Crypto.com launched OG today, a dedicated prediction markets platform spun off from its main app, marking another escalation in the race to capture the rising demand for event contract trading in the U.S. The timing is intentional: Super Bowl LX between the Seattle Seahawks and New England Patriots kicks off February 8, and it’s the biggest betting event of the year.

OG prediction market app is powered by Crypto.com | Derivatives North America (CDNA), the CFTC-registered exchange Crypto.com acquired in 2022 in what was then the largest acquisition in crypto industry history. The company claims 40x weekly growth in its prediction markets business over the past six months, prompting the decision to build a standalone platform rather than keeping event contracts as a feature within the main Crypto.com app.

“We pioneered the first ever federally regulated Sports Prediction Market platform back in 2024 and are doubling down in this space by bringing OG to the masses,” said Nick Lundgren, who has been named CEO of OG while continuing as Crypto.com’s Chief Legal Officer. Lundgren led CDNA’s December 2024 launch of the nation’s first CFTC-regulated sports event contracts.

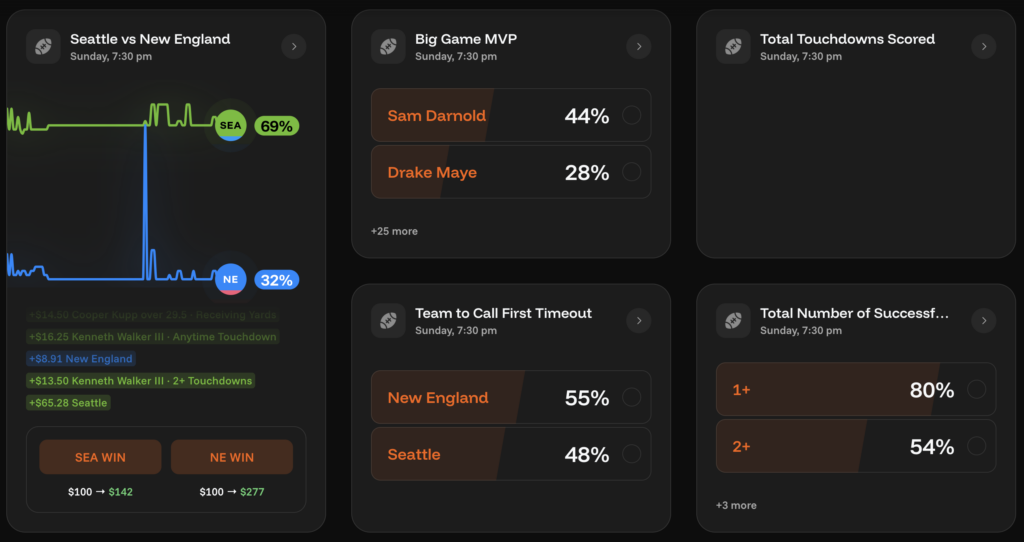

Available markets at OG prediction market app

OG launches with an extensive category lineup that rivals Kalshi’s breadth:

Sports: The Big Game (Super Bowl), Pro Football, Pro Basketball, College Basketball, Hockey, Golf, Baseball, F1, EPL, Serie A, Bundesliga, Ligue 1, Champions League, World Cup, Winter Olympics, and World Baseball Classic.

Non-Sports: Politics, Economics, Financials, Companies, Culture, Crypto, and Climate.

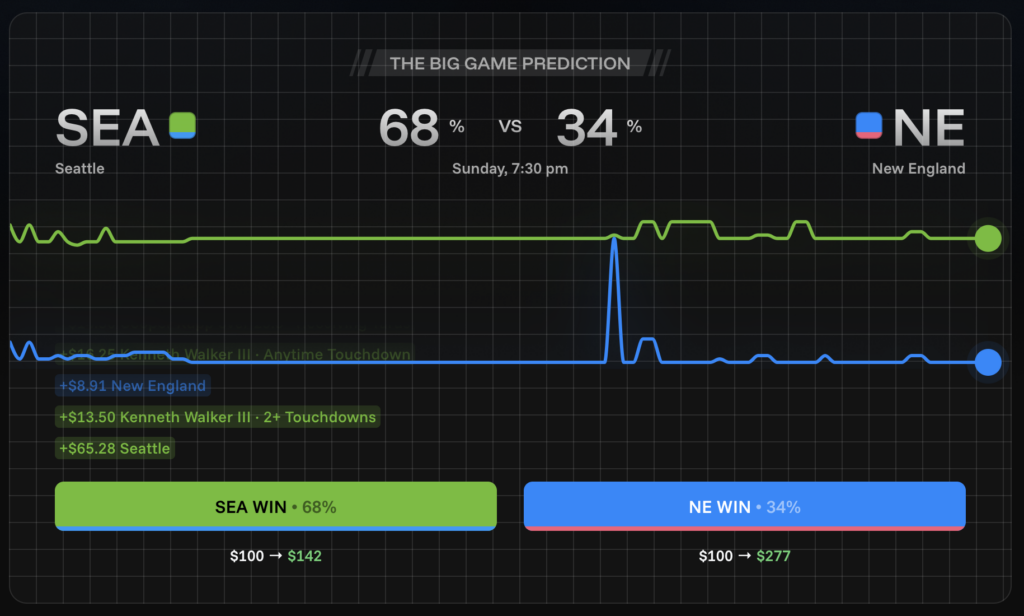

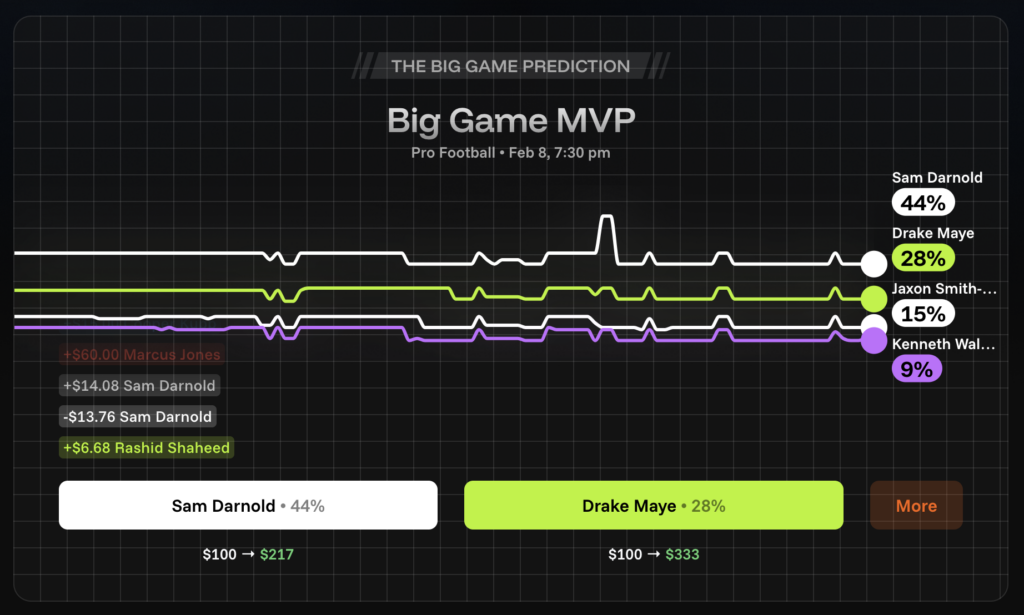

The platform prominently features Super Bowl markets at launch. Current pricing shows Seattle at 68% implied probability ($100 → $140 payout) against New England at 34% ($100 → $285). Big Game MVP markets are also live, with Sam Darnold leading at 44% implied odds. The site also offers parlays (notably, not following the “combos” terminology of other exchanges), game props, novelty props, scoring props, TD and defense props.

Novelty props include: Songs to be played at halftime, first song of halftime show, coin flip result, team to win coin flip, gatorade shower color, who will perform during halftime show, and length of national anthem.

What sets OG apart

Various features distinguish OG from competitors:

Margin Trading: OG plans to become the first U.S. prediction market to offer leverage. Once CFTC-certified, traders will access margin-based contracts through Crypto.com’s federally licensed futures commission merchant. This could fundamentally change position sizing and capital efficiency for serious traders.

No User Limits: OG’s homepage explicitly states “Sharps, VIPs, analytical thinkers are all encouraged and winners won’t be banned.” This directly addresses a pain point from traditional sportsbooks, which routinely limit or ban profitable bettors. Whether OG can maintain this policy at scale remains to be seen. This is not unique to this prediction exchange, but it’s a key selling point for sports bettor crossovers.

Social Features: The platform includes leaderboards, trader following, and opinion sharing. The company is positioning OG as part trading venue, part social layer, borrowing from Polymarket’s community engagement playbook while adding gamification elements.

VIP Program: OG will leverage Crypto.com’s sports partnerships including Crypto.com Arena, UFC, Formula 1, and UEFA Champions League for exclusive experiences.

Parlays: OG introduces “parlay” functionality, allowing traders to combine multiple event contracts. The company notes this is a “term unique to OG wherein a Customer requests a trade composed of a combination of specified events.” At other prediction market apps, they call them “combos.”

What new OG traders should know

Important information for new customers:

- Launch Bonus: First million users receive up to $500 in rewards.

- Sign-up Requirements: Full KYC including government ID, address verification, and banking information.

- Deposit Methods: USD via bank transfer or crypto conversion (350+ supported tokens through the Crypto.com ecosystem).

- Position Limits: 2.5 million contracts for $1-value markets; 250,000 for $10-value markets.

- Trading Hours: 24/7 except Saturday maintenance from 4:00-5:00 AM ET.

Fee breakdown

OG inherits CDNA’s fee structure, which varies by contract size:

| Contract Value | Exchange Fee | Technology Fee | Total Fee | Fee on Winning Settlement |

|---|---|---|---|---|

| $1 | $0.01 | $0.01 | $0.02 | $0.02 |

| $10 | $0.10 | $0.10 | $0.20 | $0.10 (tech fee waived) |

The technology fee waiver on winning trades is a notable benefit—it effectively cuts your fee in half when you’re right. On 100 winning $10 contracts, that’s $10 saved compared to losing trades.

For casual traders buying small positions, flat per-contract fees are predictable and the differences compared to other top exchanges are minimal. For high-volume traders, Polymarket’s 0.01% rate and Kalshi’s probability-weighted formula offer significant savings over OG’s flat structure.

Funding your account

OG accepts both fiat and crypto:

- USD: ACH bank transfer, wire transfer

- Crypto: Convert 350+ supported tokens to USD through the Crypto.com ecosystem

There are no deposit fees for bank transfers, though processing times vary. If you’re already a Crypto.com user, your existing wallet integrates directly.

What’s not available yet

- Margin trading: Announced but pending CFTC certification

- Volume data: Unlike Kalshi, you can’t see trading volume or order book depth on individual markets at launch

- Financial and cultural markets: Listed as “coming soon” in some categories

State availability

OG operates in 49 states plus Washington, D.C. New York is excluded due to state regulatory requirements. Sports contracts may face additional restrictions in states that have issued cease-and-desist orders to CFTC-regulated platforms (including Nevada, New Jersey, and Connecticut).

First look at OG.com

Testing OG’s web interface reveals a clean, mobile-first design that should feel familiar to DraftKings or FanDuel users. The homepage opens directly to markets rather than requiring account creation to browse. The markets are slick and the design is visually appealing.

Navigation: Horizontal category tabs (The Big Game, Trending, Pro Basketball, etc.) provide quick filtering. The UI avoids the overwhelming market lists that plague some competitors.

Market Display: Prices are shown as percentages with immediate payout calculations. A Seattle win at 68% displays “$100 → $142” directly on the card, removing mental math from the trading experience.

Regulatory Disclosure: A persistent footer reminds users that contracts are derivatives products offered by CDNA, a CFTC-regulated exchange—a transparency requirement that reinforces OG’s regulated status.

Availability: OG operates in 49 states plus Washington D.C. (New York excluded due to state regulatory requirements).

The interface prioritizes simplicity over depth. Experienced traders may find the order book visibility and position management tools less sophisticated than Kalshi’s platform, but casual users will appreciate the reduced friction.

OG joins a crowded market

OG represents Crypto.com’s bet that prediction markets deserve dedicated infrastructure rather than app-feature treatment. The margin trading roadmap could differentiate OG among serious traders, while social features and VIP experiences target casual engagement.

The platform launches into a crowded field where fee compression and liquidity depth will determine winners. But interest in prediction markets trading is peaking, and the Super Bowl will provide an even greater boost for customer acquisition, especially in states without legal sports betting apps.