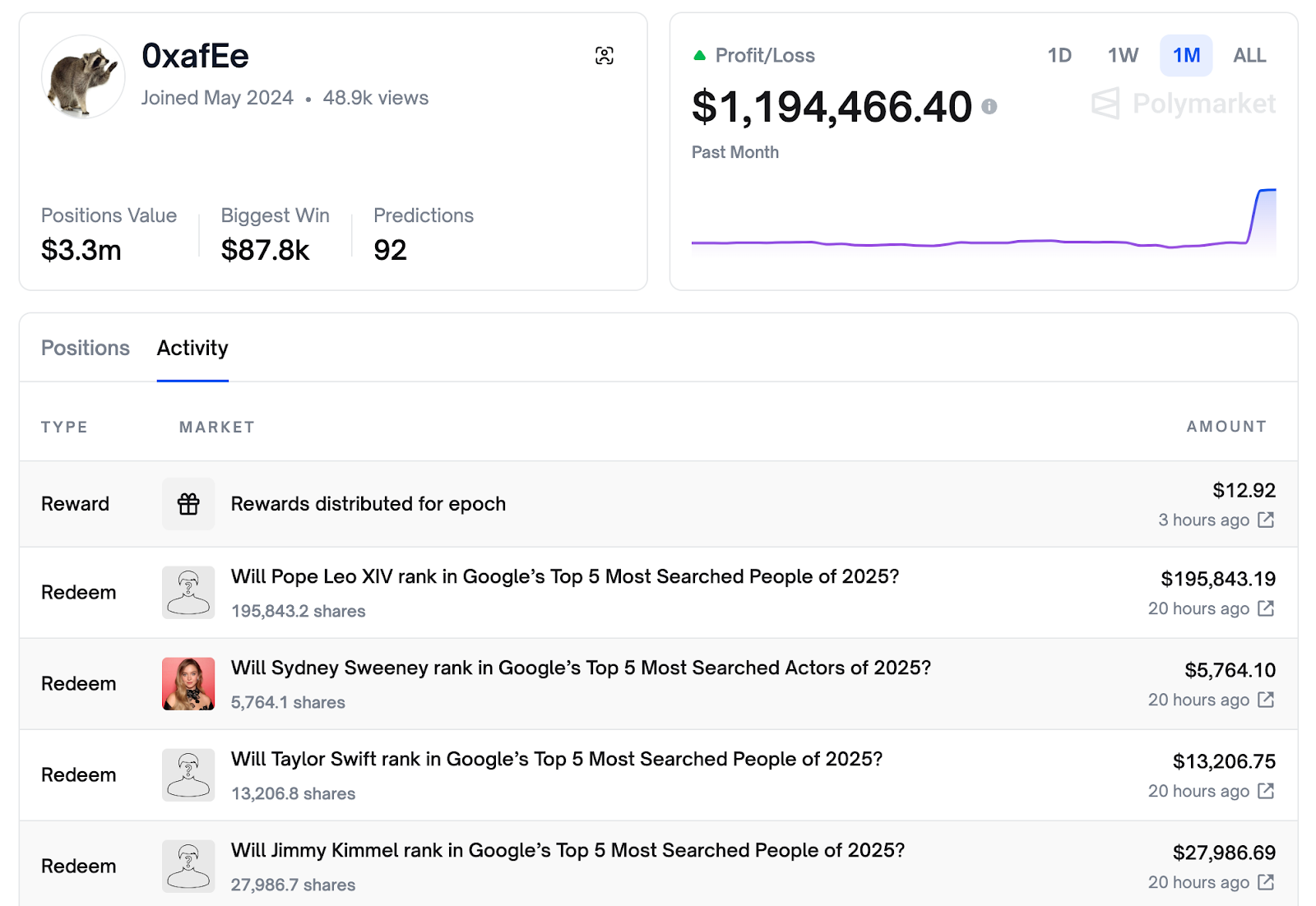

The prediction market world just had one of its most controversial market settlements. A Polymarket user known as AlphaRaccoon, walked away with over $1 million in profit in a single day. The source of the profits was all across markets on Google’s 2025 Year in Search rankings, including some very unlikely and obscure results.

Across social media, the community’s consensus was immediate: AlphaRaccoon wasn’t lucky – the user was plugged in.

The perfect storm: Google leaks and predictions

Google reportedly published the Year in Search data early by mistake, then pulled it down within minutes. Right before, AlphaRaccoon placed enormous positions across dozens of hyper-specific markets.

The red flag was that it wasn’t just on “Who will be #1?” but also whether other particular celebrities would place in the top five.

The trader went 22 for 23 on the bets.

Perhaps one of the most unlikely wins was loading up on “YES” on singer/songwriter d4vd at shockingly unlikely odds, shortly before the singer unexpectedly appeared at the top of the global rankings.

He also bet nearly $1 million that Bianca Censori would not be #1 – and was right again.

The Polymarket community has generally agreed that predicting the entire search hierarchy weeks before release would have been near-impossible without internal data.

Not the first Google win

What sealed most people’s opinions was the fact that this wasn’t AlphaRacoon’s first hit on a Google-associated market.

Just months ago, the same trader pocketed close to $150K by nailing the exact release date of Google’s Gemini 3.0 – before any public hints existed.

When the allegations surfaced, AlphaRacoon attempted to hide – changing his username – but to little effect, since all Polymarket activity is retained on-chain.

The trading history on the platform can still be viewed under the handle @0xafEe, at the time of writing.

The other side of the argument, ‘insider trading is good’

Not everyone thinks the alleged insider trading is a disaster. One camp argues this is exactly how prediction markets should work and likely why Polymarket celebrated the Spotify leak earlier this week.

The logic comes from this:

Prediction markets weren’t exactly designed to be casinos – they were imagined as crowdsourced information engines. If someone knows the truth early, it’s the market’s job to reflect it. Profit is the incentive for revealing that information.

Under this view, AlphaRaccoon didn’t corrupt the market – he updated it.

The permissionless market problem

Of course, the counterpoint is just as compelling: trust is important. Polymarket is near-permissionless – anyone can submit a market idea without credentials, identity checks, or special status. And that includes the resolution criteria, which can sometimes be flawed.

The only walled part is the review layer, where Polymarket’s team decides which proposed markets actually get published.

This leaves some holes in the process that can be exploited. If market titles and resolution criteria don’t align, users can be misled.

The Google case has plenty of controversy in this regard, due to a number of factors:

- Traders thought the market was resolved too early because the official data wasn’t out

- Rankings didn’t match

- d4vd was added as an option very late

- Google Trends showed suspicious spikes in activity, suggesting potential manipulation

Altogether, it made the outcome look driven by insider influence rather than public information.

When traders believe insiders can front-run markets – or that resolutions can be manipulated – the entire idea of “fair odds” disappears.

Prediction markets are now mainstream enough that insider exploitation is both possible and extremely profitable. Whether that’s a feature or a fatal flaw depends on who you ask.

But one thing is clear: As long as these markets stay open, permissionless, and financially juicy, insiders won’t just be a possibility – they’ll be inevitable.