Super Bowl 60 between the Seahawks and Patriots, if we’re being honest, was not the thriller we were all hoping for. But it did produce the single biggest day of trading in prediction markets‘ history — and it stress-tested exchange infrastructure in ways that exposed both the promise and the growing pains of the industry.

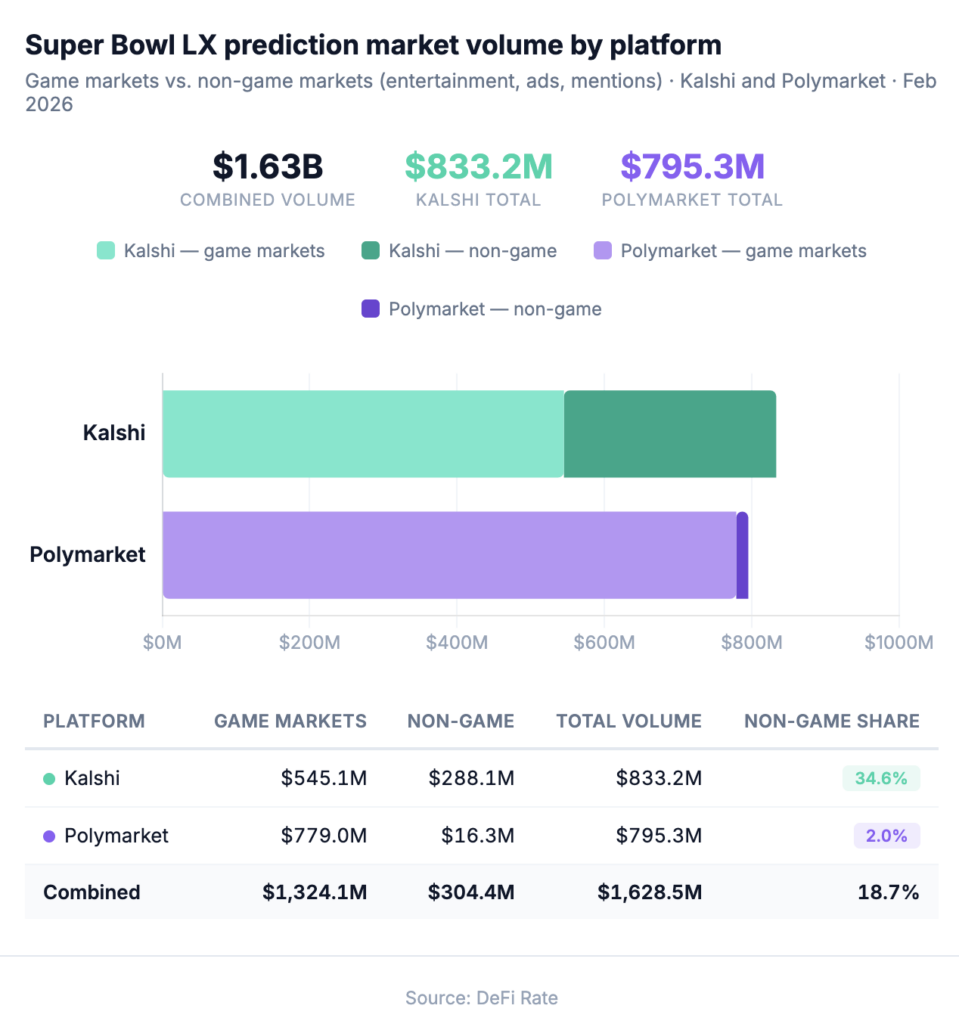

DeFi Rate tracked $1.63 billion in combined trading volume across Kalshi ($833.2M) and Polymarket ($795.3M) on Super Bowl-related markets spanning game-winner contracts, player props, halftime show predictions, ad markets, celebrity appearance trades, preset combos (parlays), and announcer mention markets. That figure is not far off from the $1.71 billion industry estimate for legal sports betting handle on the 2026 Super Bowl, though importantly, the two metrics are very much not the same (more on that later).

Kalshi separately reported that its total Super Bowl volume exceeded $1 billion, a figure that includes additional markets outside our tracking scope, particularly custom combos routed through Kalshi’s RFQ (request for quote) system. DeFi Rate’s own data shows all Kalshi trades on Super Bowl Sunday alone totaled $871.5M, consistent with other industry reporting. That single day helped push Kalshi to a record $2.8 billion week.

Year-over-year growth: two platforms, two completely different trajectories

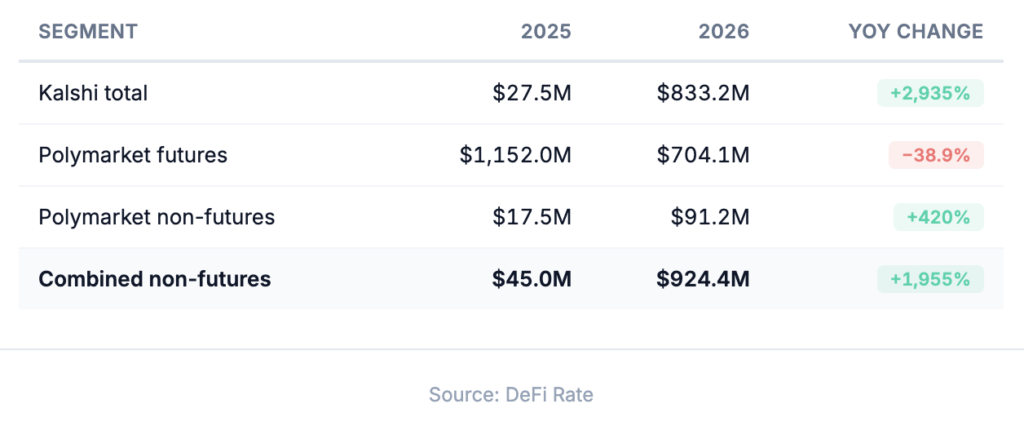

Combining the two platforms into a single YoY number would mask the important narrative that Kalshi and Polymarket actually moved in opposite directions.

Kalshi’s tracked volume grew from $27.5 million to $833.2 million — a 2,935% increase by our calculation. Last year’s entire Super Bowl offering consisted of just five different markets: game-winner and game-lines contracts ($27.0M across 4 markets) and an announcer mentions market ($434,881 across 19 strikes). This year, Kalshi ran 68 contracts across game lines, player props, halftime, ads, guests, combos, and mentions. Game lines alone went from $27.0 million to $425.2 million (+1,473%), while mentions grew from $435K to $9.0 million (+1,965%). Kalshi self-reported over $1 billion and 2,700% growth relayed by CNBC, which likely included additional RFQ-routed combo markets outside our scope. Our data substantiates overall YoY Super Bowl volume growth of at least that much for Kalshi.

Polymarket’s total, on the other hand, declined 32%, from $1.170 billion to $795.3 million. That drop is almost entirely explained by a 38.9% contraction in its season-long champion futures pool ($1.152B → $704.1M), which was the dominant source of volume in both years. The decline mostly reflects the explosive growth of Kalshi, which is now capturing the majority of sports-related trading interest in the U.S. and likely taking some of Polymarket’s global sports volume compared to a year ago. The absence of a Taylor Swift/Travis Kelce-driven cultural moment and a less narratively charged matchup compared to last year’s Chiefs-Eagles rematch may have also contributed. Polymarket’s non-futures markets, however, grew from $17.5 million to $91.2 million — up 420%.

Strip out futures entirely and the transformation is clear. Combined non-futures volume across both platforms grew from $45 million to $924 million — a 1,955% increase. One year ago, prediction market Super Bowl trading was one massive global futures pool at Polymarket and early-stage US-focused game markets at Kalshi. This year it was a multi-category ecosystem spanning halftime, ads, player props, mentions, combos, and in-game live markets across a rapidly growing network of exchanges and distribution channels.

Important note on what “trading volume” actually means

$1.6 billion in trading volume doesn’t mean $1.6 billion was bet on the Super Bowl.

As Dustin Gouker of the Event Horizon newsletter put it: “When you bet $1 at sportsbooks to win a total return of $10 (including your original bet), that’s $1 of handle. If you bet $1 at Kalshi for a total return of $10, that’s $10 in volume. Could that other $9 of volume be considered handle, sometimes, depending on who your counterparty is? Possibly. But oftentimes it will be a market maker that is playing the same role as the house at a sportsbook. That’s not something anyone would consider ‘handle.'”

On top of that, traders can buy and sell positions multiple times within a single market, and each transaction counts as a separate volume event. Take the MVP market ($52.2M on Kalshi): a trader may have bought Darnold MVP shares, sold at a profit as Seattle built a lead, and then rotated into longer shots like a defensive player or even a running back (like Kenneth Walker, who actually won the award). That’s three or four volume events from one initial stake. The same goes for in-game moneyline, spread, over/under totals and so on.

DraftKings offered its own reframing in its Q4 2025 shareholder letter. The company reported $54 billion in sportsbook handle for fiscal year 2025 but noted that “total potential payouts, or capital at risk” across all open wagers reached $2.5 trillion due to the multiplicative nature of parlays — adding in a footnote that this figure “is comparable to volume that Predictions operators report.” The implication: prediction market volume figures may not be as unprecedented as they look when measured against the same math applied to sports betting action. It could also hint at the extremely high ceiling and room for growth in the prediction market space.

Kalshi’s entertainment marketplace: $279 million on halftime and ads

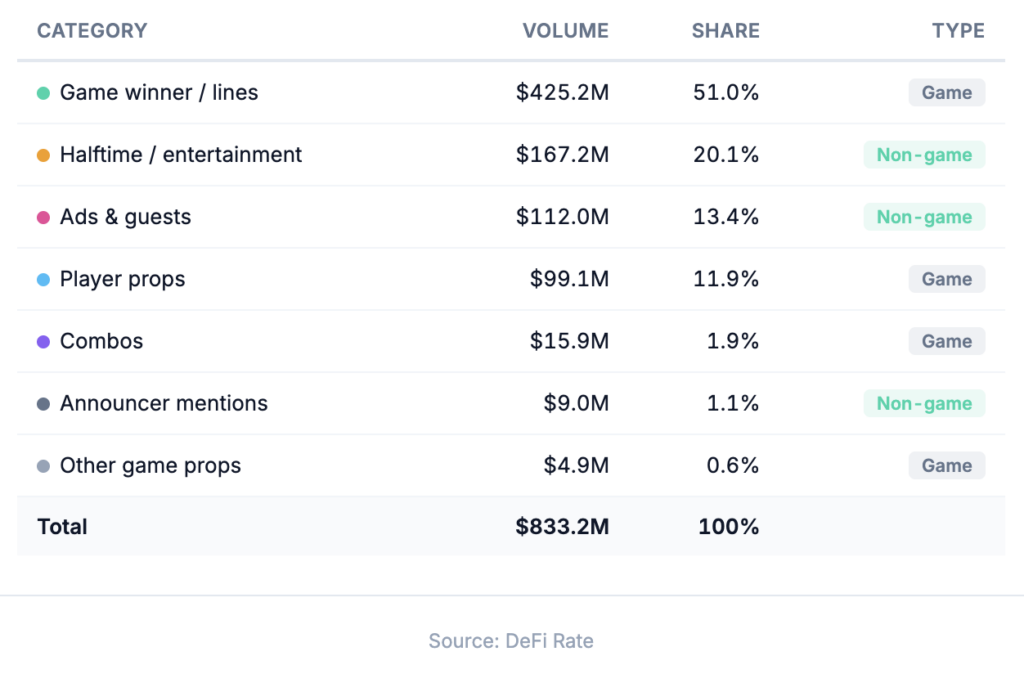

The most distinctive finding in our data is just how much of Kalshi’s volume came from outside the game itself. Of Kalshi’s $833.2 million total, $279.1 million — a full third — came from halftime, entertainment, ads, and guest appearance markets. Polymarket, by comparison, is almost entirely a game-outcome platform: 93.8% of its volume sat in Game Winner / Lines contracts.

Here’s how Kalshi’s top non-game markets performed:

The first-song market was the standout. Traders wagered $113.5 million on which song Bad Bunny would open with, making it Kalshi’s second-largest individual event, behind only the game-winner contract ($358.8M). The Super Bowl ads market did $72.2 million. MVP winner drew $52.2 million. Halftime performers pulled $47.3 million. Guest appearances added $39.8 million. One year ago, Kalshi’s entire Super Bowl offering was a single $27 million game lines market consisting of four contracts and one small announcer mention market. This year, a market about a song choice generated four times that.

Note: Our “combos” category does not include custom parlays executed via Kalshi’s RFQ system, only preset ones available through Kalshi’s API.

Also excluded from our data pull: Who will appear in a Super Bowl ad ($936,524), Will Bad Bunny say Trump or ICE ($412,419), Will Green Day say MAGA during opening ceremony ($492,397), and Who will headline Super Bowl 60 ($4,813,533).

Two platforms, two Super Bowls

The platform composition gap is striking. Polymarket concentrated its liquidity: $704.1 million of its $745.9 million in Game Winner / Lines volume came from the season-long champion futures market. Its player props totaled $12.1 million, halftime did $14.6 million, and ads barely registered at $1.7 million.

Kalshi, meanwhile, spread volume across a much wider surface area. Its game-winner contract did $358.8 million (less than half of Polymarket’s futures pool), but it generated $425.2 million across all game lines when you add the spread ($40.5M), total ($14.4M), quarter and half lines, and margin markets. Player props totaled $99.1 million on Kalshi — 8x Polymarket’s figure. Combo parlays added $15.9 million. Announcer mentions: $9.0 million.

The game itself likely suppressed in-game trading potential. Tight, back-and-forth games are well-documented drivers of live trading volume; momentum swings create natural entry and exit points, and lead changes keep both sides of the book active. Super Bowl LX was not that game. Seattle went up 9-0 at halftime on three field goals, extended to 12-0 through three quarters, and never faced a serious comeback bid. Kalshi built significant in-game infrastructure including seven sequential next-TD markets, quarter-by-quarter lines, live spread and total adjustments. But a game that was effectively over by the third quarter limited how much of that infrastructure got stressed. The next-TD markets combined for just $1.02 million across all seven events, with volume dropping off sharply after the second TD.

The user engagement gap reinforces the story. Sensor Tower data reported by CNBC showed Kalshi hitting nearly 2 million daily active users (DAU) on game day (up 1,100% YoY) compared to Polymarket’s 59,000 DAU (up 264%). For context, DraftKings reported 5 million and FanDuel 4.2 million. Kalshi’s Super Bowl week downloads were up 1,544% YoY per Sensor Tower, and Apptopia data showed its January downloads exceeded 3 million — more than DraftKings and FanDuel combined in any single month.

Our $1.63 billion total also doesn’t capture the full prediction markets category, though it’s closer than it might appear. Several apps that were live for the Super Bowl, including Robinhood, Coinbase, and Gemini, route their trades through Kalshi as futures commission merchant (FCM) partners, meaning their volume is already reflected in Kalshi’s numbers. What’s genuinely missing are markets on other CFTC-regulated exchanges: primarily CME Group and Crypto.com | Derivatives North America, which launched their standalone OG predictions app ahead of Super Bowl.

DraftKings Predictions, which sources markets from both CME Group and (as of February 6) Crypto.com, doesn’t report event-level volume. However, DraftKings’ CEO told shareholders that Predictions had “the second most downloads in its category” on Super Bowl Sunday and “delivered 3x its prior record for daily trading volume,” with strong early retention. Polymarket’s U.S.-facing app, meanwhile, only had a game-winner market up in time, with most of its $795.3 million coming from the global platform (Polymarket doesn’t break out domestic vs. international volume).

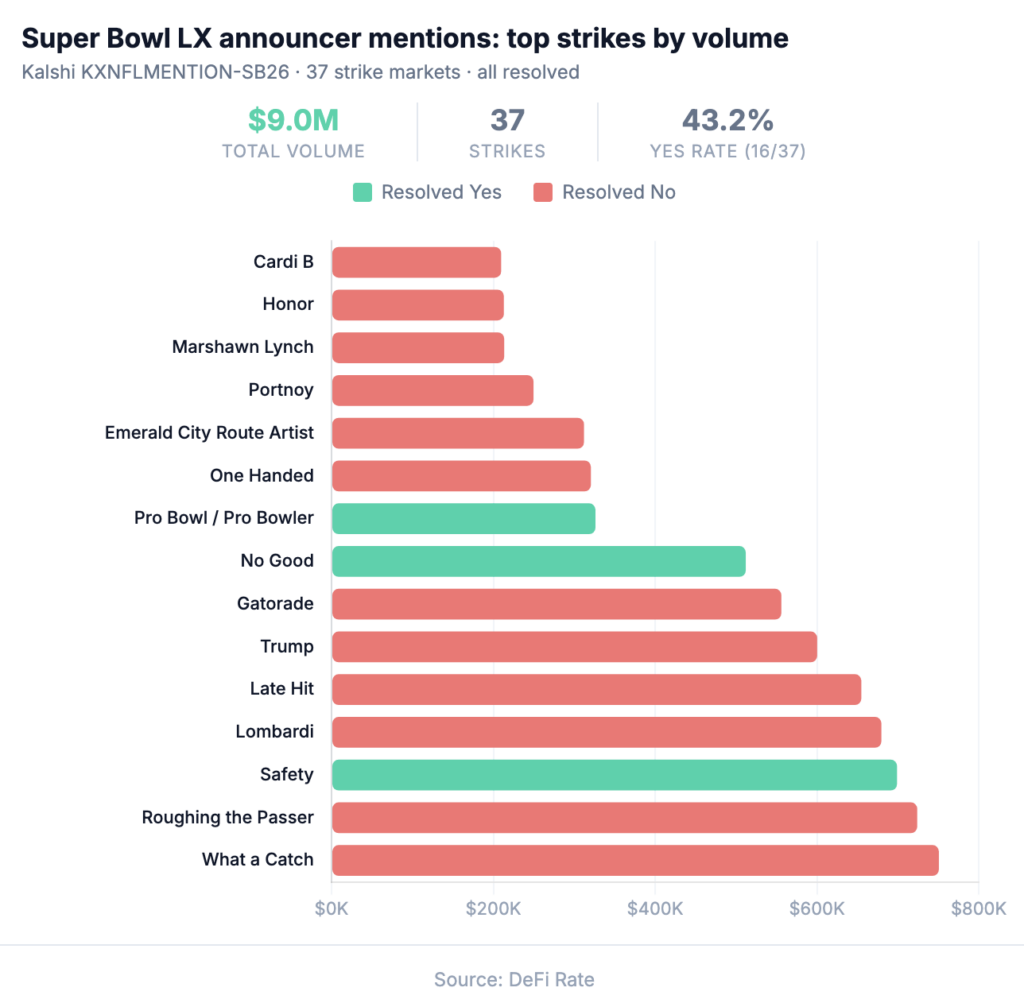

Announcer mentions draw $9 million: 1,965% YoY surge

Kalshi’s announcer mention market generated $9.0 million across 37 individual strike markets, a 1,965% increase from last year’s $434,881 across 19 markets. Only 16 of 37 strikes resolved Yes, a 43.2% hit rate.

The most-traded strikes tell their own story. “What a Catch” led at $751K (No), followed by “Roughing the Passer” at $724K (No), “Safety” at $699K (Yes — the game’s first score was indeed a safety), “Lombardi” at $680K (No), and “Late Hit” at $655K (No). “Trump” was the sixth most-traded mention at $600K, resolving No (a repeat from last year, when “Donald Trump 3+ times” was also a mention strike and likewise resolved No). “Taylor Swift 5+ times” was a 2025 strike too (also No), a detail that captures how these markets mirror the cultural moment of each Super Bowl. Other notable strikes: “Gatorade” ($556K, No), “No Good” ($512K, Yes), “Portnoy” ($250K, No), “Marshawn Lynch” ($213K, No), and “Emerald City Route Artist” ($312K, No). See top strikes by volume below.

Growing pains: Deposit failures, resolution disputes and more insider trading drama

The $1.6 billion number is impressive, but the Super Bowl also exposed real infrastructure and governance gaps that the industry needs to address.

The most immediate issue was Kalshi’s deposit system buckling under load. Complaints surfaced shortly after 5 p.m. ET via Discord and X and continued through the game. Users reported deposits deducted from bank accounts but not credited to their Kalshi balances, in some cases for over an hour, well past the windows they’d wanted to trade. I personally tried to deposit 15 minutes before kickoff and my deposit went through during halftime.

Co-founder Luana Lopes Lara acknowledged the delays on X, and Kalshi later reimbursed processing fees and added credits to affected users. For a platform that spent months on aggressive acquisition and onboarded PayPal and Venmo days before the game, the timing was brutal — and almost certainly left volume on the table.

Then came the Cardi B resolution fiasco. The rapper appeared on stage during Bad Bunny’s halftime show, dancing alongside Karol G, Pedro Pascal, and Jessica Alba. To most viewers, she performed. But Kalshi’s contract rules contained contradictory language — defining “performs” to include dancing in one clause while excluding “dancing or appearing on stage without singing/playing instruments” in another. Kalshi invoked Rule 6.3(c) to settle the $47.3 million performer market at the last traded price ($0.74 No / $0.26 Yes) rather than declaring a winner. Polymarket resolved its equivalent market as Yes. At least one trader filed a complaint with the CFTC alleging Kalshi violated the Commodity Exchange Act.

The halftime markets also attracted insider trading allegations. Multiple X users flagged suspicious trading patterns across accounts that appeared to profit from advance knowledge of halftime plans. The ordeal highlights a structural vulnerability for entertainment markets where setlists, guest appearances, and production details are known to dozens of people well before showtime. Kalshi CEO Tarek Mansour acknowledged the concern on CNBC but argued the platform applies the same enforcement framework as the NYSE and Nasdaq. That last part is contentious, though Kalshi has been ramping up integrity monitoring infrastructure and has said the exchange “ran over 200 investigations and froze relevant accounts” in the past year, even referring a small subset to law enforcement.

None of this is disqualifying. After all, sportsbooks have had their own Super Bowl uptime crises. But the deposit failures and Cardi B dispute hand ammunition to state regulators already fighting Kalshi in court, and erode trust with the casual users Kalshi is spending heavily to acquire.

Super Bowl 60 recap: Growing pains come with outsized growth

The prediction market Super Bowl is now a $1.6 billion event, at least in terms of trading volume. And it’s only the second year these platforms have offered meaningful sports event contracts around the game. Kalshi proved that a third of a major sporting event’s volume can come from game-adjacent cultural markets, especially in a one-sided defensive contest.

The infrastructure held up well enough to process $871 million in a single day, but buckled in ways that matter. And the resolution disputes around entertainment markets point to governance challenges that will only intensify as volume scales. Billion-dollar Super Bowl trading volume is the new floor. The bigger question is how high the ceiling goes.