Prediction markets set yet another all-time high this week, and they did it without a single NFL game on the schedule. Total notional volume across major platforms hit $6.32 billion for the week ending Feb. 1, up 2.2% from the prior week’s record despite this being the Super Bowl bye week.

The fact that prediction markets posted a new high during a week with zero football games is a significant signal about the maturation of this industry beyond its sports-driven core.

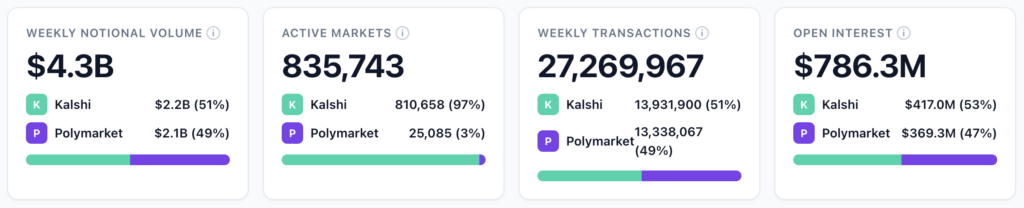

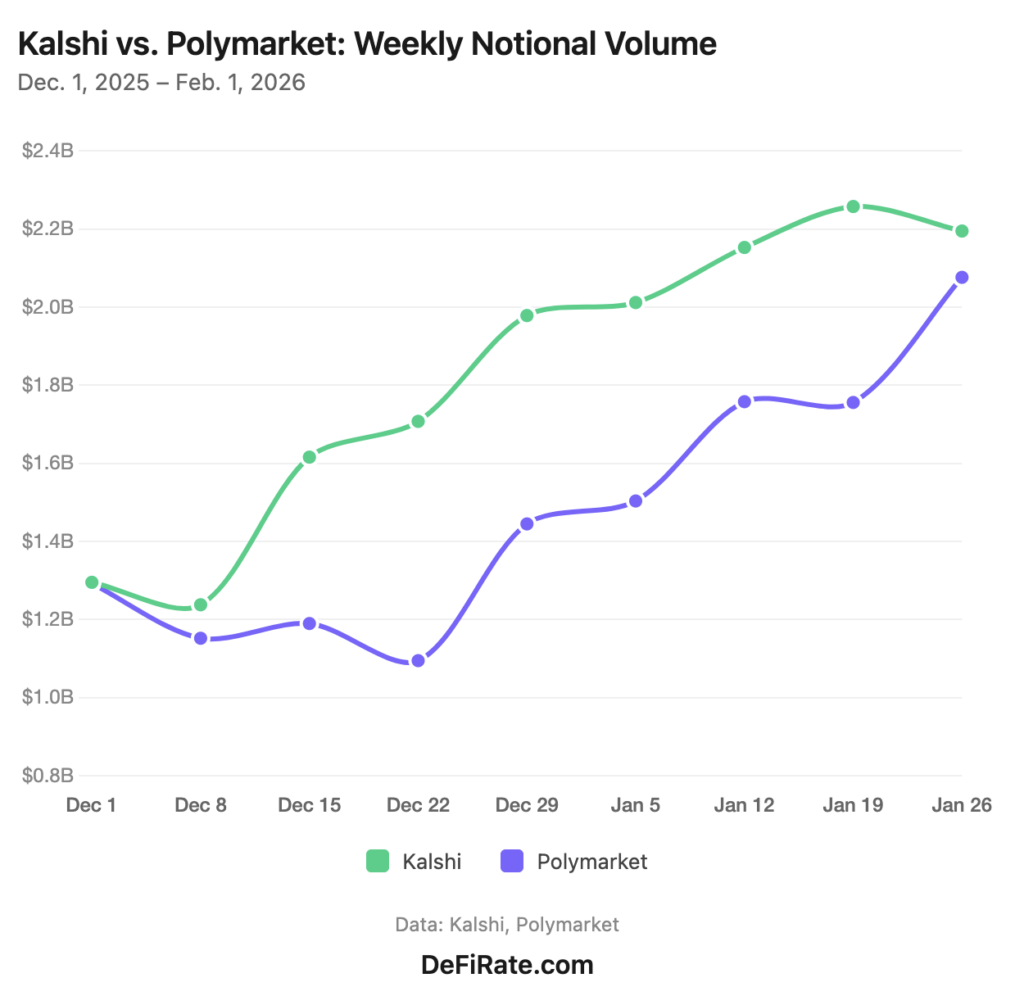

The bigger story this week is the platform shuffle. Polymarket surged 18.2% to $2.08 billion, reclaiming the No. 2 spot from Opinion and narrowing the gap with Kalshi to near parity. Kalshi dipped 2.8% to $2.20 billion, its first week-over-week decline in five weeks. Our prediction market volume tracker shows Kalshi’s active markets continue growing as Kalshi maintains a marginal lead over Polymarket on weekly transactions and open interest.

Considering the importance of sports markets (and specifically, NFL) to Kalshi’s volume, the slight WoW dip was to be expected as the absence of NFL games took a visible bite out of its sports-heavy volume mix. Meanwhile, decentralized platform Opinion fell 10.6% to $1.74 billion, sliding to third, according to Dune’s latest data.

Overall platform notional volume (Jan. 26 – Feb. 1)

| Platform | Notional Volume ($) | Market Share | WoW Change |

|---|---|---|---|

| Kalshi | $2,195,101,449 | 34.7% | −2.8% |

| Polymarket | $2,076,580,178 | 32.9% | 18.2% |

| Opinion | $1,743,534,069 | 27.6% | −10.6% |

| predict.fun | $173,909,542 | 2.8% | 20.8% |

| Limitless | $104,228,341 | 1.6% | 82.1% |

| ForecastEx | $10,992,403 | 0.2% | −14.9% |

| Myriad | $8,108,181 | 0.1% | 153.0% |

| Overtime | $5,674,345 | 0.1% | New |

| Total | $6,318,128,509 | 100% | 2.2% |

January in review: A blockbuster month for the industry

January’s four full weeks (Jan. 5 through Feb. 1) generated approximately $23.8 billion in total notional volume across tracked platforms, comfortably the biggest month on record for prediction markets.

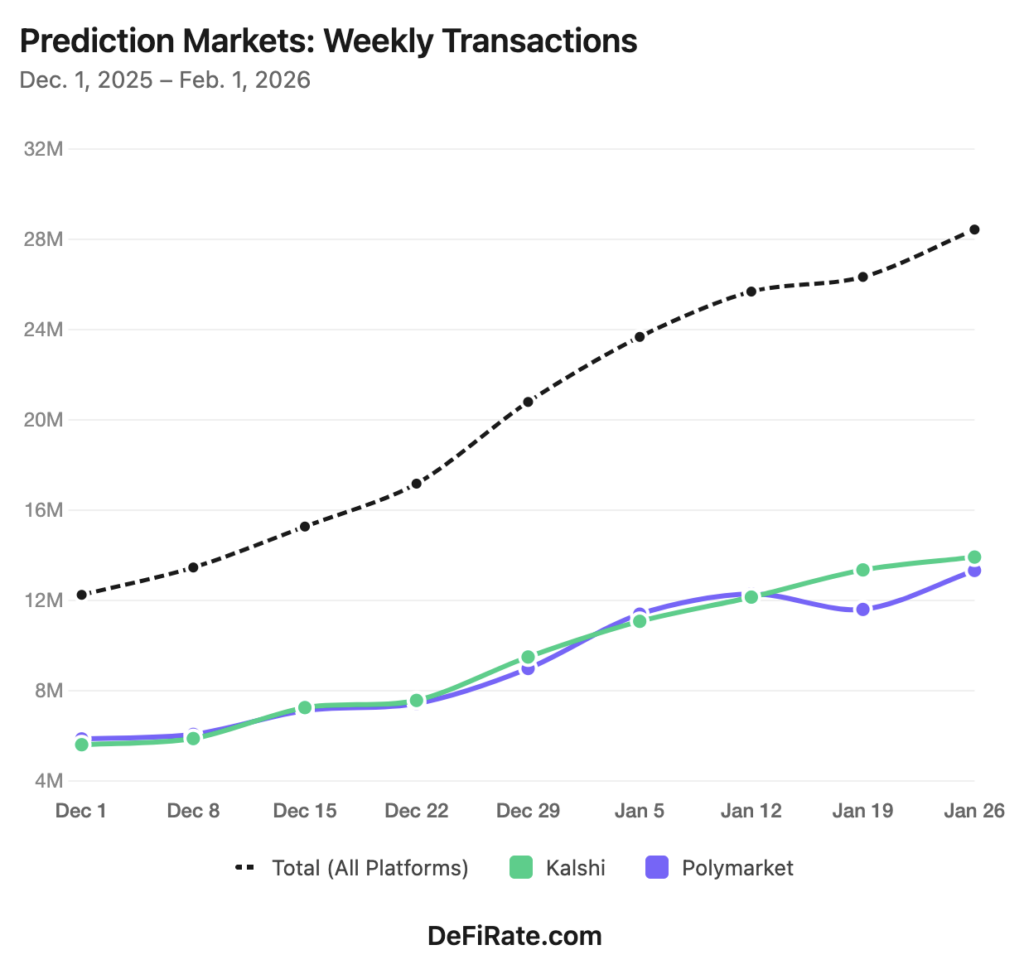

Weekly transactions tell a similarly aggressive growth story. The industry posted 28.4 million transactions this past week, up from 12.3 million in the first week of December. That’s a 132% increase over nine consecutive weeks of growth. Kalshi and Polymarket continue to account for the vast majority of those transactions, with 13.9 million and 13.3 million respectively this past week.

Weekly transactions (9-week trend from Dec. 1 through Feb. 1):

The month-over-month growth is striking. Average weekly transactions in January (26.0 million) came in roughly 79% higher than the December average (14.5 million). Average weekly notional volume in January ($5.95 billion) was up about 40% from December’s average ($4.24 billion), which ranged from approximately $4.0 billion in early December to $5.4 billion by the final week of the year.

5-Week notional volume comparison (Dec. 29 through Feb. 1):

| Platform | Dec 29–Jan 4 | Jan 5-11 | Jan 12-18 | Jan 19-25 | Jan 26–Feb 1 |

|---|---|---|---|---|---|

| Kalshi | $1,978,665,806 | $2,012,006,557 | $2,153,060,916 | $2,257,916,803 | $2,195,101,449 |

| Polymarket | $1,445,093,136 | $1,503,807,692 | $1,758,081,905 | $1,756,111,734 | $2,076,580,178 |

| Opinion | $1,809,464,856 | $1,597,197,928 | $1,941,759,497 | $1,950,364,860 | $1,743,534,069 |

| predict.fun | $71,754,844 | $108,892,161 | $113,624,631 | $143,956,073 | $173,909,542 |

| Limitless | $11,172,065 | $8,967,549 | $18,976,902 | $57,245,377 | $104,228,341 |

| ForecastEx | $68,937,906 | $32,116,056 | $31,473,041 | $12,913,898 | $10,992,403 |

| Myriad | $2,786,513 | $1,845,727 | $2,350,513 | $3,205,159 | $8,108,181 |

| Overtime | — | — | — | — | $5,674,345 |

| Total | $5,387,875,126 | $5,264,833,670 | $6,019,327,405 | $6,181,713,904 | $6,318,128,509 |

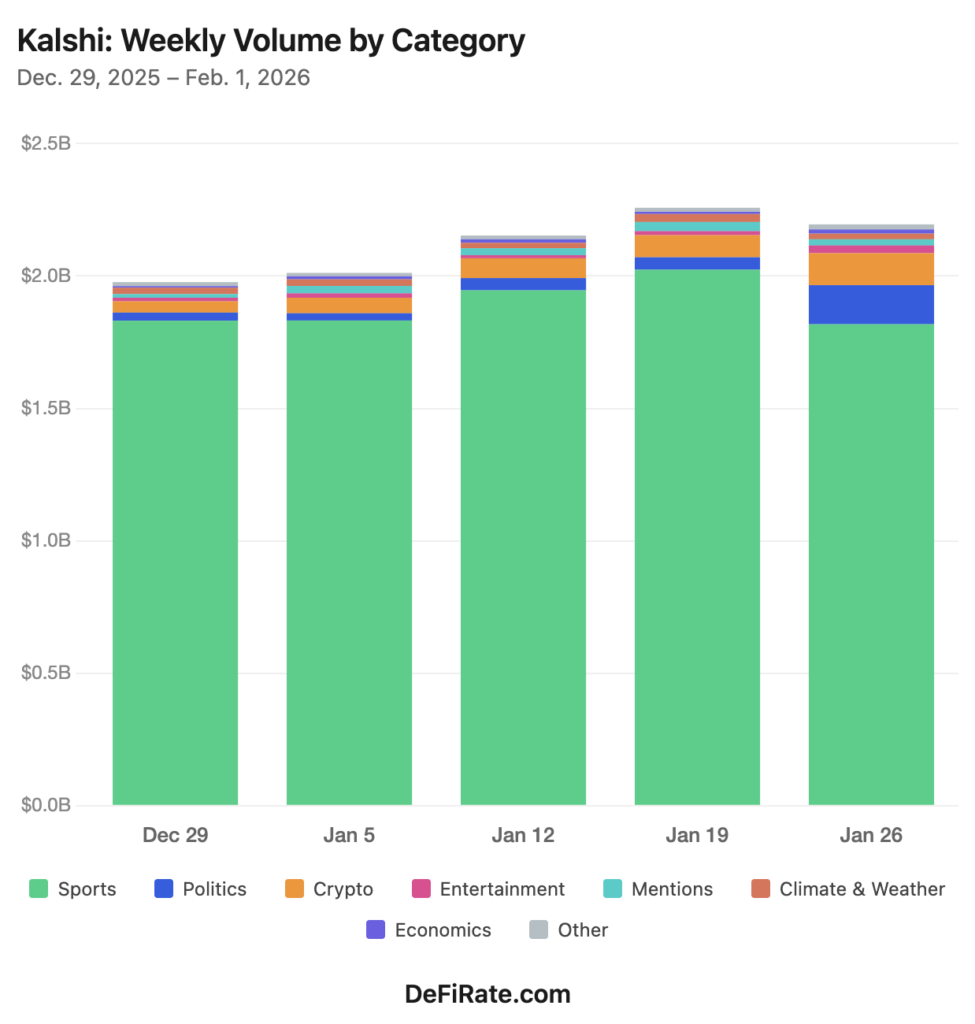

The bye week effect: Sports down, everything else up at Kalshi

With no NFL games on the calendar, Kalshi’s sports volume dropped 10.2% from $2.02 billion to $1.82 billion, pulling the category’s share of Kalshi volume from 89.6% to 82.8%. But what’s more interesting is what filled the gap.

Kalshi category breakdown week over week (Jan. 26-Feb. 1):

| Category | Jan 19-25 Volume | Jan 26 – Feb 1 Volume | WoW Change | Share |

|---|---|---|---|---|

| Sports | $2,023,977,725 | $1,818,014,719 | −10.2% | 82.8% |

| Politics | $47,009,461 | $147,566,721 | 214.0% | 6.7% |

| Crypto | $83,315,094 | $120,669,010 | 44.8% | 5.5% |

| Entertainment | $15,253,984 | $29,404,782 | 92.8% | 1.3% |

| Mentions | $34,606,957 | $23,043,088 | −33.4% | 1.0% |

| Climate and Weather | $30,093,449 | $21,558,385 | −28.3% | 1.0% |

| Economics | $8,607,514 | $15,929,229 | 85.1% | 0.7% |

| Other | $15,052,619 | $18,915,515 | 25.7% | 0.9% |

| Total | $2,257,916,803 | $2,195,101,449 | −2.8% | 100% |

Politics more than tripled, surging from $47 million to $147.6 million (+214%). That’s the highest politics volume we’ve seen on Kalshi since the weeks immediately following the 2024 election. A combination of government shutdown markets, Fed Chair speculation, and early 2026 midterm positioning are driving the surge.

Crypto jumped 44.8% to $120.7 million, Entertainment nearly doubled (+92.8%), and Economics climbed 85.1%. Economics trading is spiking with activity around March fed decision probabilities as the Fed held rates steady in January, and President Trump announced his plan to nominate Kevin Warsh as the new Fed chair.

The one notable reversal: Mention markets dropped 33.4% and Climate and Weather fell 28.3%, both coming off elevated levels in recent weeks.

Key takeaway: Kalshi’s total volume dipped 2.8% on the absence of football, but its non-sports categories collectively surged. That’s exactly the kind of diversification Kalshi needs if it’s going to sustain its volume levels through the gaps in the sports calendar.

Kalshi vs. Polymarket: Gap narrows to near parity

This was Polymarket’s strongest week in months, and it showed up across the board. The platform’s 18.2% volume jump brought combined Kalshi/Polymarket volume to $4.3 billion, with the split at a near-even 51/49 in Kalshi’s favor — the tightest it’s been since early January. Comparing the two platforms’ notional volume over the last two months clearly shows Kalshi pulling away during the peak of NFL betting season and Polymarket closing in with NFL off the table and politics and other categories becoming more central to overall trading interest.

Kalshi vs. Polymarket key metrics compared (week of Jan. 26 – Feb. 1):

| Metric | Kalshi | WoW | Polymarket | WoW |

|---|---|---|---|---|

| Notional Volume | $2,195,101,449 | −2.8% | $2,076,580,178 | 18.2% |

| Weekly Transactions | 13,931,900 | 4.3% | 13,338,067 | 14.9% |

| Active Markets | 810,658 | 326.6% | 25,085 | 2.7% |

| Open Interest | $417.0M | 1.6% | $369.3M | −1.7% |

Some key head-to-head dynamics:

Polymarket’s transaction count surged 14.9% to 13.3 million, nearly catching Kalshi’s 13.9 million. Last week Kalshi led by 1.75 million transactions; this week that margin shrank to under 600,000. With sports volume depressed, Polymarket’s more diversified category mix (crypto, politics, culture, geopolitics) is pulling its weight.

Open interest tells an interesting divergence story. Combined open interest across both platforms jumped to $786.3 million, with Kalshi at $417 million (53%) and Polymarket at $369.3 million (47%). But the trajectories this week went in opposite directions: Kalshi’s open interest ticked up modestly (+1.6%) while Polymarket’s dipped slightly (-1.7%) after last week’s 34.9% surge. But the overall trend remains upward for both.

The active markets count continues to be lopsided — Kalshi’s 810,658 vs. Polymarket’s 25,085 — though this reflects Kalshi’s granular approach to market creation (individual player props, game-specific contracts, etc.) rather than a pure measure of platform depth

The rising tide: Limitless, predict.fun and new entrants

The smaller platforms continue to show outsized growth. Limitless nearly doubled again, up 82.1% to $104.2 million — its first week crossing the $100 million mark and a remarkable rise from just $11 million nine weeks ago. predict.fun climbed 20.8% to $173.9 million. Myriad more than doubled (+153%) to $8.1 million.

A new name also appeared on the Dune dashboard this week. Overtime, another decentralized powered by the Thales Protocol on Ethereum Layer 2 networks like Arbitrum and Optimism, posted $5.7 million in its first week tracked by Dune.

Meanwhile, ForecastEx continued its slow fade, dropping another 14.9% to $11 million. The Interactive Brokers-backed platform has fallen from $69 million in early December to just $11 million — an 84% decline over nine weeks.

What to watch: Super Bowl week, shutdown fallout and the path forward

Super Bowl LX (Seahawks vs. Patriots, Feb. 8 at Levi’s Stadium) is set to be the biggest single-event volume catalyst in prediction market history. Super Bowl odds are live and the “Pro Football championship” market on Kalshi already has around $159 million in volume; Polymarket’s Super Bowl winner trading volume is approaching $700 million. Based on this week’s bye-week baseline and the Conference Championship per-game numbers, the Super Bowl could easily push next week’s total market volume well above $7 billion.

The NFL’s decision to ban prediction market advertising from the Super Bowl broadcast, as confirmed by FOS, is worth monitoring, though it seems unlikely to dampen actual trading activity.

Beyond the Super Bowl, several catalysts are in play for February:

- The government shutdown that began Jan. 31 has already driven significant volume into Kalshi’s political and government-related contracts, and that activity will likely persist until a resolution is reached.

- The March 18 FOMC meeting is already generating positioning in rate-cut markets, with prediction markets currently pricing a “hawkish hold” contrary to some bank analyst expectations.

- Midterm election markets are beginning to build liquidity, with early 2026 race markets generating growing interest across both Kalshi and Polymarket.

- SEC-CFTC coordination accelerates. On Jan. 29, SEC Chairman Paul Atkins and CFTC Chairman Michael Selig formally launched “Project Crypto” as a joint initiative to harmonize digital asset oversight, including aligned definitions and shared surveillance. Selig also directed staff to begin drafting an event contracts rulemaking and withdrew the 2024 proposed ban on political and sports contracts.

The bigger picture heading into February: prediction markets just posted three consecutive $6B+ weeks, transactions have more than doubled since early December, and the industry powered through a sports-free week without missing a beat. Sports will remain the primary volume driver for the foreseeable future, but this week’s data shows the non-sports foundation is growing fast enough to help fill the gap even when the NFL games stop.

Note: DeFi Rate volume report data is compiled from a range of sources including Dune, Kalshi, Polymarket, ForecastEx and Gemini APIs.