Compare live odds on Kalshi and Polymarket for elections, Fed decisions, and policy events

Political betting lets you trade event contracts on real political outcomes such as who will win the next presidency, whether the Fed will cut rates, or if a government shutdown is likely to happen. You can enter and exit positions anytime, and prices reflect collective market sentiment in real time.

This page compares the top political markets on Kalshi and Polymarket giving you the opportunity to gain insights into the highest liquidity over 24-hour, 7-day, and 30-day windows so you can find the latest trends, potential arbitrage opportunities and the best pricing in real-time. We also detail how to bet on politics, which contracts have the most activity and list of political betting sites.

Most popular political markets today

| Democratic Nominee 2028 | Fed Decision March |

| 2028 Presidential Winner | Republican Nominee 2028 |

| California Wealth Tax | Next US Government Shutdown |

- 7-day volume: Kalshi $77.8M / Polymarket $476.4M

- 7-day OI: Kalshi 6,736 / Polymarket 4,712

- Active markets: Kalshi 6,736 vs Polymarket 4,712 and N/A

Best political betting sites in 2026

| Predictions App | Legal | App rating | Promo code | Best for |

|---|---|---|---|---|

| Kalshi | Yes (43 states) | 4.6 iOS / 4.0 Android | DEFI ($20) | US traders, Fed |

| Polymarket | Yes | 4.8 iOS / 2.8 Android | None | Liquidity, global |

| PredictIt | Yes | 3.2 iOS / N/A | None | Down-ballot |

| Robinhood | Yes | 4.2 iOS / 4.0 Android | None | Robinhood users (Kalshi skin) |

| Crypto.com | Yes | 4.6 iOS / 4.3 Android | None | Crypto users |

| Fanatics Markets | Yes | Newly launched | None | |

| FanDuel Predicts | Yes | N/A | TBD | TBD |

| DraftKings | Yes | N/A | TBD | TBD |

| Coinbase | Expected Q1 | N/A | TBD | TBD |

Kalshi: CFTC-regulated exchange · 3.75% APY on cash · iOS, Android, Web

Kalshi operates as a CFTC-regulated designated contract market, which means USD deposits, segregated accounts, and bank withdrawals. Cash earns 3.75% APY while sitting in your account. The highest activity is usually found on presidential and Fed markets, like the 2028 Democratic nominee ($29M) and Powell’s Fed Chair status ($7.7M). Niche opportunities are available on state-level races, tariff targets by country, and White House visitor markets. Position limits reach $100K on major markets.

Kalshi’s liquidity trails Polymarket on most political event contracts. Political markets have no maker or taker fees on Kalshi. Your first bank deposit has a 30-day hold before withdrawal. Kalshi is available globally but restricts users in AZ, IL, MD, MI, MT, NJ, and OH due to ongoing state regulatory disputes.

| Regulator | CFTC (US) | Legal States | 43 states |

| Maker / Taker Fees | Varies by market | Withdrawal Fee | Free (bank), $2 (debit) |

| Resolution | Internal | Funding | ACH, debit, Apple Pay, wire, USDC |

| Settlement | Same day | Bonus Code | DEFI ($20) |

Polymarket: CFTC-approved (Nov 2025) · $2.7B 2024 presidential volume · iOS, Android, Web

Polymarket handled $3.3B in volume on the 2024 presidential race and currently leads global prediction market volume. Fed decisions regularly exceed $195M in open interest. You pay no trading fees to Polymarket—any spread you see goes to liquidity providers who facilitate your trades. Compared to Kalshi, Polymarket typically offers deeper liquidity on major political events but requires USDC deposits and a crypto wallet rather than bank transfers.

On November 25, 2025, the CFTC granted Polymarket an Amended Order of Designation, making it a regulated US exchange. US users will access markets through FCMs and traditional brokerages. Prior to this approval, US access was blocked since 2022. Deposits require USDC on Polygon—relayer fees are $3 or 0.3% (whichever is higher). Resolution uses UMA’s decentralized oracle rather than Kalshi’s internal resolution.

| Regulator | CFTC (US) | US Access | Via FCM/broker |

| Maker / Taker Fees | None | Withdrawal Fee | Network gas only |

| Resolution | UMA oracle | Funding | USDC (Polygon) |

| Settlement | Instant on-chain | Bonus Code | None |

PredictIt: CFTC-approved (Sep 2025) · 400K users · Web only

PredictIt launched in 2014 and won its lawsuit against the CFTC in July 2025, receiving full regulatory approval in September 2025 as a designated contract market. You’ll find 132 active markets covering down-ballot races, state legislature seats, and primaries that Kalshi and Polymarket often skip. If you follow niche political races—Texas Democratic Senate primaries, Tennessee special elections, or RealClearPolitics polling outcomes—PredictIt has markets for them.

Position limits cap at $850 per contract, with a 5,000 trader limit per market. The fee structure is steeper than competitors: 10% on profits plus 5% on withdrawals, which means you need roughly 16% gross returns just to break even after cashing out. Deposits via credit card or PayNearMe have no fee, but withdrawals require a 30-day holding period. Web-only interface with no mobile app.

| Regulator | CFTC (US) | Position Limit | $850/contract |

| Profit Fee | 10% | Withdrawal Fee | 5% |

| Resolution | Internal | Funding | Credit card, PayNearMe |

| Settlement | 1-3 days | Bonus Code | None |

Is betting on politics legal?

Yes, political betting is legal in the US. You won’t find it on DraftKings or FanDuel (for now)—no state gaming commission has approved political markets for sportsbooks. Instead, you trade event contracts on CFTC-regulated exchanges like Kalshi. You’re betting against other traders on an open market, not against the house. Outside the US, political betting is standard. UK bookmakers like Bet365 and William Hill have offered election odds for decades.

There are four sites for political betting available right now, though this will change in the coming months:

- Kalshi is a CFTC-regulated Designated Contract Market. The platform is available in 43 US states and globally, covering elections, Fed decisions, and policy events.

- Polymarket is available globally and leads prediction market volume. The platform received DCM status from the CFTC on November 25, 2025. US traders can access markets through FCMs and brokerages.

- PredictIt won DCM and DCO approval in September 2025 after its CFTC lawsuit. The platform has operated since 2014 and serves 400,000 active users. Only US citizens can trade on PredictIt.

- Fanatics Markets launched Dec. 3 with Crypto.com, available in 14 states.

How Kalshi opened the door to legal betting on politics

Event contracts are derivatives, not gambling. They fall under the Commodity Exchange Act and CFTC jurisdiction, bypassing state gaming laws entirely.

In 2023, Kalshi applied to list congressional control contracts—markets on which party would control the House and Senate. The CFTC rejected the application, arguing these contracts constituted illegal “gaming” because they involved “staking something of value upon the outcome of a contest of others.” The agency also raised concerns about election integrity and manipulation risk. “It is impractical for the CFTC to combat [fraud and manipulation] in the underlying market here—a political contest,” wrote CFTC Chair Rostin Behnam. Kalshi sued in federal court, challenging the rejection as an overreach of regulatory authority.

In September 2024, Judge Jia Cobb of the U.S. District Court for D.C. ruled in Kalshi’s favor. The court found that election contracts meet the statutory definition of commodity derivatives and that the CFTC’s “gaming” interpretation was unsupported by law. “Kalshi’s contracts do not involve unlawful activity or gaming,” Judge Cobb wrote. “They involve elections, which are neither.”

The CFTC immediately filed for an emergency stay, asking the court to block Kalshi from listing contracts while it appealed. Agency lawyers argued the contracts were “susceptible to manipulation” and posed “significant public interest risk” to election integrity. Kalshi went live for roughly eight hours before the D.C. Circuit granted a temporary administrative stay.

The D.C. Circuit Court of Appeals denied the stay on October 2, ruling that the CFTC failed to demonstrate likelihood of success on appeal or irreparable harm. The court called the agency’s manipulation concerns “speculative and unsubstantiated.” Kalshi relaunched election markets on October 4, 2024—32 days before the presidential election—and processed over $1 billion in volume by November.

For a full breakdown of fees, features, and market coverage, see our best prediction market apps comparison.

Types of political markets

Event contracts in this category range from presidential races to Fed rate decisions to cabinet confirmations. The tables below show platform availability and typical liquidity for each market type.

Liquidity ratings: High = $10M+ volume or tight spreads under 2%. Medium = $1M-$10M volume or spreads of 2-5%. Low = under $1M volume or wide spreads above 5%.

Election markets

| Market type | Kalshi | Polymarket | PredictIt | Liquidity |

|---|---|---|---|---|

| Presidential winner | Yes | Yes | Yes | High |

| Electoral college total | Yes | Yes | Yes | High |

| Senate/House control | Yes | Yes | Yes | High |

| Swing state outcomes | Yes | Yes | Yes | Medium |

| Individual Senate races | Yes | Yes | Yes | Medium |

| Governor races | Limited | Yes | Yes | Low |

| International elections | Limited | Yes | No | Medium |

How it works

- Presidential winner: Binary contract on which candidate wins the general election. Highest liquidity of any political market—Polymarket saw $3.3B volume on the 2024 race.

- Electoral college total: Predict how many electoral votes a candidate receives. Markets offer ranges (e.g., 270-299, 300-319) so you can bet on landslide vs. narrow victory.

- Senate/House control: Which party controls each chamber after the election. Resolves based on certified seat counts.

- Swing state outcomes: Individual state results in battleground states like Pennsylvania, Michigan, Arizona, Georgia, Wisconsin, and Nevada.

- Individual Senate races: Winner of specific Senate contests. PredictIt specializes in down-ballot races that larger platforms skip.

- Governor races: State executive elections. Coverage varies—PredictIt typically has more state-level races than Kalshi.

- International elections: Foreign elections (UK, Germany, France, Canada). Polymarket leads here; Kalshi and PredictIt focus on US races.

Economic and Fed policy markets

| Market type | Kalshi | Polymarket | PredictIt | Liquidity |

|---|---|---|---|---|

| Fed rate decisions | Yes | Yes | No | High ($186M+) |

| Rate cuts per year | Yes | Yes | No | High |

| Fed Chair removal/resign | Yes | Yes | No | Medium |

| Tariff rates (China/EU) | Yes | Yes | No | Medium |

| Recession probability | Yes | Yes | No | Medium |

| Government shutdown | Yes | Yes | Yes | Medium ($1.2M+) |

How it works

- Fed rate decisions: Will the Fed raise, cut, or hold rates at specific FOMC meetings? Highest-volume non-election market—December 2025 decision has $186M+ in volume.

- Rate cuts per year: Total number of rate cuts in a calendar year. Markets offer brackets (0, 1, 2, 3+).

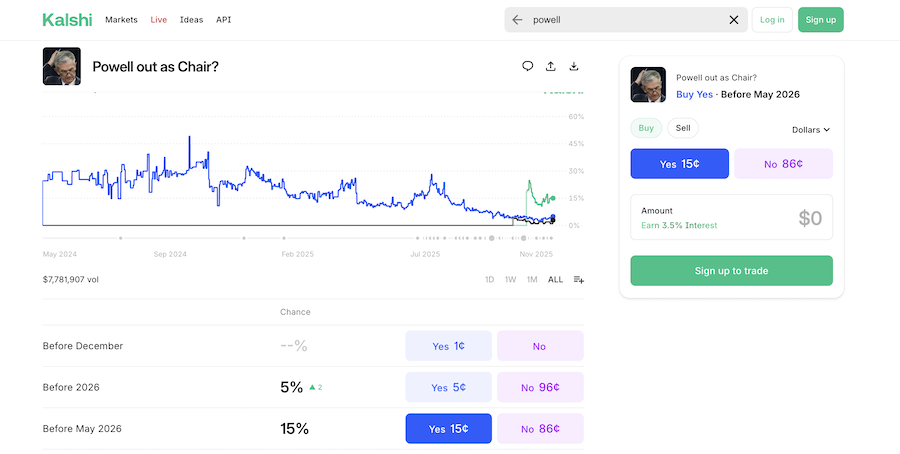

- Fed Chair removal/resign: Whether Jerome Powell leaves before his term ends (May 2026). Currently trading at elevated odds due to political pressure.

- Tariff rates: Specific tariff percentages on imports from China, EU, Mexico, Canada. Liberation Day (April 2025) tariffs drove major volume.

- Recession probability: Whether NBER declares a recession within a timeframe. Resolution depends on official NBER dating.

- Government shutdown: Whether federal operations shut down due to funding gaps. Markets exist for specific deadlines.

Other political markets

| Market type | Kalshi | Polymarket | PredictIt | Liquidity |

|---|---|---|---|---|

| Cabinet appointments | Yes | Yes | Yes | Medium |

| Supreme Court rulings | Yes | Yes | Limited | Low |

| Legislation passage | Yes | Yes | Yes | Low |

| Impeachment proceedings | Yes | Yes | Yes | Low |

How it works

- Cabinet appointments: Who gets confirmed for Secretary of State, Defense, Treasury, etc. Markets resolve on Senate confirmation votes.

- Supreme Court rulings: How SCOTUS rules on specific cases. Liquidity typically low until oral arguments generate attention.

- Legislation passage: Whether specific bills become law. Markets exist for major legislation like budget reconciliation, immigration reform or tax laws, like the California wealth tax.

- Impeachment proceedings: Whether the House votes to impeach or the Senate convicts. Resolution based on official congressional vote tallies.

Note: Geopolitical markets (Ukraine, Israel-Hamas, China-Taiwan) are available on Polymarket. We do not cover conflict or war-related markets on DeFi Rate.

Other prediction categories: Crypto — Sports

How to read political odds

Prediction markets work differently than traditional sports betting. Instead of placing bets with a sportsbook, you buy and sell contracts with other traders on an exchange based on the probability of an event taking place or not. If you’re right, the contract pays out $1.00. If you’re wrong, it’s worth $0.00. For a deeper dive, see our guide on how prediction markets work.

The price you pay reflects the market’s implied probability. A contract trading at 15¢ means the market thinks there’s a 15% chance that outcome happens.

Binary vs. multi-outcome markets

Not all markets are simple yes/no questions. Some have multiple possible outcomes.

- Binary: “Will Powell leave as Fed Chair before May 2026?” — Yes or No

- Multi-outcome: “Who will win the 2028 Democratic nomination?” — Newsom 36¢, AOC 9¢, others

- Bracket: “How many electoral votes will the winner receive?” — 270-299, 300-319, 320+

In multi-outcome markets, you pick one outcome to buy. If that specific outcome wins, you get $1.00. All other outcomes pay $0.00.

Working example: Powell out as Fed Chair

Let’s walk through a real trade using Kalshi’s “Powell out as Chair before May 2026” market.

| Market | Powell out as Chair before May 2026 |

| Current price (Yes) | 15¢ |

| Implied probability | 15% |

You think political pressure makes Powell’s early departure more likely than 15%. You decide to buy Yes.

Place your trade

| Position | Buy Yes |

| Contracts | 100 |

| Price per contract | 15¢ |

| Total cost | $15.00 |

Most platforms offer market orders (instant execution) and limit orders (you set your price). Limit orders often get better prices if you’re patient.

Here’s what it looks like on Kalshi

Note: Watch for slippage

Slippage is the difference between the price you expect and the price you actually get. It happens because you are trading against other people’s orders in an order book. If you want to buy 1,000 contracts but only 200 are available at 15¢, the next 300 might fill at 16¢, and the rest at 17¢. You expected to pay $150 but actually paid $163.

Real example: In October 2024, a trader moved $3 million to Polymarket and immediately placed it all on Trump to win. The market price was 63¢, but because they cleared the entire order book, a $274,000 portion of their order filled at 99.7¢. Those shares would only return 0.3% profit if Trump won. The price snapped back to 64¢ within minutes as arbitrageurs stepped in, but the damage was done.

To avoid slippage, use limit orders instead of market orders, or break large positions into smaller chunks. Check the order book before placing a trade to see how much liquidity exists at each price level.

Trade or hold

A month later, Trump publicly criticizes Powell and speculation increases. The market moves.

| Your cost basis | 15¢ |

| Current price | 28¢ |

| Unrealized P&L | +$13.00 (+87%) |

| Options | Sell now / Hold |

You can sell now for $28.00 and lock in $13.00 profit—without waiting to see if Powell actually leaves. This flexibility is one of the biggest advantages over traditional betting.

Settlement

If you hold until resolution, here’s how it plays out:

| Scenario | Payout | Your P&L |

|---|---|---|

| Powell leaves before May 2026 | $100.00 | +$85.00 |

| Powell stays through May 2026 | $0.00 | -$15.00 |

Settlement is automatic. Funds credit to your account within 24-48 hours of the official outcome.

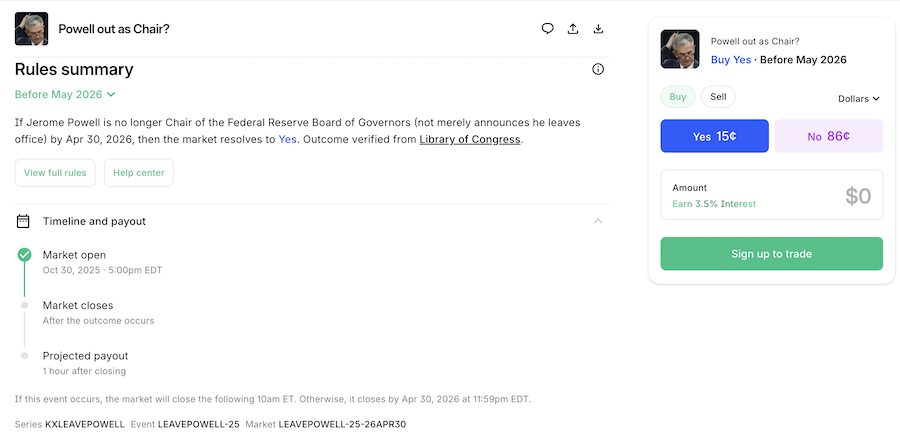

How resolution works

Each market has predefined resolution criteria—the specific conditions that determine Yes or No. Before you trade, check what triggers resolution.

For the Powell market: The contract resolves Yes if Jerome Powell ceases to serve as Federal Reserve Chair before May 15, 2026. This includes resignation, removal, death, or any other reason. If Powell is still serving as Chair on May 15, 2026, the contract resolves No.

Resolution sources vary by platform:

- Kalshi: Internal resolution team using official sources (Federal Reserve announcements, government records, certified election results)

- Polymarket: UMA’s decentralized oracle—tokenholders vote on outcomes with economic stakes for accuracy

- PredictIt: Internal resolution using pre-specified sources listed in market rules

Edge cases matter. What if Powell takes medical leave but doesn’t officially resign? What if he’s “acting” Chair? Read the full resolution criteria before trading—ambiguous outcomes have caused disputes on every platform.

Prediction markets vs. polls

Can you trust prediction market odds as forecasts? The short answer: yes, but with caveats.

Polls ask people who they plan to vote for. Markets ask people to put money on who they think will win. That difference matters. A voter might prefer Candidate A but recognize Candidate B is likely to win—and bet accordingly. Markets capture that second-order thinking.

The longest-running study comes from the University of Iowa. Researchers compared their prediction market against nearly 1,000 polls across five presidential elections and found the market delivered a more accurate forecast about three-quarters of the time. Average error on election eve was around 1.3 percentage points for the market versus 1.6 points for polls.

But markets aren’t magic. They failed spectacularly on Brexit (Betfair showed roughly 80% confidence in Remain on election day) and gave Clinton 85-91% odds in 2016. When liquidity is thin or bettors share the same biases, markets can amplify errors rather than correct them. The table below shows recent calls, right and wrong.

Recent track record (2024-2025)

| Event | Platform | Prediction | Odds | Outcome | Result |

|---|---|---|---|---|---|

| U.S. Presidential (Nov 2024) | Polymarket | Trump wins | 62% | Trump won | Correct |

| U.S. Presidential (Nov 2024) | Kalshi | Trump wins | 57% | Trump won | Correct |

| Fed Rate Decision (Sept 2024) | Polymarket | 50bps cut | 54% | 50bps cut | Correct |

| Biden Withdrawal (Jul 2024) | Polymarket | Biden drops out | 70% | Withdrew Jul 21 | Correct |

| TikTok Ban (Jan 2025) | Kalshi | Ban takes effect | 68% | Ban effective Jan 19 | Correct |

| Germany Federal (Feb 2025) | Polymarket | CDU/CSU wins | 93% | CDU won | Correct |

| Liberation Day Tariffs (Apr 2025) | Kalshi | CN/CA/IN targeted | 75-85% | All targeted | Correct |

| Canada Federal (Apr 2025) | Polymarket | Liberal/Carney | 78% | Liberal minority | Correct |

| Australia Federal (May 2025) | Polymarket | Labor/Albanese | 82% | Labor landslide | Correct |

| Trump 40% China Tariff | Kalshi | No | 87% | 54% enacted | Wrong |

| Netherlands (Oct 2025) | Polymarket | PVV most seats | ~95% | D66 tied/won | Wrong |

| Papal Conclave (May 2025) | Polymarket | Pietro Parolin | 37% | Robert Prevost | Wrong |

💡 9 of 12 called correctly (75%): The misses reveal a pattern: markets struggle with opaque processes (Papal Conclave), rapidly shifting sentiment (Netherlands), and unprecedented policy moves (54% China tariff). When public data exists, markets consistently outperform polls.

How to profit from pricing gaps

Most traders try to predict outcomes — will Trump win, will the Fed cut rates. Arbitrage is different. You profit from pricing errors without needing to be right about what happens. The market does the work; you collect the spread.

These are the two most common approaches, though nothing in prediction markets is ever guaranteed.

Multi-outcome arbitrage

In markets with multiple candidates, exactly one person wins. That means if you buy “No” on every candidate, all but one pays out. When the math works in your favor, you lock in profit regardless of who wins.

Example: “Who wins the 2028 Democratic nomination?” has three leading candidates:

- Newsom No: 64¢

- Shapiro No: 88¢

- Pritzker No: 94¢

- Total cost: $2.46

One candidate wins, so two No contracts pay $1.00 each = $2.00 return. At $2.46 cost, you lose 46¢. But when prices drift and the total drops below $2.00 — say, $1.90 — you pocket 10¢ per set no matter who wins the nomination.

Watch for: Markets that don’t cover all possibilities. If a fourth candidate can win, your “guaranteed” profit disappears.

Cross-platform arbitrage

Kalshi and Polymarket price the same events independently. When their odds diverge, you can bet both sides across platforms and guarantee a spread.

Example: “Fed cuts rates in December” trades at 72¢ Yes on Kalshi and 68¢ Yes on Polymarket. Buy Yes on Polymarket (68¢) and No on Kalshi (28¢). Total cost: 96¢. One side pays $1.00 regardless of what the Fed does — 4¢ profit per contract, locked in.

Watch for: Resolution criteria differences. What counts as a “rate cut” on one platform might not match the other. Read both rule sets before committing capital.

Use our arbitrage calculator to find live opportunities and calculate net profit after fees.

FAQ

What happens if a candidate drops out after I bet on them?

It depends on the market’s resolution criteria. Some markets ask “Who will win the election?” and resolve based on the actual winner, regardless of who was on the ballot when you traded. Others ask “Will Candidate X be the nominee?” and resolve No if they drop out. Always read the specific resolution rules before trading. Kalshi lists these under each market’s “Rules” tab.

Why do Kalshi and Polymarket show different odds for the same event?

Different user bases, different resolution criteria, and no easy way to arbitrage between them. A Bitcoin reserve market might trade at 51% on Polymarket and 37% on Kalshi because Polymarket only requires the government to “hold any amount of bitcoin” while Kalshi requires an official National Bitcoin Reserve comparable to the Strategic Petroleum Reserve. Same event name, different actual questions.

What if a market resolves incorrectly?

Kalshi uses internal resolution teams with clear sources like AP or official government data. If you believe a resolution is wrong, you can contact support, but disputes are rare because criteria are spelled out upfront. Polymarket uses UMA’s decentralized oracle where tokenholders vote on disputed outcomes. This process has sparked disputes, including a government shutdown market in 2024 that paid out Yes even though no shutdown took place.

How long until I can withdraw my winnings after a market settles?

Kalshi typically credits winning positions within 24-48 hours of the official result. First-time bank deposits have a 30-day hold before withdrawal, but subsequent deposits clear faster. Polymarket settlements are instant on-chain once the oracle confirms the outcome, but converting USDC back to dollars through an exchange adds time depending on your off-ramp.

Can I lose more than I put in?

No. Every contract on Kalshi and Polymarket is fully collateralized. If you buy 100 Yes contracts at 15¢ each, your maximum loss is $15. There is no margin, no leverage, and no way to go negative. The worst outcome is your contracts expire worthless at $0.

How are prediction market profits taxed?

Profits are taxed as ordinary income, not capital gains or gambling income. You report them on Schedule 1, Line 8z. Kalshi issues 1099-B forms for profits over $600, PredictIt issues 1099-MISC forms, and Polymarket does not issue tax documents so you need to track and report gains yourself. Consult a tax professional for your specific situation.

Is it legal to bet on politics in California, Florida, or Texas?

Yes. Kalshi is available in all three states, as are Polymarket, PredictIt, and the prediction markets on Robinhood and Crypto.com. These exchanges operate as CFTC-regulated exchanges, not state-licensed sportsbooks, so they aren’t subject to the state gaming laws that your betting site needs to abide by. California, Florida, and Texas together represent about 80 million people and some of the highest trading volume on Kalshi.

We always use primary sources for all of our work. Our authors and editors rigorously fact-check all content to ensure the information you’re reading is accurate, timely and relevant. Our source information is reviewed periodically to ensure accuracy, with dates noted of the last change.

This guide draws from CFTC filings, platform documentation, fee schedules, and court records—not press releases. We verified funding methods, fee structures, and regulatory status directly through platform help centers and official government sources. Where documentation was unclear, we tested functionality firsthand or contacted support.

Market accuracy claims come from academic research, including the University of Iowa’s election futures study (Berg, Nelson, Rietz 2008) comparing nearly 1,000 polls against market predictions. The track record table reflects outcomes verified through AP, official government announcements, and platform resolution data. We update this page when platforms announce material changes to fees, features, or regulatory status.

Regulatory and legal

- “CFTC Approves KalshiEX LLC to Register as a Designated Contract Market.” CFTC. November 5, 2020. cftc.gov

- Kalshi v. CFTC, U.S. Court of Appeals for the D.C. Circuit. October 2024. cadc.uscourts.gov

- IRS Publication 525: Taxable and Nontaxable Income. irs.gov

Platform documentation

- “Trading Fees.” Kalshi Help Center. help.kalshi.com/trading/fees

- “Interest on Your Balance.” Kalshi Help Center. help.kalshi.com/interest

- Polymarket Documentation. docs.polymarket.com

- UMA Optimistic Oracle Documentation. docs.uma.xyz

- PredictIt Market Rules. predictit.org