Top Markets by Volume

Highest trading activity across platforms

Denver at New York

KalshiWho will Trump nominate as Fed Chair?

PolymarketThunder vs. Spurs

PolymarketNuggets vs. Knicks

PolymarketOklahoma City at San Antonio

KalshiDemocratic Presidential Nominee 2028

PolymarketTimberwolves vs. Raptors

PolymarketMemphis at Sacramento

KalshiGrizzlies vs. Kings

PolymarketWhat price will Bitcoin hit in February?

PolymarketNew Orleans at Milwaukee

KalshiCeltics vs. Rockets

PolymarketPresidential Election Winner 2028

PolymarketPelicans vs. Bucks

PolymarketMinnesota at Toronto

KalshiCavaliers vs. Clippers

Polymarket2026 FIFA World Cup Winner

PolymarketRepublican Presidential Nominee 2028

PolymarketFed decision in March?

PolymarketBruins vs. Panthers

PolymarketBoston at Houston

KalshiElon Musk # tweets February 2 - February 4, 2026?

PolymarketNext Country US Strikes

PolymarketGonzaga at Portland

KalshiWhich brands will advertise during the Big Game 2026?

KalshiElon Musk # tweets January 30 - February 6, 2026?

PolymarketBitcoin above ___ on February 4?

PolymarketCleveland at Los Angeles C

KalshiWhat price will Solana hit in February?

Polymarket2026 NBA Champion

PolymarketRed Wings vs. Utah

PolymarketBYU at Oklahoma St.

KalshiMichigan St. at Minnesota

KalshiIowa at Washington

KalshiEnglish Premier League Winner

PolymarketWashington St. at Oregon St.

KalshiWestern Carolina at UNC Greensboro

KalshiClemson at Stanford

KalshiHumbert vs Mannarino

KalshiGiannis Antetokounmpo's next team?

KalshiPro Football Champion?

KalshiSharks vs. Avalanche

PolymarketSasnovich vs Eala

KalshiWhat price will Ethereum hit in February?

PolymarketKHL: Sibir Novosibirsk vs. Neftekhimik Nizhnekamsk

PolymarketTexas A&M at Alabama

KalshiWhat will Trump say this week (February 8)?

PolymarketGea vs Machac

KalshiOklahoma City at San Antonio: Spread

KalshiBlues vs. Stars

PolymarketManchester City FC vs Newcastle United FC

PolymarketLa Liga Winner

PolymarketX banned in U.K. by March 31?

PolymarketMinnesota at Nashville

KalshiUtah St. at New Mexico

KalshiUS strikes Iran by...?

PolymarketWild vs. Predators

PolymarketBitcoin Up or Down - February 5, 12AM ET

PolymarketNBA MVP

PolymarketOilers vs. Flames

PolymarketDenver at New York: Spread

KalshiKHL: Traktor vs. Ak Bars Kazan

PolymarketBoston at Florida

KalshiBitcoin price on Feb 4, 2026 at 5pm EST?

KalshiKraken vs. Kings

PolymarketButler at Providence

KalshiBitcoin above ___ on February 6?

PolymarketKhamenei out as Supreme Leader of Iran by February 28?

PolymarketCanadiens vs. Jets

PolymarketBitcoin Up or Down - February 4, 2PM ET

PolymarketBitcoin Up or Down - February 4, 11PM ET

PolymarketUS strikes Iran by Feb 28 Odds >30% by Friday?

PolymarketManchester City vs Newcastle

KalshiKnicks vs. Celtics

PolymarketMedjedovic vs Wawrinka

KalshiSun vs Ellis

KalshiLoyola Marymount at San Francisco

KalshiNortheastern Huskies vs. Hofstra Pride

PolymarketBitcoin Up or Down - February 4, 10:00PM-10:15PM ET

PolymarketBlackhawks vs. Blue Jackets

PolymarketBitcoin Up or Down - February 4, 10PM ET

PolymarketBitcoin Up or Down - February 4, 6AM ET

PolymarketBitcoin Up or Down - February 4, 2:45PM-3:00PM ET

PolymarketElon Phoenix vs. Hampton Pirates

PolymarketDenver at New York: Total Points

KalshiThailand Legislative Election Winner

PolymarketVenezuela leader end of 2026?

PolymarketWho will Trump nominate as Fed Chair?

KalshiHornets vs. Rockets

PolymarketRockets vs. Thunder

PolymarketBad Bunny’s halftime opener?

KalshiIslanders vs. Devils

PolymarketRussia x Ukraine ceasefire by March 31, 2026?

PolymarketKhamenei out as Supreme Leader of Iran by March 31?

PolymarketGreece x Turkey military engagement by June 30?

PolymarketBitcoin price on Feb 6, 2026 at 5pm EST?

KalshiWM Phoenix Open Winner?

KalshiSeattle at New England: Spread

KalshiLIV Golf Riyadh Champion?

KalshiAli Khamenei out as Supreme Leader?

KalshiWashington at Detroit

KalshiWho will attend the Big Game?

KalshiWho will perform at the Pro Football Championship?

KalshiPro Basketball Players Traded before Deadline

KalshiArsenal vs Sunderland

KalshiPro Football Championship MVP?

KalshiMVP Winner?

KalshiSeattle at New England: Total Points

KalshiWhich party will win the U.S. Senate in 2026?

KalshiNext US Presidential Election Winner?

KalshiWhich party will win the U.S. House in 2026?

KalshiWhich party will win the 2028 Presidential Election?

KalshiFed decision in January?

PolymarketWill Zelenskyy wear a suit before July?

PolymarketFed decision in December?

PolymarketUS government shutdown Saturday?

PolymarketNext president of South Korea?

PolymarketFed decision in October?

PolymarketWho will Trump nominate as Fed Chair?

PolymarketFed decision in September?

PolymarketNew York City Mayoral Election

PolymarketRomania: Bucharest Mayoral Election

PolymarketWill Trump release Epstein files by...?

PolymarketWho will die in Stranger Things: Season 5?

PolymarketIreland Presidential Election

PolymarketRomania Presidential Election Winner

PolymarketLighter market cap (FDV) one day after launch?

PolymarketMegaETH public sale total commitments?

PolymarketJake Paul vs. Anthony Joshua

PolymarketFed decision in July?

PolymarketNext Prime Minister of Canada after the election?

PolymarketUS x Venezuela military engagement by...?

PolymarketFed decision in May?

PolymarketWill Polymarket US go live in 2025?

PolymarketPoland Presidential Election

PolymarketFed decision in March?

PolymarketFed decision in June?

PolymarketMonad FDV one day after launch?

PolymarketWhat price will Bitcoin hit in January?

PolymarketLoL: T1 vs KT Rolster (BO5)

PolymarketNBA Champion

PolymarketGovernment shutdown on Jan 31, 2026?

KalshiWhen will the Government shutdown end?

PolymarketMonad public sale total commitments above ___ ?

PolymarketDemocratic Presidential Nominee 2028

Polymarket#1 Searched Person on Google this year?

PolymarketPresidential Election Winner 2028

PolymarketAlcaraz vs Zverev

KalshiRepublican Presidential Nominee 2028

PolymarketLos Angeles C at Denver

Kalshi2026 NBA Champion

PolymarketEnglish Premier League Winner

Polymarket2026 FIFA World Cup Winner

PolymarketMichigan at Michigan St.

KalshiAtlanta at Indiana

KalshiWho will Trump nominate as Fed Chair?

KalshiToronto at Orlando

KalshiDetroit at Golden State

KalshiWhat price will Bitcoin hit in February?

PolymarketPhoenix at Portland

KalshiAustralian Open Final: Alcaraz vs Djokovic

KalshiPhiladelphia at Golden State

KalshiPhiladelphia at Los Angeles C

KalshiDjokovic vs Sinner

KalshiNew Orleans at Charlotte

KalshiKentucky at Arkansas

KalshiUFC 325: Volkanovski vs Lopes

KalshiMinnesota at Memphis

KalshiMinnesota at Dallas

KalshiAtlanta at Boston

KalshiIndiana at UCLA

KalshiSan Antonio at Charlotte

KalshiCleveland at Phoenix

KalshiHouston at Indiana

KalshiPortland at New York

KalshiPortland at Washington

KalshiLos Angeles L at New York

KalshiNew York at Toronto

KalshiWhich companies will be acquired before 2027?

PolymarketChicago at Indiana

KalshiOklahoma City at Minnesota

KalshiOrlando at San Antonio

KalshiAustralian Open Final: Sabalenka vs Rybakina

KalshiPro Football Champion?

KalshiLa Liga Winner

PolymarketSeattle vs. New England

PolymarketUS strikes Iran by...?

PolymarketKhamenei out as Supreme Leader of Iran by February 28?

PolymarketUEFA Champions League Winner

PolymarketNBA MVP

PolymarketWhich brands will advertise during the Big Game 2026?

KalshiElon Musk # tweets January 30 - February 6, 2026?

PolymarketGiannis Antetokounmpo's next team?

KalshiWhat price will Ethereum hit in February?

PolymarketKhamenei out as Supreme Leader of Iran by March 31?

PolymarketPro Football Champion 2026

PolymarketRussia x Ukraine ceasefire by March 31, 2026?

PolymarketX banned in U.K. by March 31?

PolymarketWhat price will Solana hit in February?

PolymarketHuman moon landing in 2026?

PolymarketSeattle at New England: Spread

KalshiRussia x Ukraine ceasefire by February 28, 2026?

PolymarketThailand Legislative Election Winner

PolymarketAli Khamenei out as Supreme Leader?

KalshiVenezuela leader end of 2026?

PolymarketWill Ilhan Omar resign by March 31?

PolymarketBitcoin price on Feb 6, 2026 at 5pm EST?

KalshiWhat will Trump say this week (February 8)?

PolymarketIlhan Omar town hall attack staged?

PolymarketBad Bunny’s halftime opener?

KalshiFed decision in Mar 2026?

KalshiPro Football Championship MVP?

KalshiPro Basketball Players Traded before Deadline

KalshiWhat will the announcers say during the Pro Football Championship?

KalshiWM Phoenix Open Winner?

KalshiArsenal vs Sunderland

KalshiSeattle at New England: Anytime Touchdown Scorer

KalshiWorld leaders out before 2027?

KalshiCoach of the Year Winner?

KalshiHow low will Bitcoin get in 2026?

KalshiBarcelona vs Mallorca

KalshiWho will attend the Big Game?

KalshiSeattle at New England: Total Points

KalshiWhich party will win the U.S. House in 2026?

KalshiMVP winner?

KalshiMVP Winner?

KalshiWho will perform at the Pro Football Championship?

KalshiLIV Golf Riyadh Champion?

KalshiPro Basketball Champion?

KalshiEthereum price on Feb 6, 2026 at 5pm EST?

KalshiWhat will EA say during their next earnings call?

KalshiUnemployment in January 2026?

KalshiFed decision in January?

PolymarketFed decision in December?

PolymarketNew York City Mayoral Election

PolymarketWho will Trump nominate as Fed Chair?

PolymarketWill Zelenskyy wear a suit before July?

PolymarketFed decision in October?

PolymarketNext president of South Korea?

PolymarketFed decision in September?

PolymarketDemocratic Presidential Nominee 2028

PolymarketUS government shutdown Saturday?

Polymarket(Old) Romania Election

PolymarketIreland Presidential Election

PolymarketWhat price will Bitcoin hit in 2025?

PolymarketFed decision in July?

PolymarketRomania Presidential Election Winner

PolymarketRomania: Bucharest Mayoral Election

PolymarketNBA Champion

PolymarketWhat price will Bitcoin hit in January?

PolymarketWill Trump release Epstein files by...?

PolymarketFed decision in June?

PolymarketLighter market cap (FDV) one day after launch?

PolymarketNext Prime Minister of Canada after the election?

PolymarketRepublican Presidential Nominee 2028

Polymarket2026 NBA Champion

PolymarketWho will die in Stranger Things: Season 5?

PolymarketTop Spotify Artist 2025

PolymarketPresidential Election Winner 2028

PolymarketUS x Venezuela military engagement by...?

PolymarketPoland Presidential Election

PolymarketChile Presidential Election

PolymarketFed decision in May?

PolymarketNFC Championship Winner: Los Angeles vs Seattle

KalshiJake Paul vs. Anthony Joshua

PolymarketEurovision Winner 2025

PolymarketMegaETH public sale total commitments?

PolymarketWill Polymarket US go live in 2025?

PolymarketFed decision in March?

Polymarket2026 FIFA World Cup Winner

PolymarketBuffalo at Denver

KalshiLos Angeles R at Chicago

KalshiEnglish Premier League Winner

PolymarketCollege Football Championship: Miami vs Indiana

KalshiGovernment shutdown on Jan 31, 2026?

KalshiAFC Championship Winner?

KalshiAlcaraz vs Zverev

KalshiWho will Trump nominate as Fed Chair?

KalshiWill Trump acquire Greenland before 2027?

PolymarketLos Angeles C at Denver

KalshiPro Football Champion?

KalshiUFC 324: Gaethje vs Pimblett

KalshiSan Francisco at Seattle

KalshiMichigan at Michigan St.

KalshiLa Liga Winner

PolymarketUEFA Champions League Winner

PolymarketHouston at New England: Spread

KalshiAtlanta at Indiana

KalshiHouston at Pittsburgh

KalshiHouston at New England

KalshiToronto at Orlando

KalshiLos Angeles L at Los Angeles C

KalshiLos Angeles C at New England

KalshiDetroit at Golden State

KalshiAustralian Open Final: Alcaraz vs Djokovic

KalshiMusetti vs Djokovic

KalshiPortland at Washington

KalshiLos Angeles L at Denver

KalshiMiami (FL) at Ole Miss

KalshiPhoenix at Portland

KalshiPro Football Champion 2026

PolymarketDallas at Sacramento

KalshiPhiladelphia at Golden State

KalshiDenver at Milwaukee

KalshiPhiladelphia at Los Angeles C

KalshiMinnesota at Utah

KalshiWhich companies will be acquired before 2027?

PolymarketVenezuela leader end of 2026?

PolymarketUS strikes Iran by...?

PolymarketKhamenei out as Supreme Leader of Iran by March 31?

PolymarketSeattle vs. New England

PolymarketWill the US acquire part of Greenland in 2026?

PolymarketNBA MVP

PolymarketRussia x Ukraine ceasefire by March 31, 2026?

PolymarketWhat price will Bitcoin hit in February?

PolymarketMeasles cases in U.S. in 2026?

PolymarketKhamenei out as Supreme Leader of Iran by February 28?

PolymarketWill China invade Taiwan by end of 2026?

PolymarketAli Khamenei out as Supreme Leader?

KalshiWill the Iranian regime fall by March 31?

PolymarketWhich brands will advertise during the Big Game 2026?

KalshiGiannis Antetokounmpo's next team?

KalshiWill the Iranian regime fall before 2027?

PolymarketKhamenei out as Supreme Leader of Iran by June 30?

PolymarketThailand Legislative Election Winner

PolymarketRussia x Ukraine ceasefire by end of 2026?

PolymarketSeattle at New England: Spread

KalshiOscars 2026: Best Supporting Actor Winner

PolymarketMVP winner?

KalshiWorld leaders out before 2027?

KalshiPro Football Championship MVP?

KalshiWill Trump buy at least part of Greenland?

KalshiBitcoin price on Feb 6, 2026 at 5pm EST?

KalshiFed decision in Mar 2026?

KalshiBad Bunny’s halftime opener?

KalshiWill the US take control of any part of Greenland?

KalshiUS GDP growth in Q4 2025?

KalshiCoach of the Year Winner?

KalshiWill the Supreme Court rule in favor of Trump's tariffs?

KalshiOscar for Best Picture?

KalshiMen's College Basketball Champion

KalshiPro Basketball Champion?

KalshiMVP Winner?

KalshiWhich party will win the U.S. House in 2026?

KalshiDemocratic Presidential nominee in 2028?

KalshiPro Basketball Players Traded before Deadline

KalshiWhen will Bitcoin hit $150k?

KalshiLas Vegas Pro Football - Next Head Coach?

KalshiOscar for Best Actor?

KalshiSeattle at New England: Anytime Touchdown Scorer

KalshiTim Walz out as Governor of Minnesota?

KalshiWho will attend the Big Game?

KalshiCategory Breakdown

Compare volume and activity across platforms by category

Kalshi Categories

| Category | Markets | Volume | Change |

|---|---|---|---|

| Politics | 5,610 | $2.7M | -51.3% |

| Sports | 1,025,654 | $105.9M | -53.2% |

| Crypto | 3,171 | $8.8M | -37.8% |

| Economics | 2,178 | $1.1M | +131.4% |

| Financials | 681 | $486.7K | -51.2% |

| Tech & Science | 309 | $61.1K | -43.2% |

| Culture | 4,845 | $388.1K | +58.6% |

| Climate | 1,677 | $571.3K | +52.7% |

| Misc | 4,318 | $124.9K | -21.4% |

| World | 5,351 | $13.6K | +86.7% |

Polymarket Categories

| Category | Markets | Volume | Change |

|---|---|---|---|

| Politics | 4,749 | $45.1M | -33.9% |

| Sports | 12,289 | $85.2M | -10.4% |

| Crypto | 1,769 | $31.7M | -10.6% |

| Economics | 854 | $7.1M | -8.2% |

| Finance | 1,472 | $4.0M | +0.4% |

| Tech | 670 | $9.4M | -6.8% |

| Culture | 1,615 | $1.8M | +10.9% |

| Weather | 362 | $1.5M | +3.8% |

| Misc | 3,254 | $36.7M | -5.6% |

| Mentions | 31 | $29.7K | -74.3% |

Kalshi Categories

| Category | Markets | Volume | Change |

|---|---|---|---|

| Politics | 8,812 | $77.4M | +248.1% |

| Sports | 406,487 | $1.5B | +25.5% |

| Crypto | 13,089 | $120.7M | +98.8% |

| Economics | 1,236 | $5.8M | -35.8% |

| Financials | 1,315 | $3.2M | +39.2% |

| Tech & Science | 401 | $1.0M | +2.9% |

| Culture | 10,397 | $10.8M | +139.4% |

| Climate | 4,296 | $6.6M | -29.2% |

| Misc | 9,667 | $3.3M | +32.4% |

| World | 21,841 | $3.7M | +34.6% |

Polymarket Categories

| Category | Markets | Volume | Change |

|---|---|---|---|

| Politics | 3,623 | $545.4M | +75.3% |

| Sports | 13,166 | $708.3M | +4.1% |

| Crypto | 2,601 | $237.8M | +3.4% |

| Economics | 889 | $108.3M | -55.5% |

| Finance | 1,973 | $43.7M | +9.9% |

| Tech | 819 | $73.6M | +12.4% |

| Culture | 1,863 | $16.0M | +2.4% |

| Weather | 830 | $10.1M | -7.1% |

| Misc | 7,751 | $207.5M | +37.3% |

| Mentions | 49 | $1.4M | +233.6% |

Kalshi Categories

| Category | Markets | Volume | Change |

|---|---|---|---|

| Politics | 14,095 | $120.1M | +218.5% |

| Sports | 920,457 | $3.6B | -28.6% |

| Crypto | 28,179 | $245.9M | +102.2% |

| Economics | 2,532 | $22.5M | -20.3% |

| Financials | 3,100 | $9.0M | +11% |

| Tech & Science | 1,008 | $2.7M | -88.7% |

| Culture | 14,305 | $24.5M | +18.2% |

| Climate | 7,039 | $25.1M | -10.3% |

| Misc | 44,861 | $684.6M | -0.5% |

| World | 35,410 | $7.1M | -69.1% |

Polymarket Categories

| Category | Markets | Volume | Change |

|---|---|---|---|

| Politics | 5,147 | $1.5B | +80.8% |

| Sports | 34,986 | $2.8B | +100.9% |

| Crypto | 8,048 | $993.8M | +25% |

| Economics | 1,325 | $713.4M | +122.2% |

| Finance | 3,486 | $124.6M | +54.9% |

| Tech | 1,358 | $299.6M | +32.1% |

| Culture | 3,155 | $84.3M | -49.4% |

| Weather | 2,416 | $39.0M | +122.8% |

| Misc | 20,531 | $601.5M | +4128.5% |

| Mentions | 119 | $2.8M | +321.4% |

Latest news making headlines

- Feb. 3: Jupiter announced that it will bring Polymarket to the Solana blockchain for the the first time.

- Feb. 3: Crypto.com announced the launch of OG.com, a new prediction market site where users can borrow against bet sizes and margin trading.

- Jan. 30: Robinhood CEO Vlad Tenev announced that the platform will add self-custody, lending, staking, and 24/7 trading for tokenized U.S. stocks in the coming months.

- Jan. 28: Coinbase launches its new prediction market, tied to Kalshi. Available in all 50 states and the full spread of sports.

- Jan. 26: Prediction markets generate $6.18 billion in weekly notional volume, setting yet another all-time high.

- Jan. 21: Portugal blocks access to Polymarket following reports of large trading volume on the country’s presidential election markets.

- Jan. 20: CME, which provides markets for FanDuel Predicts and DraftKings Predictions, filed three new product certifications. The three new markets include Super Bowl touchdown props.

- Jan. 19: The New York Stock Exchange announced that it’s building a new platform that will allow tokenized stocks and ETFs trading 24/7.

- Jan. 19: Prediction markets generate $5.9 million in total notional volume, include new all-time weekly highs for both Kalshi and Polymarket.

- Jan. 16: FanDuel Predicts becomes available in all 50 U.S. states, making FanDuel the first sports gaming operator to offer prediction markets nationwide.

- Jan. 15: High Roller Technologies announced a partnership with Crypto.com, with intentions to enter the U.S. prediction markets space.

- Jan. 14: Kalshi signs pro golfer Bryson DeChambeau as an ambassador, marking the first athletic endorsement deal for the company.

- Jan. 14: Sleeper gets NFA approval to begin offering sports prediction markets.

- Jan. 12: Prediction markets generate $5.23 billion in weekly notional volume, with both Kalshi and Polymarket setting new weekly highs.

- Jan. 12: New York lawmakers reintroduce a bill (AB A9251) that aims to restrict certain kinds of prediction markets.

- Jan. 9: Polymarket becomes the exclusive prediction market partner of the Golden Globes through a newly-announced partnership.

- Jan. 8: Gemini adds sports markets to its Gemini Predictions app, just in time for the start of the NFL playoffs.

What are prediction markets?

Prediction markets are a venue for trading contracts tied to the outcome of a future event. Sites such as Kalshi and Polymarket allow participants to buy and sell shares in contracts tied to various markets, including politics, economics, pop culture events, and weather forecasts.

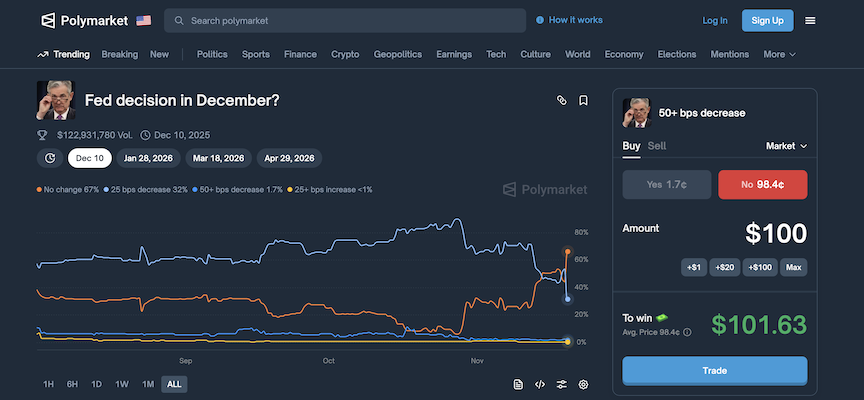

Contracts are the financial instruments used to facilitate trade in prediction markets. At most sites, traders can buy “Yes” or “No” shares on the outcome, with prices ranging from 1 cent to $1. The price serves as an indicator of the perceived likelihood of an event happening. As an example, consider the following market for an economic indicator:

- Fed Decision: 50+ bps decrease

- Yes: $0.017

- No: $0.984

Using the contracts’ pricing as a guide, traders view it as less likely that the funds rate will not decrease when this contract closes. If their speculation proves to be correct, they would earn $1 per contract. Meanwhile, those who hold “Yes” shares would see the value of their holdings go to zero.

As prediction markets remain open, the price of contracts will fluctuate as traders buy and sell shares in response to new developments. Naturally, there are no guarantees that the market pricing will translate into exactly what will happen.

However, it is a “wisdom of the crowds” indicator that points to an outcome’s overall probability and likelihood.

How prediction markets work

Prediction market apps function similarly to other financial markets. Traders buy and sell contracts on the outcome of a future event. For comparison, stock market traders buy and sell shares of companies, while popular markets on a commodities exchange include the price of oil or gold.

In all of the above, traders are speculating on a result in hopes of being correct and ultimately earning a profit. For prediction markets, there are three main components to know:

- Contracts: These are the financial instruments that are traded and tied to the outcome of future events.

- Participants: Those who are trading in the markets and providing liquidity as they buy and sell based on their predictions.

- Mechanisms: The platforms that make the markets available, calculate prices, and facilitate transactions.

Most prediction platforms feature binary options markets, which translates into participants choosing “Yes” or “No” on the available contracts that they are interested in speculating on. The apps make money by charging a fee that varies based on the price of the market. Using the Crypto.com app and a $100 trade as an example, the fee is capped at a maximum of $1.74.

As you view the available contracts on prediction market platforms, you’ll notice that the total value of “Yes” and “No” options does not equal exactly $1. For example:

- Winner of the March Madness tournament semifinal

- Duke: $0.72

- Houston: $0.29

The total of the two prices works out to $1.01. This is due to the spread, which is the difference in demand. There is high demand for a market such as this one with a tight spread. If the spread is more prominent, such as $0.05, there’s lower demand and likely less volume and liquidity in the market for that contract.

Kalshi and Polymarket provide diverse market options for traders to choose from, such as:

- What will the fed funds rate be in March?

- Who will be the Democratic nominee in 2028?

- Who will Trump nominate for Fed Chair?

- How high will Bitcoin go in 2026?

The pricing of contracts can be viewed as the market’s collective “best guess” on the likelihood of an event outcome.

Most popular markets

You can trade on a wide range of real-world events on prediction market platforms. Contracts are available on outcomes in a variety of markets, including:

- Sports: Game results, championships, build combo trades

- Politics: Elections, candidate nominations, legislative outcomes

- Economics: Central bank rates, inflation, indicators

- Crypto: Cryptocurrency prices, market events

- Culture: Award shows, celebrity news, viral trends

- Climate: Temperature records, storm predictions

- Companies & Financials: Corporate achievements, stock market trends, index prices

- Tech & Science: Tech adoption milestones, scientific breakthroughs

- Health & World: Health and wellness issues, global news, and developments

- Mentions: Predictions on words and phrases used by public figures

In terms of overall coverage, Kalshi and Polymarket provide the broadest range of options. Crypto.com is currently limited to sports, PredictIt focuses on politics, while other niche platforms have yet to capture a good deal of mainstream attention. Some platforms allow users to propose new markets, while others curate their offerings centrally.

In terms of overall usage, Polymarket leads in global web traffic, while Kalshi is tops among US-regulated options. Beyond the trading aspect, prediction markets are often cited for their forecast accuracy. The platforms essentially aggregate the opinions of traders, offering a “wisdom of the crowds’ look at the probability of an event or outcome happening.

How does pricing work on contracts?

Prediction market contracts are binary options that pay out a fixed amount. It’s typically set at $1 if the event occurs, and $0 if it does not. Before the contract settles, prices will fluctuate between those ranges as traders enter and exit positions.

When viewing a contract offering on a prediction market platform, the pricing reflects the market’s collective estimate of the probability that the event will happen. Consider the following example:

- Contract: “Will the Fed raise interest rates in May?”

- Pricing: $0.70 for “Yes” and $0.32 for “No.”

- Implication: The market implies a 70% chance of a rate hike and a 32% chance it won’t happen.

As you’ll notice, the pricing doesn’t exactly equal $1, while the implied probability is greater than 100%. Small differences such as these are common and often reflect the spread between bid and ask pricing or trading fees. Markets with higher liquidity tend to have more stable prices and tighter spreads, while wider price swings can happen in less active contracts.

While contracts remain open, prices will continue to move as traders react to new information and shifting sentiment, providing a real-time snapshot of the overall market sentiment. At settlement, the resolution for a correct contract call is $1, while the other side will drop to $0.

Kalshi vs. Polymarket fee comparison

The trading fees and costs on prediction markets can impact your overall returns. The table below has a breakdown of the main fees you’ll encounter on Kalshi and Polymarket.

| Fee Type | Kalshi | Polymarket |

| Trading Fee | $0.07–$1.74 per 100 contracts (varies by contract price; see example) | No trading fee |

| Profit/Settlement | None | None |

| Deposit Fee | ACH free; Debit card 2% | None (USDC only) |

| Withdrawal Fee | ACH free; Debit card $2 | 1.5% on USDC withdrawals |

Kalshi’s trading fee is variable and depends on the contract price. For 100 contracts, it can be as low as $0.07 and up to $1.74. There are no settlement fees to worry about. Meanwhile, Polymarket does not charge any trading or settlement fees.

To illustrate the difference, assume that you’re buying 100 contracts at $0.55 on either platform. At Kalshi, this price point triggers the maximum fee for 100 contracts of $1.74, while Polymarket charges $0. You’d be in for a total of $56.74 at the former, and $55 at the latter.

If you make the right call, the contract settles at $1 in both spots. At Kalshi, you’ll get back $100, less your fee of $1.74, for a total of $98.26. Polymarket will return an even $100 since there are no fees attached.

Beyond trading and settlement, be sure to consider the deposit and withdrawal fees that are outlined above. Traders should also be aware of potential “hidden costs” like bid-ask spreads, and the potential challenges of exiting positions in less liquid markets.

Profit potential for betting on predictions

Prediction markets offer opportunities for traders to profit by buying and selling contracts. In its simplest form, the goal is to make the correct calls so your contracts settle at full value. Traders can also aim to “buy low and sell high.”

Strategies for doing just that include looking for mispriced outcomes and acting before the rest of the market catches on. While the potential for returns is real, profits aren’t guaranteed. Market efficiency, liquidity, and timing all play a big role in shaping your results.

How much can you make by buying a low-priced contract?

Buying low-priced contracts can be enticing due to the potential for big returns. Naturally, there’s plenty of risk here. The contract is priced low for a reason, namely that the chances of that outcome happening aren’t great.

Let’s consider the following fictitious example for an NBA Playoff game in which there’s a clear favorite to win, at least as far as the market is concerned.

- Underdog contract price: $0.10 (10% chance)

- Quantity: You buy 100 contracts for a total of $10.

- Kalshi trading fee: $0.63 (for 100 contracts at this price point)

- Total upfront cost: $10 + $0.63 = $10.63

- Outcome: Underdog wins; contracts settle at $1 each

- Payout: 100 × $1 = $100

- Net profit: $100 – $10.63 = $89.37

In this case, a small investment yields a large return if the prediction is correct. Seeking out low-priced contracts with realistic profit potential can be part of a well-rounded trading approach, but remember to account for the increased risks of trading less-likely outcomes.

What happens if you sell your contract before the event?

Prediction markets aren’t just about holding contracts to settlement. You can also sell your position before the event concludes if the odds move in your favor. This is especially common in political markets, where news cycles and polling shifts can cause prices to swing rapidly.

Consider the following as an example: “Will Candidate X win the election?”

- Polymarket contract price: $0.45 (45% chance)..

- Quantity: You buy 50 contracts for a total of $22.50.

- New developments and polling substantially boosts Candidate X’s chances.

- The contract price rises to $0.70.

- You decide to sell all 50 contracts at $0.70 each for a total of $35

- Polymarket trading fee: $0 (no trading fee; only a withdrawal fee applies if you cash out)

- Net profit: $35 – $22.50 = $12.50

- If you withdraw your USDC, a 1.5% withdrawal fee applies: $35 × 0.015 = $0.53

By selling before the event, you lock in your gains and avoid the uncertainty of the final outcome. This approach can be especially useful when you think the market has overreacted or you want to cash out and take your profit after a favorable news development.

Can you profit by betting ‘No’ on an event?

Prediction markets also allow you to profit by betting against an outcome happening. This is where you would buy the “No” side of the equation when you anticipate that the contract will ultimately resolve to that end result.

Consider the following example: “Will U.S. inflation exceed 4% this quarter?”

- Kalshi “No” contract price: $0.60 (60% chance).

- Quantity: You buy 75 contracts for a total of $45.

- Kalshi trading fee: $1.50 (at $0.02 per contract for this price point)

- Total upfront cost: $45 + $1.50 = $46.50

- If inflation comes in below 4%, each contract settles at $1

- Payout: 75 × $1 = $75

- Net profit: $75 – $46.50 = $28.50

Taking the “No” side can be a valuable strategy when you believe the market is overestimating the likelihood of an event. Regardless of which outcome you choose, stick to your comfort level for both contract pricing and the total amount of your trades.

Are prediction markets the same as gambling?

Prediction markets are not, by definition, the same as gambling. The former is considered a tool for forecasting outcomes based on probabilities. Casino, sports, and lottery are generally viewed as games of chance. That said, there are similarities between the two, most notably that the goal is to turn a profit.

From the perspective of a prediction platform, the contracts are on equal footing to a commodities exchange. Using the Chicago Mercantile Exchange as an example, futures and options are traded on stock indexes, precious metals, energy commodities, and more. Traders take positions on the various instruments based on their expectations of what will happen.

In a prediction market, traders are doing the same thing, albeit in a broader variety of options, such as political, cultural, and economic events. The gambling label has been attached to these platforms as they have risen in popularity, even more so since the introduction of contracts on various sporting events, such as the winner of March Madness or the next Super Bowl winner.

Are prediction markets legal?

Prediction market platforms like Kalshi, PredictIt, and ForecastEx are currently available across the US. However, questions on their overall legality continue to linger. A case between Kalshi and the Commodities Futures Trading Commission remains unresolved. Kalshi won the latest round, but litigation is ongoing.

The platform offered contracts for the 2024 US elections, and has since expanded into sports futures. Meanwhile, states like Illinois, Nevada, New Jersey, and Ohio have presented the company with cease-and-desist letters, essentially arguing that they’re offering unregulated sports betting.

If interest in prediction markets is a guide, then the future looks incredibly bright. Kalshi and Polymarket have attracted extensive volume for tentpole events that it has offered contracts for, including the 2024 US elections, the Super Bowl, and March Madness.

Understanding the math of prediction market contracts

Prediction market contract pricing is generally straightforward. You can view an available market and quickly determine the implied probability of an event happening, at least as far as the overall market sentiment is concerned.

That said, the actual trading of contracts takes a little more doing on the calculation front. You can use the below formulas and examples as a cheat sheet to help gain even more of a comfort level with prediction market trading.

How to calculate the number of contracts you can buy

Formula: Number of Contracts = (Available Capital) ÷ (Contract Price + Fees)

Example:

- You want to trade $50.

- Each contract you’re interested in costs $0.25.

- Kalshi fee: $0.02 per contract at this price point.

- Calculation: $50 ÷ ($0.25 + $0.02) ≈ 192 contracts

Estimating potential profit and loss

Formula: Profit = (Sell Price – Buy Price) × Number of Contracts – Fees

Example:

- You buy 100 contracts at $0.30 and sell at $0.60.

- Profit = ($0.60 – $0.30) × 100 = $30

- Kalshi fee: $1.68 (for 100 contracts at $0.60)

- Net profit = $30 – $1.68 = $28.32

Finding your break-even price

Formula: Break-even Price = (Buy Price + Total Fees) ÷ Number of Contracts

Example:

- You buy 50 contracts at $0.40, for a total of $20.

- Total fees if you sold at the same price: $1 ($0.02 per contract).

- Break-even = ($20 + $1) ÷ 50 = $0.42 per contract

- You need to sell above $0.42 to make a profit.

By taking the time to understand these quick calculations, you could spot appealing opportunities that much quicker. As an added benefit, you’ll be better equipped to manage risk and make more informed trades.

Risks to consider when trading in prediction markets

Trading in prediction markets can be entertaining and potentially profitable, but it’s not devoid of risk. Understanding the potential pitfalls can help you mitigate unnecessary mistakes and ultimately make more informed decisions. Key risks to consider include:

- Unexpected outcomes: There’s always the potential for a complete loss of your stake, even when the odds seem overwhelmingly in your favor.

- Low liquidity: Certain markets attract a limited amount of volume, which can make it difficult to buy or sell contracts at fair prices.

- Platform issues: While top platforms tend to operate without lengthy interruptions, there are simply no guarantees when it comes to security or technical glitches.

- Regulatory environment: Prediction markets are soaring in popularity and readily accessible, but are also subject to developments from ongoing legal challenges.

- Distorted prices: Biases, groupthink, manipulation, and misinformation could all impact contract pricing in both high- and low-volume markets.

If you trade in prediction markets, there is risk. However, you can take steps to help manage it better. At the top of the list, you should only trade with money that you can afford to lose. Nothing is guaranteed with trading, no matter what the odds may suggest.

Next, stay informed about what’s happening. Knowing what’s going on with the regulatory front can help you make better decisions on where to park your funds. Lastly, stick to what you know and don’t blindly chase volume. After all, the herd isn’t always correct.