cap at $2,500; bank transfers have no limit.

| Method | Fee | Speed | Minimum |

| Debit Card | $2 fee per transaction | 30 minutes | $10 |

| Bank Transfer (ACH) | None | 3-5 days | $10 |

| Crypto (USDC) | Network or provider fees may apply. | 30 minutes | $10 |

Kalshi tax considerations

Kalshi reports all trading activity to the IRS, so if you hit certain reporting thresholds, expect to receive tax documents. According to Kalshi’s Help Center, they issue three types of forms: a 1099-INT for interest payments, a 1099-MISC for credits and rewards (the sign-up bonus), and a 1099-B for transaction proceeds from crypto transfers.

Kalshi calculates your profits and losses using FIFO (First-In-First-Out) accounting, and your P&L data (including fees and rebates) updates on the first of each month. For a full estimate of your crypto tax exposure across wallets and platforms, our free tax calculator supports multiple cost basis methods including FIFO.

Why this matters heading into 2026

A provision in the One Big Beautiful Bill Act, signed by President Trump on July 4, 2025, caps gambling loss deductions at 90% starting January 1, 2026. For traditional sports bettors, this creates a scenario where you can break even and still owe taxes. A bettor in the top federal tax bracket who wins $1 million and loses $1 million would owe roughly $37,000 under the new rule.

Prediction markets like Kalshi occupy uncertain territory. Because Kalshi operates as a CFTC-regulated financial exchange rather than a sportsbook, some argue that trades should be treated like other financial instruments, where 100% of losses can offset gains. However, the IRS hasn’t issued guidance yet, and tax specialists are divided. For anyone trading significant volume, consulting a tax professional familiar with both gambling and financial instruments is essential for 2026 and beyond.

Responsible trading and how to block

Kalshi offers three self-imposed limits through account settings:

- Trading break: Temporary restriction (minimum 1 day). You cannot exit open positions during the break.

- Voluntary opt-out: Long-term self-exclusion, including a permanent option.

- Personalized funding cap: Monthly deposit limit. Increases take effect the following month.

These tools only apply to direct Kalshi access—not through FCMs.

How to permanently block the Kalshi app

Since Kalshi operates under CFTC regulation rather than state gaming commissions, it isn’t included in regulatory checks for self-excluded individuals. The financial industry currently lacks a centralized self-exclusion system, though Gamban now blocks trading platforms like Robinhood and Webull.

To block access to Kalshi specifically, you can use customizable site blockers: Freedom ($7/month), Cold Turkey (free/$39), SelfControl (Mac, free), or LeechBlock (browser extension). You will need to block kalshi.com and help.kalshi.com, delete the app, and use Screen Time to prevent reinstalls.

Support resources

- National Council on Problem Gambling: 1-800-522-4700

- Gamblers Anonymous: gamblersanonymous.org

- SAMHSA National Helpline: 1-800-662-4357

Our final score: 4.6 / 5.0

Kalshi gets a 4.6 out of 5 with room to improve on the operational side. The app volume tells the story. Elections, politics, and major sporting events drive the bulk of trading activity, with sports contracts now accounting for roughly 90% of Kalshi’s business since the start of the 2025-26 NFL season.

Liquidity on these markets runs deep enough to absorb institutional-sized orders. The same cannot be said for Kalshi’s more eccentric contracts on sneaker releases, celebrity appearances, and weather. The thin order books make it difficult to enter or exit trades at scale.

The 4% annual on cash balances, including funds tied up in open positions, is a decent selling feature. There are three major flaws though—lack of live support, holds on deposits and more importantly, no responsible gambling initiative.

What went into this Kalshi review

This review represents approximately five hours of research, including reading documentation and four hours of first-hand experience across multiple sessions. We don’t summarize. We dug into the documentation, regulatory filings, and fee structures to surface what mattered most to our readers.

- Our process: We evaluate prediction markets across seven weighted categories: regulatory status (20%), fee structure (25%), yield on capital (15%), position limits (15%), funding options (10%), market coverage (10%), and platform experience (5%). These weights reflect what serious traders care about — regulatory clarity, competitive fees, and room to scale.

- The data: This comes from help centers, terms of service, fee schedules, and CFTC filings. We also pull active markets directly from Kalshi.com to give you real-time market data, pricing, and volume. Where documentation is unclear, we test directly or contact support.

- We look for the details: Kalshi’s fee isn’t just “low”. It’s 0.07 × contracts × price × (1-price), capped at $1.75 per 100 contracts. Crypto.com charges $0.20 per contract ($0.10 exchange + $0.10 technology fee), dropping to $0.10 if settled in-the-money (plus gas fees). These numbers matter.

- We built cross-platform comparison tools. Our World Cup and Fed decision pages pull live pricing from multiple platforms to surface arbitrage opportunities.

- Conflicts and updates: We may earn a commission from some of the products on Defi Rate. Ratings are based on verified data, not partnership status.

- Update status: This page is updated daily with current market data. We will also update if Kalshi announces material changes to fees, features, or regulatory status.

Last full review completed on February 10, 2026 with a code change from DEFI to DEFI.

FAQs

Why is my Kalshi referral code expired or not working?

If your Kalshi referral code has expired or isn’t working, try entering the code DEFI instead. It’s active through March 2026 and unlocks the $10 bonus after your first $10 in trades. Many codes circulating on Reddit, social media, and poker forums are tied to limited-time promotions that are no longer valid, but DEFI is maintained and verified monthly.

The most commonly reported expired code is DNEGS, which was part of Daniel Negreanu’s Kalshi ambassador deal from September 2025. That promotion offered a $40 bonus on a $100 deposit and included entry into a WSOP Paradise package giveaway. This promotion ended after the December event. If you entered DNEGS or a similar expired code during signup, you have up to 72 hours to replace it with an active code like DEFI, as long as you haven’t made your first deposit yet. On mobile, tap the waffle icon in the top left and select “add referral code” below the leaderboard icon and enter DEFI.

Can I bet on the Olympics at Kalshi?

You can trade on the Olympics in all 50 states, including California. There is a near-endless list of markets, including player and game event props. The market has contracts open for country with most gold medals, who will place gold, silver or bronze overall and individual sporting events. If this is your first time on Kalshi, take advantage of the new customer promo, giving you a free $10 with your first $10 trade. Enter the promo code DEFI on sign up.

Is Kalshi considered gambling?

Legally, no. Kalshi is regulated by the CFTC as a Designated Contract Market under the Commodity Exchange Act—the same framework governing the CME and other derivatives exchanges. This classification is why Kalshi operates in states where sports betting is illegal. Several states are still challenging this in court, but federal rulings have consistently sided with Kalshi. That said, the behavioral risks are real. Prediction markets can trigger the same patterns as gambling.

Is Kalshi a crypto or blockchain betting site?

No. Kalshi is a traditional financial exchange regulated by the CFTC—not a blockchain-based platform. Your funds are held in USD, and all trading happens off-chain. Kalshi accepts crypto deposits (SOL, USDC, BTC) through partner ZeroHash, but these convert to dollars when they hit your account.

What cryptocurrency contracts can I trade on Kalshi?

Kalshi offers over 50 crypto-specific markets covering Bitcoin, Ethereum, and other major assets. Contracts include price thresholds (“Will Bitcoin hit $100K this year?”), yearly highs and lows (“How high will ETH get in 2026?”), and price ranges at specific dates (“Will XRP be above $2 on December 31?”). All crypto contracts settle using CF Benchmarks Real-Time Indexes—the same pricing data used by the CME—which averages 60 seconds of price data from major exchanges to prevent manipulation. Crypto betting markets see consistent volume but typically have less liquidity than sports or political contracts.

For a detailed breakdown of crypto contract types across platforms, see our guide to crypto prediction markets.

How do crypto deposits work on Kalshi?

Kalshi accepts deposits in USDC, BTC, SOL, and WLD through its partner ZeroHash. They also announced Venmo as an available option right before the Super Bowl. All crypto deposits are instantly converted to USD—your balance and trades are held in U.S. dollars, not crypto. Coinbase is launching a prediction markets platform powered by Kalshi, which may offer a more familiar interface for crypto-native users.

If you prefer to stay fully on-chain, Polymarket (Polygon/USDC) is the main alternative with comparable sports coverage. It offers NFL, NBA, MLB, and NHL contracts alongside politics and crypto markets. Other on-chain platforms like Drift BET (Solana) and Myriad (BNB Chain) exist but focus primarily on elections, crypto, and cultural events rather than traditional sports.

How do fees work on Kalshi?

Kalshi charges between $0.01 and $0.02 per contract, depending on the contract price. Fees are capped on 100-contract blocks, which can make trading more cost-efficient for active users.

What is the minimum deposit at Kalshi?

The minimum deposit is $1, however the new account promo offer requires at least $10 in trades before you can get the free $10.

Can I cancel a trade after placing it?

No. Once an order executes, it’s final. You can close your position by selling the contracts back into the market before the event settles.

When does Kalshi payout?

Funds hit your account immediately after a contract settles—typically within minutes for sports and elections, or the next business day for economic data like Fed decisions. Winning contracts pay $1 each; losing contracts pay $0. From there, you can withdraw via debit card or crypto (same day, often under 30 minutes) or bank transfer (1-4 business days).

How is the outcome of a market decided on Kalshi?

Kalshi uses verified third-party data sources listed in each market’s rules. Once the event occurs, the exchange confirms the result and settles all contracts automatically.

We always use primary sources for all of our work. Our authors and editors rigorously fact-check all content to ensure the information you’re reading is accurate, timely and relevant. Our source information is reviewed periodically to ensure accuracy, with dates noted of the last change.

- “Kalshi Rule Filings v1.18”. CFTC. v1.18 https://www.cftc.gov/sites/default/files/filings/orgrules/25/07/rules07012525155.pdf

- “Trading Fees.” Kalshi Help Center. https://help.kalshi.com/trading/fees.

- “Security Holds.” Kalshi Help Center. https://help.kalshi.com/security-holds

- “Interest on Your Balance.” Kalshi Help Center. https://help.kalshi.com/interest

- “Documents and Taxes.” Kalshi Help Center. https://help.kalshi.com/documents-and-taxes

- “Volume Incentive Program.” Kalshi Help Center. https://help.kalshi.com/incentive-programs/volume-incentive-program

- “Liquidity Incentive Program.” Kalshi Help Center. https://help.kalshi.com/incentive-programs/liquidity-incentive-program

- “CFTC Approves KalshiEX LLC to Register as a Designated Contract Market.” U.S. Commodity Futures Trading Commission. https://www.cftc.gov/PressRoom/PressReleases/8442-21