Coinbase Financial Markets filed federal lawsuits Thursday against Illinois, Connecticut, and Michigan, seeking to block the states from enforcing gambling laws against its planned prediction markets offering.

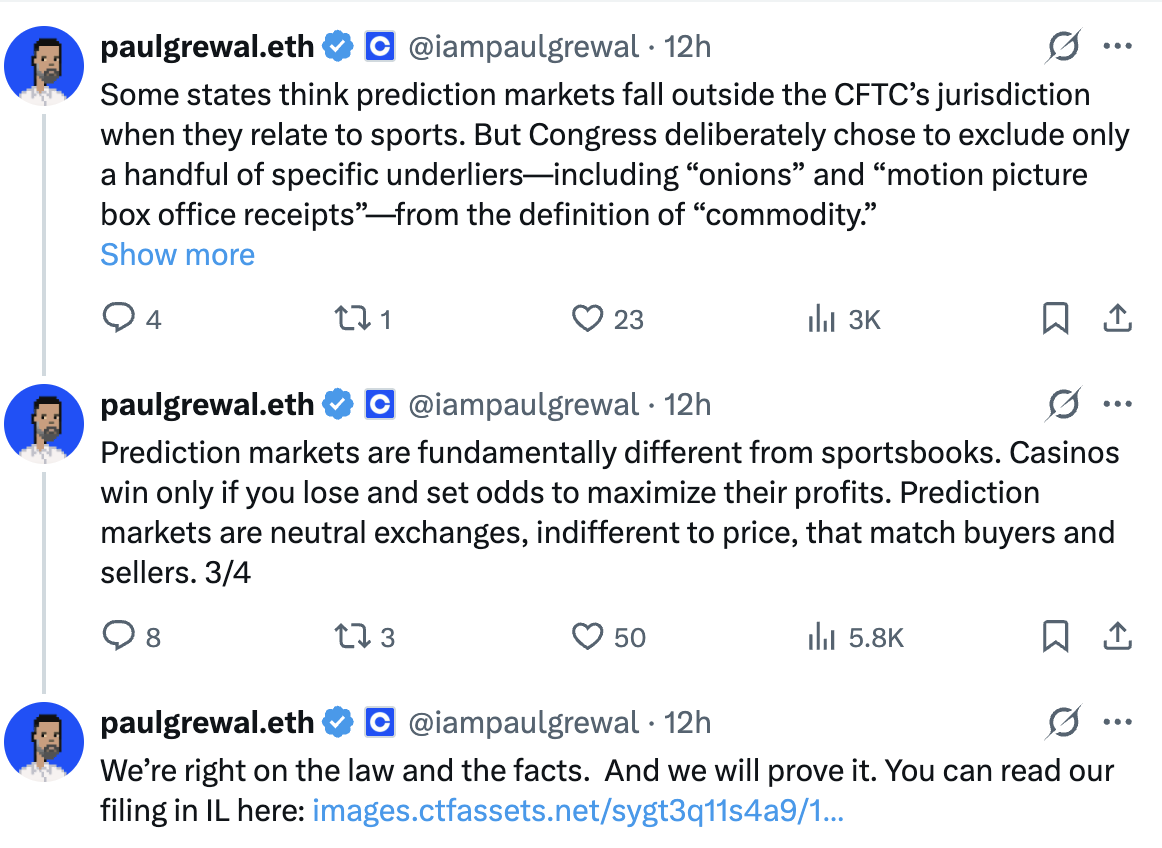

The company’s Chief Legal Officer, Paul Grewal, announced on X that the lawsuits were filed to “confirm what is clear: prediction markets fall squarely under the jurisdiction of the @CFTC, not any individual state gaming regulator.”

In its 40-page complaint, filed in the U.S. District Court for the Northern District of Illinois, Coinbase argues that federal commodities law preempts state gambling regulations when it comes to event contracts traded on federally registered exchanges.

According to the filing, Coinbase plans to begin offering event-contract trading in January 2026 through a partnership with KalshiEX LLC, a CFTC-registered exchange. The contracts allow users to trade on predictions about future events, including sports outcomes.

Legal strategy targets state overreach

According to the complaint, prediction markets have become a multi-billion-dollar industry. The filing states that Kalshi announced in July 2025 that it had facilitated more than $2 billion in sports-related event contract trades.

The company seeks:

- A preliminary and permanent injunction preventing Illinois from enforcing gambling laws against Coinbase’s event contract offerings

- A declaratory judgment that Illinois laws are preempted by federal law as applied to event contracts traded on CFTC-designated exchanges

Coinbase argues it faces irreparable harm because it must either abandon a “critical part of its business plan” or risk civil or criminal enforcement action. The company states it has “devoted significant resources to building CEA-compliant infrastructure to host event contract trading” for “a product that Coinbase has invested substantial resources building over the last six months.”

The complaint argues that Illinois enforcement would damage Coinbase’s reputation: “Illinois’s enforcement actions, premised on the theory that Coinbase is violating state law notwithstanding Coinbase’s full compliance with federal law, would immediately undermine Coinbase’s hard-earned reputation as a leader in this space and as a public company that values compliance and follows all applicable laws.”

Illinois has threatened civil and criminal penalties

Illinois gaming regulators sent cease-and-desist letters on April 1, 2025 to Kalshi, Robinhood, and Crypto.com, alleging these companies engaged in “sports wagering activity in Illinois over the Internet and on mobile devices” without a state license.

The state’s position is that offering sports event contracts violates the Illinois Sports Wagering Act (230 ILCS 45), the Illinois Criminal Code (720 ILCS 5/28-1(a)), and Administrative Code provisions. Illinois threatened civil and criminal penalties for non-compliance.

On April 25, 2025, the Illinois Gaming Board wrote to the CFTC expressing “significant concerns” about sports event contracts and urging the federal agency to “prohibit the businesses you oversee from offering sport event contracts that violate state law.”

On October 23, 2025, Illinois issued a public memorandum warning all licensees that parties who “participate in or facilitate” prediction market activities without a license are “engaged in illegal gambling.”

Coinbase’s federal preemption argument

Coinbase argues that event contracts are “swaps” under the Commodity Exchange Act, which grants the CFTC “exclusive jurisdiction” over such instruments when traded on designated contract markets.

The complaint cites the CEA’s definition of swaps as covering any agreement that “provides for any purchase, sale, payment, or delivery…dependent on the occurrence, nonoccurrence, or the extent of the occurrence of an event or contingency associated with a potential financial, economic, or commercial consequence” (7 U.S.C. § 1a(47)(A)(i)-(ii)).”

Congress granted the CFTC exclusive jurisdiction over derivatives traded on federal exchanges through amendments to the CEA in 1974 and expanded this to specifically cover swaps in 2010. According to the complaint, Congress eliminated language that preserved state law applicability to futures trading, and legislative history shows Congress sought to prevent “total chaos” from different state laws regulating futures markets.

Coinbase Financial Markets is registered with the CFTC as a Futures Commission Merchant (FCM). Kalshi has been a CFTC-registered Designated Contract Market since November 3, 2020 and began listing sports event contracts in January 2025 after certifying compliance with federal requirements.

Coinbase argues that obtaining state gambling licenses would conflict with federal requirements that exchanges provide “impartial access” to all users nationwide, as state licenses impose geographic restrictions.

The case is assigned number 1:25-cv-15406 in the Northern District of Illinois.