Kaito AI and Polymarket are officially rolling out what they call “attention markets,” a new category of prediction markets that lets users wager on internet trends rather than traditional real-world events. In a post on X, Kaito said the product will be integrated directly into its main platform, with a standalone site also in the works.

The rollout will begin with crypto-related markets, before “expanding into AI, finance, entertainment, sports, geopolitics, and other culturally relevant areas.”

We're taking the next step into Attention Markets, built in partnership with @Polymarket – the next stage in predicting internet trends!

— Kaito AI 🌊 (@KaitoAI) February 10, 2026

Prediction Markets are becoming a core part of not only crypto, but everyday life more widely.

Measurable attention opens up a new way for… pic.twitter.com/cI8E6b2RFV

Attention market traders will take positions on shifts in “mindshare” – how much something is being discussed – and “sentiment,” meaning whether the tone of that discussion is positive or negative. Kaito aggregates this data from platforms such as X, TikTok, Instagram and YouTube and soon, Polymarket traders will be able to access markets based on that data.

From pricing outcomes to pricing narratives

Prediction markets have typically focused on measurable outcomes: election results, court rulings, ETF approvals, macroeconomic releases and so on. Attention markets move the focus from outcomes to narratives, and that shift is quite significant. The product becomes less about what happens, and more about what people are talking about.

In crypto markets, where sentiment and momentum can drive price action, measurable attention could act as an early signal.

Many traders already monitor social buzz, so if attention can be quantified, packaging it into tradable markets could offer valuable real-time insights on momentum.

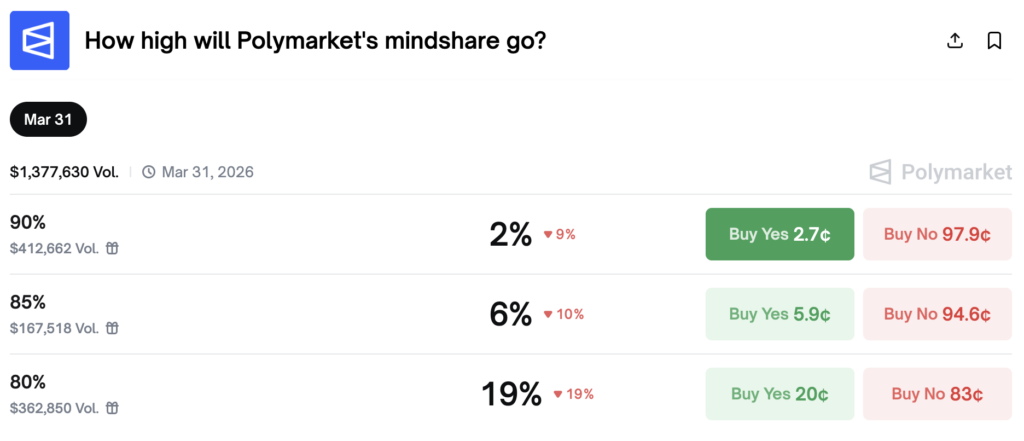

Polymarket already has two mindshare markets live, as of Feb. 11, 2026. One is on Polymarket’s mindshare by March 31, with trading volume over $1.3 million.

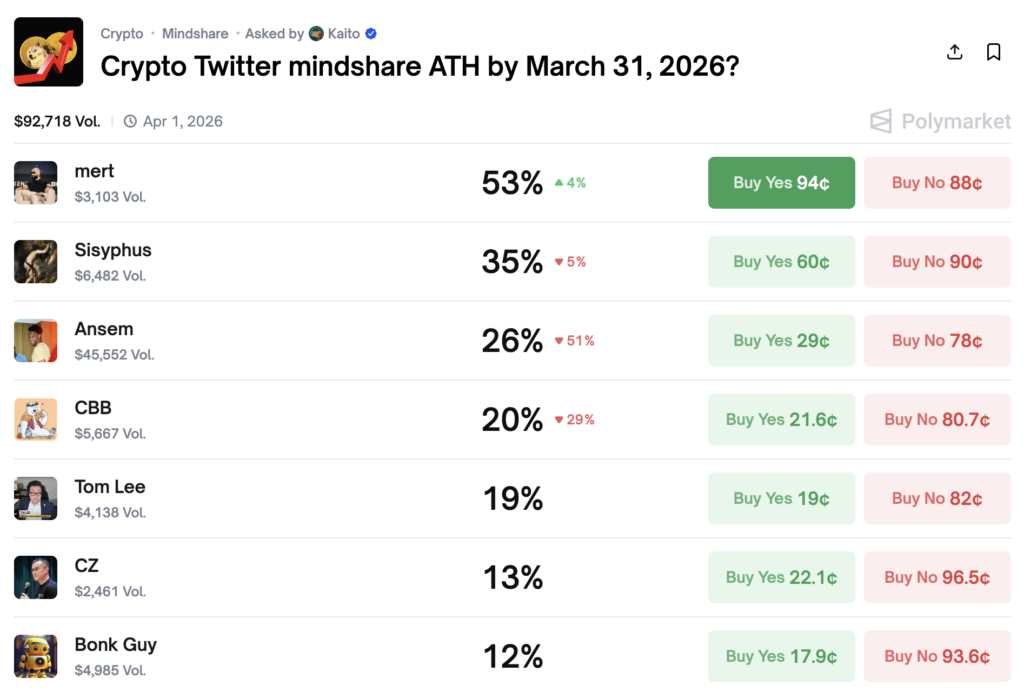

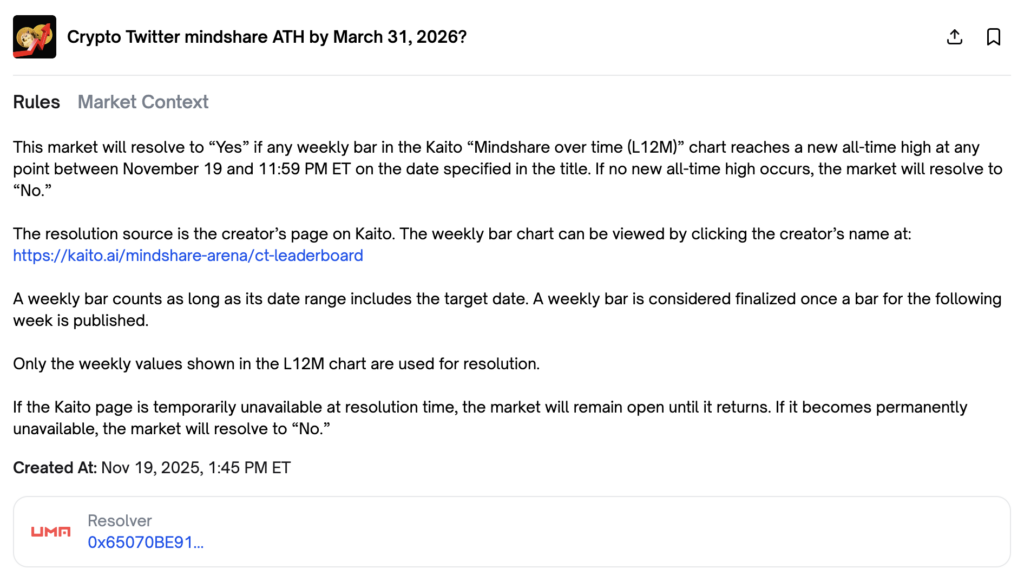

The other is for a crypto twitter mindshare new all-time high by March 31. The resolution rules on this market are less straight-forward, so make sure you fully understand the rules before trading.

Community excitement (and skepticism)

Reaction to the announcement has been mixed but engaged, with supporters describing it as a clever evolution of prediction markets into everyday life. But several concerns have also surfaced.

One major issue that immediately comes to mind is data integrity. If payouts depend on social media metrics, what happens with artificial engagement? Buying bot traffic, coordinating influencer pushes, or gaming algorithms are already common online, so financial incentives tied to those metrics would likely amplify those behaviors.

Another big concern is how transparent the data actually is. One X user asked how Kaito can measure “accurate attention” after major accounts get banned. If platforms like X change their rules, limit API access, or remove large accounts, that could directly affect how much content is being counted – and how sentiment is measured.

Since these markets rely on Kaito’s own data models and aggregation methods, users may start asking simple questions, like:

- What exactly counts as “mindshare”?

- How is sentiment scored?

- And if people disagree with the numbers, who decides what’s correct?

If real money depends on those metrics, clarity around how they’re calculated, and how disputes are handled, will become increasingly important.

Who owns the value of attention?

Some community members also raised concerns around fairness. If user engagement and discourse generate the data that powers these markets, should active contributors be compensated? One commenter suggested that Kaito community members “known as yappers” – those driving discussion – deserve recognition or rewards.

That question touches on a broader tension: attention has always been monetized by platforms. Now it may also be monetized through financial markets layered on top of it.

There is also the issue of reflexivity. Traders who bet that a topic’s mindshare will rise, might also actively promote it to push their position. The market could become both a reflection of attention and a mechanism that shapes it.

A new asset class or a fragile experiment?

The potential upside is easy to understand. We know that brands, investors, and traders already watch online engagement to see what’s gaining traction. If that attention data can be turned into a tradable market, it could act like a live scoreboard for what’s trending in crypto and other industries.

But attention isn’t as stable as something like an election result or an economic report. It changes quickly – and it can be influenced or manipulated more easily.

With attention markets, Kaito and Polymarket are testing a big idea: can online conversation itself become something reliable enough to trade? Over time, we’ll see whether these markets help people better understand trends – or simply add another source of noise and controversy in the rapidly-expanding economy of tradable events and assets.