The federally-regulated prediction market is rolling out tokenized versions of its event contracts on Solana, enabling traders to buy and sell their Kalshi positions – just like any other on-chain asset.

The move looks like a direct swing at Polymarket, which until now has owned the lion’s share of on-chain prediction market traffic.

Why this matters

These tokens mirror the exact same payouts as the regular, off-chain contracts on Kalshi – the key difference is now they’re tokenized and can move freely throughout the Solana ecosystem.

This provides Kalshi users with:

- More anonymity: Instead of trading only inside Kalshi’s garden walls, you can hold and swap tokenized versions on-chain.

- Greater accessibility: Anyone plugged into the Solana ecosystem – DEXes, wallets, and frontends – can trade them.

- Improved decentralization: Crypto users now get self-custody, open liquidity, and permissionless trading – without giving up Kalshi’s regulated backbone.

Its Solana support is already live, with DFlow and Jupiter already plugged in as the first platforms bridging Kalshi’s off-chain orderbook to Solana liquidity.

Eating Polymarket’s lunch

It’s no secret that crypto traders are already power users of prediction markets.

They typically drive large position sizes, churn out significant volume, and are obviously bigtime proponents of self-custody and privacy.

Until now, Polymarket has owned that crowd, by being fully on-chain from the beginning.

But Kalshi’s move is likely to take a bite out of that Polymarket pie, bridging its federally-approved platform to the on-chain world.

The timing couldn’t be better, as prediction markets cross $28 billion in cumulative volume this year.

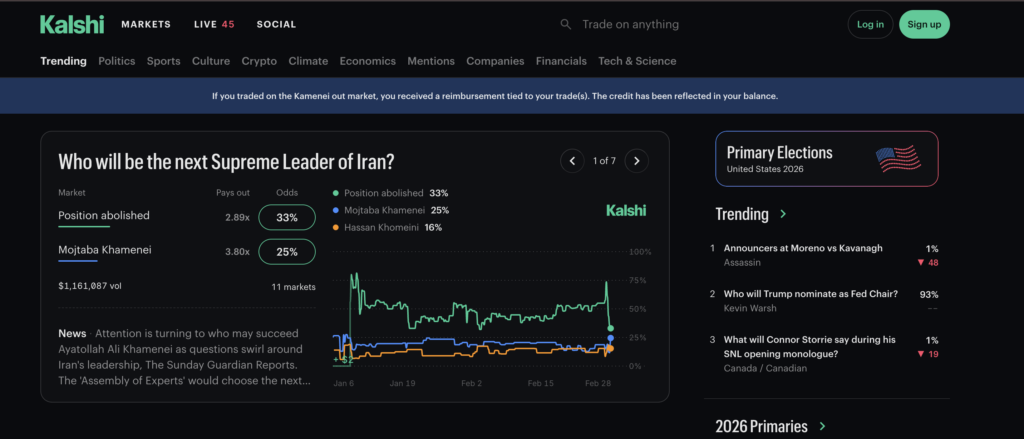

Kalshi itself has been on a tear, including thousands of new betting contract markets, rapid global expansion, and a fresh $1 billion raise at a whopping $11 billion valuation.

Any growth from its on-chain presence will likely only compound that growth further.

Liquidity is the whole game

Kalshi’s head of crypto, John Wang, has a very straightforward view on liquidity:

“If you don’t have liquidity, you don’t have a market.”

Tapping into the $3 trillion crypto market opens the floodgates to the kind of liquidity Kalshi needs to stay competitive – especially as Polymarket comes around to relaunching in the US.

More liquidity means tighter spreads, more accurate pricing, and the ability for large players to size in without severely impacting the order books.

What does this mean going forward?

Prediction markets look like they’re entering a new era.

Regulated platforms like Kalshi are realizing they can’t ignore the pull of on-chain liquidity, while fully on-chain platforms like Polymarket push hard for mainstream adoption and user growth.

Traders, on the other hand, just want the best of both worlds: deeper liquidity, tighter spreads, more anonymity, and smoother UX.

Kalshi’s move to tokenize its contracts on Solana sits right at that intersection.

Crypto-native users get the privacy and permissionless access they’re used to, without abandoning the regulatory clarity that Kalshi has fought years to secure.

If Kalshi can keep expanding its markets and nail the on-chain integration, this could be the first prediction platform that is both legally clean and genuinely crypto-native.

Not just bridging two ecosystems, but blending them into something entirely new.