NFL announcer mention markets are heading into their biggest event yet. Kalshi has listed 34 terms for Super Bowl LX, each resolving based solely on whether NBC’s Mike Tirico or Cris Collinsworth says them during Sunday’s broadcast of the Seattle Seahawks vs. New England Patriots.

The concept is simple: buy Yes if you think a term gets said, buy No if you don’t. A winning contract pays $1. But what started as a curiosity at the beginning of the NFL season has quietly become one of the fastest-growing product categories in prediction markets, generating an estimated $48 million in total volume across 61 NFL games this season, according to DeFi Rate’s Super Bowl mention market tracker.

As of Friday afternoon (two days before the Big Game), Kalshi’s market had over $1.2 million in volume ($115K for Polymarket). Our analyst believes this market could reach $5 million on Sunday.

“Mention markets have grown in popularity for a few reasons: the overall platform growth, their successful virality and the fact that significant edge remains to be discovered in these new markets,” Kalshi spokesperson Jack Such told David Purdum last week.

That last part, “significant edge remains to be discovered,” is a notable admission. It suggests that these markets are still inefficient, and that traders willing to do the homework on announcer tendencies, matchup narratives, and order book dynamics can find value that casual participants are leaving on the table.

Considering that nugget, let’s dig into where those edges might lie based on specific announcer tendencies and game narratives. But first, a look at the explosive growth of NFL mentions trading across the season.

How mention markets grew 715% in a single NFL season

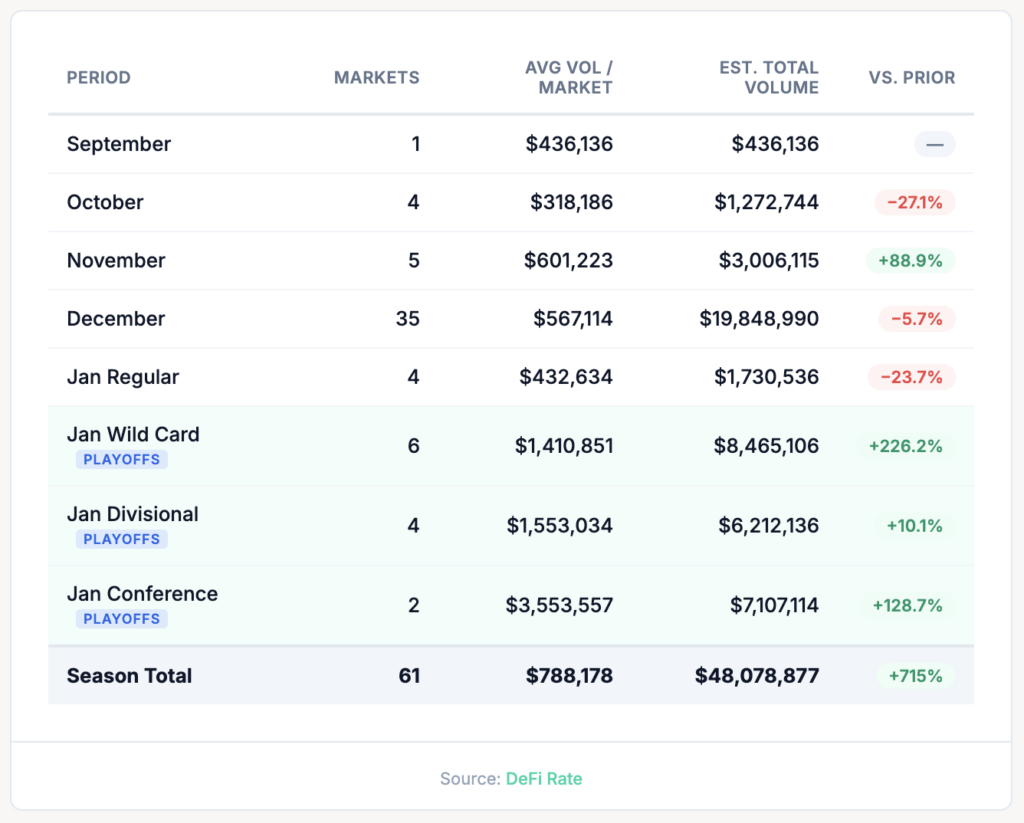

DeFi Rate has tracked NFL mention market volume across all 61 Kalshi markets offered this season, from the September opener through the Conference Championships. The growth trajectory tells a clear story: steady adoption through the regular season, followed by an exponential playoff surge.

During the regular season, average volume per market held in a relatively tight band between $318,000 and $601,000. The markets were stable but still relatively niche. Then came the playoffs. Wild Card weekend averaged $1.41 million per market — a 3.3x jump from the regular season. By the Conference Championships, that number had reached $3.55 million, an 8.1x increase over the September opener and a 715% growth rate for the season.

The scale also jumped in December as Kalshi went from offering five NFL mention markets in November to 35 in December — a 7x increase in supply. Per-market volume dipped just 6%, from $601,000 to $567,000. But the key point is that demand kept pace with supply rather than diluting, signaling that the product had found real market fit.

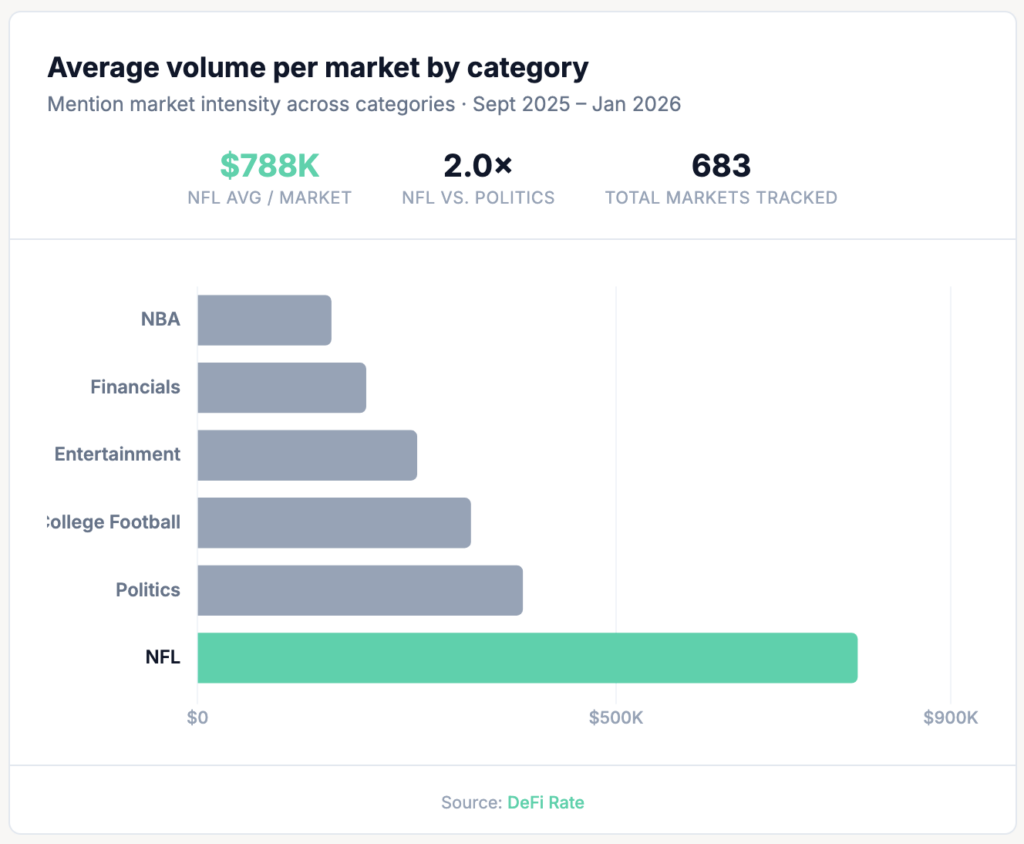

For context, NFL mention markets generate $788,000 in average volume per market — more than double the per-market average for political mention markets ($388,000 across 303 markets) and nearly five times the rate of NBA mention markets ($159,000 across 66 markets), despite the NFL having far fewer total markets listed. The per-market intensity reflects a concentrated, engaged trading base.

What mention markets are available for the Super Bowl

Kalshi’s Super Bowl mention market includes 34 terms, each structured as a binary Yes/No contract. Resolution is straightforward: if Tirico or Collinsworth says the term during the broadcast, Yes pays $1. If neither says it, No pays $1.

This is a critical distinction worth understanding. On Kalshi, only the two booth announcers count; sideline reporting does not count. Neither do comments from players, coaches caught on field mics, or halftime analysts. The resolution is scoped specifically to Tirico and Collinsworth, which makes their individual broadcasting tendencies the single most important variable for traders to analyze.

Polymarket also has 27 mention market terms listed for the Super Bowl, but with a broader resolution rule: anyone speaking on the broadcast can trigger a Yes, including players, coaches, and sideline interviews. It’s worth noting that Polymarket’s mention markets are only available on its global platform and are not accessible to U.S. traders on Polymarket US, which currently only offers sports markets approved by the CFTC. For U.S.-based traders, Kalshi is the primary venue for Super Bowl mention market contracts.

Here’s how current pricing breaks down on Kalshi’s Super Bowl mention market, organized by probability tier. Our live Super Bowl mention market has real-time odds and volume data across both platforms.

Current Super Bowl mention markets odds snapshot:

The Collinsworth factor: broadcasting tendencies that move prices

Cris Collinsworth is calling his sixth Super Bowl — tied with Troy Aikman for the most among active color analysts. This is his fourth season in the booth with Tirico on Sunday Night Football. That volume of on-air time has produced a set of well-documented broadcasting patterns, and those patterns are now directly reflected in mention market pricing.

The Mahomes obsession

The most-discussed mention market contract heading into Sunday is “Mahomes,” currently trading at 76¢ cents on Kalshi (76% implied probability). Patrick Mahomes is a three-time Super Bowl champion who has appeared in five Super Bowls, including last year’s game, but he has no direct involvement in Super Bowl LX. The market exists entirely because of Collinsworth’s well-established tendency to reference Mahomes regardless of who is playing. The tendency has become such a reliable part of his commentary that it’s spawned its own meme ecosystem.

At Super Bowl Radio Row this week, Collinsworth addressed it directly: “I probably will say Patrick Mahomes’ name, and I have no idea why. But now that you’ve planted it in my head, I assume you bet the over and you’re trying to get me to do that.”

@koacolorado You can now blame AROD if Cris Collinsworth mentions Mahomes in the big game 😅 🗣️ “I probably will say Patrick Mahomes’ name and I have no idea why. Now that you planted it in my head …” 🙈 #KOASuperWeek #biggame #patriots #seahawks #mahomes ♬ original sound – KOA Colorado

For traders, the self-awareness cuts both ways. On one hand, Collinsworth just confirmed the tendency is real and that he’s unlikely to suppress it. On the other, there’s a small chance the heightened awareness leads him to consciously avoid it, though nothing in his broadcasting history suggests that kind of restraint.

At 27¢, the ‘No’ contract implies a 27% chance Collinsworth gets through an entire Super Bowl broadcast — one featuring two quarterbacks who invite comparison to elite predecessors — without mentioning the best quarterback in football. Traders should price that scenario accordingly.

Historical callback tendencies and the Seahawks-Patriots narrative

Collinsworth leans heavily on legacy narratives, and this specific matchup gives him an unusually deep well to draw from. The Seahawks and Patriots met in Super Bowl XLIX in February 2015, producing one of the most analyzed final plays in NFL history: Malcolm Butler’s interception at the goal line, the decision not to hand off to Marshawn Lynch, and the collapse of what many considered Seattle’s “Legion of Boom” dynasty.

Several Kalshi contracts are priced directly around the probability that Collinsworth revisits that history:

| Term | Kalshi Price | Why Collinsworth is likely to reference it |

|---|---|---|

| Tom Brady | 90¢ | The defining figure of the Patriots franchise is a near-certainty when New England is in the Super Bowl. Collinsworth has praised Brady extensively throughout his career. Brady is also in Fox’s broadcast booth this year, which NBC will likely acknowledge. |

| Legion of Boom | 70.5¢ | Seattle’s iconic early-2010s secondary with Sherman, Thomas, and Chancellor. Collinsworth called those games and will draw comparisons to the current defense under Mike Macdonald. |

| Marshawn Lynch | 68¢ | Beast Mode’s shadow looms large over any Seahawks Super Bowl. The decision not to run Lynch on the 1-yard line in XLIX is one of the most debated calls in NFL history. |

| Russell Wilson | 64.5¢ | The former Seahawks QB who threw the interception that ended XLIX. The emotional resonance of that moment for the franchise makes it a natural callback, especially with a new QB (Sam Darnold) getting the opportunity Wilson never got again in Seattle. |

| Dynasty | 62¢ | The Patriots’ six-title run under Brady and Belichick defines the word in modern football. New coach Mike Vrabel — a former Patriots player and three-time Super Bowl champion with New England — adds another layer. |

| Gronk / Gronkowski | 60¢ | Multiple Super Bowl touchdowns, a Hall of Fame career, and a personality that makes him a natural reference point. Likely in attendance or referenced by the broadcast. |

The matchup narrative practically guarantees that Collinsworth will weave through several of these threads during the broadcast. A Seahawks red-zone drive in the fourth quarter, for instance, would almost certainly trigger references to Lynch, the Butler interception, and possibly Wilson in rapid succession. Traders thinking about correlated outcomes across multiple contracts may find value in bundling several of these mid-range historical callback terms.

Collinsworth’s QB-centric analysis style

Beyond specific names, Collinsworth’s commentary is disproportionately focused on quarterback evaluation. He consistently breaks down QB mechanics, decision-making, and composure under pressure, and he defaults to comparisons with elite contemporaries — primarily Mahomes and Brady.

This tendency is relevant for a Super Bowl featuring two contrasting quarterback narratives. Drake Maye is a second-year Patriots quarterback in his first Super Bowl, a blank canvas for Collinsworth’s analytical breakdowns. Sam Darnold carries one of the NFL’s most compelling redemption stories — the “seeing ghosts” moment with the Jets, the journeyman years, and now a Super Bowl start in a city that gave up on him. Expect Collinsworth to lean into both narratives, with frequent comparisons to past quarterbacks who faced similar moments.

| Term | Kalshi Price | QB narrative connection |

|---|---|---|

| Record | 87.5¢ | Any statistical milestone from either QB or the game itself. Collinsworth regularly cites records to contextualize QB performance. |

| Comeback / Come Back | 93.5¢ | One of the highest-probability terms. If the game is competitive at all, this resolves Yes. Directly tied to the Darnold redemption arc and any in-game deficit. |

| Pro Bowl / Pro Bowler | 75¢ | Collinsworth frequently references Pro Bowl selections when evaluating player caliber. Multiple Pro Bowlers on both rosters. |

| Next Gen Stat | 88¢ | NBC’s proprietary analytics. Tirico or Collinsworth regularly cite these during broadcast to highlight QB release time, separation, and other measurables. |

What about Tirico?

Mike Tirico is calling his first Super Bowl as NBC’s lead play-by-play voice, a milestone in its own right. His style is more measured and factual than Collinsworth’s — he narrates the action rather than editorializing it. As a result, Tirico is the more likely trigger for terms that fall into standard play-by-play vocabulary: “Safety” (97.5%), “MVP” (96.5%), “Lombardi” (95.5%), “Levi’s” (94%), and “Record” (87.5%).

One angle worth watching: both head coaches are named Mike: Mike Vrabel (New England) and Mike Macdonald (Seattle). Analysts have noted Tirico may reference the “Mike vs. Mike” dynamic given it’s his first name too. This doesn’t have a dedicated contract, but it’s the kind of setup that naturally leads into other mention market terms like “honor” or “record” as Tirico contextualizes the coaching matchup.

The mid-range: where the interesting trades live

The near-certainties (Safety at 97.5%, MVP at 96.5%) and the long shots (Assault at 17%, Roughing the Passer at 20%) don’t offer much room for analysis. The contracts worth studying are in the 50–75% range, where the market is genuinely uncertain and specific knowledge about the broadcast, matchup, and announcer tendencies can create an informational edge.

| Term | Kalshi Price | Why it could resolve Yes | Why it might not |

|---|---|---|---|

| Mahomes | 70¢ | Collinsworth’s documented tendency; self-acknowledged at Radio Row. Neither QB is Mahomes-caliber, inviting the comparison. | Collinsworth could consciously avoid it given the heightened attention. No Chiefs connection to the game. |

| Legion of Boom | 70.5¢ | Seahawks in the Super Bowl = immediate callback to their last Super Bowl era. Collinsworth called those games. | The current Seattle defense is built differently. The reference may feel forced if the defense isn’t dominant early. |

| Marshawn Lynch | 68¢ | The goal-line decision in XLIX is one of the most discussed plays ever. A Seahawks red-zone sequence would almost certainly trigger it. | If the game script doesn’t produce a comparable moment, the reference may not come up organically. |

| Wind / Windy | 67.5¢ | Levi’s Stadium is an open-air venue in Santa Clara. February weather in the Bay Area can be unpredictable, and any wind impacts kicking and passing. | Calm conditions would remove the need to discuss it. Weather is inherently unpredictable. |

| Russell Wilson | 64.5¢ | The ghost of XLIX. Wilson threw the interception that lost that game. A Seahawks Super Bowl without mentioning their last Super Bowl QB seems unlikely. | Wilson is now with a different team and has no direct involvement. It’s a backward-looking reference. |

| Dynasty | 62¢ | The Patriots are the dynasty. Vrabel was part of it as a player. The franchise returning to the Super Bowl naturally invites that framing. | It could feel premature to apply the term to the current iteration of the team, which has no titles. |

| Schedule | 56.5¢ | The NFL’s 18-game season debate has been an ongoing story. Networks often reference scheduling during Super Bowl broadcasts. | It’s not a natural game-flow topic. Would require a deliberate editorial segment. |

| Tush Push | 55¢ | The Eagles’ signature play became a league-wide talking point. Collinsworth has referenced it in non-Eagles games. | Neither team runs it. The reference would be purely tangential. |

| Cardi B | 50.5¢ | Bad Bunny is performing the halftime show. Cardi B and Bad Bunny have collaborated on songs including “I Like It.” Halftime commentary could trigger this. | Collinsworth and Tirico typically don’t call the halftime show. This would likely need to come from a broader broadcast segment. |

How traders find edge: order books, models and what to watch for

For traders considering Super Bowl mention markets, the approach is different from sports betting or trading on actual Super Bowl game odds or Super Bowl MVP. You’re not predicting what happens on the field; you’re predicting what comes out of two specific people’s mouths over the course of a three-plus hour broadcast. That distinction creates both opportunities and pitfalls.

Reading the order book

Mention markets on Kalshi are traded through a central limit order book, the same structure used by stock exchanges. This means you can see resting bids and asks before placing your own order, and the depth of the book at various price levels reveals information about how other traders are positioned.

During a live stream on Hive analyzing Super Bowl props and mention markets, trader @FhantomBets identified imbalance in the order book as “sharp money” — a sign that someone with high conviction and significant capital was heavily positioned. And it was obvious what well-known mention market traders were behind the bids, even though individual trades on Kalshi are anonymous.

The lesson for Super Bowl mention market traders: in these relatively low-liquidity markets, large positional size at specific price levels can reveal where informed money is sitting. Before entering a position, look at both sides of the order book. If one side has significantly more depth concentrated at tight price levels, that asymmetry is information.

What to be aware of before trading

A few practical considerations for anyone looking at these contracts:

Liquidity varies widely across terms. The highest-volume Super Bowl mention contracts — Safety, Mahomes, Tom Brady — have thousands of dollars in 24-hour volume and tight bid-ask spreads. Lower-probability contracts like Assault or Roughing the Passer may have wider spreads and less depth, meaning you could get filled at a worse price than expected, or struggle to exit a position before resolution.

Resolution is binary and final. There’s no partial credit. If the contract is “Marshawn Lynch” and Collinsworth says “Lynch” without the first name, the resolution depends on Kalshi’s specific contract language. Read the resolution rules for each individual contract before trading.

The broadcast is longer than you think. NBC’s Super Bowl coverage will run for hours, including extensive pregame segments. However, Kalshi contracts typically resolve based on the game broadcast itself (kick to final whistle), not the full pre- and post-game coverage. Verify the exact resolution window.

Correlated events matter. Many mention market terms are not independent. If Collinsworth starts discussing the Seahawks’ last Super Bowl appearance, he’s likely to mention Legion of Boom, Marshawn Lynch, Russell Wilson, and possibly the Malcolm Butler interception in the same two-minute segment. Traders with positions across multiple correlated contracts should understand that a single storyline shift can resolve several contracts simultaneously.

Announcer awareness creates a meta-game. Collinsworth knows about these markets. He acknowledged it publicly at Radio Row. Whether that awareness makes him more likely to lean into expected references (playing to the audience) or more cautious about them (avoiding the appearance of market influence) is genuinely uncertain. NBC has not publicly commented on whether it has provided any guidance to its broadcast team regarding mention markets.

A season-long signal for the prediction market industry

The growth of NFL mention markets this season is more than a novelty story. It represents one of the clearest use cases for event contract trading: a time-bounded, high-attention event with well-defined resolution criteria and a diverse range of probability outcomes. The fact that mention markets generated $788,000 in average volume per market — outpacing every other mentions category DeFi Rate tracks on a per-market basis — suggests they’ve found genuine product-market fit.

The trading volume of NFL mention markets tells a clear story about consumer demand. At $160 million+ in total Super Bowl trading volume on Kalshi alone across all market types, this is no longer a fringe product.

For mention markets specifically, the Super Bowl is the culmination of a season that saw per-market volume grow from under half a million dollars to north of $3.5 million. Watch for the trading volume in the NFL championship game to far surpass that during the course of Sunday’s broadcast.