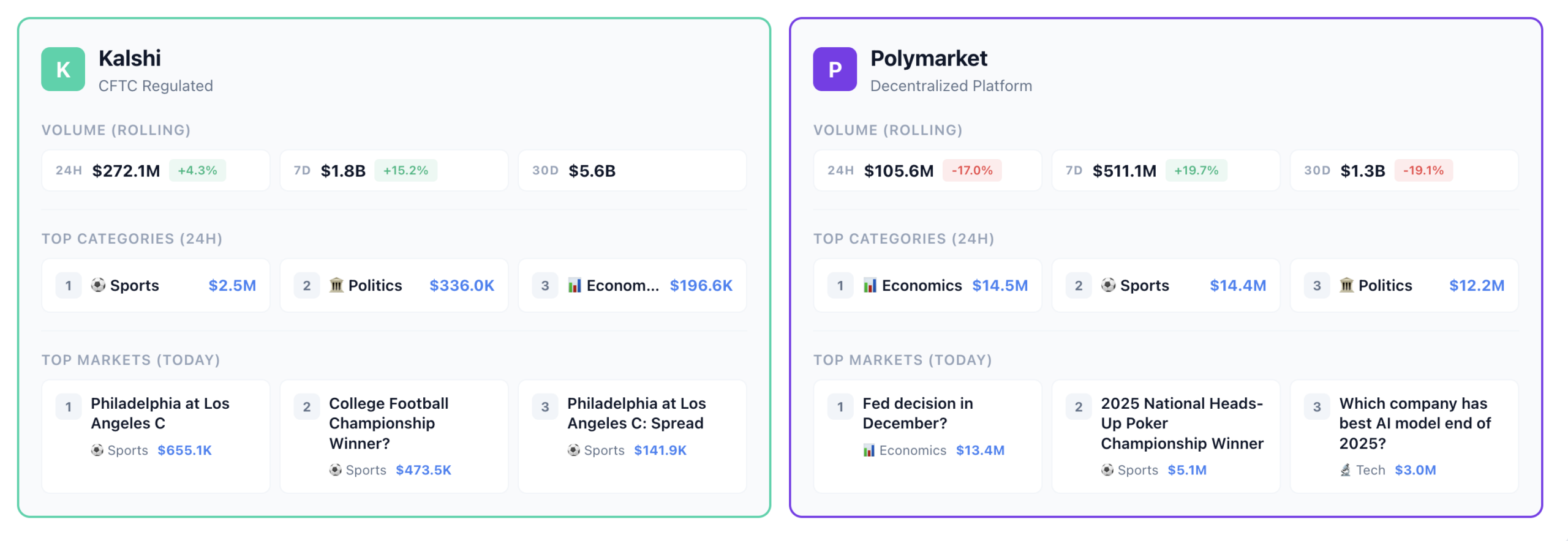

Rolling weekly volume topped $2.3 billion across Kalshi and Polymarket over the past seven days.

Kalshi posted a little over $1.76 billion in rolling weekly volume, while Polymarket recorded $511 million. Kalshi’s share of the market stands at 78%.

Data from DeFi Rate tracker. Weekly figures reflect seven-day rolling volume as of December 8, 2025 at 12:31 AM PST

NFL continues the weekly volume cycle, followed by Fed decision

NFL games again led Kalshi’s weekly volume. Kansas City at Dallas was the top market at $47.1 million, followed by Cincinnati at Baltimore ($43.7 million) and Green Bay at Detroit ($33.0 million). Indiana at Ohio State ($32.4 million) rounded out the top four as the week’s largest college football market. All four contracts have settled—Dallas, Cincinnati, Green Bay, and Indiana won.

Polymarket’s top sports markets are futures. The 2026 NBA Champion contract has drawn $14.7 million in volume, with Oklahoma City leading at 42% odds. The UEFA Champions League Winner market sits at $12.1 million, with Arsenal (19%) ahead of Bayern Munich (18%).

The upcoming Fed decision closes Dec. 10. Traders have placed $111 million on the contract—$87.5 million on Polymarket, $23.4 million on Kalshi. Odds on a 25 basis point cut sitting at 91-93% across both markets.

Though Kalshi has a lead on Polymarket, Robinhood accounts for a significant share of Kalshi’s volume. In the company’s Q3 2025 earnings call, incoming CFO Shiv Verma said “a very large chunk of Kalshi’s volume is actually coming from Robinhood.” The brokerage traded 2.5 billion prediction market contracts in October.

Other partners offering Kalshi contracts include Webull (hourly crypto and Fed events), which launched in February, and PrizePicks (sports and culture picks in 38 states), which launched November 14.

Polymarket received CFTC approval for intermediated trading on November 25, allowing brokerages and FCMs to list its contracts. The platform partnered with PrizePicks the same week as Kalshi, but that integration awaits Polymarket’s full U.S. launch. MetaMask rolled out Polymarket predictions last week.