Fantasy sports platform Sleeper has begun rolling out prediction market trading, with Super Bowl LX event contracts already available inside the Sleeper app just days ahead of kickoff.

Sleeper Markets has partnered with Kalshi to offer sports event contracts, the companies announced today, with additional event markets planned for later expansion.

The rollout follows Sleeper Markets LLC receiving approval from the National Futures Association (NFA) to operate as a Futures Commission Merchant (FCM), a designation that allows the company to partner with an existing exchange to offer event contract trading. That approval led Sleeper to drop its lawsuit in which it accused the Commodity Futures Trading Commission (CFTC) of improperly delaying the registration process.

The sports event contracts are available to Sleeper’s 10 million users nationwide, according to a news release. Eric Kim, Sleeper’s head of operations, said the partnership with Kalshi is a great fit for the platform’s sports-focused users.

“This is an exciting next step for Sleeper, and a natural extension of our mission to build the most engaging experience for our users,” Kim said in the release. “Partnering with Kalshi gives us the opportunity to bring prediction markets directly into the place where millions of fans already come together around sports.”

Kalshi 🤝 @SleeperHQ

— Kalshi (@Kalshi) February 6, 2026

We’ve partnered with Sleeper to bring Kalshi markets to 10 million more people. pic.twitter.com/GcJOTASPsz

Super Bowl, other sports markets already live inside the Sleeper app

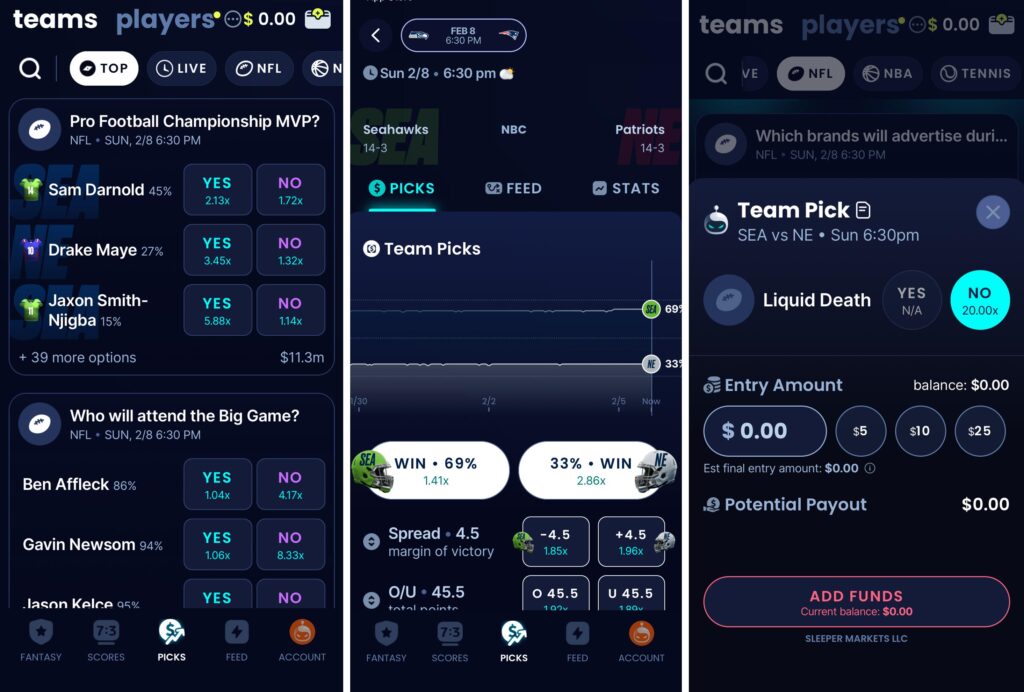

Numerous Super Bowl-related prediction markets, as well as markets for NBA, tennis, international soccer, and other sporting events, were already accessible through Sleeper’s “Team Picks” interface on Friday morning.

Super Bowl markets visible in the Sleeper app include traditional game outcomes, point spread-style contracts, and total score over/unders, plus MVP contracts and novelty markets tied to off-field events surrounding Sunday’s championship game.

Non-athletic Super Bowl markets featured in the app include those related to which brand will advertise during the broadcast, which celebrities will be in attendance, and what songs Bad Bunny will perform during halftime.

Sleeper’s Player Picks product appears to remain a traditional DFS pick’em offering based on player performance projections, with fixed multiplier payouts rather than tradable event contracts.

Sleeper’s in-app availability map lists its broader “Picks” product as available in roughly 30 states plus Washington, D.C., but the news release suggests that its sports prediction markets are available in all 50 states.

From Ohio, I was able to easily trade in one of the Team Picks Super Bowl markets. On fellow DFS operator PrizePicks, which also features markets from Kalshi, I could trade in off-field Super Bowl markets from Ohio, but not the actual game markets found in the app’s Team Picks section.

Sleeper contract fees and risk disclosures outlined

Sleeper’s help-center disclosures confirm the platform is operating prediction markets as an intermediary. The company says it “routes customer orders to KalshiEX LLC.”

Fee disclosures indicate a relatively simple pricing model. Sleeper states it charges “a $0.01 per contract fee,” while “Kalshi charges a separate $0.01 exchange fee,” bringing the typical transaction cost to roughly $0.02 per executed contract.

On onboarding, Sleeper’s documentation says event contract trading requires identity verification. Users must complete KYC checks, including providing a Social Security number and uploading images of a government-issued photo ID, and fund accounts in U.S. dollars. Those requirements align with standard onboarding procedures for regulated futures trading platforms.

The help-center pages also, in a section called “Event Contract Risks,” reference the ongoing legal battles between states and prediction platforms over the ability to offer sports event contracts. If Kalshi’s sports events contracts become legally restricted in a state, it “could result in the liquidation of the covered event contracts open at the time of the ruling and (would prohibit) any new contracts from being entered,” the disclosure states.

From regulatory standoff to market launch

Sleeper’s entry into prediction markets follows months of regulatory tension as the company worked to secure approval to operate as an intermediary for federally regulated event contracts. The firm applied for FCM registration with the NFA in May 2025, a designation required to accept customer orders and route trades to a Designated Contract Market like Kalshi.

After months without approval, Sleeper sued the CFTC in September, alleging the agency had improperly delayed or obstructed its application. The complaint argued the delay was harming the company’s ability to launch regulated event-contract trading and sought to compel the agency to move forward with the registration review.

The standoff ended in January when the NFA approved Sleeper’s FCM registration. The company subsequently withdrew its lawsuit, clearing the way for the Kalshi partnership and allowing prediction market trading to begin appearing inside the Sleeper app ahead of the Super Bowl.

Sleeper the latest DFS platform to launch prediction markets

Sleeper’s prediction market launch puts it alongside Underdog and PrizePicks, two other major fantasy sports platforms that have rolled out sports-related prediction market products in the run-up to the Super Bowl.

Together, the moves may signal a broader shift among DFS operators toward federally regulated event contracts as a complementary product category, particularly in states where traditional sportsbook expansion has slowed or regulatory frameworks remain unsettled. The overlap between fantasy sports audiences and prediction market traders makes sports a natural entry point for platforms seeking liquidity and user adoption.

The clustering of launches ahead of the Super Bowl suggests prediction markets are increasingly being positioned as a mainstream sports engagement tool rather than a niche financial product. Whether that trend continues will depend largely on how ongoing legal disputes over sports event contracts play out, but the growing involvement of established DFS operators indicates the sector may see regulated prediction markets as a durable new revenue channel rather than a short-term experiment.