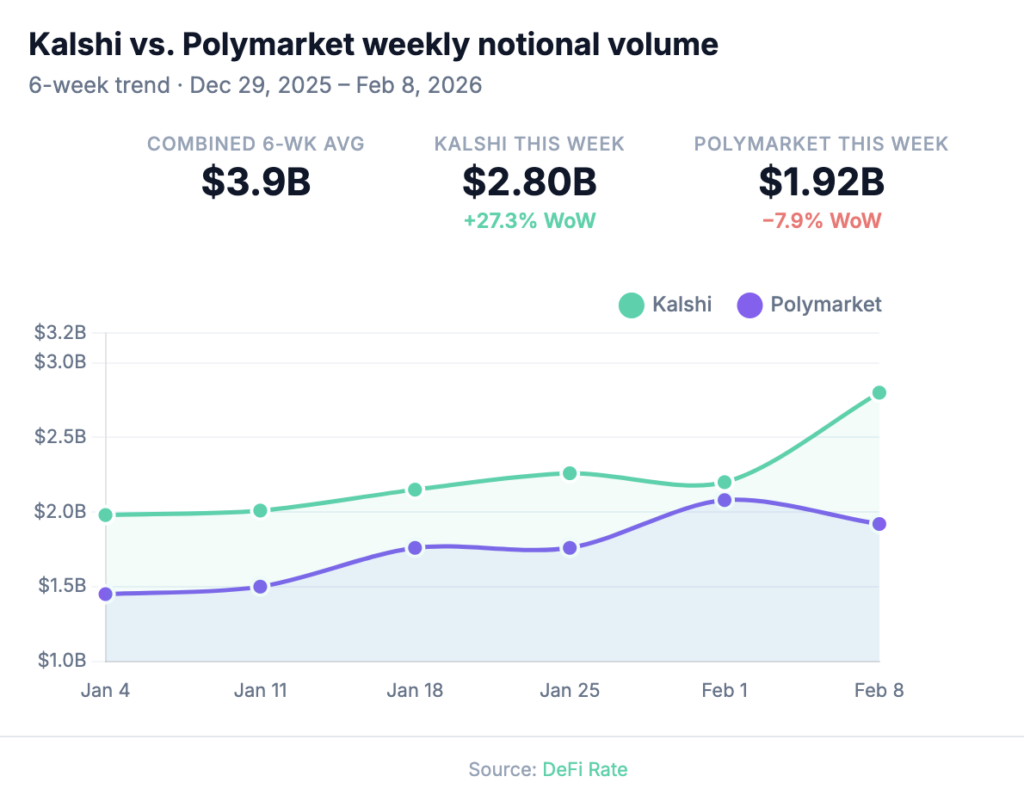

Total notional volume across tracked prediction exchanges came in at $6.26 billion for the week ending Feb. 8, down just 0.9% from the prior week’s $6.32 billion all-time high. That makes four consecutive weeks above $6 billion and six straight weeks of all-time or near-all-time activity.

The big volume story of the week is Kalshi surging 27.3% to $2.80 billion, its largest single week on record, driven by trading activity on Super Bowl 60 between the Seahawks and Patriots. Polymarket pulled back 7.9% to $1.92 billion, and Opinion fell 28.7% to $1.24 billion, its lowest weekly total since early January.

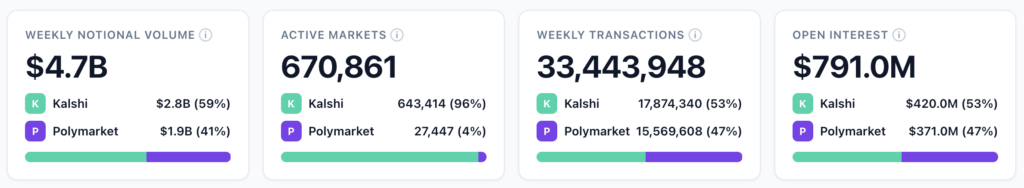

DeFi Rate’s prediction market tracker, which aggregates Kalshi and Polymarket data in real time, shows the two platforms combining for $4.7 billion in weekly notional volume across 33.4 million transactions, with Kalshi edging Polymarket 53% to 47%.

The broader all-platform picture, tracked by Dune, shows open interest across all tracked exchanges approaching the $1 billion mark at $948 million as of Feb. 6, with Kalshi ($468M), Polymarket ($346M), and Opinion ($112M) accounting for the vast majority.

Kalshi’s Super Bowl surge reverses the convergence trend

Last week’s headline was Kalshi and Polymarket reaching near-parity. This week, Kalshi flipped the script.

After Kalshi’s share of the two-platform combined volume fell from 57.7% (week of Jan. 4) to a low of 51.4% (week of Feb. 1), Super Bowl week snapped the trend. Kalshi’s $2.80 billion against Polymarket’s $1.92 billion gives it a 59.4% share, its highest yet.

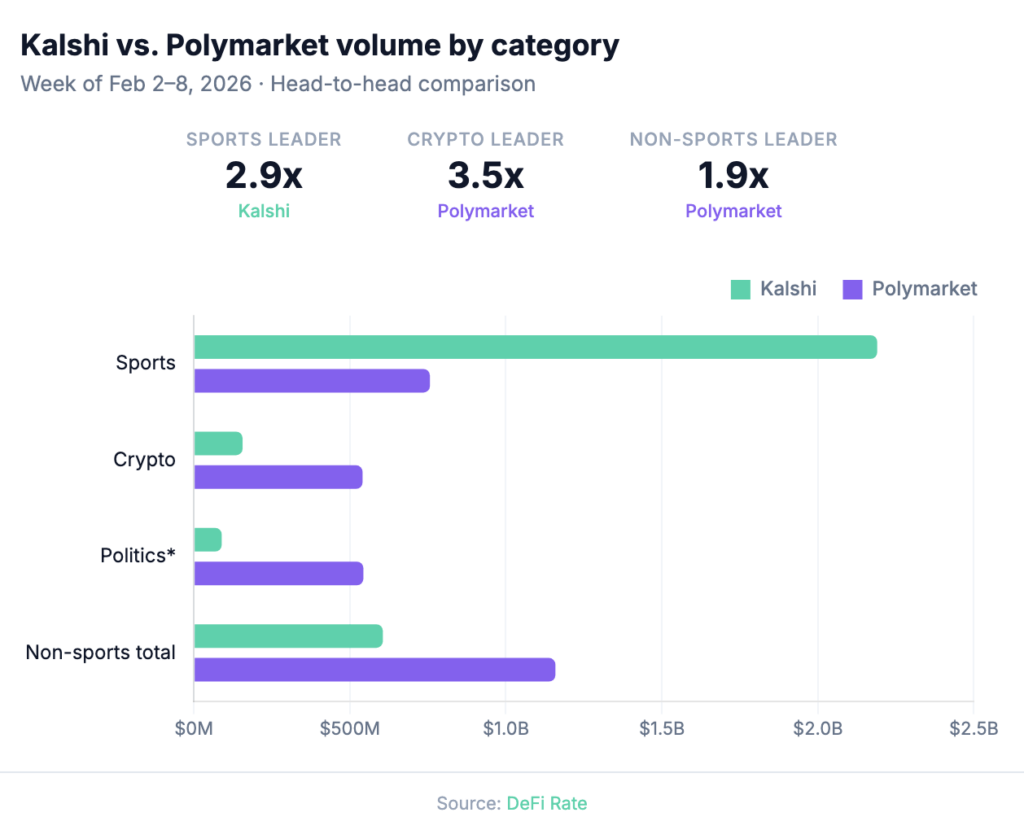

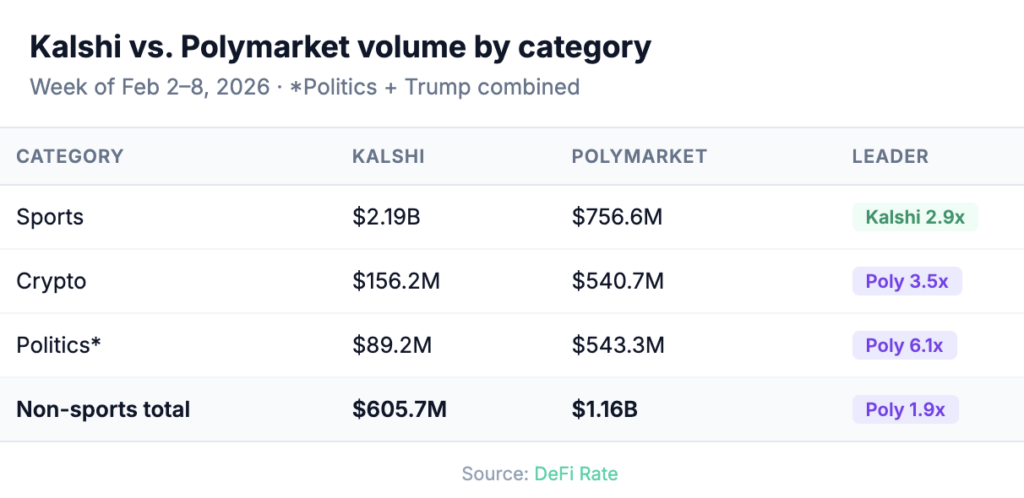

The divergence is driven almost entirely by sports. Kalshi processed $2.19 billion in sports volume alone this week (78.3% of total exchange volume), while Polymarket’s sports figure was $757 million. Strip sports out, and the picture looks different: Polymarket led non-sports volume at $1.16 billion to Kalshi’s $606 million. That non-sports gap continues to widen.

Prediction platform rankings (week of Feb. 2-8)

| Platform | Volume | Share | WoW |

|---|---|---|---|

| Kalshi | $2.80B | 44.7% | +27.3% |

| Polymarket | $1.92B | 30.6% | −7.9% |

| Opinion | $1.24B | 19.8% | −28.7% |

| predict.fun | $215.7M | 3.4% | +24.0% |

| Limitless | $68.9M | 1.1% | −33.9% |

| Myriad | $11.4M | 0.2% | +40.7% |

| ForecastEx | $5.8M | 0.1% | −47.3% |

| Overtime | $4.7M | 0.1% | −17.5% |

| Total | $6.26B | −0.9% |

predict.fun was the standout among smaller platforms, climbing 24% to $215.7 million and widening its lead as the clear fourth-place exchange. Limitless gave back a chunk of its recent gains, falling 33.9% after an 82% surge the week prior. Opinion’s 28.7% WoW drop to $1.24 billion is its lowest weekly volume since early January and pushes it firmly into third, well behind the Kalshi-Polymarket pair.

Super Bowl 60 volume hits $1.3 billion on the game alone

Kalshi’s Super Bowl markets processed more than $900 million in trading volume according to our data tracking, including $500,171,547 just on the game itself. Compared to last year’s $27.0 million on the same market (game winner), it’s a ~18.5x year-over-year jump for Kalshi.

Polymarket’s Super Bowl game markets reached $749.12 million ($704.1 million on Super Bowl champion futures market; $55.26 million on a single-game market), per our tracking. Combined, prediction market Super Bowl volume on the game alone exceeded $1.3 billion.

Apart from the game lines, the main categories driving nearly $400 million in Super Bowl volume on Kalshi were Bad Bunny’s first-song market at $113.5 million, Super Bowl MVP ($52.2 million), and a slew of popular novelty props including what brands will advertise in a commercial ($72.2 million). Polymarket’s volume was concentrated in its long-dated championship futures pool, with relatively modest game-day activity. Our pre-kickoff snapshot showed a 95/5 Kalshi-to-Polymarket split on 24-hour Super Bowl trading volume heading into the game.

The total Super Bowl volume, while impressive, would have been much higher had the Patriots actually kept the game close. In-game trading ramps up in close and back-and-forth games, which was not the case in this defensive battle dominated by the Seahawks. Kalshi also likely left money on the table in terms of trading volume due to deposit delays at a most inopportune time.

Weekly transactions surge to 34.6 million

Weekly transactions across all tracked platforms during Super Bowl week jumped 21.8% to 34.6 million, a new all-time high. Kalshi led transactions this week at 17.9 million (51.7%), flipping the prior week’s order, while Polymarket contributed 15.6 million (45.0%). The surge aligns with Super Bowl engagement: more traders, more frequent activity, and likely a wave of casual participants entering through the biggest sports event of the year.

Opinion’s 608,906 transactions against $1.24 billion in volume continues to underscore its unusually large average trade size of roughly $2,038 per transaction, compared to $157 at Kalshi and $123 at Polymarket.

Polymarket reported 300,047 weekly active users, down from 323,525 in the previous week but still far ahead of the field. Opinion trailed at 67,804, with Limitless (11,188), predict.fun (7,564), Myriad (1,475), and Overtime (561) rounding out the group. Kalshi does not publicly report weekly user counts in this dataset.

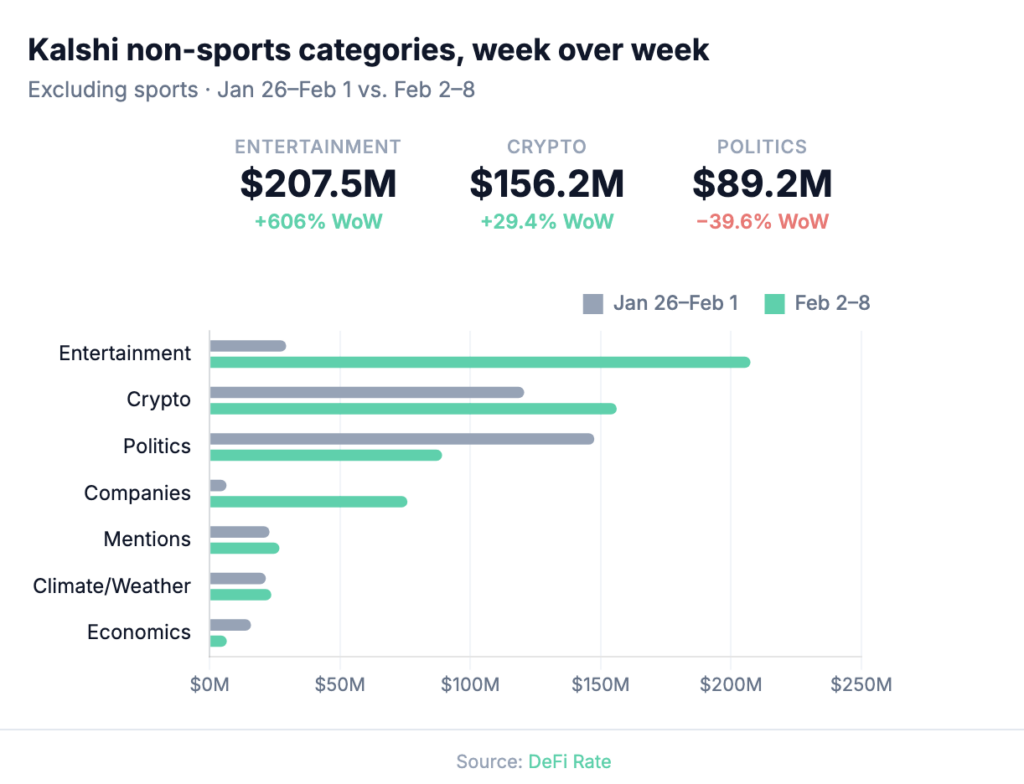

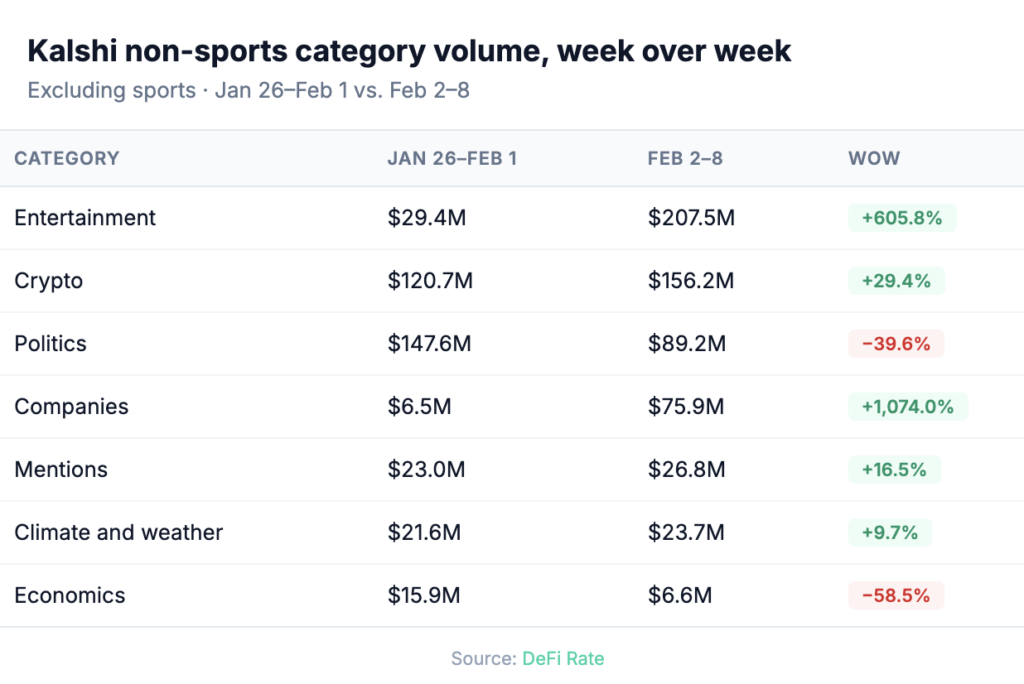

Kalshi category breakdown

Kalshi’s category-level data shows $2.80 billion in total weekly volume, with sports and entertainment combining for 85.7% of all activity.

The entertainment explosion is the Super Bowl story. Kalshi’s entertainment category, which includes halftime show props, broadcast markets, and celebrity-adjacent outcomes, surged from $29.4 million to $207.5 million in a single week as Super Bowl LX dominated the cultural conversation. Sports volume also climbed 20.3% to $2.19 billion, recovering from the prior week’s bye-week dip and pushing Kalshi to its record weekly total.

On the flip side, politics gave back most of the prior week’s 214% surge, falling 39.6% to $89.2 million. The government shutdown that began Jan. 31 had driven a spike in political contract activity, but as the week progressed, that urgency faded. Economics took the biggest hit at −58.5%, falling to $6.6 million as the FOMC positioning that drove the prior week’s surge cooled ahead of the March meeting.

Polymarket category breakdown

| Category | Volume | Share |

|---|---|---|

| Sports | $756.6M | 39.5% |

| Crypto | $540.7M | 28.2% |

| Politics | $382.6M | 20.0% |

| Trump | $160.7M | 8.4% |

| Economy | $27.5M | 1.4% |

| Tech | $16.9M | 0.9% |

| Culture | $16.2M | 0.8% |

| Weather | $10.4M | 0.5% |

| Other | $3.7M | 0.2% |

Polymarket’s distribution tells a different story than Kalshi’s. No single category accounts for more than 40% of total volume. Crypto price markets are a genuine strength with $540.7 million in weekly volume, nearly 3.5x Kalshi’s crypto volume, driven by Bitcoin price markets, ETF flow contracts, and altcoin speculation. Political markets at $382.6 million similarly dwarf Kalshi’s $89.2 million, with Polymarket’s global user base providing deep liquidity on U.S. policy and geopolitical events.

The Trump category at $160.7 million is also worth flagging. Polymarket separates Trump-specific contracts from its broader politics category, and the volume there is largely driven by executive action markets, tariff speculation, and appointment-related contracts rather than traditional partisan election betting.

Head-to-head category comparison: Kalshi vs. Polymarket

Kalshi’s sports dominance is well-established, but Polymarket’s non-sports lead continues to widen.

*Politics + Trump combined

Polymarket processed nearly twice the non-sports volume this week at $1.16 billion versus Kalshi’s $606 million. In crypto alone, Polymarket handles 3.5x what Kalshi does. In politics (including Trump-related contracts), Polymarket ran 6.1x Kalshi’s volume.

What to watch this week

Watch for the expected post-Super Bowl correction. Kalshi’s $2.80 billion week was built on $2.19 billion in sports and $207.5 million in entertainment, categories that will both deflate sharply without the NFL. The next few weeks will test whether NBA, college basketball, and non-football sports can sustain anything close to the volume Kalshi has been posting since September.

Crypto.com’s OG app, which launched Feb. 3 on CFTC-regulated infrastructure, adds another competitor to the mix. Early volume data isn’t in the Dune dashboards yet, but the $500 sign-up promotion could pull activity from existing platforms in the near term.

Prediction markets are entering a transitional window. The NFL engine is off, election season hasn’t ramped yet, and the next major macro catalyst (March 18 FOMC) is still over five weeks out. How platforms perform in this quieter stretch will say a lot about whether the growth trajectory is structural or event-dependent, but most likely it’s a combination of both.

Volume data sourced from DeFi Rate’s prediction market tracker and Dune Analytics prediction market dashboards. DeFi Rate tracks Kalshi and Polymarket in real time across volume, transactions, open interest, and category breakdowns. Broader platform data including Opinion, predict.fun, Limitless, Myriad, ForecastEx, and Overtime is compiled from Dune.