ProphetX, a sports prediction platform currently operating under a sweepstakes model, has filed applications with the U.S. Commodity Futures Trading Commission (CFTC) to register as both a Designated Contract Market (DCM) and a Derivatives Clearing Organization (DCO).

If approved, ProphetX would become the first federally regulated exchange dedicated specifically to sports-based event contracts.

The company announced the filing on Monday, calling it a major step toward offering real-money trading on sports outcomes nationwide under federal oversight.

“Our goal has always been to build a transparent, compliant and innovative marketplace that treats sports outcomes with the same integrity and structure as any other asset class,” said Dean Sisun, CEO and Co-Founder of ProphetX. “Filing for DCM and DCO status is the next logical step in legitimizing the future of user-driven sports trading.”

Why the Shift Now?

ProphetX’s move comes amid tightening regulatory pressure on sweepstakes wagering models. Several states, including California, have taken action against sweepstakes-style gaming apps, while platforms have faced advertising restrictions and market withdrawals.

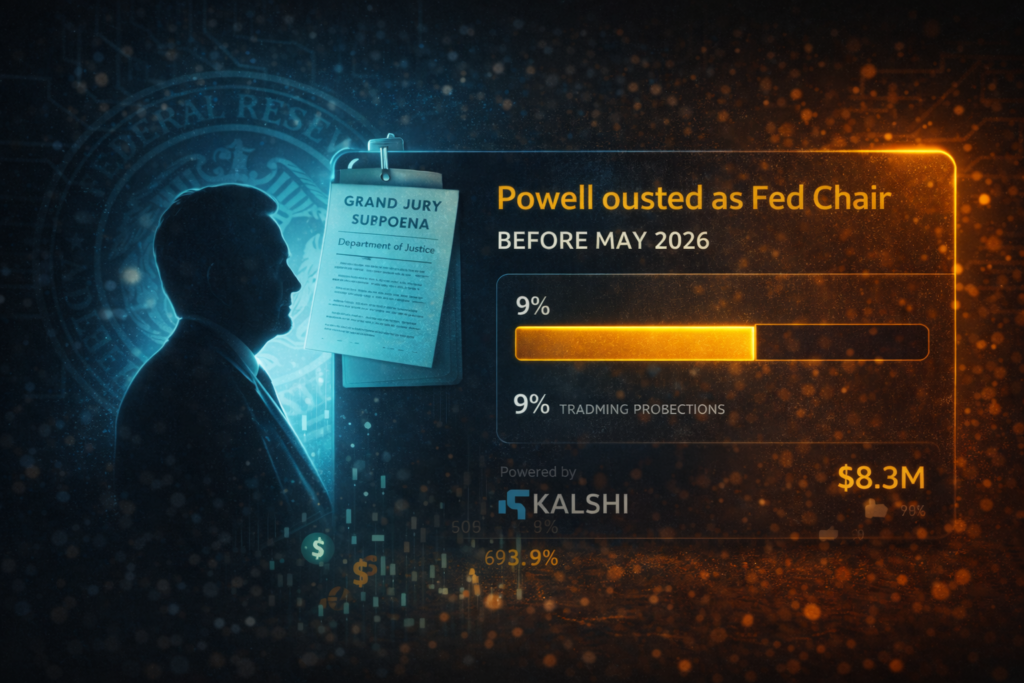

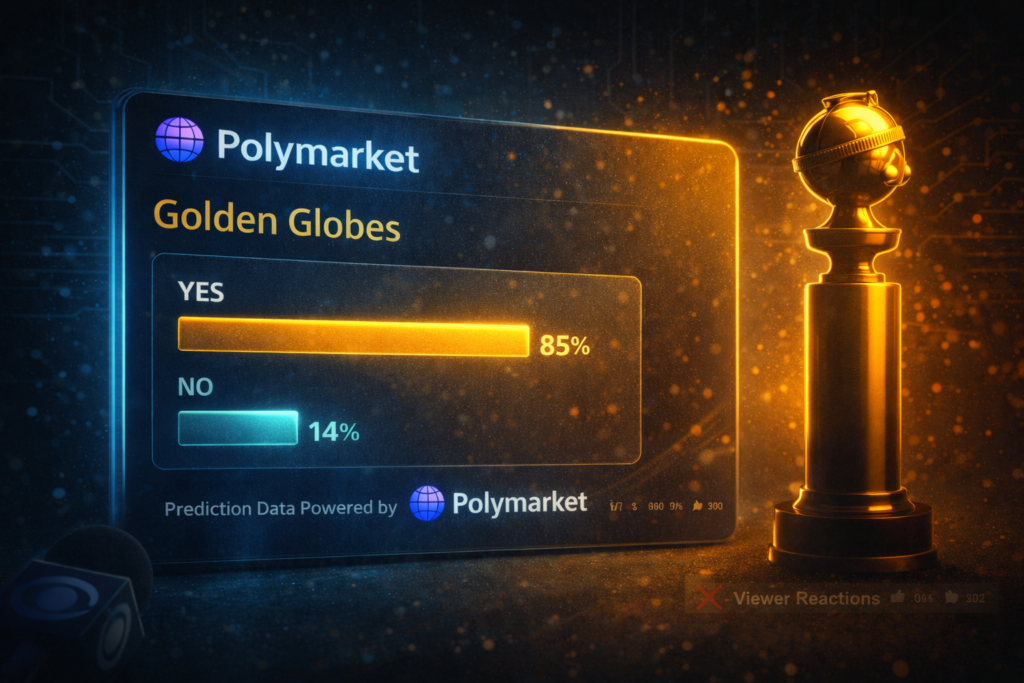

At the same time, prediction markets have gained serious traction in the U.S. Kalshi and Polymarket have gone through several massive funding rounds and seen rapid growth in trading volume across categories ranging from elections to sports to macroeconomic outcomes. Major gaming operators, including DraftKings, FanDuel, and Underdog, are now exploring federally regulated event-contract products of their own.

By seeking DCM and DCO status, ProphetX aims to shift from state-by-state gaming oversight to a single federal regulatory framework. This structure has drawn increasing interest from operators seeking a scalable compliance path.

A Sports-First Positioning

This distinction is significant.

Unlike platforms that started with politics or financial events and later added sports, ProphetX’s product has been sports-driven since launch. The company operated as a licensed sports betting exchange in New Jersey before transitioning to a sweepstakes model to reach more markets.

If approved, ProphetX would allow users to trade directly on outcomes of games and performance metrics, with contracts priced through market-driven supply and demand rather than traditional sportsbook odds.

Co-founder Jake Benzaquen called it “adapting sports to the CFTC framework,” rather than adapting the CFTC to sports. That might sound like a small semantic difference, but it reflects a strategic advantage: sports bettors are already prediction market participants, they just don’t use the vocabulary yet.

ProphetX is trying to build an interface that makes the transition feel native.

What Comes Next?

CFTC approvals for new exchanges are typically lengthy, and the agency has been operating with limited staffing due to the ongoing federal government shutdown. ProphetX does not expect a final determination until 2026.

In the interim, the company will continue operating under its existing sweepstakes model.

If approved, ProphetX would join Kalshi, Polymarket (returning U.S. operations), and Crypto.com’s exchange as platforms allowed to offer event contracts nationwide. It would be the first among them built exclusively for sports.

Essentially, ProphetX is betting that the future of sports trading looks more like the CME Group than Caesars. If they’re right, the sports betting industry will look very different in five years.

In the meantime, everyone else in the prediction markets industry will be watching the CFTC docket very closely.