As the DeFi ecosystem continues to grow, users are tasked with keeping up with more positions across more platforms on an increasing number of projects, contracts, and tokens.

While this growth is exciting, it’s increasingly important to have products and tools that help us easily manage our holdings across various networks and DeFi protocols.

An overview on portfolio management in DeFi

An increasing number of products are becoming available to help track and manage token balances, DeFi positions, NFTs, and more.

Traditional web3 wallets had difficulty tracking assets and positions within DeFi protocols, but new tools make it easy to see everything across all protocols and chains in one place.

Instead of searching through wallets and protocols, users can now use a single dashboard to view and manage their assets.

Let’s look at some key features of these DeFi asset management tools.

Portfolio management characteristics

Notable aspects of portfolio management products include:

- Multi-Chain Compatibility: Track assets and positions across multiple blockchain networks at once.

- DeFi Position Detection: Monitor positions within DeFi protocols, not just what’s in the wallet account.

- Portfolio Performance Tracking: View charts and figures showing the total value of all assets and positions.

- Built-in DeFi Tools: Access swaps, bridges, staking, and more directly from the portfolio dashboard.

- Automated: The tracker automatically updates asset balances and positions from the public blockchain, no manual entry needed.

- Non-Custodial: Users maintain control of their funds at all times.

Editor’s top picks in asset management projects

Here are a few projects we recommend checking out, to manage your DeFi portfolio in one place.

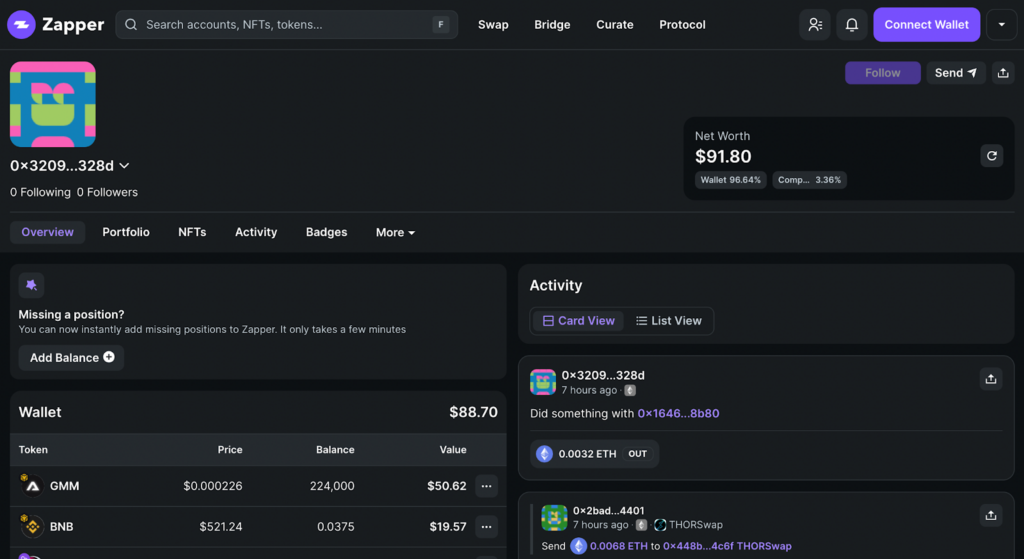

1. Zapper

Zapper is a one-stop platform for managing DeFi assets across multiple blockchains and protocols – with a twist.

Users can connect their wallets to track, trade, and analyze their crypto holdings in real-time through a social media-like interface.

Zapper contains a news feed of popular on-chain activity, along with multiple tabs to take a look at trending tokens and NFTs. This includes a personalized “for you” feed that lets users follow other users’ addresses.

The platform has also launched Zapper Protocol, incentivized by the $ZAP token. It aims to make Ethereum easy to understand, by encouraging people to interpret and contextualize on-chain information.

Why choose Zapper?

- Social Media-Styled Portfolio Management: Complete with news feed, “follow” functions, and chat features.

- Multi-Chain Support: Supports 11+ EVM chains including Ethereum, Arbitrum, Optimism, and Polygon.

- NFT Management: Integrates NFT projects for detailed tracking of trading volumes, price fluctuations, and market holdings.

- On-Chain Information Tracking: Offers updates on recent on-chain activities, large transactions, and prices across supported networks.

- Incentivized Community Participation: The community can contribute through Zapper protocol, incentivized with $ZAP tokens.

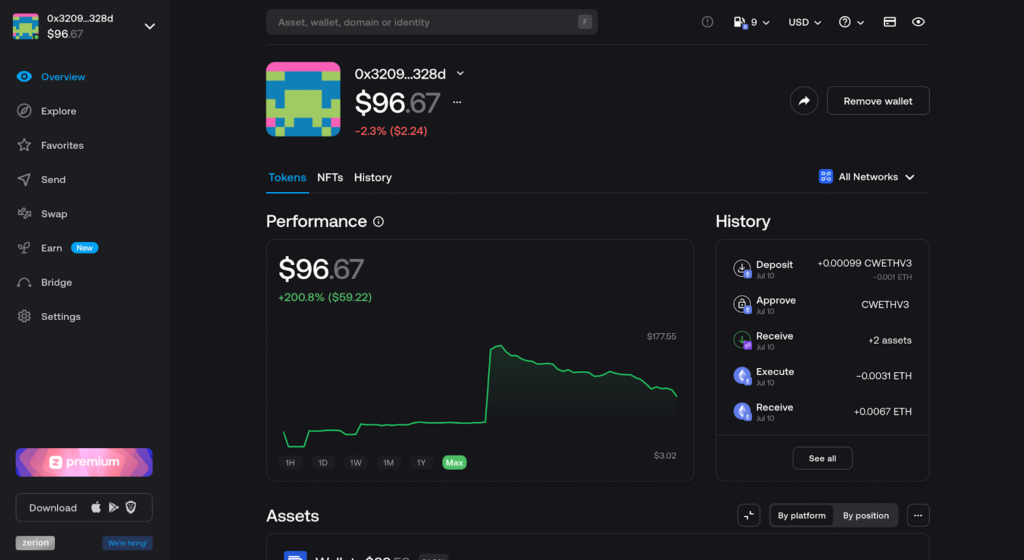

2. Zerion

Zerion started as just a portfolio tracker, but has now become a fully-fledged DeFi wallet, too.

Available as a browser extension and a mobile app, Zerion enables users to track all their crypto assets, DeFi positions, and NFTs across multiple chains – but also actively manage them in the same place.

It’s integrated with over 500 protocols and keeps your funds secure and under your control with non-custodial security.

Zerion also comes with some social aspects, such as an “explore” page and a follow function to track other users’ wallets.

Why choose Zerion?

- DeFi Wallet AND Portfolio Tracker: Users can actively manage everything from one place, on desktop and mobile (iOS and Android).

- Integrated Dapp Browser: Access any DeFi app directly from the wallet.

- Multichain Support:Supports 27+ EVM networks, including Ethereum, Polygon, Arbitrum, and BNB Chain.

- Social Features: Contains explore page and a follow feature, to keep track of interesting on-chain activity.

- Community and Integration: Supports 500+ integrated protocols.

- Trading and Swapping: Offers single-transaction bridging and swapping, with routing optimized for best deals.

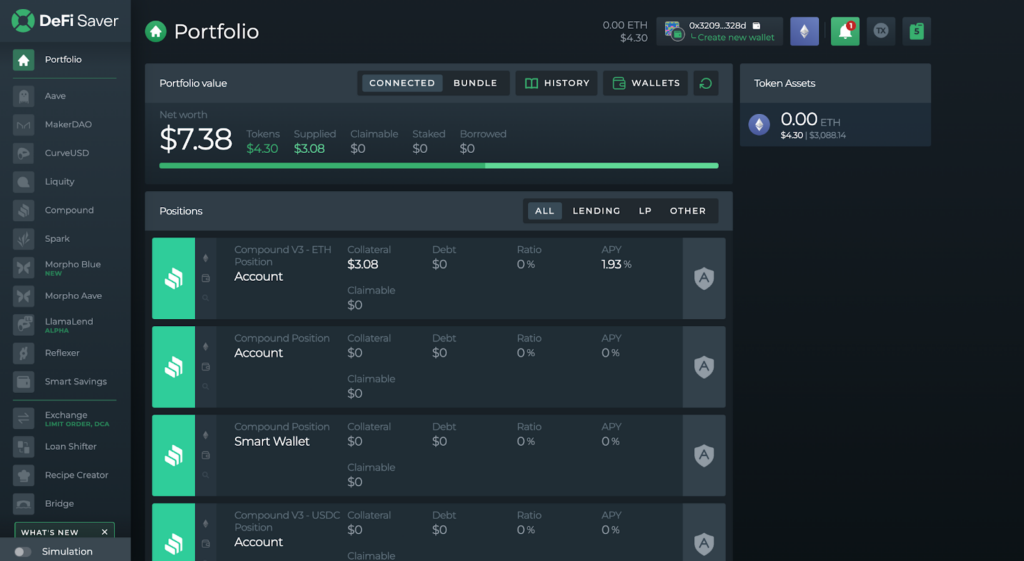

3. DeFi Saver

DeFi Saver is a more serious portfolio management tool, for DeFi power-users.

It allows users to not only track assets and positions, but also to interact directly with major DeFi protocols such as Aave, MakerDAO, Compound, and several others. This makes DeFi Saver perfect for those who wish to conduct all of their DeFi transactions from one place – without needing to visit other apps.

On top of general DeFi use, users can also use various special tools that can create leveraged positions, shift loans between protocols in a single transaction, and automate orders.

Why choose DeFi Saver?

- Made For DeFi Power-Users: Built-in interfaces to directly use all major DeFi protocols, without the fluff.

- Leverage Management: Create and adjust leveraged positions with easy-to-use Boost and Repay options.

- Loan Shifter: Seamlessly move positions between different protocols, including collateral and debt swaps in one transaction.

- Automation Tools: Automate stop-loss, take profit, and trailing stop orders.

- Custom Transaction Builder: Create complex, multi-protocol transactions including flash loans and token swaps.

- Recipe Creator: Drag-and-drop system for creating custom transaction strategies, which can be executed in a single transaction.

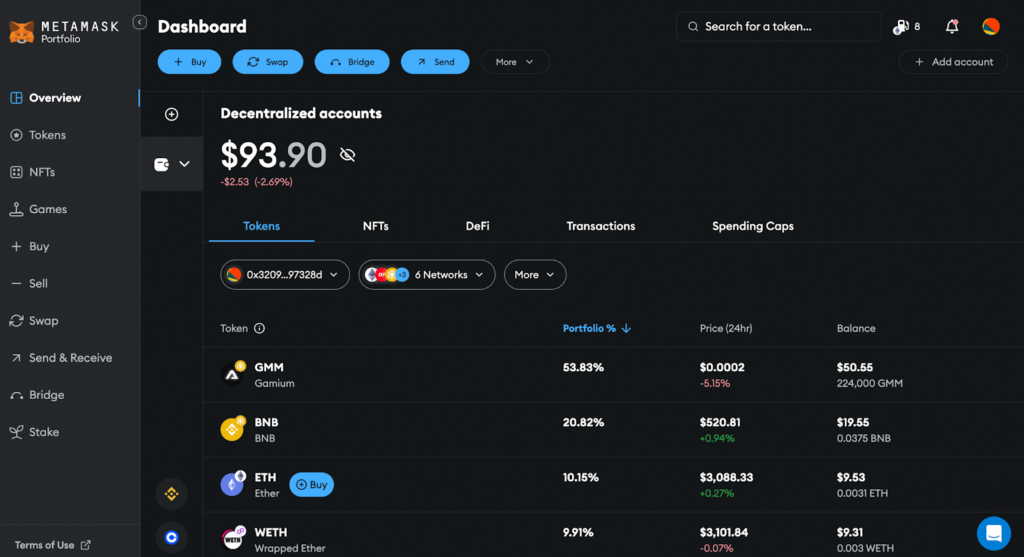

4. MetaMask Portfolio

MetaMask Portfolio is the default portfolio management tool for MetaMask Wallet’s tens of millions of users.

It’s just one click away in the MetaMask Wallet browser extension or mobile app, giving users immediate access to a single dashboard for viewing and managing their tokens, NFTs, and DeFi positions.

MetaMask Portfolio gives users the option of importing their Binance or Coinbase CEX account via API keys, so they can view (but not trade) their centralized exchange account balances too.

Users can execute token swaps and bridge assets between multiple EVM chains, without leaving the interface.

Why choose MetaMask Portfolio?

- MetaMask Wallet Integration: Deep integration with the MetaMask wallet extension and mobile app, for a seamless experience.

- Multiple Account Management: Aggregate and track multiple MetaMask accounts at once.

- CEX Account Support: Track Binance and Coinbase accounts via API key integration.

- Tax Partnerships: Discounts on tax services when working with partnering providers.

- Eligible Airdrops Detector: Users are automatically informed if they are eligible for major airdrops.

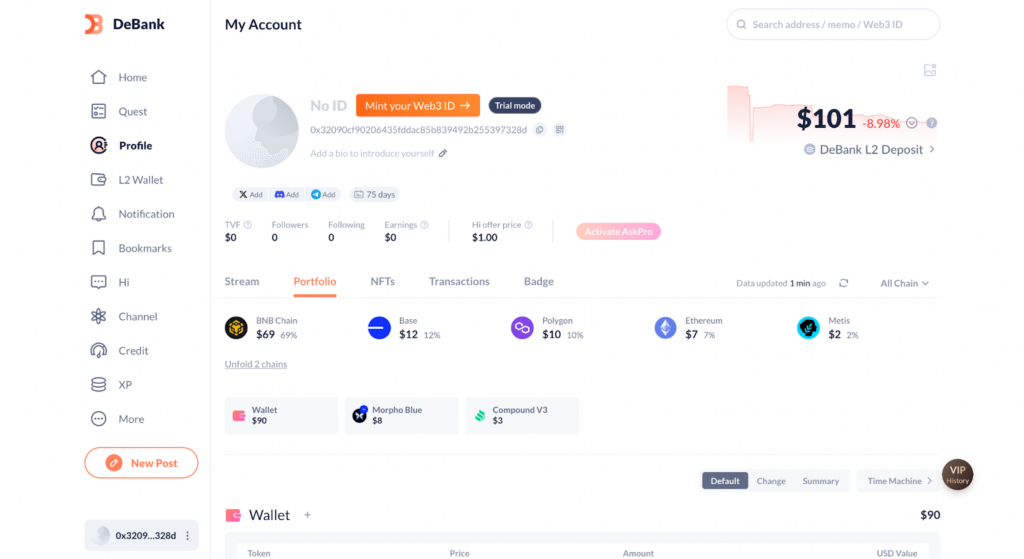

5. DeBank

DeBank is another popular portfolio management dashboard with a focus on social features. These include user profiles, the ability to follow other users, a news feed, and a chat function.

Users can track their token balances, DeFi positions and NFTs across several EVM chains in an intuitive fashion – but there’s no built-in function for swaps, bridging or other on-chain actions.

Many features are limited, unless you pay for a subscription or Mint a Web3 ID on DeBank’s layer 2 network. This L2 chain is designed to facilitate the platform’s chat app, DeBank Hi, which lets users charge money for receiving messages from other users.

Why choose DeBank?

- Social Features: Customizable profiles, ability to follow other users, “for you” news feed, permissioned channels, and more.

- Paid Messaging: Purchase anyone’s attention, or sell your own attention to earn.

- Multichain Support: Supports 108+ EVM networks, including Ethereum, Polygon, Arbitrum, BNB Chain, and Avalanche.

- “Time Machine” Feature: Compare asset changes between any two dates of your choice.

- Transaction History Analysis Mode: Provides in-depth analysis of transactions for any address.

Conclusion

Managing assets across various DeFi platforms can be overwhelming as the ecosystem grows. Fortunately, portfolio management tools like Zapper, Zerion, DeFi Saver, MetaMask Portfolio, and DeBank simplify this process.

These tools help users efficiently manage portfolios, stay informed about market activity, and make informed decisions from a single interface, making DeFi investment more streamlined and accessible.

Managing your crypto portfolio also includes understanding tax implications. For insights on DeFi tax obligations, see our crypto tax guide.

FAQ

Simply connect your web3 wallet to any of the protocols. Some of them don’t require a wallet connection at all – simply enter your public address into the search bar on the app.

When you connect a wallet, no funds are transferred – the dashboard simply analyzes and displays the different values across various positions and holdings.

Yes, all asset management products are non-custodial, meaning there is no transferring of funds or need to share crucial information like private keys in order to benefit from their services.