In a move that everyone on Kalshi and Polymarket saw coming, the U.S. Federal Reserve cut interest rates for the third time in a row.

On Wednesday, the Fed lowered the benchmark rate by a quarter of a point, down to the 3.50%-3.75% range. Though the decision wasn’t unanimous–Fed Governor Stephen Miran, Kansas City Fed President Jeffrey Schmid and Chicago Fed President Austan Goolsbee dissented–the prediction markets were in lockstep going into the decision.

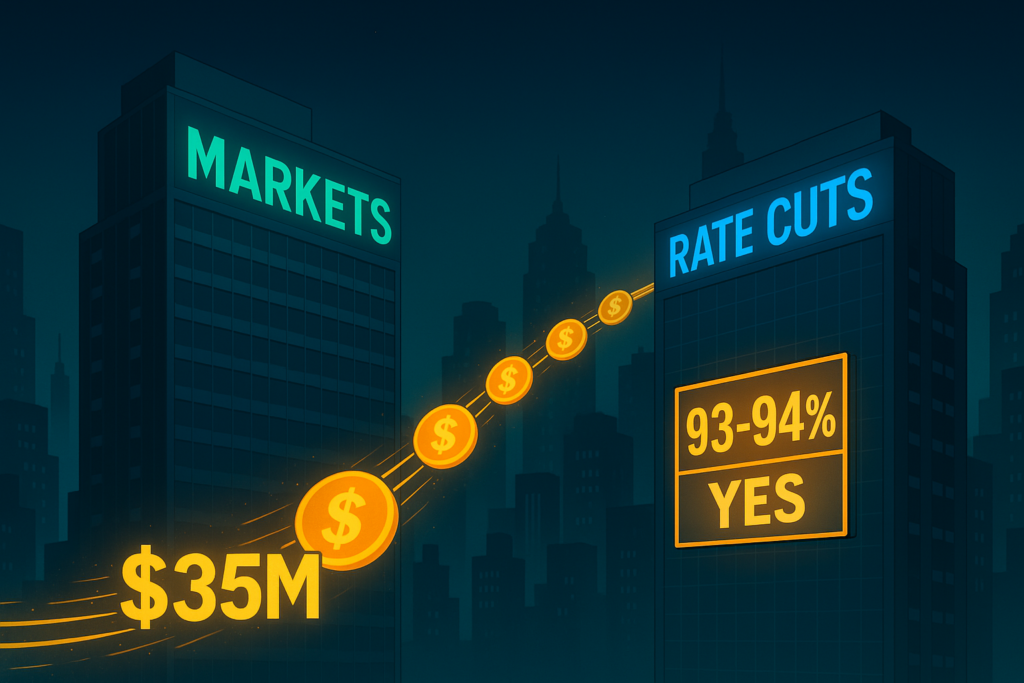

Earlier in the week, both Polymarket and Kalshi had a likelihood of a cut at 94% odds. By close, the odds had increased to 97%. Polymarket had $54.06M in volume on the 25 bps decrease. Meanwhile, Kalshi had $11.2m in volume on the feds cutting the rate.

Slowing markets expected to continue

The market wasn’t always so sure about the Fed cut, partly because the Fed has provided little information in recent months. The Bureau of Labor Statistics canceled its October 2025 jobs report, and the November report is delayed (it arrives on December 16, two days before the report on November’s inflation data drops, per NBC News).

Federal Reserve Chair Jerome Powell cited the U.S. government shutdown as the reason for the silence. “Although important federal government data for the past couple of months have yet to be released, available public and private sector data suggest that is the outlook for employment and inflation has not changed,” said Powell, per CNN.

On top of that, ADP released a report in early December stating that the United States shed 120,000 jobs, resulting in a net loss of 32k. And the Fed’s favorite measure of inflation, personal consumption expenditures—better known as consumer spending—showed that spending was only up 0.2% (after taking out food and energy costs). As of September, the U.S. inflation rate is 3.0%, well above the Fed’s 2.0% target.

So, when considering these factors—and how the October Federal Open Market Committee’s minutes said the committee had “strong differing views” on a third consecutive rate cut, Polymarket’s initial prediction leaned heavily to “no change.”

However, when New York Fed President John Williams delivered a speech at the Central Bank of Chile Centennial Conference in late November, he said that he saw “a further adjustment in the near term to the target range for the federal funds rate.” This caused a surge in the odds favoring a cut, going from 40% to 70%.

Adding to the odds, Federal Reserve Board of Governors Christopher Waller, Michelle Bowman and Stephen Miran have also openly pushed for a rate cut, per CNN (Miran wanted a half-point cut, explaining why he dissented to the .25 decrease).

Thus, this is why there were 97% odds for a cut going into Wednesday’s decision.

Last cut for a while? Traders seem to think so

The term “hawkish cut” has become a buzzword in recent weeks, meaning they would go through with the reduction but make it clear this is the last one for a while.

CNBC noted that the Federal Open Market Committee is split between members who favor cuts as “a way to head off further weakness in the labor market” and members who think that cutting interest rates threatens to aggravate inflation. Thus, this third cut is a compromise.

Bill English, the Fed’s former director of monetary affairs, told CNBC that he expected the message to get the point across, that “they’ve made an adjustment and they’re comfortable where they are, and they don’t see a need to do anything more in the near term, as long as things play out more or less as they expect.”

With this decision, the markets has begun speculation on a Fed decision in January. So far, early predictions on Kalshi and Polymarket have 85% that the fed maintains the rate.