DeFi project Gondor has raised a new $2.5 million pre-seed round in December 2025, adding fresh momentum to its push to become the core lending layer for on-chain prediction markets.

The round included participation from Prelude, Castle Island Ventures, and Maven11, with continued backing from the Polymarket ecosystem.

The raise is tied closely to Gondor’s next big step: the launch of its public beta.

Gondor, along with the clear interest in its product, shows prediction markets are moving beyond simple betting apps – and now need real financial infrastructure underneath them.

Prediction market capital is locked and idle

Right now, prediction markets like Polymarket suffer from a basic inefficiency.

That is, once you place a bet, your capital is stuck until the market resolves – and sometimes that’s for several months. That capital can’t be traded, lent, reinvested, or used as collateral. It just sits there.

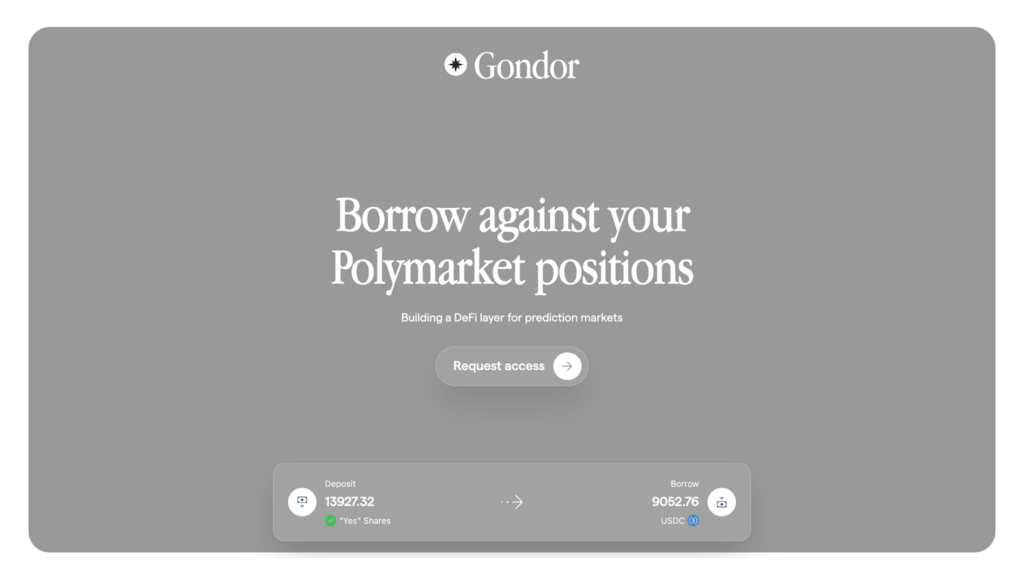

Gondor fixes that by letting traders borrow $USDC stablecoins against their open Polymarket positions. You deposit your active “Yes” or “No” shares into Gondor, and the protocol lets you take out a loan while keeping your original exposure intact.

In a nutshell, prediction positions stop being dead capital, and start behaving like real financial assets.

2x leverage comes to Polymarket next week

With its beta launch, Gondor is introducing up to 2x leverage through a simple looping strategy.

Traders can borrow against their position and redeploy that capital into a second position, effectively doubling exposure without adding new funds.

This kind of leverage is completely new to prediction markets. Until now, traders had to either close positions or bring in outside capital to scale. Gondor gets rid of that limitation.

The team has already hinted at pushing leverage higher – to as much as 4x to 5x in 2026 – once liquidity and risk systems are proven in production.

Beyond just “trading”

Gondor’s product isn’t just about leverage for trading. It’s about turning prediction markets into a real on-chain asset class.

Earlier this year, Ethereum founder Vitalik Buterin pointed out that prediction markets are unattractive for serious hedging because they generate no yield.

While Gondor doesn’t directly add yield to positions, it adds the tools that make yield possible down the line – collateralization, lending, leverage, and eventually structured financial products.

That’s why Gondor frames itself as the Aave of prediction markets.

It doesn’t compete with Polymarket – it sits as a platform on top of it, powering liquidity and capital flow the same way lending protocols power DeFi today.

Leverage is risky business

As all crypto traders are aware, adding leverage to prediction markets will also add real risk – and that risk isn’t isolated to just individual users.

If the value of a position drops far enough, it can be liquidated. If too many leveraged positions unwind at once, it could cause sharp, fast-moving cascades in thin markets.

Gondor is trying to manage this by starting with conservative borrowing limits and only supporting high-liquidity markets during beta.

It is still in its very early stages. The protocol is just entering beta, and real stress testing hasn’t happened yet, but this is a live attempt to build the missing financial layer for on-chain prediction markets.

Whether Gondor becomes that layer is still an open question. But with fresh capital secured and its beta now live, it’s officially one of the most important experiments happening in the prediction market space right now.