Robinhood’s live event Tuesday evening, titled YES/NO, unveiled a product roadmap to allow users to trade or hedge whatever they want through prediction market combinations. The company also unveiled new infrastructure and AI tools to support this expansion.

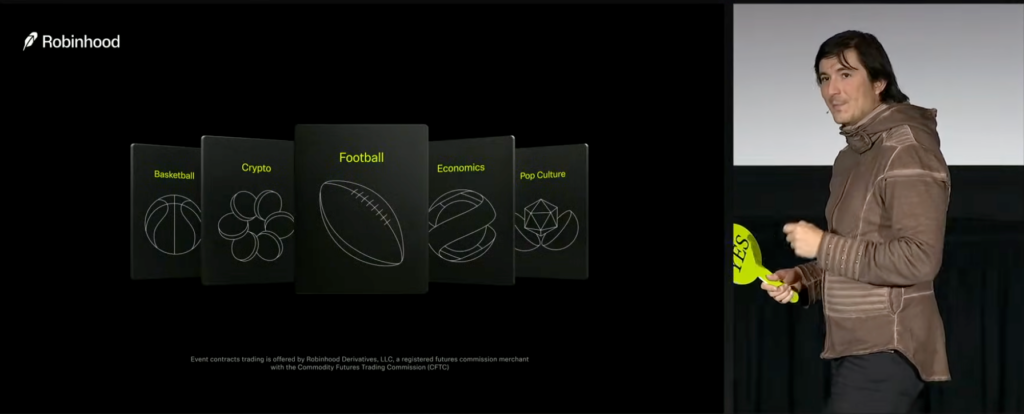

CEO Vlad Tenev said the company is building a stack to combine binary event contracts across sports, politics, culture and other categories into customized trades—effectively letting users create their own financial instruments for any outcome they want to hedge or speculate on.

“What all this means is that you’ll be able to trade and hedge pretty much anything,” Tenev said, describing a future where prediction market combinations extend far beyond sports contracts the company.

Starting with NFL, ending with everything else

“Combos really lay a groundwork for a new era of prediction markets,” Lee said. “They will begin within single games, but we plan on bringing them across games and ultimately across entire categories. Imagine mixing your predictions in sports, culture, politics, really any category into one trade.”

Tenev acknowledged that executing this vision could create complex challenges for users trying to navigate “tens potentially hundreds of thousands of markets and millions of potential combinations” alongside the stocks, options, and cryptocurrencies already available on Robinhood.

The rollout of preset combinations, essentially parlays, starts this week for NFL and custom combinations in January. The move puts Robinhood in direct competition with Kalshi, which expanded its parlay-style “combos” this week after processing over $100 million in volume.

Owning the stack becomes a necessity

The cross-category combo vision builds on moves Robinhood made last month. In a joint venture with trading firm Susquehanna International Group, the company acquired a 90% stake in LedgerX, a CFTC-regulated derivatives exchange and clearinghouse, from MIAX (Miami International Holdings) in a deal announced on November 25th. The transaction, expected to close in the first quarter of 2026, gives Robinhood (along with Susquehanna) independent control over clearing and settlement operations.

Robinhood said the acquisition would provide “the flexibility to build faster and deliver more contracts and services to traders”—language that takes on new meaning with Tuesday’s announcement of cross-category combos. It’s unlikely to do this with partnerships, meaning owning the entire infrastructure is critical.

The company currently offers prediction markets through partnerships with ForecastEx and Kalshi, both CFTC-regulated exchanges. Owning LedgerX eliminates dependence on partners who control what contracts get listed and when—a constraint when building tools that mix Fed decisions, sports outcomes, and weather events into single trades.

“When we talk about democratizing trading, it’s not just about giving people access to what the elites have,” Tenev said. “It’s also about making trading more personal and enabling people to trade what really matters to them.”

Cortex upgrade positioned as AI analysis

Cross-category combos will create a challenge for users that Robinhood plans to address through artificial intelligence. The company showcased major upgrades to Robinhood Cortex, its AI-powered investing assistant, positioning it as essential infrastructure to expand on tradable outcomes.

The upgrade, set to roll out in early 2026 to Robinhood Gold subscribers, will be embedded throughout the app and allow users to execute trades, conduct research, and adjust account settings using conversational language. A Gold membership costs $5 per month or $50 annually.

Oren Naim, Robinhood’s vice president of platforms, emphasized the AI assistant is designed to provide objective analysis rather than advisory recommendations. “The idea is to give you kind of an objective summary of both sides of the story,” Naim said.

The company is also launching portfolio-level “Digests” powered by Cortex, which will provide personalized insights explaining daily movements in users’ specific holdings. Additionally, Sherwood Media, Robinhood’s news division, announced a daily prediction markets newsletter called “Scoreboard” to help customers track games, statistics, and market movements.