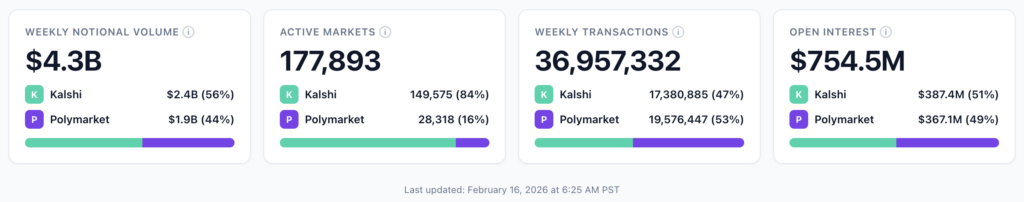

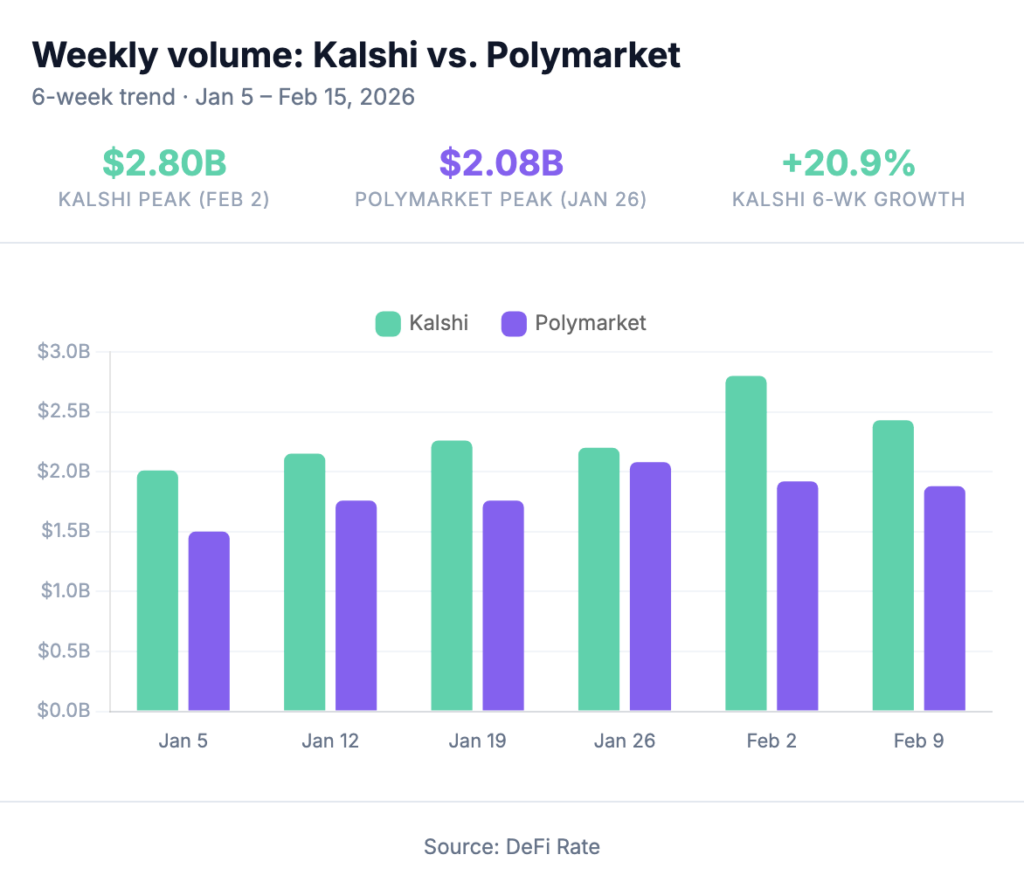

Combined weekly notional volume across top prediction market platforms dropped to $5.3 billion for the full week following the Super Bowl, a modest dip considering the current concentration of sports volume across the industry. Kalshi and Polymarket combined for $4.3 billion in volume in the week ending Feb. 15, according to DeFi Rate’s prediction market tracker, which aggregates real-time data across both platforms. Of that total, Kalshi accounted for $2.4 billion (56%) and Polymarket $1.9 billion (44%), with total weekly transactions hitting 37 million (53% on Polymarket and 47% on Kalshi).

It’s the clearest sign yet that the Super Bowl trading cycle has wound down and the industry is settling into a post-football reality. But the zoomed out picture is bullish for prediction market volume no matter how you slice it. Six months ago, the entire prediction market industry (or at least the major tracked platforms) did $2 billion in a month. Now it’s doing more than double that in a single week.

The question isn’t whether prediction markets have arrived. It’s what happens next, and whether the sector’s heavy reliance on sports can sustain the kind of growth that’s turned this from a niche trading ecosystem into a multi-billion-dollar weekly market.

The Super Bowl peak and the dip that followed

Before getting into the pullback, it’s worth underscoring just how big the Super Bowl was for prediction markets. On Feb. 8 alone (the day of the Big Game), tracked platforms processed $1.34 billion in notional volume across 7.5 million transactions. Kalshi accounted for $871.5 million of that daily total (64.9%), with Polymarket adding $311.9 million. To put that single day in perspective: the entire prediction market industry did $2 billion for the full month of August 2025. Super Bowl Sunday did well over half of that in 24 hours.

| Platform | Super Bowl day volume (Feb 8) | Daily transactions |

|---|---|---|

| Kalshi | $871.5M | 5,139,407 |

| Polymarket | $311.9M | 2,275,711 |

| Opinion | $91.9M | 31,459 |

| predict.fun | $58.8M | 30,633 |

| Limitless | $8.7M | 21,308 |

| Overtime.io | $983K | 3,171 |

| Myriad | $97K | 9,449 |

| Total | $1.34B | 7,511,138 |

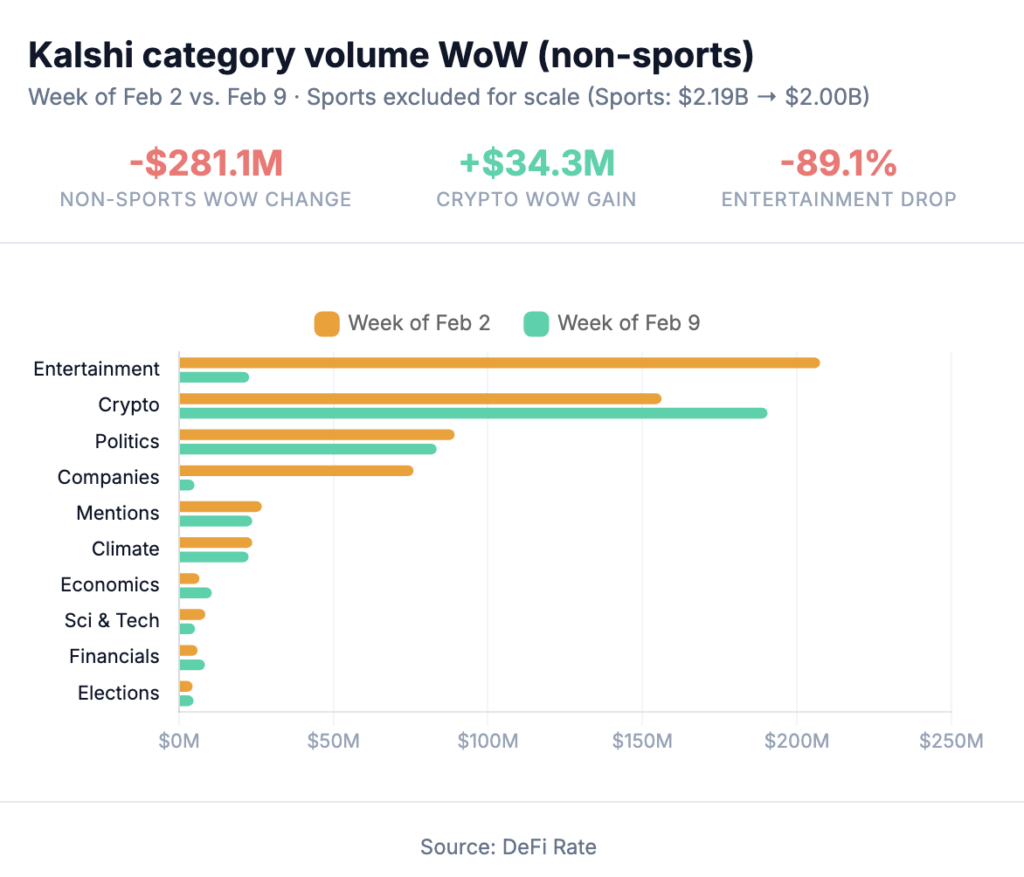

That kind of spike was never going to sustain, at least in the short-term. As expected, category-level volume for the following full week dropped off considerably. On Kalshi, entertainment category volume, which captured the bulk of Super Bowl culture and novelty prop markets, cratered from $207.5 million (week of Feb. 2) to $22.7 million (week of Feb. 9), an 89% WoW drop. Sports volume on Kalshi dipped from $2.19 billion to $1.996 billion, while Polymarket’s sports category fell from $756.6 million to $688.7 million.

This tracks with what we flagged in last week’s Super Bowl volume breakdown: the Super Bowl is the single largest volume event on the sports betting and now prediction market calendar; The week after always brings a correction.

The Feb. 16 snapshot from our tracker shows the two-platform total (Kalshi + Polymarket) settling at $4.3 billion for the most recent completed week.

Open interest remains healthy at $754.5 million, essentially a coin flip between Kalshi ($387.4 million, 51%) and Polymarket ($367.1 million, 49%). Active markets continue to heavily favor Kalshi at 149,575 versus Polymarket’s 28,318, a 5.3x advantage in market availability. However, as we regularly note, Kalshi’s contract breadth also results in a number of thin markets.

Platform breakdown: Who gained, who gave back

Here’s the full platform-by-platform comparison for the weeks ending Feb. 8 (Super Bowl week) and Feb. 15, sourced from Dune Data Dashboards:

| Platform | Feb 2-8 volume | Feb 9-15 volume | WoW change | Mkt share (2/9-15) |

|---|---|---|---|---|

| Kalshi | $2.80B | $2.43B | −13.2% | 45.5% |

| Polymarket | $1.92B | $1.88B | −1.9% | 35.2% |

| Opinion | $1.24B | $709.7M | −42.8% | 13.3% |

| predict.fun | $215.7M | $184.7M | −14.4% | 3.5% |

| Limitless | $68.9M | $109.4M | +58.7% | 2.1% |

| Myriad | $11.4M | $17.0M | +48.8% | 0.3% |

| ForecastEx | $5.8M | — | — | — |

| Overtime.io | $4.7M | $3.9M | −17.2% | 0.1% |

| Total | $6.26B | $5.33B | −14.8% | 100% |

The headline decline of nearly 15%, from $6.26 billion to $5.33 billion, was not distributed evenly, and the platform-level divergence tells a more interesting story than the top-line number.

Polymarket was the most resilient of the major platforms. Its $1.88 billion marked just a 1.9% week-over-week decline, the smallest pullback among the top three by a wide margin. Polymarket’s market share jumped from 30.6% to 35.2% as a result — its highest in the all-platform breakdown in weeks. The platform held ground because its Crypto category ($589.1 million) surged 8.9% and its Politics volume ($387.7 million) barely moved, absorbing the post-Super Bowl dip in Sports.

Kalshi took a more substantial hit, dropping $368 million to $2.43 billion — a 13.2% decline driven almost entirely by the Super Bowl unwind in entertainment and sports. Even so, Kalshi maintained its position as the volume leader at 45.5% market share, actually ticking up from 44.7% as Opinion’s drop was far steeper. A $2.43 billion week still ranks among the platform’s top five ever.

Opinion’s pullback was the story of the week. The onchain exchange shed 42.8% of its volume, falling from $1.24 billion to $709.7 million — the largest relative decline of any tracked platform by a significant margin. Its market share contracted from 19.8% to 13.3%. We’ve noted Opinion’s outsized volatility in prior reports, and this week reinforced the pattern: the platform swings harder in both directions than its larger competitors. Whether this reflects a more event-driven user base, thinner market depth, or structural differences in how volume is generated remains an open question. But at $709.7 million, Opinion is still comfortably the third-largest exchange in the space, at least in terms of volume.

Limitless was the week’s biggest gainer on a percentage basis, surging 58.7% from $68.9 million to $109.4 million and crossing the $100 million weekly threshold for what appears to be the first time. Myriad also posted a strong week, up 48.8% to $17 million. Both remain small in absolute terms, but the counter-cyclical growth is notable: while the top three all declined, two of the smallest exchanges posted their best weeks yet. ForecastEx dropped out of the Feb. 9 data entirely after posting just $5.8 million the prior week.

Kalshi and Polymarket together accounted for 80.8% of all tracked volume, up from 75.3% the prior week. The gap between the two leaders and the rest of the field widened as Opinion pulled back, reinforcing that the effective market remains a two-platform race for most practical purposes.

On the user side, Polymarket continues to dominate among platforms reporting weekly active users (Kalshi is excluded from Dune’s user tracking). For the week of Feb. 9, Polymarket logged 309,991 weekly users, 85.5% of the 362,704 total tracked across non-Kalshi platforms. Limitless (26,445) and Opinion (18,098) are the only other exchanges clearing 10,000 weekly users, with predict.fun (6,543) rounding out the meaningful bases.

That user concentration underscores a structural difference. Opinion processed $709.7 million in weekly volume with just 18,098 users — roughly $39,200 per user per week. Polymarket’s 309,991 users generated $1.88 billion, or about $6,060 per user. The 6.5x gap in per-user volume reinforces what we’ve noted before: Opinion’s base skews heavily toward larger, institutional-style traders, while Polymarket has a far broader retail footprint. Both models are viable, but they carry different risk profiles when volumes contract — a concentrated large-trader base can shift more abruptly than a broad retail one.

Six months of relentless growth

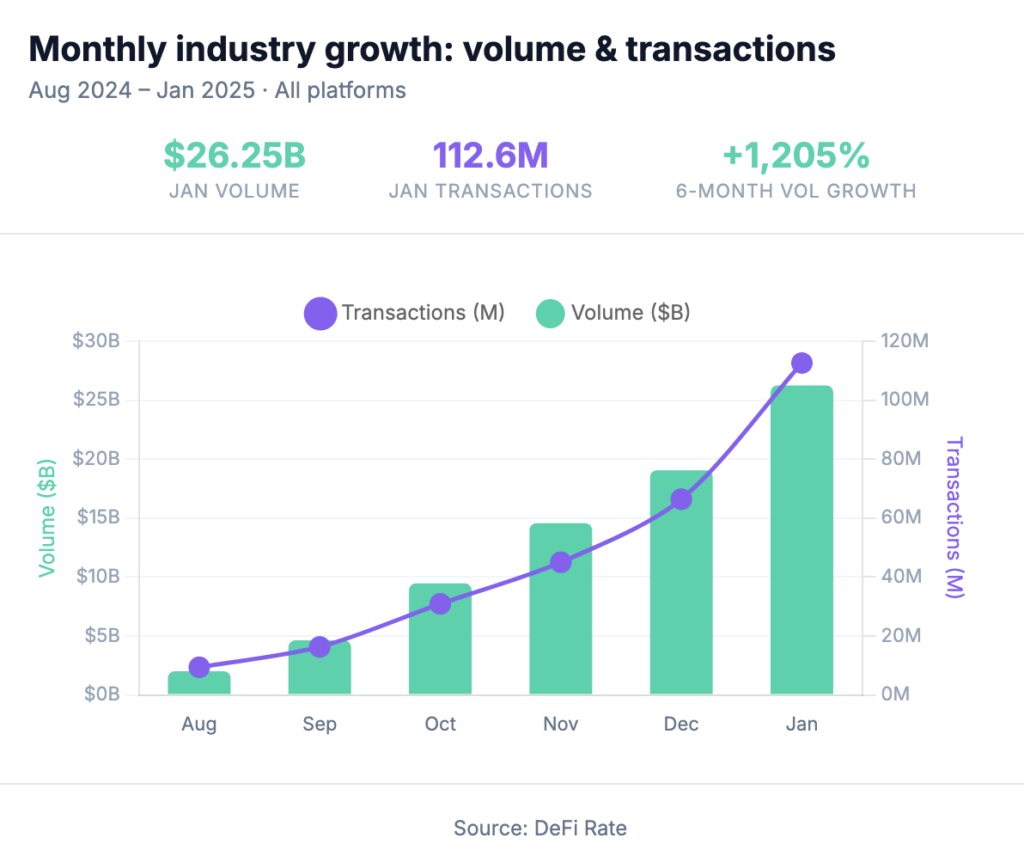

The weekly pullback matters for trend-watchers, but doesn’t matter much for the macro story. Here’s the monthly trajectory across all tracked platforms over the past six months:

*Note: Opinion was added to monthly tracking at Dune in October; predict.fun was added in November.

That’s a 13x increase in volume and a 12x increase in transactions in half a year. January alone at $26.25 billion exceeded the combined total of August, September, and October ($16.1 billion). The industry went from crossing $2 billion monthly to clearing that figure in a couple days in the span of two quarters.

The transaction growth signals that the boom is not just in trading volume, but is supported by rising adoption and overall transactions. The market went from 9.4 million monthly transactions in August to 112.6 million in January, which reflects not just larger trades but significantly more participants engaging more frequently. January’s 112.6 million transactions averaged 3.6 million per day, compared to roughly 304,000 per day in August.

January’s platform breakdown adds further context. Kalshi led volume at $9.55 billion, followed by Opinion at $8.08 billion and Polymarket at $7.66 billion. On transactions, Kalshi (54.5 million) and Polymarket (52.0 million) ran nearly neck and neck, together accounting for 94.6% of all monthly transactions. Opinion’s 3.2 million transactions against its $8.08 billion in volume further illustrates its outsized per-trade size — a dynamic that continues to set it apart from the field.

For context on platform-level growth arcs: Kalshi’s monthly volume went from $874 million in August to $9.55 billion in January, an increase of nearly 11x. Polymarket went from $1.1 billion to $7.66 billion (a 7x jump). And platforms that barely registered six months ago — Opinion and predict.fun were added in October and November, respectively — are now generating hundreds of millions per week.

Kalshi vs. Polymarket: the sports vs. non-sports divide comes into focus

Kalshi continues to outpace Polymarket in total notional volume, a clear result of Kalshi’s emphasis on and success around sports markets. You can see the weekly volume trend between these two platforms over the last six weeks in the chart below:

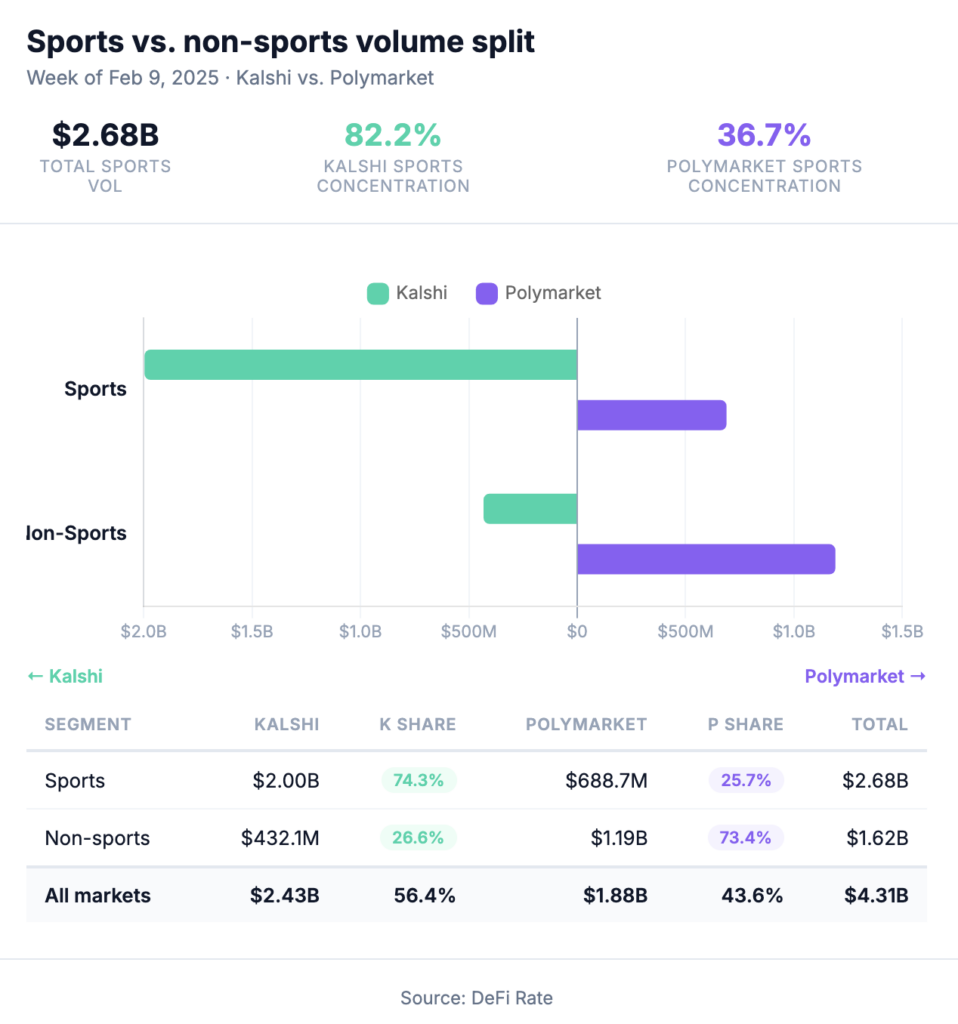

Perhaps the most analytically interesting development in recent weeks has been how clearly Kalshi and Polymarket have carved out distinct market positions. The post-Super Bowl data puts this in the sharpest focus yet.

When you split the week of Feb. 9-15 data by sports and non-sports categories, a stark picture emerges:

| Segment | Kalshi | Polymarket | Total |

|---|---|---|---|

| Sports | $1.996B (74.3%) | $688.7M (25.7%) | $2.685B |

| Non-sports | $432.1M (26.6%) | $1.191B (73.4%) | $1.623B |

In sports markets, Kalshi dominates at nearly 3:1. In non-sports, the dynamic flips entirely, with Polymarket leading by roughly the same ratio. These platforms aren’t just competing; they appear to be serving fundamentally different audiences and use cases.

Kalshi’s sports concentration intensified from 78.3% of total volume (week of Feb. 2) to 82.2% (week of Feb. 9). Meanwhile, its non-sports categories are growing. Crypto climbed 22% to $190.5 million, economics jumped 60.6% to $10.6 million, and financials rose 40% to $8.4 million. But they still represent a fraction of the sports engine.

Polymarket’s category mix is far more diversified. Its top three categories for the week ending Feb. 8 were sports ($688.7 million, 37%), crypto ($589.1 million, 31%), and politics ($387.7 million, 21%). Crypto has been Polymarket’s growth engine of late, surging 8.9% week-over-week and approaching parity with sports as the platform’s top category. Culture (+56.2% to $25.3 million), weather (+61.5% to $16.8 million), and earnings (+440% to $5.4 million, albeit from a small base) all grew as well, a sign that Polymarket’s non-sports liquidity is deepening across multiple verticals simultaneously.

This divergence isn’t accidental. Kalshi has been leaning aggressively into sports — and it’s working from a volume and customer acquisition perspective. The platform’s Robinhood distribution partnership drove over $200 million in March Madness volume last year, and more recently, Kalshi brought on Milwaukee Bucks star Giannis Antetokounmpo as a shareholder and marketing partner. The deal, announced Feb. 6, makes Antetokounmpo the first basketball player to join Kalshi as a shareholder, with the partnership spanning live events and marketing. The move drew both mainstream headlines and controversy. But It’s a clear indication of where Kalshi sees its brand heading as the NBA enters the playoff push, namely, continuing to lean into marketing around sports trading.

Despite the absence of NFL and football volume in the coming months, the upcoming sports schedule is packed. Beyond the high-revenue generating March Madness tournament, the golf majors kick off with the Masters in April, and 2026 FIFA World Cup trading ramps up in June. The NCAA basketball tournament and World Cup could be sustained volume drivers for weeks, not days. The bottom line is in the short term, there will be no shortage of high-profile sporting events to help fill the gap left by the NFL.

But is sports enough? The sustainability question

The sports pipeline may be packed, but it doesn’t fully answer a more fundamental question that’s been percolating beneath the industry’s headline growth numbers: is prediction markets’ heavy reliance on sports sustainable over the long term, or is it a growth trap?

Ethereum co-founder Vitalik Buterin weighed in on this directly last week, warning that the sector appears to be over-converging toward sports betting and short-term crypto price speculation at the expense of broader financial utility. His argument isn’t that sports markets are inherently flawed. Buterin is concerned that platforms like Kalshi are optimizing for what generates quick revenue while neglecting the kind of hedging and risk-transfer infrastructure that could make prediction markets durable financial tools rather than entertainment products with different rails.

It’s a fair critique worth considering, especially when you look at Kalshi’s category concentration. At 82% sports volume, the platform’s revenue base is tightly coupled to the sports calendar. When the NFL season ends, volume dips. When the NBA and college basketball wind down in June, it could dip again, right as the World Cup potentially picks up the slack. The question is whether this seasonal cycle — and prediction markets’ broader utility as serious financial instruments — can sustain the kind of institutional interest and user retention that justifies the platform’s latest multi-billion dollar funding rounds.

Buterin’s alternative vision, prediction markets as generalized hedging instruments rather than entertainment speculation vehicles, points to a longer-term opportunity. Kalshi itself has made early moves in this direction, filing a sportsbook hedging program aimed at the sports business industry, an acknowledgment that the platform plans to build on utility beyond the retail bettor.

The tension is real, though. Polymarket’s more balanced category split, with crypto and politics each contributing meaningfully alongside sports, suggests it may be better positioned for periods when the sports calendar goes quiet. A platform that derives 37% of its volume from sports is structurally different from one that derives 82%. Both are growing, but their vulnerability profiles look very different heading into the spring.

None of this diminishes what the industry has accomplished. Going from $2 billion in monthly volume to $26 billion in six months — and from 9.4 million monthly transactions to 112.6 million — is extraordinary by any measure. But as prediction markets mature from their explosive growth phase into something that needs to sustain institutional credibility, durable demand beyond the sports cycle could help define the next chapter for the industry.

Data sourced from DeFi Rate’s prediction market tracker and Dune Data Dashboards. Weekly data reflects the most recently completed calendar week unless otherwise noted. Monthly figures represent full calendar months.