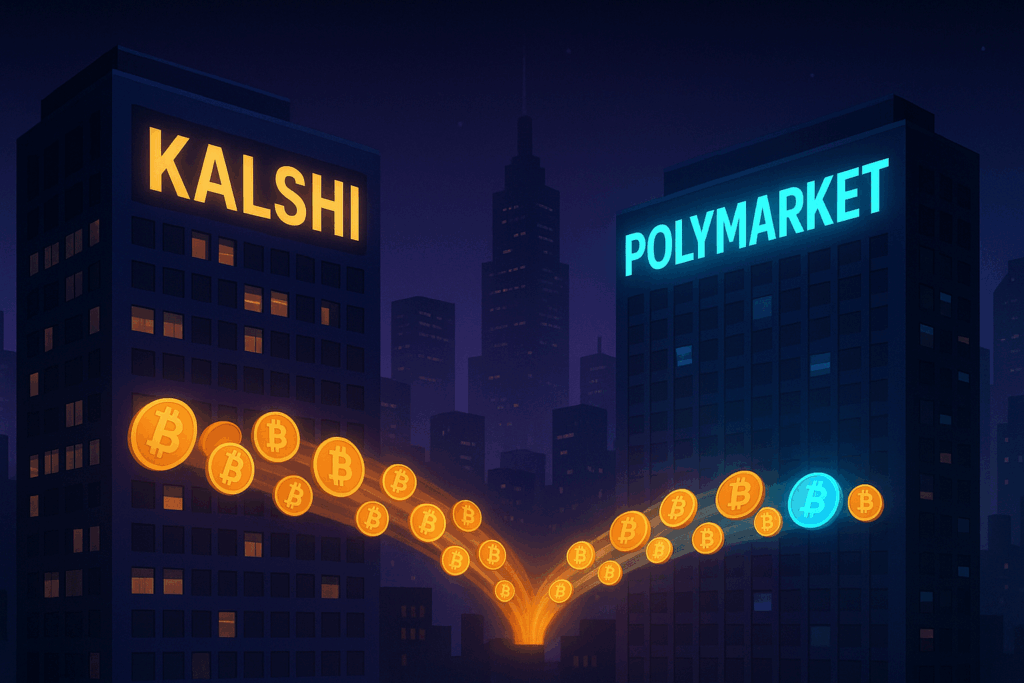

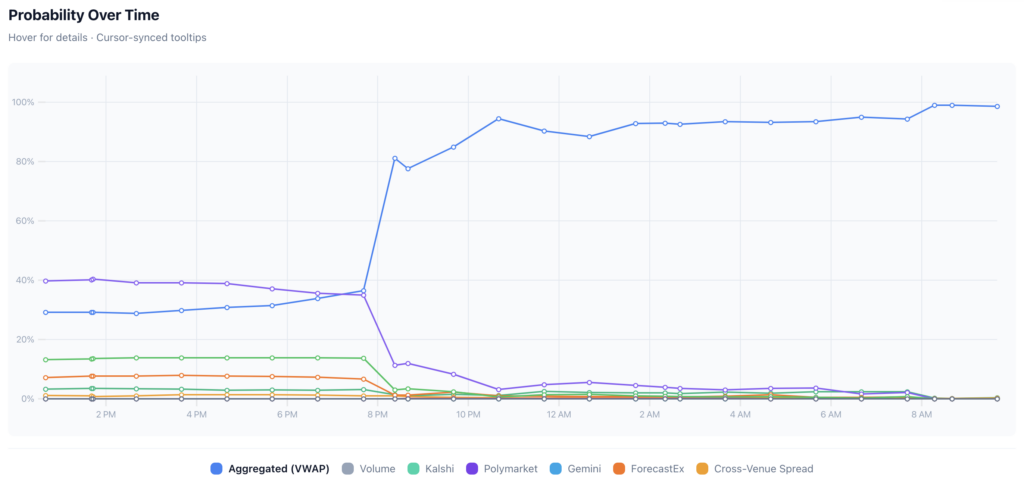

President Donald Trump announced Friday morning that he’s nominating Kevin Warsh to succeed Jerome Powell as Federal Reserve chair. Prediction markets signaled the pick well before the official announcement, with Warsh’s odds on Kalshi surging from 31% to 81% on the evening of January 29 after reports emerged of his White House meeting with Trump. By Friday morning, his probability had climbed above 95% across platforms, with Polymarket showing 99.3% and Kalshi at 98.5%. The market generated $32.3 million in 24-hour volume, with Polymarket accounting for 82.9% of the action.

Now, prediction market traders turn to when Warsh will be confirmed and how many confirmation votes he will receive and from whom. Others are wondering how a Kevin Warsh-led Federal Reserve will impact other economic factors including fed rates and monetary policy.

Who is new Fed Chair nominee Kevin Warsh?

Warsh, 55, served as a Fed governor from 2006 to 2011, placing him at the center of the central bank’s response to the 2008 financial crisis. He worked closely with then-Chair Ben Bernanke and Timothy Geithner during the meltdown, negotiating a survival path for his former employer Morgan Stanley. Before joining the Fed, Warsh served as a special assistant to President George W. Bush for economic policy.

Warsh was a finalist in the 2017 Fed chair search before Trump ultimately selected Powell — a decision Trump has publicly called a mistake. His nomination ends a months-long selection process led by Treasury Secretary Scott Bessent that included 11 candidates before narrowing to four finalists: Warsh, Fed Governor Christopher Waller, BlackRock executive Rick Rieder, and National Economic Council Director Kevin Hassett.

Warsh vs. Powell: A different approach to monetary policy

The two men represent distinct philosophies on central banking. Powell has favored a data-dependent, cautious approach with extensive public communication through press conferences, speeches, and the dot plot. Warsh has called for a more restrained Fed that speaks less and acts more decisively.

In a Wall Street Journal op-ed late last year, Warsh criticized Powell’s Fed for accepting “stagflation in the next couple of years, as if subpar growth and inflation 40% above target is the best that can be done.” He argued that “inflation is a choice” resulting from policy decisions rather than external factors like tariffs or supply chains.

On the balance sheet, the two diverge sharply. Powell has gradually wound down the Fed’s holdings from their pandemic peak of $8.9 trillion to roughly $6.5 trillion. Warsh has been a longtime critic of quantitative easing, arguing the Fed’s “bloated balance sheet” subsidized Wall Street at the expense of Main Street. He has called for significantly reducing holdings and redeploying that capacity toward lower interest rates for households and small businesses.

Perhaps most significantly, Warsh believes AI-driven productivity gains will be “a significant disinflationary force,” justifying more aggressive rate cuts than the current Fed has been willing to deliver. He’s argued a 1-percentage-point increase in annual productivity growth could double living standards within a generation.

Why Trump chose Warsh

Trump has relentlessly pushed for lower interest rates, recently calling for rates “two points and even three points lower” than current levels. While Warsh built his reputation as an inflation hawk during his Fed tenure, he has aligned himself with the president in recent months by publicly advocating for cuts.

Warsh also brings credibility that other candidates lacked. “He has the respect and credibility of the financial markets,” said David Bahnsen, chief investment officer of The Bahnsen Group, on CNBC’s Squawk Box. “There was no person who was going to get this job who wasn’t going to be cutting rates in the short term. However, I believe longer term he will be a credible candidate.”

Trump praised Warsh in his Truth Social announcement: “I have known Kevin for a long period of time, and have no doubt that he will go down as one of the GREAT Fed Chairmen, maybe the best. On top of everything else, he is ‘central casting,’ and he will never let you down.”

Market reactions and interest rate expectations

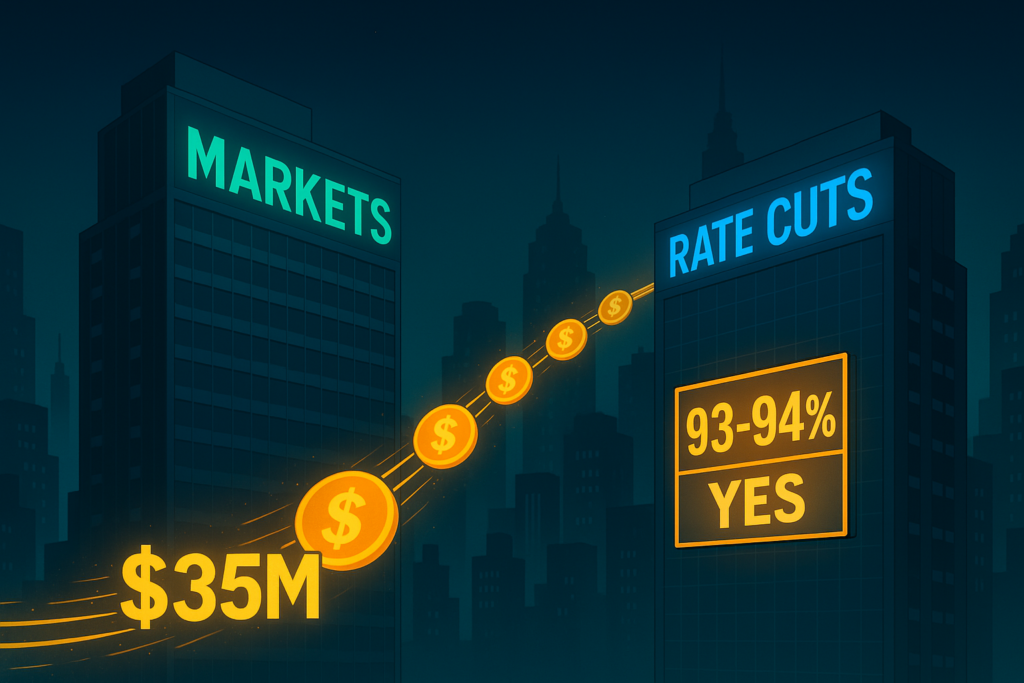

Financial markets responded cautiously to the nomination. Stock futures fell roughly 0.5% overnight before paring losses after the official announcement. The 10-year Treasury yield climbed to 4.27%, with the 30-year leading gains at five basis points higher. The dollar strengthened against major currencies while gold dropped 2.8%.

The mixed reaction reflects uncertainty about which Warsh will show up — the historical hawk or the newly dovish Trump ally. Nomura strategist Andrew Ticehurst summarized the market view: “The market perception is that Kevin Warsh would be the relatively more traditional and less dovish option as Fed chair, in which case we might see fewer rate cuts.”

The Fed currently holds its benchmark rate at 3.5%-3.75% after three consecutive quarter-point cuts in late 2025. Interest rate markets are pricing in at most two rate reductions in 2026, with the next move expected no sooner than June.

Warsh’s appointment is unlikely to deliver the aggressive cuts Trump wants, at least immediately. The Fed chair can’t dictate policy alone — rate decisions require consensus among the 12 voting FOMC members. At Wednesday’s meeting, only two governors (Stephen Miran and Christopher Waller) dissented from the decision to hold rates steady.

Seeking Alpha analysts noted that despite political pressure, “the Fed’s power to lower long-term rates remains constrained by persistent inflation and high government debt.”

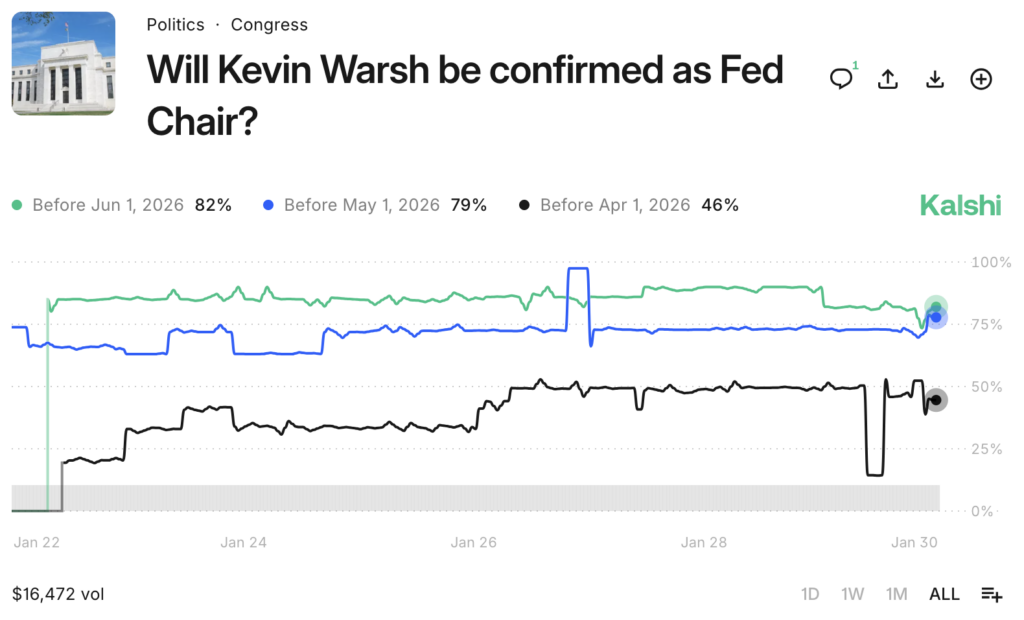

When will Warsh be confirmed?

While the prediction markets are showing a high likelihood of Warsh being confirmed before June, some obstacles remain, and a lot could happen between now and then. With relatively low trading volume so far, forecasts aren’t reliable yet. But so far, Kalshi markets are showing confidence of 82% that Warsh will be confirmed before June, and possibly by April or May.

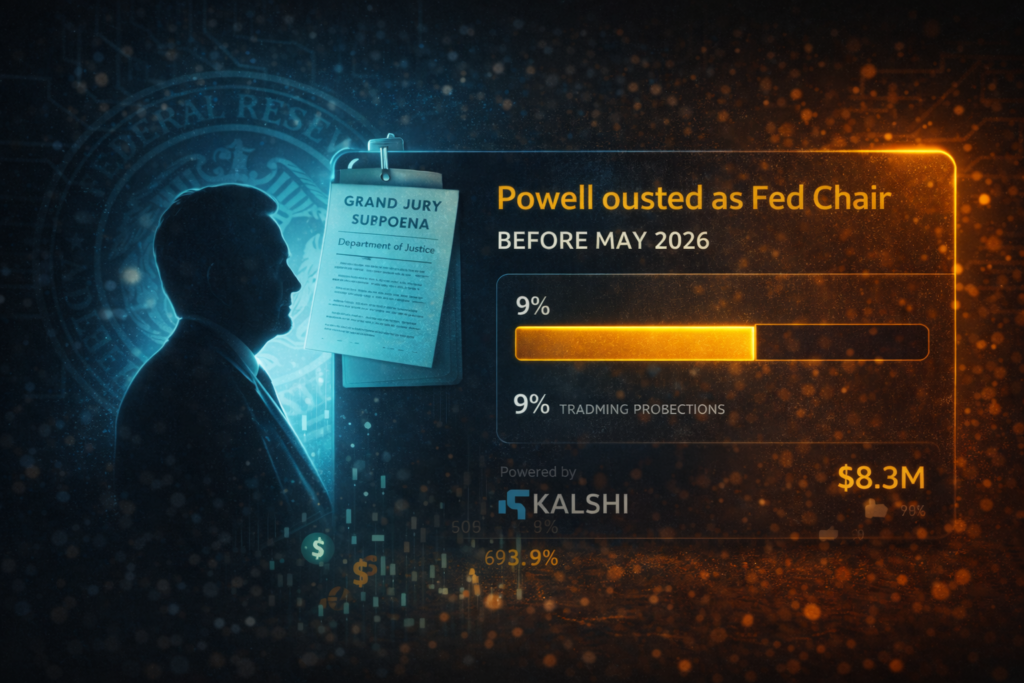

Warsh’s confirmation is certainly not a done deal yet. Republican Senator Thom Tillis of North Carolina has pledged to block any Fed nominee until the Justice Department concludes its investigation of Powell over headquarters renovation costs.

Tillis said on X: “Kevin Warsh is a qualified nominee with a deep understanding of monetary policy,” but he also confirmed: “I will oppose the confirmation of any Federal Reserve nominee, including for the position of Chairman, until the DOJ’s inquiry into Chairman Powell is fully and transparently resolved.”

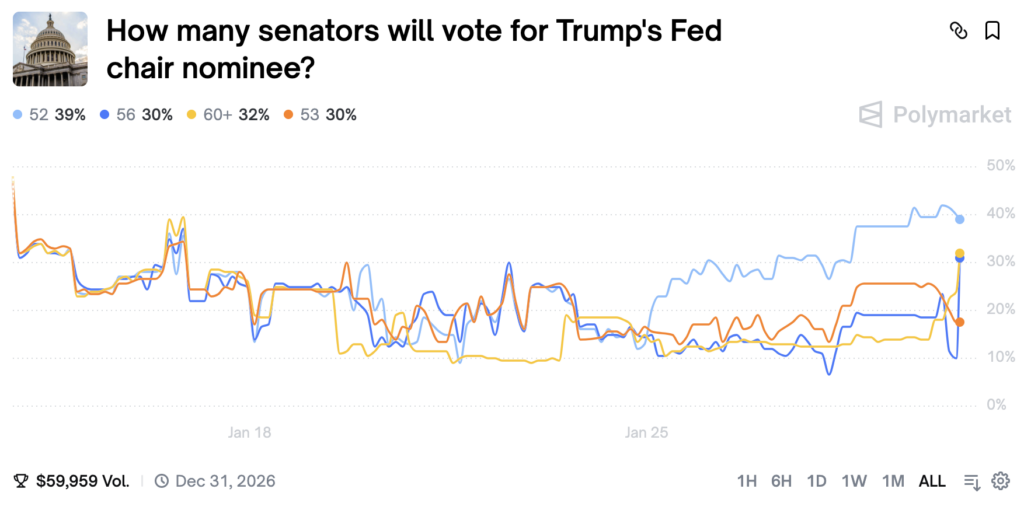

Powell’s term as chair ends May 15, though his term as a Fed governor runs until January 2028. If Powell chooses to remain on the board, it would limit Trump’s ability to install a majority of his own nominees and could create procedural complications for Warsh’s confirmation. Leading up to a confirmation vote, prediction markets are offering markets on who will vote for or against Warsh as Fed chair, and how many senators will vote to confirm him.

Polymarket currently shows a 39% chance of Warsh being confirmed with exactly 52 votes — the most likely scenario — but liquidity is still thin in this market as well. The coming weeks should reveal whether Tillis’s blockade threat, or other potential dissent, poses a real threat to Warsh’s confirmation. And if he is confirmed, many will be watching and trading on Warsh’s potential impact on monetary policy and interest rates going forward.