Yield aggregator Yearn launched its new YFI governance token on July 17, 2020, along with several new liquidity pools.

Excerpt from the YFI token blog post | Source: Medium.com/iearn/

Best-known at the time for its Y Curvepool, Yearn provided (and continues to provide) users with multiple ways to earn interest by contributing their capital to different pools.

At the time, Yearn’s pools offered some of the highest lending rates in DeFi. Its flagship pool managed $8 million in assets and a return of over 10% APY between its inception and the YFI token launch.

Yearn’s suite of products created a comprehensive system for lending and arbitrage, moving liquidity across various different DeFi platforms to get the best returns.

This included everything from Curve to Compound, Aave, Uniswap and several more.

How to Earn YFI Governance Tokens

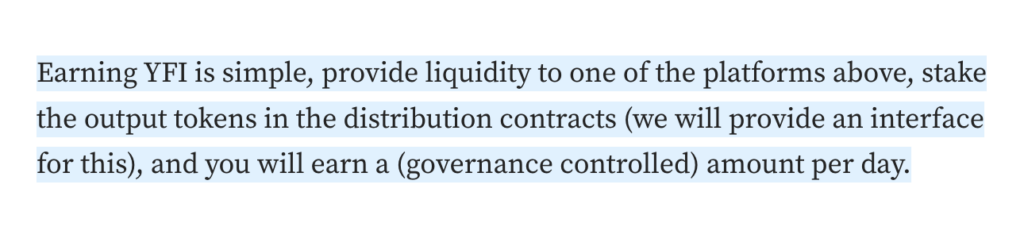

Earning YFI at its launch was straightforward: Provide liquidity to one of Yearn’s products below and stake the liquidity provision tokens.

The products included:

- yTrade: Allowing trading of top stablecoins (DAI, USDC, USDT, TUSD, and sUSD) with leverage up to 1000x using an initiation fee, or 250x without.

- yLiquidate: An automated system for handling defaults on Aave loans.

- yLeverage: Allowing users to open a 5x leveraged Dai Vault using USDC as collateral.

- ySwap: A stable Automated Market Maker (AMM) allowing for single-sided liquidity provision while earning interest and rewards.

- *.finance: A new credit delegation platform for smart contract to smart contract credit delegation lending (details TBA).

Whereas other DeFi protocols had portions set aside for their teams or sold in initial offerings, Yearn made it clear that YFI tokens were designed to have no financial value beyond their use in governance.

Burning YFI For Rewards

A new staking interface would enable YFI holders to burn their earnt YFI, in exchange for aDAI.

The pool of aDAI was to be generated by fees from several sources and mechanisms across the protocol including:

- Interest, system, and leverage fees

- Liquidation bonuses

- Proceeds from liquidity mining on other DeFi protocols.

This provided YFI with some clear inherent value, despite the team’s claims stating otherwise.

Where Is Yearn Now?

Yearn has steadily continued development, despite an $11 million hack in 2021 and the departure of its founder, Andre Cronje in March 2022.

The protocol currently has a total value locked (TVL) of $260.8 million, according to DeFiLlama.com.

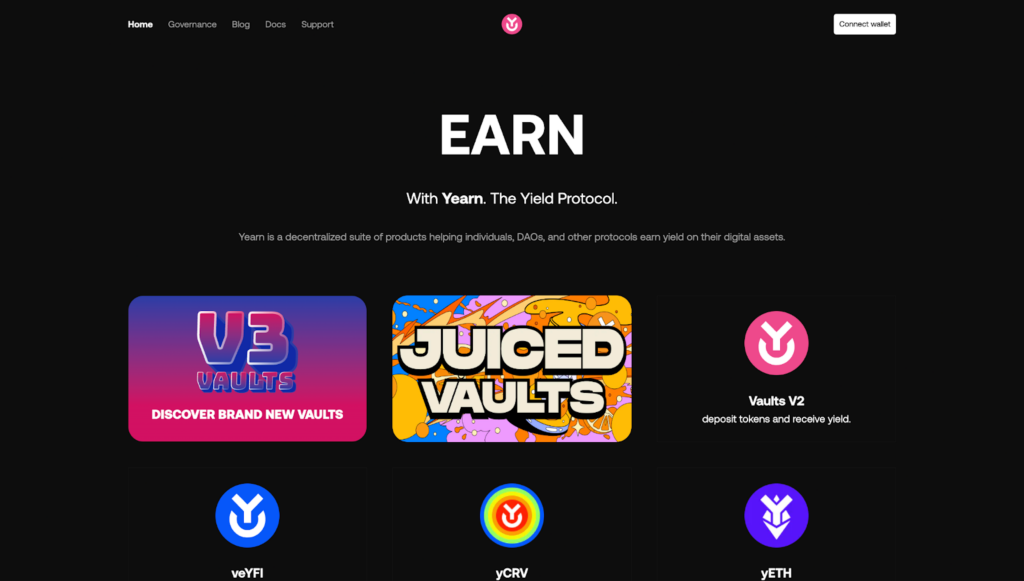

The current Yearn homepage | Source: Yearn.fi

Yearn continues to provide a suite of various useful products and portals. Those available today include:

- V3 Vaults: Choose between single or multiple strategies for their assets, providing more control and accommodating various risk appetites.

- Juiced Vaults: Invest in Ajna, a new protocol. These strategies are new and exciting, but have limited liquidity.

- V2 Vaults: Earn returns from a wide range of existing DeFi strategies. Increased flexibility over V1, but less customizable than V3.

- veYFI: Lock YFI tokens to receive boosted vault rewards, participate in governance, and earn from early exit penalties and non-distributed gauge rewards.

- yCRV: Earn revenue from protocol fees and vote-maximized bribes, which is converted to crvUSD stablecoin and distributed to yCRV stakers.

- yETH: Deposit liquid staking tokens (LSTs) to receive yETH, or deposit and stake to receive st-yETH and start earning liquid staking yield.

- yPrisma: Earn revenue from protocol fees and vote-maximized bribes, which is converted to mkUSD stablecoin and distributed to yPRISMA stakers.

Although it’s relatively easy to deposit into a Yearn vault, it remains a platform for the more DeFi-savvy users.

With a relatively complex and mixed combination of yield-generating strategies, users will need to know the ins and outs of DeFi to understand what their deposits are really doing.