Better late than never? Gemini Predictions, the prediction market-arm of the Gemini crypto platform, announced on Jan. 8 that it was offering sports event contracts for the College Football Playoff semifinals and the NFL’s Wild Card weekend, entering the world of sports betting just as the football season begins its final stretch.

To be fair, Gemini only just launched its prediction exchange to U.S. customers last month. Gemini Predictions went live on Dec. 15, after the Winklevoss twins’ crypto-exchange platform (and its affiliate, Gemini Titan) received a Designated Contract Market (DCM) license from the U.S. Commodities Futures Trading Commission (CFTC).

“Gemini Predictions™ offers event contracts that are simple yes or no questions on future events. For example, ‘Will one bitcoin end this year higher than $200k?’ Yes or no. Or, ‘Will Elon Musk’s X end up paying the full $140 million fine to the European Commission in 2026?” Yes or no,'” read the press release. “The move marks Gemini’s latest step in building our one-stop super app where customers can trade crypto, stake, earn crypto credit card rewards, stablecoin rewards, and more.”

First impressions of Gemini sports markets

Gemini’s main identity has always been as a crypto exchange. That central goal is reflected in the platform’s initial scant slate of prediction markets and non-prominent positioning within the app.

A month after launching, Gemini Predictions has just 30 active prediction markets, half of which are sports related. There are a handful of NBA markets, upcoming football games, and markets based on the end-of-the-season NFL awards (Coach of the Year, MVP, Offensive rookie of the year, etc.).

Pricing on their markets to date isn’t its strong suit, and nothing that would set Gemini apart from its competitors. However, since Gemini advertised at launch that “customers will be able to trade fee-free for a limited time,” the appeal of trading without fees could lure some customers from more established platforms.

Odds & pricing at Gemini vs. other exchanges

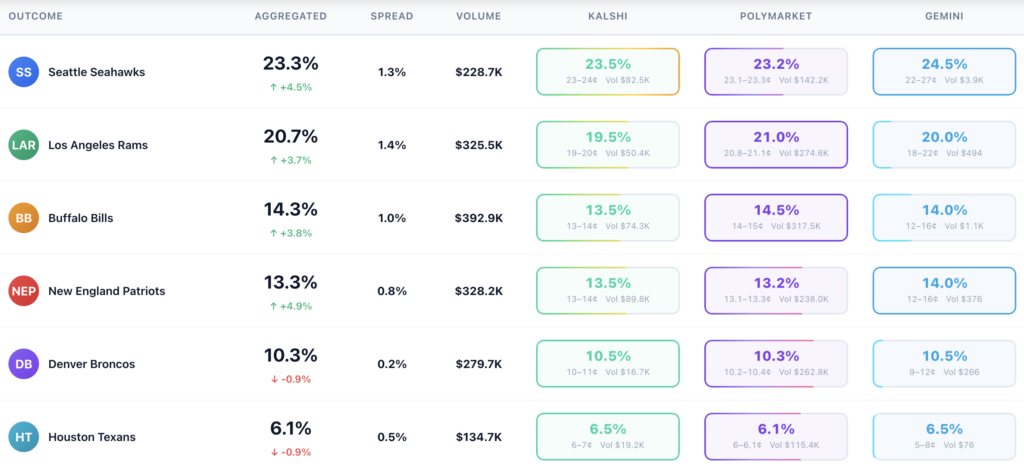

So, how does Gemini stack up against Kalshi and Polymarket in terms of pricing and odds? Taking the 2026 Super Bowl Odds as an example, Gemini’s pricing appears generally worse for customers though some markets may be roughly the same.

While Gemini’s Super Bowl odds generally follow the same order or pattern of favorites as you’ll find on the other exchanges, the spread of prices is significantly wider. For example, if you wanted to buy Yes shares on the favorite, Seattle Seahawks, you might encounter pricing anywhere between 22¢ and 27¢. This is mostly due to the much lower volume and liquidity on Gemini versus at Kalshi and Polymarket. With much less trading activity on Gemini’s individual markets, the pricing is not as tight.

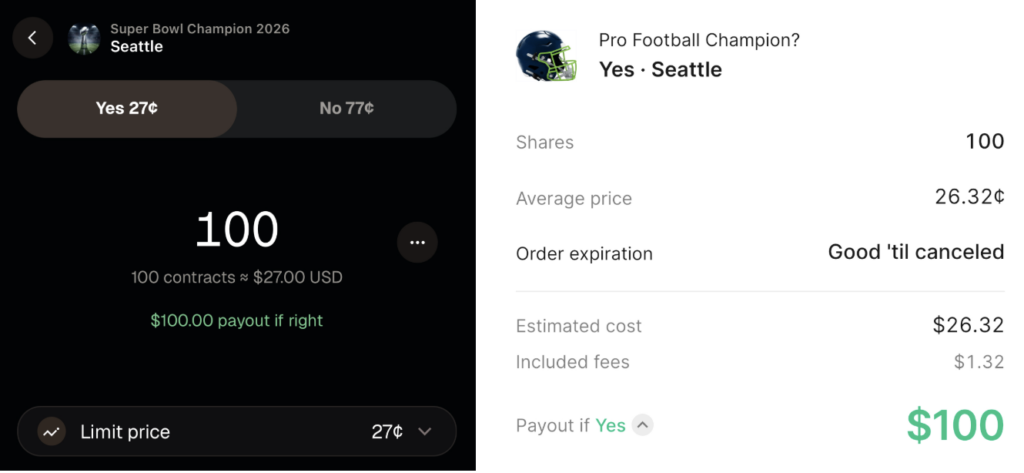

At time of writing, 100 shares of Seahawks to win it all on Gemini cost $27 (to win $100) and on Kalshi, the same 100 contracts costs $26.32 (25¢ per share plus $1.32 in fees) to win the same $100.

In this particular example, Gemini’s inefficient pricing costs you an extra 2.6%. While it may not seem like much, it could be very costly at scale, or in situations where the pricing is even worse when you go to trade. And this is without fees.

Because Gemini started late in the game, market volume and liquidity is far behind its top competitors. Kalshi’s Super Bowl market has already crossed the $100M volume mark, while Polymarket’s is over $669M. With the Big Game taking place Feb. 8, those markets will grow substantially over the next month. That could also be the case for Gemini, if the platform can overcome initial barriers to liquidity.

Final verdict: Shop around

Gemini Predictions is less than a month old, so it would be unfair to judge the platform too harshly, especially compared to market leaders Kalshi and Polymarket. With that said, it does seem like Gemini Predictions is the side dish to Gemini’s main course of crypto trading.

The main message for potential traders, including existing Gemini customers, is to shop around for the best prices if you want to seriously dabble in prediction markets.

Perhaps a year from now, when it’s time for Super Bowl 2027, Gemini will be standing shoulder-to-shoulder with Kalshi and Polymarket, but at this point? They seem content to sit on the bench.