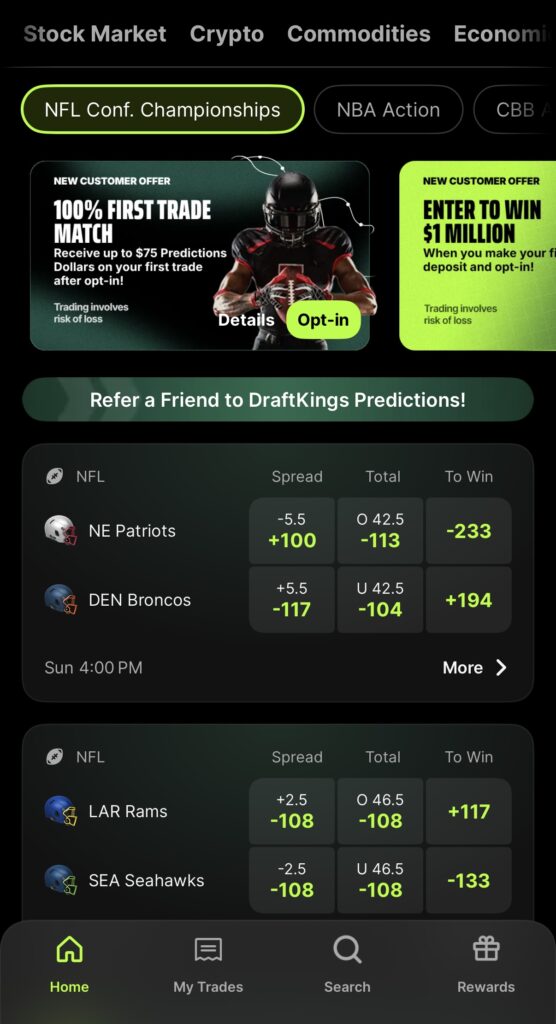

CME Group and Kalshi have self-certified a fresh batch of event contracts with the CFTC this week, expanding their sports and economic offerings as the prediction market space continues its rapid evolution. As CME Group is the market provider for DraftKings Predictions and FanDuel Predicts, the new additions will likely be appearing on both apps in the coming days.

CME’s additions focus on expanding basic sports offerings, with touchdown props for the Super Bowl, tennis major winners (in time for Grand Slam events starting in May), and college basketball over/under totals which are already available for trading. Meanwhile, Kalshi is expanding in-game markets for tennis and also filed to offer Winter Olympic medal markets in time for the 2026 Milano Cortina Winter Olympics in February.

CME’s latest filings

CME filed three new product certifications on January 20 for binary event contract swaps:

- Pro Football Championship First Touchdown and Time-Interval Touchdown — CME certified contracts for which player will score the first touchdown of the Super Bowl, as well as touchdown outcomes within specific time intervals of the game (so, markets like “anytime TD”).

- Pro Tennis Tournament Men’s & Women’s Singles Champion — Outright winner markets for the men’s and women’s singles finals at major professional tennis tournaments. The Australian Open is underway now, with the three other Grand Slam majors taking place over the summer, beginning in May.

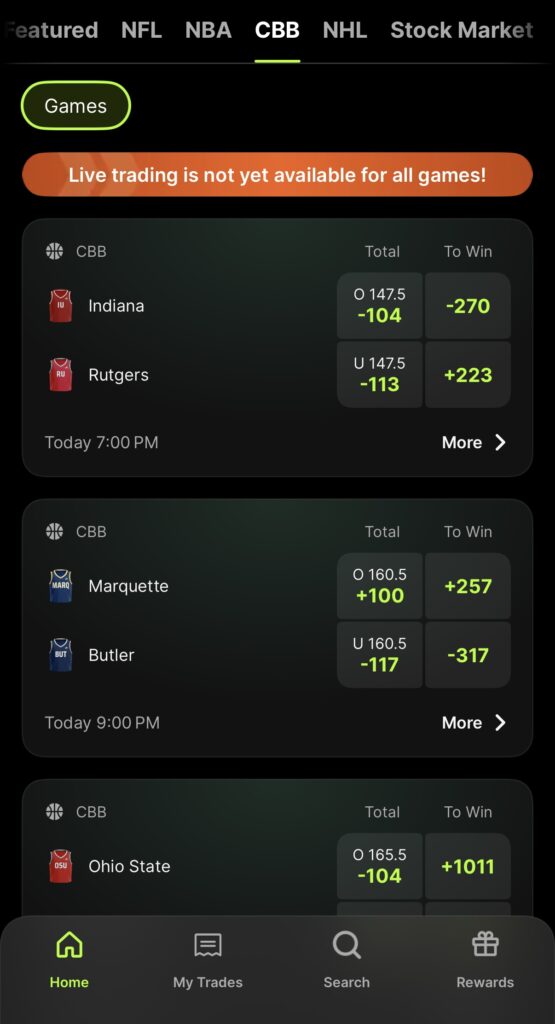

- College Basketball Game Total Points — Over/under style contracts on total points scored in college basketball games. These have already been added to CBB markets on the apps.

The initial listing schedule on the filing specified that all three contracts would be listed “no sooner than 1/22/26,” meaning the tennis and Super Bowl TD prop markets could appear any day now.

DraftKings and FanDuel prediction apps still rolling out

These certifications follow CME’s January 13 certifications for total points contracts covering pro football, pro basketball, pro hockey, and college football games. All of CME’s sports event contracts are offered to retail traders through FanDuel Predicts and DraftKings Predictions, which launched in a limited number of initial states in December 2025.

FanDuel Predicts expanded from five states into all 50 states in mid-January, with sports contracts offered only in 18 states. DraftKings Predictions is available in 38 states and offers sports event contracts in 17 of those. In all their available states, the apps offer CME markets on the stock markets, crypto, commodities and economics.

Next logical additions would be player performance markets (AKA player props) for the Super Bowl, and possibly other Big Game-related markets outside of the game itself, like who will win the coinflip, National Anthem length, halftime show props, what companies will air ads during the event, and more. Such markets are already available on more established prediction market exchanges, and some of them are even offered on FanDuel and DraftKings sportsbook products in some states. Notably, FanDuel and DraftKings predictions products do not yet offer mention markets, where traders on Kalshi and Polymarket can bet on whether announcers will say a particular word or phrase during broadcasts (or speakers in other publicly-aired events).

Other expectations for near-term additions include player performance markets to be added to other pro sports (like NHL and NBA), as well as point spread markets for CBB, probably ahead of March Madness. DraftKings Predictions also has a disclaimer right now that “Live trading is not yet available for all games!” within the college basketball tab, so it seems they are still building those markets out. MLB and Culture markets are also still notably missing at this point, and will likely be added eventually.

Kalshi expands in-game sports offerings, plans Winter Olympics markets

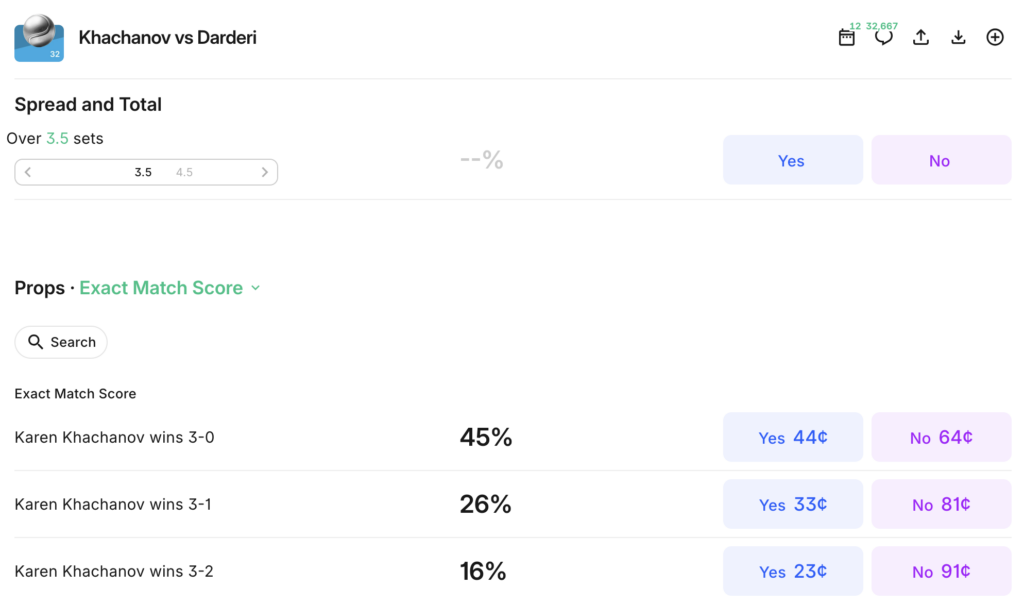

Kalshi (KEX) filed four tennis-related contracts on January 16, expanding further into micro-betting offerings:

- Will player win set in tennis match? — Contracts on individual set outcomes.

- Will the fastest serve in tennis match be above/below/exactly/at least/between count speed? — Serve speed prop markets.

- Will tennis match be decided in above/below/exactly/between/at least count sets? — Total sets markets.

- Will player win tennis match set score? — Set score outcome contracts.

Until now, Kalshi has focused sports market expansion on broadening categories (volume of sporting events and leagues you can trade on) and depth within NFL markets, including player performance props and same-game parlays called “combos.” The tennis markets were certified for Jan. 16, ahead of the Australian Open finals this weekend. So far, Kalshi has tennis match winner, total sets (spread), and exact match score markets listed for tennis.

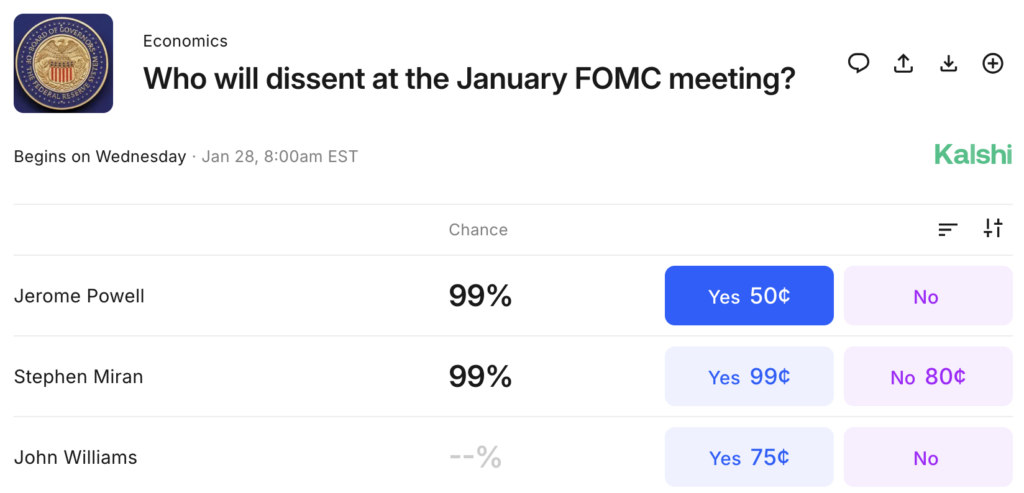

Kalshi also certified a new FOMC-related contract on January 14: “Will <member> dissent at the <meeting> FOMC meeting?” — allowing traders to bet on whether any Fed voting member will dissent from the rate decision at upcoming Federal Reserve meetings. This contract is listed but there is no trading activity yet.

Kalshi also made adjustments to its Winter Olympics filings on January 13. The exchange withdrew three previously certified contracts covering Olympic achievements, event occurrences, and performance metrics, then re-certified a revised version: “Will <participant> achieve <achievement> at the <year> Winter Olympics?” The reformulated contract appears to consolidate the earlier filings into a cleaner structure ahead of the Milano Cortina 2026 Winter Olympics in February.

Prediction market expansion continues

The new certifications underscore the divergent strategies of the various exchanges and Kalshi’s headstart on the sports front. CME is building out its sports catalog methodically through its new partnerships with FanDuel and DraftKings, focusing on major leagues, championship events and game totals that mirror traditional sportsbook offerings. The exchange’s sports event contracts are only available in states where online sports betting is not yet legal.

Kalshi, meanwhile, continues to expand across multiple trading categories while focusing on sports, which they still offer in all 50 states. The exchange already dominates the CFTC-regulated prediction market space, topping $2 billion in weekly trading volume during peak sports seasons, with roughly 90% of volume currently coming from sports. Polymarket isn’t far behind, also approaching $2 billion weekly trading volume.

The new FOMC dissent contract adds to Kalshi’s popular suite of Fed-related products, which have become go-to instruments for traders hedging macroeconomic risk and other retail speculators. Top prediction market exchanges’ Fed meeting and inflation markets are seeing record activity ahead of the January 28 FOMC meeting, with the exchange pricing a 96-98% probability of the Fed holding rates steady.

The new tennis markets mark Kalshi’s further expansion into micro-betting or in-game markets outside of NFL, potentially setting the stage for further in-game markets on additional team and individual sports.

Prediction market exchanges continue to face regulatory headwinds, particularly over their offering of sports contracts allegedly in conflict with existing state sports betting regulations. Over 30 states have filed amicus briefs supporting state authority over sports prediction markets, and Kalshi alone is engaged in more than ten lawsuits with states.

Still, the steady cadence of new product certifications signals that both CME and Kalshi are betting the federal regulatory framework will hold. And if not, they will have a deeper slate of markets to unfold when that time comes. In the meantime, demand for sports markets remains high across the U.S., and prediction markets are booming in growth as they help fill the demand.