Top Markets by Volume

Highest trading activity across platforms

English Premier League Winner

PolymarketLa Liga Winner

PolymarketFed decision in March?

PolymarketRC Celta de Vigo vs. Real Madrid CF

Polymarket2026 NBA Champion

Polymarket2026 FIFA World Cup Winner

PolymarketLos Angeles L at Denver

KalshiDemocratic Presidential Nominee 2028

PolymarketRepublican Presidential Nominee 2028

PolymarketIran strikes Israel on...?

PolymarketMiami at Charlotte

KalshiBitcoin above ___ on March 6?

PolymarketWill Crude Oil (CL) hit__ by end of March?

PolymarketChicago at Phoenix

KalshiSSC Napoli vs. Torino FC

PolymarketElon Musk # tweets February 27 - March 6, 2026?

PolymarketWill Iran close the Strait of Hormuz by...?

PolymarketPresidential Election Winner 2028

PolymarketSan Diego at Loyola Marymount

KalshiNext Supreme Leader of Iran?

PolymarketUS x Iran ceasefire by...?

PolymarketCharleston Southern at Winthrop

KalshiNew Orleans at Sacramento

KalshiDrake at Belmont

KalshiCounter-Strike: Aurora Gaming vs Legacy (BO3) - ESL Pro League Stage 2

PolymarketShelton vs Opelka

KalshiStetson at Austin Peay

KalshiCounter-Strike: TheMongolz vs paiN (BO3) - ESL Pro League Stage 2

PolymarketCelta Vigo vs Real Madrid

KalshiGaston vs Kouame

KalshiParis Saint-Germain FC vs. AS Monaco FC

PolymarketArnold Palmer Invitational presented by Mastercard Winner?

KalshiWill the Iranian regime fall by March 31?

PolymarketWolverhampton Wanderers FC vs. Liverpool FC

PolymarketGolden State at Houston

KalshiLakers vs. Nuggets

PolymarketThe Citadel at Chattanooga

KalshiWhat price will Bitcoin hit in March?

PolymarketFC Bayern München vs. Borussia Mönchengladbach

PolymarketNew York at Denver

KalshiCounter-Strike: MOUZ vs Heroic (BO3) - ESL Pro League Stage 2

PolymarketPortland at Houston

KalshiOpinion FDV above ___ one day after launch?

PolymarketEthereum above ___ on March 6?

PolymarketZheng vs Kopriva

KalshiRibeiro vs Heide

KalshiElon Musk # tweets March 6 - March 13, 2026?

PolymarketUC Davis at Long Beach St.

KalshiCounter-Strike: Natus Vincere vs Monte (BO3) - ESL Pro League Stage 2

PolymarketSouthern Miss at Texas St.

KalshiUIC at Murray St.

KalshiUEFA Champions League Winner

PolymarketCounter-Strike: FURIA vs B8 (BO3) - ESL Pro League Stage 2

PolymarketMonfils vs Auger-Aliassime

KalshiValparaiso at Bradley

KalshiRC Celta de Vigo vs. Real Madrid CF - More Markets

PolymarketCobolli vs Kecmanovic

KalshiCristian vs Joint

KalshiMiami (OH) at Ohio

KalshiBlanchet vs Virtanen

KalshiWhat day will the Paradex token launch be?

PolymarketFlorida Gulf Coast at Lipscomb

KalshiVCU at Dayton

KalshiWill the Iranian regime fall by June 30?

PolymarketBitcoin Up or Down - March 6, 2:05PM-2:10PM ET

PolymarketBitcoin price on March 6?

PolymarketLos Angeles L at Denver: Spread

KalshiOscars 2026: Best Picture Winner

PolymarketCounter-Strike: Spirit vs 3DMAX (BO3) - ESL Pro League Stage 2

PolymarketBNP Paribas Open: Ben Shelton vs Reilly Opelka

PolymarketBitcoin Up or Down - March 6, 9:30PM-9:35PM ET

PolymarketNortheastern at North Carolina A&T

KalshiButler at Georgetown

KalshiParis Saint-Germain FC vs. AS Monaco FC - More Markets

PolymarketUC Riverside at Hawai'i

KalshiLargest Company end of March?

PolymarketWill the US confirm that aliens exist before 2027?

PolymarketBellarmine at Central Arkansas

KalshiCounter-Strike: FUT Esports vs Astralis (BO3) - ESL Pro League Stage 2

PolymarketBitcoin price on Mar 6, 2026 at 5pm EST?

KalshiCounter-Strike: G2 vs FaZe (BO3) - ESL Pro League Stage 2

PolymarketBulls vs. Suns

PolymarketStearns vs Sierra

KalshiLos Angeles C at San Antonio

KalshiWill the Iranian regime fall by April 30?

PolymarketWill Reza Pahlavi enter Iran by...?

PolymarketMiami at Charlotte: Spread

KalshiNew Supreme Leader of Iran by...?

PolymarketNBA MVP

PolymarketValorant: Nongshim RedForce vs Gentle Mates (BO3) - VCT Masters Santiago Playoffs

PolymarketWill Jesus Christ return before 2027?

PolymarketPelicans vs. Kings

PolymarketFed decision in April?

PolymarketElon Musk # tweets March 3 - March 10, 2026?

PolymarketWolverhampton Wanderers FC vs. Liverpool FC - More Markets

PolymarketFC Bayern München vs. Borussia Mönchengladbach - More Markets

PolymarketEthereum price on March 6?

PolymarketWill Iran close the Strait of Hormuz in 2026?

KalshiNext Prime Minister of Hungary

PolymarketMiami (OH) at Ohio: Spread

KalshiNew Orleans at Phoenix

KalshiFlorida at Detroit

KalshiEtcheverry vs Shapovalov

KalshiMiami at Charlotte: Total Points

KalshiColorado at Dallas

KalshiUCF at West Virginia

KalshiPro Basketball Champion?

KalshiWho will be the next Supreme Leader of Iran?

KalshiVancouver at Chicago

KalshiSt. John's at Seton Hall

KalshiFairfield at Saint Peter's

KalshiSvrcina vs Sinner

KalshiLos Angeles C at San Antonio: Spread

KalshiSt. John's at Seton Hall: Spread

KalshiIndiana at Los Angeles L

KalshiUFC 326: Holloway vs Oliveira

KalshiRepublican nominee for Senate in Texas?

KalshiPuerto Rico Open Winner?

KalshiMiami vs. Charlotte

Polymarket USNew York at Denver: Spread

KalshiNicaragua vs Dominican Republic

KalshiCharleston Southern vs. Winthrop

Polymarket USThe Citadel vs. Chattanooga

Polymarket USDrake vs. Belmont

Polymarket USLongwood vs. UNC Asheville

Polymarket USSouthern Miss vs. Texas State

Polymarket USFlorida Gulf Coast vs. Lipscomb

Polymarket USVCU vs. Dayton

Polymarket USPenn vs. Brown

Polymarket USNew York vs. Denver

Polymarket USOmaha vs. South Dakota

Polymarket USPortland vs. Houston

Polymarket USMiami (OH) vs. Ohio

Polymarket USNortheastern vs. North Carolina A&T

Polymarket USValparaiso vs. Bradley

Polymarket USBowling Green vs. Eastern Michigan

Polymarket USFLA Panthers vs. DET Red Wings

Polymarket USStetson vs. Austin Peay

Polymarket USColumbia vs. Harvard

Polymarket USDallas vs. Boston

Polymarket USNew Orleans vs. Phoenix

Polymarket USVAN Canucks vs. CHI Blackhawks

Polymarket USMON Canadiens vs. ANA Ducks

Polymarket USCAR Hurricanes vs. EDM Oilers

Polymarket USUIC vs. Murray State

Polymarket USUT Martin vs. Tennessee State

Polymarket USFairfield vs. Saint Peter's

Polymarket USBuffalo vs. Toledo

Polymarket USBellarmine vs. Central Arkansas

Polymarket USCOL Avalanche vs. DAL Stars

Polymarket USD.C. United SC vs. Inter Miami CF 2026

Polymarket USArkansas vs. Missouri

Polymarket USMichael Johnson vs. Drew Dober

Polymarket USCody Durden vs. Nyamjargal Tumendemberel

Polymarket USAtlanta United FC vs. Real Salt Lake 2026

Polymarket USRicky Turcios vs. Alberto Montes

Polymarket USReinier de Ridder vs. Caio Borralho

Polymarket USAtlanta United FC vs. Real Salt Lake 2026

Polymarket USNorth Carolina vs. Duke

Polymarket USSaint Louis vs. George Mason

Polymarket USOrlando vs. Minnesota

Polymarket USUCLA vs. USC

Polymarket USCody Garbrandt vs. Xiao Long

Polymarket USFlorida Atlantic vs. Wichita State

Polymarket USLouisiana Tech vs. Delaware

Polymarket USHouston vs. Oklahoma State

Polymarket USStanford vs. North Carolina State

Polymarket USPhiladelphia Union vs. San Jose Earthquakes 2026

Polymarket USWisconsin vs. Purdue

Polymarket USNCAA Tournament Winner: Nebraska

Polymarket US2026 NBA Champion: Boston

Polymarket USSumudaerji vs. Jesus Aguilar

Polymarket USLos Angeles C vs. Memphis

Polymarket USNew York City FC vs. Orlando City SC 2026

Polymarket USNashville SC vs. Minnesota United FC 2026

Polymarket USSouth Carolina vs. Ole Miss

Polymarket USGolden State vs. Oklahoma City

Polymarket USRodolfo Bellato vs. Luke Fernandez

Polymarket USNHL Stanley Cup Champion: VEG Golden Knights

Polymarket USDavidson vs. St. Bonaventure

Polymarket USUS strikes Iran by...?

PolymarketKhamenei out as Supreme Leader of Iran by February 28?

PolymarketWho will Trump nominate as Fed Chair?

Polymarket2026 NBA Champion

PolymarketFed decision in March?

Polymarket2026 FIFA World Cup Winner

PolymarketEnglish Premier League Winner

PolymarketKhamenei out as Supreme Leader of Iran by March 31?

PolymarketElon Musk # tweets February 24 - March 3, 2026?

PolymarketLa Liga Winner

PolymarketDemocratic Presidential Nominee 2028

PolymarketWhat price will Bitcoin hit in February?

PolymarketUS next strikes Iran on...?

PolymarketElon Musk # tweets February 27 - March 6, 2026?

PolymarketPresidential Election Winner 2028

PolymarketRepublican Presidential Nominee 2028

PolymarketWill Iran close the Strait of Hormuz by...?

PolymarketWill the Iranian regime fall by March 31?

PolymarketNext Supreme Leader of Iran?

PolymarketWhat price will Bitcoin hit in March?

PolymarketUS x Iran ceasefire by...?

PolymarketWolverhampton Wanderers FC vs. Liverpool FC

PolymarketLos Angeles L at Denver

KalshiRC Celta de Vigo vs. Real Madrid CF

PolymarketDenver at Oklahoma City

KalshiGolden State at Houston

KalshiUS next strikes Iran on...?

PolymarketArsenal FC vs. Chelsea FC

PolymarketThe Masters - Winner

PolymarketOklahoma City at New York

KalshiWC Semifinals: England vs India

KalshiAtlanta at Milwaukee

KalshiBitcoin above ___ on March 3?

PolymarketPhiladelphia at Boston

KalshiBitcoin above ___ on March 4?

PolymarketCeltics vs. Bucks

PolymarketUS/Israel strikes Iran by...?

PolymarketLos Angeles C at Golden State

KalshiChicago at Phoenix

KalshiCleveland at Detroit

KalshiWhat price will Ethereum hit in February?

PolymarketClippers vs. Warriors

PolymarketWill the Iranian regime fall by June 30?

PolymarketWho will attend the State of the Union address?

PolymarketGonzaga at Saint Mary's

KalshiNew Orleans at Los Angeles L

KalshiBitcoin above ___ on March 6?

PolymarketSan Antonio at New York

KalshiCavaliers vs. Pistons

PolymarketIndia vs West Indies

KalshiBitcoin above ___ on March 1?

PolymarketNevada at UNLV

KalshiVenezuela leader end of 2026?

PolymarketDenver at Utah

KalshiNuggets vs. Thunder

PolymarketUEFA Champions League Winner

PolymarketLoL: JD Gaming vs Bilibili Gaming (BO5) - LPL Playoffs

PolymarketBitcoin above ___ on February 28?

PolymarketLos Angeles L at Golden State

KalshiIran strikes Israel on...?

PolymarketWill Crude Oil (CL) hit__ by end of March?

PolymarketWill Khamenei leave Iran by...?

PolymarketUSC at Washington

KalshiWarriors vs. Rockets

PolymarketLakers vs. Nuggets

PolymarketNew Orleans at Los Angeles C

KalshiHouston at Miami

KalshiDallas at Orlando

KalshiSan Diego at Loyola Marymount

KalshiBoston at Milwaukee

KalshiMinnesota at Denver

KalshiWho will Trump nominate as Fed Chair?

KalshiDetroit at Orlando

KalshiNew Orleans at Utah

KalshiDetroit at San Antonio

KalshiCharlotte at Boston

KalshiNew Orleans at Sacramento

KalshiNBA MVP

PolymarketWill Jesus Christ return before 2027?

PolymarketWill Reza Pahlavi enter Iran by...?

PolymarketArnold Palmer Invitational presented by Mastercard Winner?

KalshiWill the US confirm that aliens exist before 2027?

PolymarketWho will be the next Supreme Leader of Iran?

KalshiOscars 2026: Best Picture Winner

PolymarketF1 Drivers' Champion

PolymarketWill the Iranian regime fall before 2027?

PolymarketWhat day will the Paradex token launch be?

PolymarketRepublican nominee for Senate in Texas?

Kalshi2026 NHL Stanley Cup Champion

PolymarketGTA VI released before June 2026?

PolymarketRussia x Ukraine ceasefire by March 31, 2026?

PolymarketGPT-5.3 released by...?

PolymarketLargest Company end of March?

PolymarketWill Iran close the Strait of Hormuz in 2026?

KalshiFed decision in Mar 2026?

KalshiMiami at Charlotte

Kalshi2026 ICC Men's T20 World Cup Winner

KalshiTexas Senate Democratic primary margin of victory?

KalshiTexas Senate Democratic primary turnout?

KalshiPro Basketball Champion?

Kalshi2026 Texas Senate matchup?

KalshiMen's College Basketball Champion

KalshiNew York at Denver

KalshiPortland at Houston

KalshiOscar for Best Actor?

KalshiMiami (OH) at Ohio

KalshiPuerto Rico Open Winner?

KalshiWill the U.S. confirm that aliens exist before 2027?

KalshiWorld Baseball Classic Winner?

KalshiLos Angeles C at San Antonio

KalshiDenver vs. Utah

Polymarket USOscar for Best Picture?

KalshiUFC 326: Holloway vs Oliveira

KalshiOklahoma City vs. New York

Polymarket USLos Angeles C vs. Golden State

Polymarket USMiami at Charlotte: Spread

KalshiHow long will the next government shutdown last?

KalshiWhen will Bitcoin hit $150k?

KalshiBoston vs. Milwaukee

Polymarket USArnold Palmer Invitational presented by Mastercard Top 20 Finisher

KalshiUtah vs. Washington

Polymarket USHow high will Bitcoin get in March?

KalshiGolden State vs. Houston

Polymarket USSan Antonio vs. New York

Polymarket USDemocratic Presidential nominee in 2028?

KalshiChicago vs. Phoenix

Polymarket USAtlanta vs. Milwaukee

Polymarket USDetroit vs. Orlando

Polymarket USOscar for Best Supporting Actor?

KalshiWho will leave Trump's Cabinet next?

KalshiPurdue vs. Northwestern

Polymarket USNew Orleans vs. Sacramento

Polymarket USNew York vs. Toronto

Polymarket USNevada vs. UNLV

Polymarket USPortland vs. Memphis

Polymarket USToronto vs. Washington

Polymarket USDetroit vs. Cleveland

Polymarket USGonzaga vs. Saint Mary's

Polymarket USHouston vs. Washington

Polymarket USNew Orleans vs. Los Angeles L

Polymarket USMiami vs. Charlotte

Polymarket USRutgers vs. Maryland

Polymarket USBaylor vs. UCF

Polymarket USCharlotte vs. Boston

Polymarket USSan Diego vs. Loyola Marymount

Polymarket USUtah vs. Philadelphia

Polymarket USCleveland vs. Brooklyn

Polymarket USSouth Carolina State vs. North Carolina Central

Polymarket USDallas vs. Orlando

Polymarket USPhoenix vs. Sacramento

Polymarket USD.C. United SC vs. Inter Miami CF 2026

Polymarket USMichael Johnson vs. Drew Dober

Polymarket USArkansas vs. Missouri

Polymarket USCody Durden vs. Nyamjargal Tumendemberel

Polymarket USAtlanta United FC vs. Real Salt Lake 2026

Polymarket USRicky Turcios vs. Alberto Montes

Polymarket USAtlanta United FC vs. Real Salt Lake 2026

Polymarket USCody Garbrandt vs. Xiao Long

Polymarket USNorth Carolina vs. Duke

Polymarket USSaint Louis vs. George Mason

Polymarket USOrlando vs. Minnesota

Polymarket USUCLA vs. USC

Polymarket USFlorida Atlantic vs. Wichita State

Polymarket USLouisiana Tech vs. Delaware

Polymarket USHouston vs. Oklahoma State

Polymarket USStanford vs. North Carolina State

Polymarket USWAS Capitals vs. BOS Bruins

Polymarket USPhiladelphia Union vs. San Jose Earthquakes 2026

Polymarket USWisconsin vs. Purdue

Polymarket USUS strikes Iran by...?

PolymarketWho will Trump nominate as Fed Chair?

PolymarketFed decision in March?

PolymarketBig Game Champion 2026

PolymarketDemocratic Presidential Nominee 2028

Polymarket2026 FIFA World Cup Winner

Polymarket2026 NBA Champion

PolymarketKhamenei out as Supreme Leader of Iran by February 28?

PolymarketWhat price will Bitcoin hit in February?

PolymarketRepublican Presidential Nominee 2028

PolymarketPresidential Election Winner 2028

PolymarketPro Football Champion?

KalshiEnglish Premier League Winner

PolymarketLa Liga Winner

PolymarketUS next strikes Iran on...?

PolymarketSeattle vs. New England

PolymarketKhamenei out as Supreme Leader of Iran by March 31?

PolymarketVenezuela leader end of 2026?

PolymarketElon Musk # tweets February 24 - March 3, 2026?

PolymarketWhich coalition will form the next Dutch government?

PolymarketPortugal Presidential Election

PolymarketElon Musk # tweets February 27 - March 6, 2026?

PolymarketWhich crypto company will ZachXBT expose for insider trading?

PolymarketWill Jesus Christ return before 2027?

PolymarketWhat price will Ethereum hit in February?

PolymarketUEFA Champions League Winner

PolymarketElon Musk # tweets February 3 - February 10, 2026?

PolymarketWhich brands will advertise during the Big Game 2026?

KalshiDenver at Oklahoma City

KalshiBad Bunny’s halftime opener?

KalshiElon Musk # tweets February 10 - February 17, 2026?

PolymarketUS x Iran diplomatic meeting in person by...?

PolymarketNBA MVP

Polymarket2026 NHL Stanley Cup Champion

PolymarketSan Antonio at Golden State

KalshiThe Masters - Winner

PolymarketWho will perform at the Pro Football Championship?

KalshiWhich company has the best AI model end of February?

PolymarketWho will Trump nominate as Fed Chair?

KalshiCleveland at Detroit

KalshiElon Musk # tweets February 6 - February 13, 2026?

PolymarketOklahoma City at Los Angeles L

KalshiWill the Iranian regime fall by March 31?

PolymarketWinter Games 2026: Ice Hockey Gold Medal Winner

PolymarketUS/Israel strikes Iran by...?

PolymarketLos Angeles C at Los Angeles L

KalshiUS next strikes Iran on...?

PolymarketElon Musk # tweets February 13 - February 20, 2026?

PolymarketElon Musk # tweets January 30 - February 6, 2026?

PolymarketWill Iran close the Strait of Hormuz by...?

PolymarketIce Hockey USA vs Canada: Gold Medal (M)

KalshiSeattle at New England: Spread

KalshiHouston at Iowa St.

KalshiWhat will Trump say during the State of the Union?

KalshiNext Prime Minister of Hungary

PolymarketElon Musk # tweets February 17 - February 24, 2026?

PolymarketIndiana at New York

KalshiDenver at Los Angeles C

KalshiPhiladelphia at Los Angeles L

KalshiWinter Games 2026: Most Gold Medals

PolymarketWho will attend the Big Game?

KalshiOrlando at Los Angeles C

KalshiLargest Company End of February?

PolymarketLos Angeles L at Phoenix

KalshiThailand Legislative Election Winner

PolymarketAT&T Pebble Beach Pro-Am Winner?

KalshiElon Musk # tweets February 20 - February 27, 2026?

PolymarketBoston at Denver

KalshiMinnesota at Los Angeles C

KalshiWhat price will Solana hit in February?

PolymarketLos Angeles C at Sacramento

KalshiHouston at New York

KalshiTexas Tech at Arizona St.

KalshiWill the US confirm that aliens exist before 2027?

PolymarketAli Khamenei out as Supreme Leader?

KalshiLos Angeles L at Denver

KalshiHouston at Kansas

KalshiGolden State at Houston

KalshiFrench Ligue 1 Winner

PolymarketNext Supreme Leader of Iran?

PolymarketGTA VI released before June 2026?

PolymarketWill the Iranian regime fall by June 30?

PolymarketRussia x Ukraine ceasefire by March 31, 2026?

PolymarketNBA Western Conference Champion

PolymarketNBA Eastern Conference Champion

PolymarketOscars 2026: Best Picture Winner

PolymarketWhat price will Bitcoin hit in March?

PolymarketFed decision in Mar 2026?

KalshiWill the Iranian regime fall before 2027?

PolymarketArnold Palmer Invitational presented by Mastercard Winner?

KalshiWho will be the next Supreme Leader of Iran?

KalshiWill the U.S. confirm that aliens exist before 2027?

KalshiRepublican nominee for Senate in Texas?

KalshiWill Reza Pahlavi enter Iran by...?

PolymarketMen's College Basketball Champion

KalshiWhat day will the Paradex token launch be?

PolymarketPro Basketball Champion?

Kalshi2026 ICC Men's T20 World Cup Winner

KalshiWill Iran close the Strait of Hormuz in 2026?

KalshiDemocratic Presidential nominee in 2028?

KalshiMiami at Charlotte

KalshiHow long will the next government shutdown last?

KalshiTexas Senate Democratic primary margin of victory?

KalshiTexas Senate Democratic primary turnout?

KalshiMVP Winner?

Kalshi2026 Texas Senate matchup?

KalshiOscar for Best Picture?

KalshiWhen will Bitcoin hit $150k?

KalshiOscar for Best Actor?

KalshiWorld leaders out before 2027?

KalshiNext US Presidential Election Winner?

KalshiWho will win Survivor Season 50?

KalshiNew York at Denver

Kalshi2027 Pro Football Champion

KalshiWhat will EA say during their next earnings call?

KalshiWhich party will win the U.S. House in 2026?

KalshiPortland at Houston

KalshiWorld Baseball Classic Winner?

KalshiRepublican nominee for President in 2028?

KalshiMasters Tournament Winner?

KalshiDenver vs. Oklahoma City

Polymarket USDenver vs. Utah

Polymarket USOklahoma City vs. New York

Polymarket USLos Angeles C vs. Golden State

Polymarket USCleveland vs. Detroit

Polymarket USMinnesota vs. Los Angeles C

Polymarket USBoston vs. Milwaukee

Polymarket USUtah vs. Washington

Polymarket USGolden State vs. Houston

Polymarket USSan Antonio vs. New York

Polymarket USSan Antonio vs. Detroit

Polymarket USChicago vs. Phoenix

Polymarket USAtlanta vs. Milwaukee

Polymarket USOrlando vs. Los Angeles C

Polymarket USCleveland vs. Oklahoma City

Polymarket USDetroit vs. Orlando

Polymarket USMiami (OH) vs. Western Michigan

Polymarket USLos Angeles L vs. Phoenix

Polymarket USSacramento vs. Memphis

Polymarket USMinnesota vs. Portland

Polymarket USToronto vs. Washington

Polymarket USPurdue vs. Northwestern

Polymarket USNew York vs. Chicago

Polymarket USNew Orleans vs. Sacramento

Polymarket USNew York vs. Toronto

Polymarket USBoston vs. Los Angeles L

Polymarket USCleveland vs. Milwaukee

Polymarket USNevada vs. UNLV

Polymarket USPortland vs. Memphis

Polymarket USSan Antonio vs. Toronto

Polymarket USD.C. United SC vs. Inter Miami CF 2026

Polymarket USMichael Johnson vs. Drew Dober

Polymarket USArkansas vs. Missouri

Polymarket USCody Durden vs. Nyamjargal Tumendemberel

Polymarket USAtlanta United FC vs. Real Salt Lake 2026

Polymarket USRicky Turcios vs. Alberto Montes

Polymarket USAtlanta United FC vs. Real Salt Lake 2026

Polymarket USCody Garbrandt vs. Xiao Long

Polymarket USNorth Carolina vs. Duke

Polymarket USSaint Louis vs. George Mason

Polymarket USOrlando vs. Minnesota

Polymarket USUCLA vs. USC

Polymarket USFlorida Atlantic vs. Wichita State

Polymarket USLouisiana Tech vs. Delaware

Polymarket USHouston vs. Oklahoma State

Polymarket USStanford vs. North Carolina State

Polymarket USWAS Capitals vs. BOS Bruins

Polymarket USPhiladelphia Union vs. San Jose Earthquakes 2026

Polymarket USWisconsin vs. Purdue

Polymarket USNCAA Tournament Winner: Nebraska

Polymarket USCategory Breakdown

Compare volume and activity across platforms by category

Kalshi Categories

| Category | Markets | Volume | Change |

|---|---|---|---|

| Politics | 14,746 | $2.3M | -26% |

| Sports | 582,688 | $117.6M | -26.8% |

| Crypto | 2,399 | $16.4M | -37.8% |

| Economics | 2,778 | $2.5M | -3.7% |

| Financials | 585 | $275.5K | -20.8% |

| Tech & Science | 381 | $86.3K | -43.7% |

| Culture | 15,450 | $659.3K | -1.9% |

| Climate | 2,856 | $598.3K | -8.6% |

| Misc | 8,341 | $428.2K | +143.8% |

| World | 23,252 | $836.1K | -16.8% |

Polymarket Categories

| Category | Markets | Volume | Change |

|---|---|---|---|

| Politics | 5,058 | $50.4M | -9.1% |

| Sports | 17,187 | $160.3M | +6.3% |

| Crypto | 2,049 | $37.3M | -4.6% |

| Economics | 915 | $23.9M | +15.3% |

| Finance | 1,378 | $6.5M | +0.5% |

| Tech | 631 | $8.5M | -8.6% |

| Culture | 1,021 | $4.1M | +0.4% |

| Weather | 548 | $3.2M | -23.9% |

| Misc | 9,640 | $66.6M | +74.9% |

| Mentions | 58 | $152.0K | +69.3% |

Kalshi Categories

| Category | Markets | Volume | Change |

|---|---|---|---|

| Politics | 15,469 | $41.7M | -29.1% |

| Sports | 660,163 | $1.2B | -13.8% |

| Crypto | 15,686 | $179.5M | -1.7% |

| Economics | 1,834 | $7.0M | +0.1% |

| Financials | 1,461 | $2.1M | +27.2% |

| Tech & Science | 1,597 | $1.1M | -3.5% |

| Culture | 16,472 | $6.9M | +4.1% |

| Climate | 4,317 | $8.1M | -17.5% |

| Misc | 5,745 | $5.0M | +23.9% |

| World | 33,514 | $9.3M | +15.5% |

Polymarket Categories

| Category | Markets | Volume | Change |

|---|---|---|---|

| Politics | 4,897 | $553.8M | +12.6% |

| Sports | 16,737 | $888.2M | +12.3% |

| Crypto | 3,752 | $280.9M | +8.2% |

| Economics | 851 | $96.2M | +77.8% |

| Finance | 1,476 | $33.0M | -37.7% |

| Tech | 744 | $63.0M | -40.9% |

| Culture | 1,213 | $24.3M | +12.9% |

| Weather | 1,272 | $19.7M | +22.5% |

| Misc | 12,127 | $309.1M | +43.9% |

| Mentions | 75 | $673.9K | +21.9% |

Kalshi Categories

| Category | Markets | Volume | Change |

|---|---|---|---|

| Politics | 43,969 | $157.2M | +29.7% |

| Sports | 2,262,225 | $5.6B | +52.4% |

| Crypto | 57,713 | $693.4M | +175.7% |

| Economics | 4,313 | $44.2M | +90.9% |

| Financials | 5,379 | $9.0M | -1.1% |

| Tech & Science | 3,753 | $8.2M | +202.9% |

| Culture | 49,567 | $51.2M | +107.7% |

| Climate | 9,489 | $34.6M | +36.9% |

| Misc | 26,777 | $12.5M | -98.2% |

| World | 139,597 | $30.1M | +308.5% |

Polymarket Categories

| Category | Markets | Volume | Change |

|---|---|---|---|

| Politics | 7,000 | $1.8B | +18.6% |

| Sports | 47,291 | $3.1B | +9.4% |

| Crypto | 10,364 | $1.1B | +11.3% |

| Economics | 1,397 | $284.3M | -60.3% |

| Finance | 3,599 | $149.3M | +20.8% |

| Tech | 1,409 | $332.1M | +12% |

| Culture | 2,650 | $129.9M | +54.6% |

| Weather | 3,877 | $69.9M | +80.3% |

| Misc | 40,886 | $1.2B | +92.1% |

| Mentions | 133 | $3.1M | +9.5% |

Latest news making headlines

- March 3: Kalshi inked a deal with the AP that will allow the exchange to use official AP election data in its markets. Negative public reactions reflect the industry’s current public trust issues.

- March 2: Nasdaq’s proposed binary “yes-or-no” contracts through its subsidiary Nasdaq MRX could test SEC-CFTC coordination efforts. shift regulatory oversight toward the SEC in prediction markets.

- March 2: A new coalition led by former Trump Chief of Staff targets sports prediction markets, claiming they are illegal sports gambling dressed as financial products.

- March 2: DraftKings shared on Investor Day its prediction market roadmap, including plans to launch a ‘Super App’ later this year to take advantage of what they see as a $10B annual revenue opportunity.

- March 1: The death of Iran’s Supreme Leader resulted in market resolution controversies for Khamenei markets on both Polymarket and Kalshi, with the two exchanges taking vastly different approaches to settlement.

- Feb. 26: Flutter’s Q4 earnings call confirmed FanDuel Predicts investment will trend toward the upper end of its $200M–$300M guidance range. CEO Peter Jackson framed prediction markets as an accelerant for sportsbook legalization, not a cannibalization risk, while PENN, Caesars, and MGM stayed on the sidelines over gaming license concerns.

- Feb. 26: ZachXBT alleged that Axiom Exchange employees exploited internal dashboard access to track private user wallets and front-run influencer trades, and it happened outside any CFTC or SEC jurisdiction, with no statutory framework defining the conduct as illegal.

- Feb. 26: Trump’s SOTU skipped crypto entirely while calling for the Stop Insider Trading Act to pass “without delay.” Some industry insiders are now reading insider trading reform as a prerequisite to the CLARITY Act — a sequencing some see as realistic, others as a poison pill.

- Feb. 25: Kalshi publicly named two insider trading violators, including a former California gubernatorial candidate who traded his own election market, and a video editor tied to MrBeast markets, as part of a broader transparency push amid sector-wide scrutiny.

- Feb. 25: DimeTrades filed for CFTC Designated Contract Market status, backed by some members of Kalshi’s legal team, positioning itself as a new entrant to the regulated U.S. prediction market landscape.

- Feb. 25: Trump’s SOTU generated $11.97M in Kalshi mention market volume, with 79% of trading concentrated on speech night across 55 contracts.

- Feb. 23: Weekly volume held at $5.25B as Kalshi approached 50% market share, rising 6.7% WoW while Polymarket slid 3.2% and Opinion posted a third straight week of double-digit declines.

- Feb. 23: FiscalNote, a publicly traded policy intelligence platform, filed SEC paperwork outlining a prediction markets push — including advocacy-sponsored markets and fantasy leagues — with veteran strategist Dr. Laila Mintas named as strategic adviser.

- Feb. 23: Crypto.com received conditional OCC approval for a national trust bank charter, positioning it to offer federally regulated custody and staking — pending a checklist of outstanding requirements.

- Feb. 23: DeFi Rate investigated whether Opinion’s $8B January volume reflects real trading activity, finding trade sizes 13–25x the industry norm, sharp user count swings, and structural incentives pointing to inflated data.

- Feb. 20: Kalshi announced a partnership with Tradeweb targeting institutional macro hedging, embedding prediction market data into a fixed-income platform used by 3,000+ institutions, with direct trading integration still a future possibility.

- Feb. 19: The White House hosted a third round of CLARITY Act negotiations with Coinbase, Ripple, and banking representatives, with talks described as constructive but a compromise on stablecoin yields still unresolved.

- Feb. 19: NYSE President Lynn Martin said prediction markets now function as inputs to traditional markets, citing Polymarket’s early call on the 2024 election as the moment S&P futures moved in lockstep with crypto platform odds.

- Feb. 19: Infrastructure startup Fireplace secures $1.5M funding to build a Bloomberg-style data and trading terminal.

- Feb. 19: Polymarket launched public US APIs and permissionless liquidity rewards, opening its platform to third-party builders and allowing anyone to sponsor market depth — a structural shift toward institutional participation.

- Feb. 18: Novig raised $75M in a Pantera-led Series B at a $500M valuation, pivoting from a sweepstakes model to pursue CFTC-regulated exchange status as its path to nationwide sports prediction market operation.

- Feb 18: Bitwise filed with the SEC (Securities and Exchange Commission) under a dedicated brand called PredictionShares to launch a new suite of ETFs based around upcoming US elections.

- Feb. 17: Coinbase appears to be scrapping its social push on the Base App in favor of strengthening its “everything exchange” following a reported Q4 net loss of $667 million.

- Feb. 16: CFTC chair Michael Selig wrote a WSJ op-ed in which he defended federally regulated prediction markets as the agency prepares to weigh in with an amicus brief on a closely watched appeals court case between Crypto.com and Nevada regulators.

- Feb. 13: Super Bowl 60 produced $1.63 billion in combined trading volume between Kalshi and Polymarket, a figure that marks the biggest single day of trading on record for prediction markets.

What are prediction markets?

Prediction markets are a venue for trading contracts tied to the outcome of a future event. Sites such as Kalshi and Polymarket allow participants to buy and sell shares in contracts tied to various markets, including politics, economics, pop culture events, and weather forecasts.

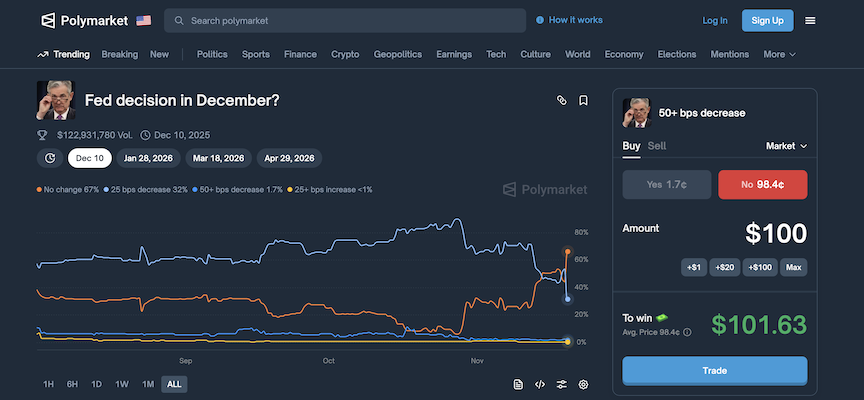

Contracts are the financial instruments used to facilitate trade in prediction markets. At most sites, traders can buy “Yes” or “No” shares on the outcome, with prices ranging from 1 cent to $1. The price serves as an indicator of the perceived likelihood of an event happening. As an example, consider the following market for an economic indicator:

- Fed Decision: 50+ bps decrease

- Yes: $0.017

- No: $0.984

Using the contracts’ pricing as a guide, traders view it as less likely that the funds rate will not decrease when this contract closes. If their speculation proves to be correct, they would earn $1 per contract. Meanwhile, those who hold “Yes” shares would see the value of their holdings go to zero.

As prediction markets remain open, the price of contracts will fluctuate as traders buy and sell shares in response to new developments. Naturally, there are no guarantees that the market pricing will translate into exactly what will happen.

However, it is a “wisdom of the crowds” indicator that points to an outcome’s overall probability and likelihood.

How prediction markets work

Prediction market apps function similarly to other financial markets. Traders buy and sell contracts on the outcome of a future event. For comparison, stock market traders buy and sell shares of companies, while popular markets on a commodities exchange include the price of oil or gold.

In all of the above, traders are speculating on a result in hopes of being correct and ultimately earning a profit. For prediction markets, there are three main components to know:

- Contracts: These are the financial instruments that are traded and tied to the outcome of future events.

- Participants: Those who are trading in the markets and providing liquidity as they buy and sell based on their predictions.

- Mechanisms: The platforms that make the markets available, calculate prices, and facilitate transactions.

Most prediction platforms feature binary options markets, which translates into participants choosing “Yes” or “No” on the available contracts that they are interested in speculating on. The apps make money by charging a fee that varies based on the price of the market. Using the Crypto.com app and a $100 trade as an example, the fee is capped at a maximum of $1.74.

As you view the available contracts on prediction market platforms, you’ll notice that the total value of “Yes” and “No” options does not equal exactly $1. For example:

- Winner of the March Madness tournament semifinal

- Duke: $0.72

- Houston: $0.29

The total of the two prices works out to $1.01. This is due to the spread, which is the difference in demand. There is high demand for a market such as this one with a tight spread. If the spread is more prominent, such as $0.05, there’s lower demand and likely less volume and liquidity in the market for that contract.

Kalshi and Polymarket provide diverse market options for traders to choose from, such as:

- What will the fed funds rate be in March?

- Who will be the Democratic nominee in 2028?

- Who will Trump nominate for Fed Chair?

- How high will Bitcoin go in 2026?

The pricing of contracts can be viewed as the market’s collective “best guess” on the likelihood of an event outcome.

Most popular markets

You can trade on a wide range of real-world events on prediction market platforms. Contracts are available on outcomes in a variety of markets, including:

- Sports: Game results, championships, build combo trades

- Politics: Elections, candidate nominations, legislative outcomes

- Economics: Central bank rates, inflation, indicators

- Crypto: Cryptocurrency prices, market events

- Culture: Award shows, celebrity news, viral trends

- Climate: Temperature records, storm predictions

- Companies & Financials: Corporate achievements, stock market trends, index prices

- Tech & Science: Tech adoption milestones, scientific breakthroughs

- Health & World: Health and wellness issues, global news, and developments

- Mentions: Predictions on words and phrases used by public figures

In terms of overall coverage, Kalshi and Polymarket provide the broadest range of options. Crypto.com is currently limited to sports, PredictIt focuses on politics, while other niche platforms have yet to capture a good deal of mainstream attention. Some platforms allow users to propose new markets, while others curate their offerings centrally.

In terms of overall usage, Polymarket leads in global web traffic, while Kalshi is tops among US-regulated options. Beyond the trading aspect, prediction markets are often cited for their forecast accuracy. The platforms essentially aggregate the opinions of traders, offering a “wisdom of the crowds’ look at the probability of an event or outcome happening.

How does pricing work on contracts?

Prediction market contracts are binary options that pay out a fixed amount. It’s typically set at $1 if the event occurs, and $0 if it does not. Before the contract settles, prices will fluctuate between those ranges as traders enter and exit positions.

When viewing a contract offering on a prediction market platform, the pricing reflects the market’s collective estimate of the probability that the event will happen. Consider the following example:

- Contract: “Will the Fed raise interest rates in May?”

- Pricing: $0.70 for “Yes” and $0.32 for “No.”

- Implication: The market implies a 70% chance of a rate hike and a 32% chance it won’t happen.

As you’ll notice, the pricing doesn’t exactly equal $1, while the implied probability is greater than 100%. Small differences such as these are common and often reflect the spread between bid and ask pricing or trading fees. Markets with higher liquidity tend to have more stable prices and tighter spreads, while wider price swings can happen in less active contracts.

While contracts remain open, prices will continue to move as traders react to new information and shifting sentiment, providing a real-time snapshot of the overall market sentiment. At settlement, the resolution for a correct contract call is $1, while the other side will drop to $0.

Kalshi vs. Polymarket fee comparison

The trading fees and costs on prediction markets can impact your overall returns. The table below has a breakdown of the main fees you’ll encounter on Kalshi and Polymarket.

| Fee Type | Kalshi | Polymarket |

| Trading Fee | $0.07–$1.74 per 100 contracts (varies by contract price; see example) | No trading fee |

| Profit/Settlement | None | None |

| Deposit Fee | ACH free; Debit card 2% | None (USDC only) |

| Withdrawal Fee | ACH free; Debit card $2 | 1.5% on USDC withdrawals |

Kalshi’s trading fee is variable and depends on the contract price. For 100 contracts, it can be as low as $0.07 and up to $1.74. There are no settlement fees to worry about. Meanwhile, Polymarket does not charge any trading or settlement fees.

To illustrate the difference, assume that you’re buying 100 contracts at $0.55 on either platform. At Kalshi, this price point triggers the maximum fee for 100 contracts of $1.74, while Polymarket charges $0. You’d be in for a total of $56.74 at the former, and $55 at the latter.

If you make the right call, the contract settles at $1 in both spots. At Kalshi, you’ll get back $100, less your fee of $1.74, for a total of $98.26. Polymarket will return an even $100 since there are no fees attached.

Beyond trading and settlement, be sure to consider the deposit and withdrawal fees that are outlined above. Traders should also be aware of potential “hidden costs” like bid-ask spreads, and the potential challenges of exiting positions in less liquid markets.

Profit potential for betting on predictions

Prediction markets offer opportunities for traders to profit by buying and selling contracts. In its simplest form, the goal is to make the correct calls so your contracts settle at full value. Traders can also aim to “buy low and sell high.”

Strategies for doing just that include looking for mispriced outcomes and acting before the rest of the market catches on. While the potential for returns is real, profits aren’t guaranteed. Market efficiency, liquidity, and timing all play a big role in shaping your results.

How much can you make by buying a low-priced contract?

Buying low-priced contracts can be enticing due to the potential for big returns. Naturally, there’s plenty of risk here. The contract is priced low for a reason, namely that the chances of that outcome happening aren’t great.

Let’s consider the following fictitious example for an NBA Playoff game in which there’s a clear favorite to win, at least as far as the market is concerned.

- Underdog contract price: $0.10 (10% chance)

- Quantity: You buy 100 contracts for a total of $10.

- Kalshi trading fee: $0.63 (for 100 contracts at this price point)

- Total upfront cost: $10 + $0.63 = $10.63

- Outcome: Underdog wins; contracts settle at $1 each

- Payout: 100 × $1 = $100

- Net profit: $100 – $10.63 = $89.37

In this case, a small investment yields a large return if the prediction is correct. Seeking out low-priced contracts with realistic profit potential can be part of a well-rounded trading approach, but remember to account for the increased risks of trading less-likely outcomes.

What happens if you sell your contract before the event?

Prediction markets aren’t just about holding contracts to settlement. You can also sell your position before the event concludes if the odds move in your favor. This is especially common in political markets, where news cycles and polling shifts can cause prices to swing rapidly.

Consider the following as an example: “Will Candidate X win the election?”

- Polymarket contract price: $0.45 (45% chance)..

- Quantity: You buy 50 contracts for a total of $22.50.

- New developments and polling substantially boosts Candidate X’s chances.

- The contract price rises to $0.70.

- You decide to sell all 50 contracts at $0.70 each for a total of $35

- Polymarket trading fee: $0 (no trading fee; only a withdrawal fee applies if you cash out)

- Net profit: $35 – $22.50 = $12.50

- If you withdraw your USDC, a 1.5% withdrawal fee applies: $35 × 0.015 = $0.53

By selling before the event, you lock in your gains and avoid the uncertainty of the final outcome. This approach can be especially useful when you think the market has overreacted or you want to cash out and take your profit after a favorable news development.

Can you profit by betting ‘No’ on an event?

Prediction markets also allow you to profit by betting against an outcome happening. This is where you would buy the “No” side of the equation when you anticipate that the contract will ultimately resolve to that end result.

Consider the following example: “Will U.S. inflation exceed 4% this quarter?”

- Kalshi “No” contract price: $0.60 (60% chance).

- Quantity: You buy 75 contracts for a total of $45.

- Kalshi trading fee: $1.50 (at $0.02 per contract for this price point)

- Total upfront cost: $45 + $1.50 = $46.50

- If inflation comes in below 4%, each contract settles at $1

- Payout: 75 × $1 = $75

- Net profit: $75 – $46.50 = $28.50

Taking the “No” side can be a valuable strategy when you believe the market is overestimating the likelihood of an event. Regardless of which outcome you choose, stick to your comfort level for both contract pricing and the total amount of your trades.

Are prediction markets the same as gambling?

Prediction markets are not, by definition, the same as gambling. The former is considered a tool for forecasting outcomes based on probabilities. Casino, sports, and lottery are generally viewed as games of chance. That said, there are similarities between the two, most notably that the goal is to turn a profit.

From the perspective of a prediction platform, the contracts are on equal footing to a commodities exchange. Using the Chicago Mercantile Exchange as an example, futures and options are traded on stock indexes, precious metals, energy commodities, and more. Traders take positions on the various instruments based on their expectations of what will happen.

In a prediction market, traders are doing the same thing, albeit in a broader variety of options, such as political, cultural, and economic events. The gambling label has been attached to these platforms as they have risen in popularity, even more so since the introduction of contracts on various sporting events, such as the winner of March Madness or the next Super Bowl winner.

Are prediction markets legal?

Prediction market platforms like Kalshi, PredictIt, and ForecastEx are currently available across the US. However, questions on their overall legality continue to linger. A case between Kalshi and the Commodity Futures Trading Commission remains unresolved. Kalshi won the latest round, but litigation is ongoing.

The platform offered contracts for the 2024 US elections, and has since expanded into sports futures. Meanwhile, states like Illinois, Nevada, New Jersey, and Ohio have presented the company with cease-and-desist letters, essentially arguing that they’re offering unregulated sports betting.

If interest in prediction markets is a guide, then the future looks incredibly bright. Kalshi and Polymarket have attracted extensive volume for tentpole events that it has offered contracts for, including the 2024 US elections, the Super Bowl, and March Madness.

Understanding the math of prediction market contracts

Prediction market contract pricing is generally straightforward. You can view an available market and quickly determine the implied probability of an event happening, at least as far as the overall market sentiment is concerned.

That said, the actual trading of contracts takes a little more doing on the calculation front. You can use the below formulas and examples as a cheat sheet to help gain even more of a comfort level with prediction market trading.

How to calculate the number of contracts you can buy

Formula: Number of Contracts = (Available Capital) ÷ (Contract Price + Fees)

Example:

- You want to trade $50.

- Each contract you’re interested in costs $0.25.

- Kalshi fee: $0.02 per contract at this price point.

- Calculation: $50 ÷ ($0.25 + $0.02) ≈ 192 contracts

Estimating potential profit and loss

Formula: Profit = (Sell Price – Buy Price) × Number of Contracts – Fees

Example:

- You buy 100 contracts at $0.30 and sell at $0.60.

- Profit = ($0.60 – $0.30) × 100 = $30

- Kalshi fee: $1.68 (for 100 contracts at $0.60)

- Net profit = $30 – $1.68 = $28.32

Finding your break-even price

Formula: Break-even Price = (Buy Price + Total Fees) ÷ Number of Contracts

Example:

- You buy 50 contracts at $0.40, for a total of $20.

- Total fees if you sold at the same price: $1 ($0.02 per contract).

- Break-even = ($20 + $1) ÷ 50 = $0.42 per contract

- You need to sell above $0.42 to make a profit.

By taking the time to understand these quick calculations, you could spot appealing opportunities that much quicker. As an added benefit, you’ll be better equipped to manage risk and make more informed trades.

Risks to consider when trading in prediction markets

Trading in prediction markets can be entertaining and potentially profitable, but it’s not devoid of risk. Understanding the potential pitfalls can help you mitigate unnecessary mistakes and ultimately make more informed decisions. Key risks to consider include:

- Unexpected outcomes: There’s always the potential for a complete loss of your stake, even when the odds seem overwhelmingly in your favor.

- Low liquidity: Certain markets attract a limited amount of volume, which can make it difficult to buy or sell contracts at fair prices.

- Platform issues: While top platforms tend to operate without lengthy interruptions, there are simply no guarantees when it comes to security or technical glitches.

- Regulatory environment: Prediction markets are soaring in popularity and readily accessible, but are also subject to developments from ongoing legal challenges.

- Distorted prices: Biases, groupthink, manipulation, and misinformation could all impact contract pricing in both high- and low-volume markets.

If you trade in prediction markets, there is risk. However, you can take steps to help manage it better. At the top of the list, you should only trade with money that you can afford to lose. Nothing is guaranteed with trading, no matter what the odds may suggest.

Next, stay informed about what’s happening. Knowing what’s going on with the regulatory front can help you make better decisions on where to park your funds. Lastly, stick to what you know and don’t blindly chase volume. After all, the herd isn’t always correct.