Prediction markets notched another all-time high week, with total notional volume across major platforms reaching $6.18 billion, up 3.1% from the prior week’s record. Kalshi led the way again with $2.26 billion in volume (+4.9% WoW), extending its streak to 15 consecutive weeks of outperforming Polymarket on notional volume.

Top-line numbers for week of Jan. 19-25:

- Kalshi: $2.26B (+4.9% WoW) — 36.5% market share

- Opinion: $1.95B (+0.4% WoW) — 31.5% market share

- Polymarket: $1.76B (−0.1% WoW) — 28.4% market share

- Total market*: $6.18B (+3.1% WoW)

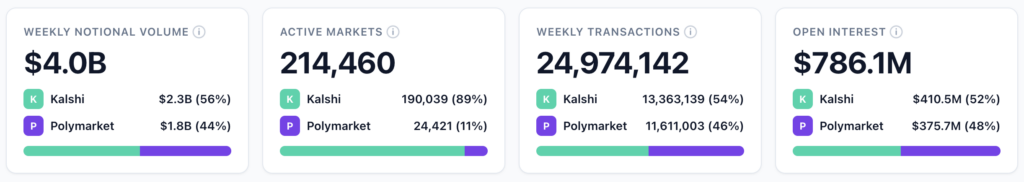

Kalshi vs. Polymarket volume for the week of Jan. 12-18:

According to our Notional Volume dashboard, Kalshi continues to dominate in terms of number of active markets, maintains a small edge over Polymarket in open interest, and surpassed Polymarket in weekly transactions for the first time last week. Another first last week: Kalshi and Polymarket combined hit the $4 billion mark for weekly notional volume.

*Note that total market volume only includes the platforms currently tracked by Dune Data Dashboards.

Top prediction platforms by the numbers (Week of Jan. 19-25)

Polymarket’s essentially flat week marks the first time since early December the platform hasn’t posted volume growth, while Kalshi continues to pull away on the strength of its sports markets (helped along by high profile NFL games). The big three (Kalshi, Opinion, Polymarket) remain tightly clustered at the top. Meanwhile, the smaller platforms are showing explosive growth week over week: Limitless surged 201.6% to $57.2M, and ForecastEx more than doubled with a 133.9% gain.

Top platforms notional volume and market share (week of Jan. 19-25):

| Platform | Notional Volume ($) | Market Share | WoW Change |

|---|---|---|---|

| Kalshi | $2,257,916,803 | 36.5% | +4.9% |

| Opinion | $1,950,364,860 | 31.5% | +0.4% |

| Polymarket | $1,756,111,734 | 28.4% | −0.1% |

| predict.fun | $143,956,073 | 2.3% | +26.7% |

| Limitless | $57,245,377 | 0.9% | +201.6% |

| ForecastEx | $12,913,898 | 0.2% | +133.9% |

| Myriad | $3,205,159 | <0.1% | +36.4% |

| Total | $6,181,713,904 | 100% | +3.1% |

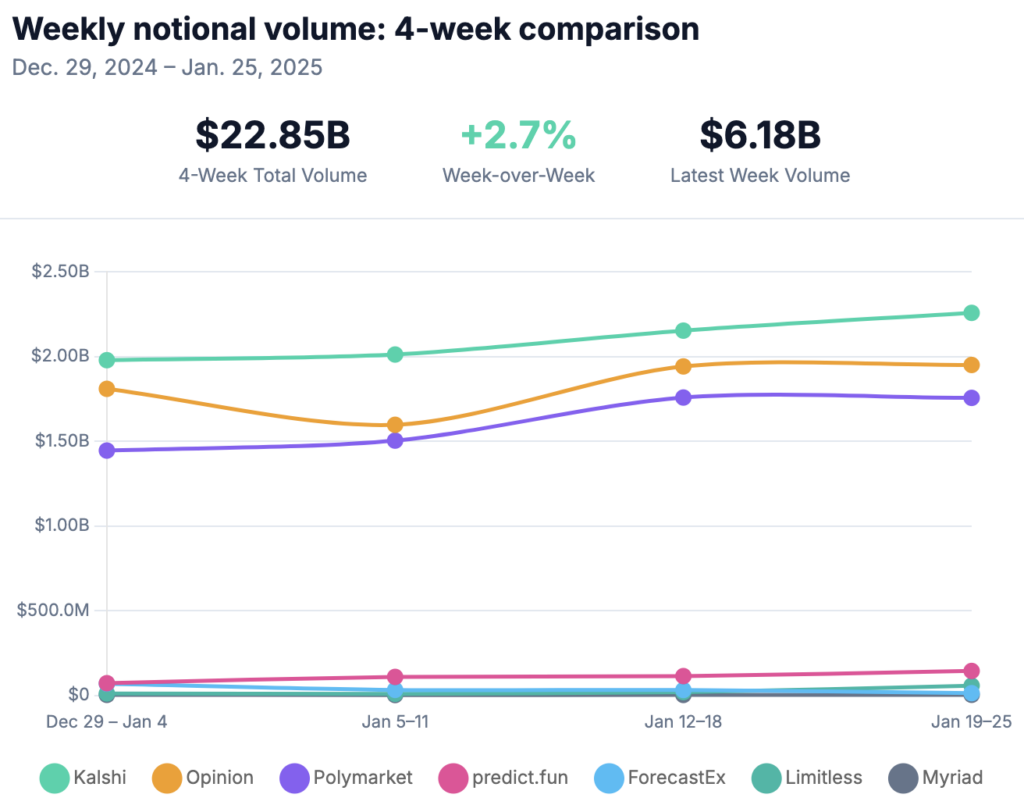

Weekly Notional Volume: 4-Week Comparison (Dec. 29 – Jan. 25):

A few trends that jump out in the data from the last four weeks:

- Kalshi has posted four consecutive weeks of growth, climbing from $1.98B to $2.26B (+14.1% over the period).

- Polymarket showed strong mid-month growth but has flattened out the past two weeks.

- Limitless is the breakout story, up from $11M to $57M over four weeks (+412%).

- ForecastEx is heading in the opposite direction, dropping from $69M to $13M (-81%).

- Opinion remains volatile week-to-week but consistently in the $1.6-1.95B range.

Kalshi vs. Polymarket: The rivalry by the numbers

The two dominant platforms continue to trade punches, but Kalshi is clearly pulling ahead on volume while Polymarket shows strength in other areas.

| Metric | Kalshi | WoW Change | Polymarket | WoW Change |

|---|---|---|---|---|

| Notional Volume | $2.3B | +6.8% | $1.8B | +2.4% |

| Weekly Transactions | 13,363,139 | +9.9% | 11,611,003 | −5.6% |

| Active Markets | 190,039 | +23.9% | 24,421 | +22.8% |

| Open Interest | $410.5M | +15.3% | $375.7M | +34.9% |

Key takeaways:

- Kalshi now leads on transactions too: For the first time in recent memory, Kalshi overtook Polymarket in weekly transactions (13.4M vs 11.6M). The prior week, Polymarket still held a slight edge.

- Market share gap widens: Kalshi now commands 56% of combined Kalshi/Polymarket volume, up from roughly 55% the week prior and ~50% in early January.

- Polymarket’s open interest surge: Despite essentially flat volume, Polymarket’s open interest jumped 34.9% WoW to $375.7M. This suggests traders are taking longer-dated positions rather than churning short-term sports bets.

- Active markets ratio: Kalshi’s 190K active markets vs. Polymarket’s 24K represents a nearly 8:1 ratio, though the vast majority of Kalshi’s non-sports markets remain thinly traded.

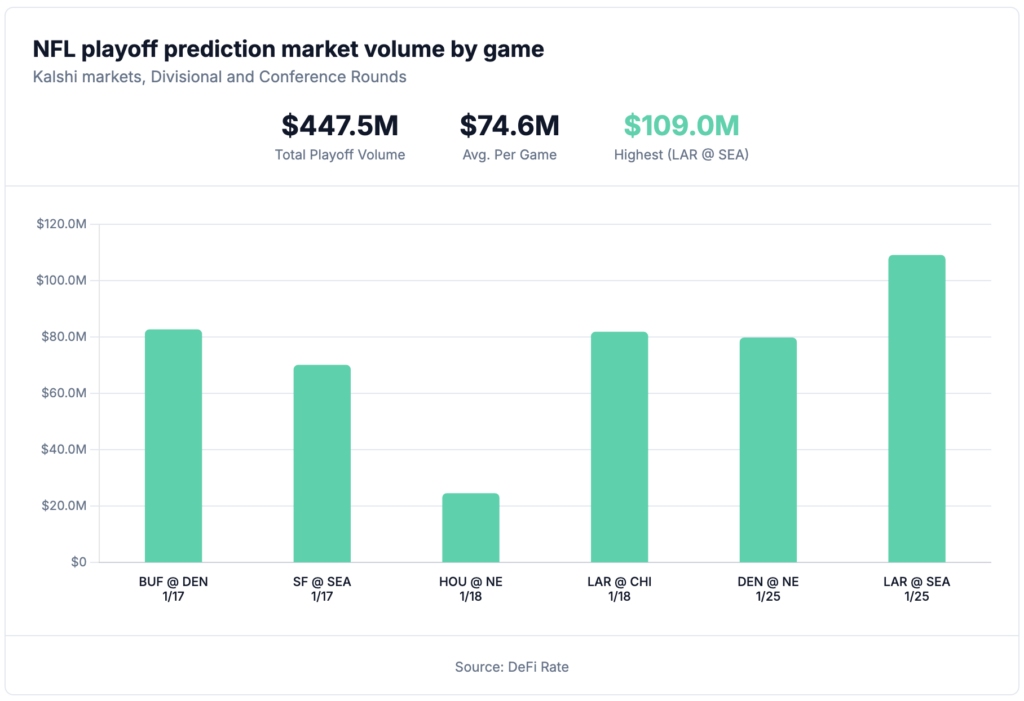

NFL playoffs drive another big sports week

Conference Championship Sunday lived up to expectations, bringing massive volume concentrated in two marquee games. The Rams-Seahawks NFC Championship drew $109 million in trading volume at Kalshi alone, making it the single highest-volume NFL game of the playoffs so far.

The two Conference Championship games combined for $188.7 million in volume, compared to $258.8 million spread across four Divisional Round games the weekend prior. That works out to roughly $94M per game for Conference Championships vs. $65M per game for Divisional Round — a 45% jump in per-game volume as the stakes increased.

Expect that to grow substantially for the Super Bowl which already has volume of $145.5M on Kalshi and $693.4M on Polymarket. The NFC Champion Seattle Seahawks are currently settling in as a 67% favorite in Super Bowl odds over the AFC winning New England Patriots.

NFL playoff trading volume at Kalshi (Divisional and Conference Championship rounds):

As the chart above shows, the Texans-Patriots game was an outlier with lower volume ($24.5M), while the Conference Championship finale (Rams-Seahawks), a 31-27 thriller, drew the highest trading activity at $109M.

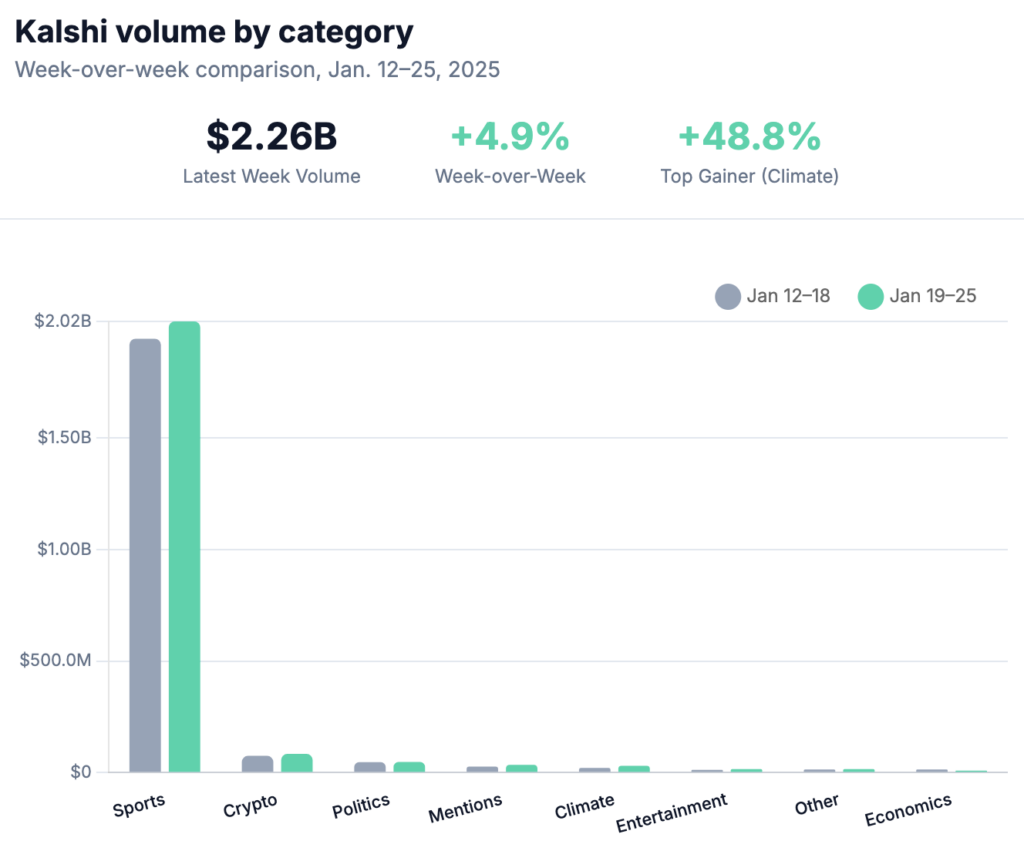

Kalshi category breakdown: Sports still king, but diversification continues

Sports continue to dominate Kalshi’s category mix at 89.6% of total volume, though that share has gradually ticked down from 91.1% three weeks ago as non-sports categories grow faster in percentage terms.

A few category trends worth noting:

- Climate and Weather jumped 48.8%, likely driven by winter storm markets as severe cold snaps hit much of the country.

- Mentions surged 31.5% due to a number of factors including higher volume of mention market offerings combined with a rise in political mention market popularity. This week’s jump was also boosted by increased NFL playoff-related mention market volume and the upcoming Fed chair FOMC press conference mention market.

- Economics dropped 36.7%, in part because markets have settled on near-certainty for no rate cut in January ahead of this week’s FOMC meeting.

- Crypto continues steady growth at +11.3%, now commanding 3.7% of Kalshi volume.

What to watch: Super Bowl, platform moves and potential obstacles

Super Bowl LX (Feb. 9) looms as the next major volume catalyst. The two-week gap between Conference Championships and the Super Bowl will likely cause a noticeable dip before the big spike.

March Madness (mid-March) will be the next major sustained volume driver after the Super Bowl. Expect a relative lull in sports-driven volume between Feb. 10 and March 15, which could allow non-sports categories like crypto, politics, entertainment and mention markets to claim a larger share of the mix. That said, Kalshi already has markets covering 14 top-level sports categories (and dozens of sub-categories) and continues to deepen its sports offerings, including ramping up live or micro-markets for tennis adding to Winter Olympics markets. These additional offerings could help make up for the temporary major sports lull.

Other developments we’re monitoring

Platform moves:

- Polymarket US remains in limited rollout; a broader launch could help the platform claw back market share lost to Kalshi’s sports dominance.

- We’ll be watching for whether newer entrants like DraftKings Predictions, FanDuel Predicts, Fanatics Markets and Gemini, can drive meaningful liquidity and volume with a smaller slate of offerings in the coming months.

- Robinhood will eventually cease contributing liquidity and volume to Kalshi by listing its prediction markets.

News broke last week that Robinhood, in partnership with liquidity provider Susquehanna International, has completed its planned acquisition of MIAXdx (Miami International Holdings, Inc. Derivatives Exchange). The new acquisition of MIAXdx, already approved by the CFTC as a Designated Contract Market (DCM) and Derivatives Clearing Organization (DCO), will allow Robinhood to “list and clear fully collateralized futures, options on futures, and swaps” which includes prediction markets.

Considering upwards of 50% of Kalshi’s volume originates from Robinhood users, the move could mark a substantial setback for Kalshi’s notional volume. However, additional partnerships including more distribution channels, in combination with growth in other categories (especially politics and elections in the lead-up to the 2026 midterms) should help fill much of the gap left by Robinhood’s eventual departure.

Regulatory watch:

Several states are exploring Massachusetts-style legal challenges to Kalshi’s sports contracts after an MA court recently ruled against Kalshi’s sports offerings. But appeals remain in progress and it could take months before we have a definitive, far-reaching court ruling on the matter. An adverse ruling in a higher court could significantly impact volume if sports must be stripped, but we likely not for another year or more.

Meanwhile, the shifting tides in CFTC leadership could help shape future regulations for event contracts, but strict sports-related restrictions are not likely to be included in new Chair Michael Selig’s vision.