DAZN’s decision to integrate prediction markets into its US platform through a partnership with Polymarket aims to combine live sports streaming with real-time financial speculation. But there are questions about regulation, competition, and the exposure of younger audiences to betting products.

Speaking at the ICE 2026 trade show, DAZN CEO Shay Segev framed prediction markets as a natural extension of fan engagement. He placed DAZN alongside platforms such as Kalshi, Polymarket, and Crypto.com. Yet DAZN’s entry comes at a time when the US prediction market is already crowded and increasingly scrutinized.

Licensing first, product later

One of the clearest unknowns is regulatory status. DAZN does not currently operate a CFTC-regulated prediction market and has confirmed it will apply for the necessary licenses before launching prediction trading in the US. That puts it behind incumbents such as Kalshi, which spent years securing approval before going live nationwide.

Without Futures Commission Merchant (FCM) status or a track record in regulated derivatives, DAZN’s predictions product will initially rely heavily on Polymarket’s infrastructure and liquidity. In the near term, Polymarket data will be embedded directly into DAZN broadcasts, with trading functionality dependent on regulatory approval.

That dependency raises questions about how differentiated DAZN’s offering can be, given Polymarket’s strong brand recognition.

DAZN is expanding what it means to experience sport.

We’ve partnered with @Polymarket to bring a powerful new real‑time layer to the DAZN ecosystem.

From live & on‑demand sport to scores, news, FanZone and betting in regulated markets, DAZN already unifies the best of sport in… pic.twitter.com/unE4pKyR4Y— DAZN (@dazngroup) January 20, 2026

Competing without a betting base

DAZN’s existing betting arm, DAZN Bet, launched in 2022 and now operates in the UK, Ireland, Spain, Italy, and Germany. While management cites betting as an increasingly important contributor to engagement, it remains a secondary revenue stream. Moreover, DAZN Bet is not active in the US.

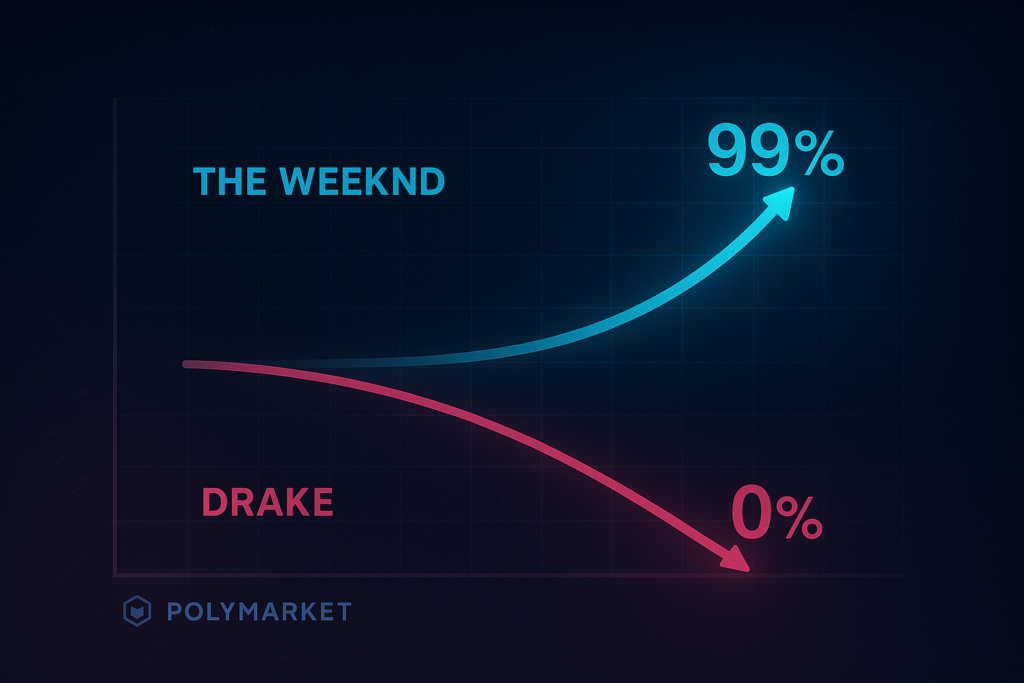

This leaves DAZN attempting to enter the American prediction market without an established domestic betting customer base. Competitors such as Kalshi and Fanatics have focused heavily on regulatory positioning and customer acquisition, while Polymarket has benefited from viral growth tied to political events.

DAZN’s advantage lies elsewhere in distribution. The company is betting that predictions embedded directly into broadcasts can convert passive viewers into active participants, with millions of viewers tuning in to live sports.

Whether that conversion is sufficient to compete with standalone platforms remains an open question.

The underage exposure dilemma

According to Similarweb data, DAZN’s audience is heavily male. Apparently, its largest age group is between 25 and 34 years old. However, as a global sports streaming platform, DAZN also attracts younger viewers. This includes users under 18, particularly those interested in football, boxing, and combat sports.

Integrating prediction markets into the viewing experience raises concerns about how DAZN will segregate betting-related content from minors. Unlike standalone prediction platforms, which typically require age verification at sign-up, DAZN’s core product is entertainment-first.

The company has not yet detailed how it plans to firewall predictions from underage accounts, or how prominently prediction data will appear during live broadcasts viewed by mixed-age audiences. As regulators focus on gambling exposure through digital media, this aspect could prove decisive.

A $2.8b deal: How DAZN Polymarket will change our habits

DAZN sports streaming giant has partnered with Polymarket

What is Polymarket?

It is the largest prediction market platform, launched in 2020. Attracted tens of millions of dollars from major funds, like Founders Fund and… pic.twitter.com/rr4bF2BJ06— dionysiosfirst (@brightdio) January 23, 2026

Profitability pressure behind the strategy

DAZN’s move into predictions also reflects mounting pressure to reach profitability. The company has recorded losses for years, though its latest filings show a reduction in deficits, with 2024 revenue rising to £3.2 billion and losses reduced to $877.5 million.

Management sees engagement monetization as the path forward. Predictions, alongside betting, FanZone interactions, and AI content, are meant to keep users active.

Still, prediction markets are low-margin businesses unless they achieve massive scale. Without acting as the house, DAZN’s upside depends on increased retention, cross-selling, and engagement rather than direct trading revenue.

DAZN’s partnership with Polymarket fits into a trend of prediction markets moving closer to mainstream media.

As Shayne Coplan, Polymarket’s CEO, put it, “every sporting event is a conversation about what happens next.” DAZN is betting that conversation can become a product. Whether it becomes a profitable one and whether it can be done responsibly at scale are questions regulators, competitors, and viewers will be watching closely.