Efforts in Washington to repeal a cap on the federal gambling loss tax deduction have struggled to gain traction in recent months. With previous legislative efforts in Congress stalling and more recent proposals just getting off the ground, prediction markets have reflected a corresponding loss of momentum for a 2026 repeal.

The tax provision, enacted last year as part of the sweeping One Big Beautiful Bill Act (OBBB), limits the deduction for gambling losses to 90%, a reversal from the longstanding rule that allowed gamblers to offset 100% of losses against winnings for federal tax purposes. Industry groups and lawmakers from both parties have called the cap unfair, warning it could hurt both gamblers and key gaming markets.

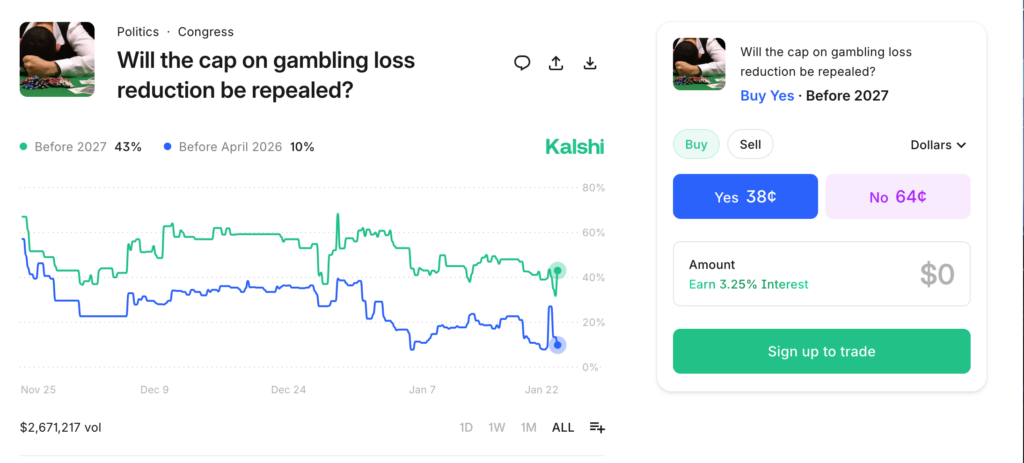

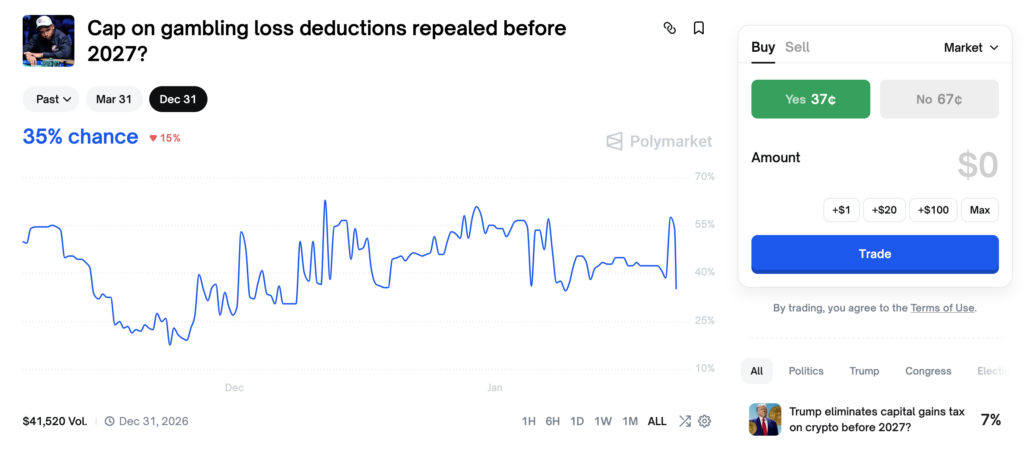

Since the first week of January, odds in markets on both Kalshi and Polymarket that the deduction cap will be repealed in 2026 had fallen below 50%, and were trading around the 40% range as of late afternoon on Jan. 21. At around 6 p.m., as members of Congress were making their case that a rollback of the cap should be included in a broader appropriations bill, the odds spiked briefly before drifting downward again as word spread that no such amendment would be included.

Despite the pullback in market sentiment, lawmakers have continued exploring bipartisan paths to restore the full deduction. However, a repeal this year remains uncertain. If Congress does not act before the end of the year, gamblers could be limited to deducting only 90% of their losses on 2026 tax returns.

FAIR BET Act seeks to repeal gambling loss tax change

The sweeping OBBB, signed into law in mid‑2025, included a tax provision that fundamentally changed how gambling losses are deducted on federal returns beginning with the 2026 tax year. Under the new law, deduction is limited to 90% of losses, even if the losses equal or exceed winnings. That change can create so‑called “phantom income,” where a bettor owes tax on money they never actually kept. For example, someone who wins $50,000 and loses $50,000, under prior rules, would owe no tax. With the new law, they can only deduct $45,000 of losses (90%), leaving $5,000 in taxable income despite breaking even.

Soon after the deduction cap became law, Democratic Rep. Dina Titus of Nevada moved to reverse it with the FAIR BET Act. Introduced in August 2025, the bill would simply strike the 90% language and restore the full 100% loss deduction in the tax code. Titus, representing Nevada’s major gaming constituencies, argued that the limit could push bettors toward offshore operators or “the predictions market” and undermine legal gambling activity. She also said the cap might incentivize gamblers to avoid reporting their income.

The FAIR BET Act has encountered significant headwinds. It remains under consideration in the House Ways and Means Committee, but there has been no progress since it was first referred there last summer, despite Titus urging expedited action in December. The bill has continued to gather co‑sponsors, including some from the Republican side of the aisle, but, overall, movement has been slow.

Titus pushes to add deduction cap repeal to spending package

Beyond her push to pass the FAIR BET Act as a standalone bill, Titus has tried to have the deduction cap repealed by adding it as an amendment to various pieces of must-pass legislation. An attempt to attach repeal language to the National Defense Authorization Act was denied by the House Rules Committee in September. Titus also reportedly tried to attach the cap repeal to a must-pass, $180 billion appropriations bill, but it wasn’t included in the final bill that passed on Jan. 15.

On Jan. 21, Titus and other congressional supporters of the repeal spoke before the House Rules Committee as they reviewed House Resolution 7148, a consolidated spending package that will fund various federal departments through September.

Titus, who submitted a deduction cap repeal amendment to H.R. 7148, said that the cap was snuck into the OBBB and that many of her fellow lawmakers were unaware it was included and didn’t support it.

“Well, here’s a chance to fix it,” Titus told the committee. “If you restore that long standing 100% deduction, you’ll simply return to the law the way it was before, the way it was understood, the way it was practiced for many years, and you don’t have to rewrite anything else. You can just change that 90 back to 100. It’s a very simple fix.”

FULL HOUSE Act recently introduced in the House

Earlier this month, a bipartisan legislative effort to repeal the gambling loss deduction cap gained fresh momentum with the introduction of the FULL HOUSE Act in the U.S. House. Introduced by Rep. Max Miller (R‑Ohio) and co-sponsored by Rep. Steven Horsford (D‑Nev.), whose district includes much of the Las Vegas gaming industry, the bill would also restore the full 100% deduction by amending the Internal Revenue Code.

Introduced on Jan. 8, the FULL HOUSE Act was referred to the House Ways and Means Committee and has not yet been scheduled for consideration, leaving its path to the floor unclear. Because Ways and Means is the key tax‑writing committee in the House, advancing the bill out of it would be a promising sign. But even if it clears that step, the bill would still need support from a majority of the full House and Senate before year’s end to take effect for the 2026 tax year.

Miller and Horsford also testified at the Jan. 21 House Rules Committee hearing to submit an amendment to H.R. 7148.

“Our bill is simple and it’s clean,” Horsford told the committee. “We restore the law to what it was before (the OBBB). Nothing more, nothing less. This type of change is necessary to ensure that existing rules, regulations, and court precedents remain relevant.”

The House Rules Committee reconvened early on Jan. 22 and ultimately adjourned without voting to add either of the deduction cap repeal amendments to the spending package.

Prediction market odds for deduction cap repeal have cooled

Prediction market odds on the repeal of the gambling loss deduction cap have cooled noticeably after reaching their highs late last year. Kalshi and Polymarket both launched contracts in November tracking whether the cap would be repealed in 2026, including separate markets for action before April 1 and before the end of the year. Both platforms had also introduced markets last summer focused on whether repeal would occur by the end of 2025.

On Polymarket, liquidity has been relatively thin. The “Cap on gambling loss deductions repealed before 2027?” market has drawn just over $41,000 in trading volume, while the “repealed by March 31?” contract has seen roughly $65,000 traded. Prices in the “before 2027” market climbed somewhat steadily through November and early December, with “Yes” contracts topping out around 63% as Titus intensified her push for repeal. Since then, however, the market has steadily re-priced lower. Odds slipped below 50% in early January, briefly touching the mid-30% range before a short-lived rebound tied to last night’s developments in Washington.

Kalshi’s contracts have exhibited a similar trajectory, but with substantially deeper liquidity and tighter pricing. Across its repeal-related markets, Kalshi has processed more than $2.6 million in trading volume. The “repealed before 2027” contract peaked near 68% in late December, before sliding sharply to roughly 40% on Jan. 7. Since that pullback, prices have struggled to regain the 50% level, suggesting traders have become more skeptical that repeal will advance in Congress.

That skepticism was briefly interrupted on Jan. 21, when social media clips circulated showing testimony in favor of repeal-related amendments during the House Rules Committee hearing. In response, traders aggressively bid up “Yes” contracts on Kalshi, with prices momentarily surging into the upper 90% range.

Gamblers take note of prediction market price surge

The spike caught the attention of the broader gambling community, which has been closely following the cap repeal efforts. Professional sports bettor and popular gambling content creator Captain Jack Andrews shared a screenshot of Kalshi’s “before 2027” market showing “Yes” odds at 97%, fueling short-term speculation that repeal language might successfully be attached to the bill.

Andrews later posted about what probably caused the brief price surge.

“What likely happened is the same market maker was seeding most of the No side and pulled out when it looked like strong momentum in the committee hearing,” Andrews wrote on X. “That spiked the prices. Other market makers filled in, moving the price back down.”

Price swings due to breaking news provide trading opportunities

By noon on Jan. 22, pricing in the markets on both platforms had fallen slightly below where it was before news of the House Rules Committee testimony began circulating. Polymarket’s odds took longer to settle back down, creating brief windows where traders using both platforms could buy or sell at noticeably different prices.

Movements like this illustrate how prediction markets can be used not just to express a long-term view, but to trade around short-term swings. Sudden bursts of attention from viral clips and breaking news can push odds higher or lower than where they ultimately land. Traders who are watching closely can step in to take profits during spikes or buy back positions after prices cool off.

The markets can also serve a more practical purpose for gamblers and industry participants with real financial exposure to the policy outcome. Professional bettors, high-volume players, and gambling businesses all face uncertainty over how losses will be treated for tax purposes. By taking positions tied to repeal efforts, they can potentially offset some of the financial risk if Congress ultimately doesn’t move in favor of their interests.

As the legislative debate continues, odds are likely to keep swinging, less as definitive predictions and more as a real-time reflection of headlines, sentiment, and how traders react to them.