When is an invasion not an invasion? Irate traders on Polymarket want to know.

The leading global blockchain-based prediction market platform found itself mired in controversy over its “Will the U.S. invade Venezuela by Dec. 31?” trading market.

Polymarket determined that the United States’ Jan. 3 military operation, where U.S. forces captured Venezuelan President Nicolás Maduro and his wife, Cilia Flores, at their home in Caracas, did not qualify as an “invasion.”

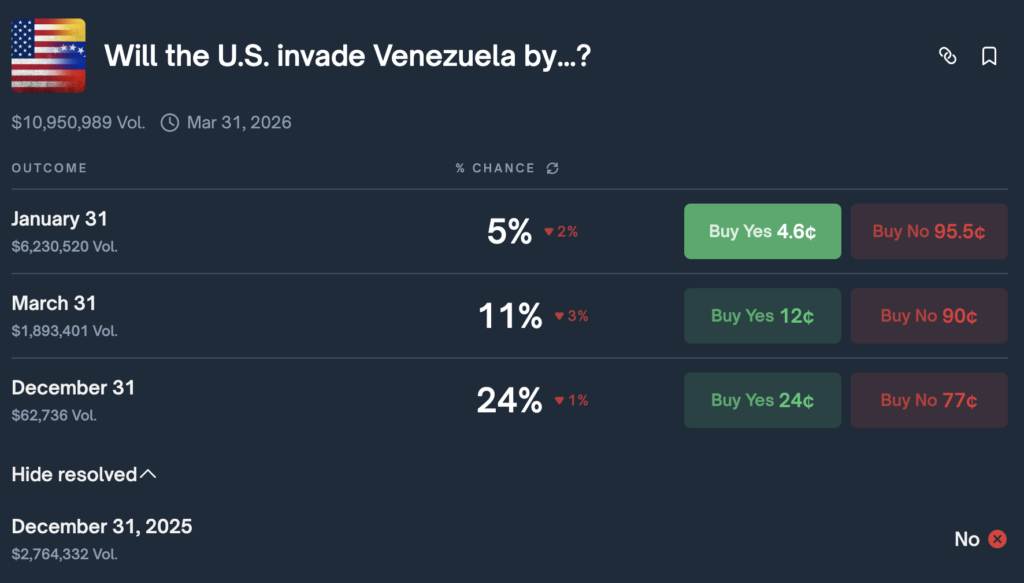

In the lead-up to the raid, the exchange had accrued more than $10.5 million in trading volume, with “by January 31” attracting the highest trading volume. MarketWatch, which first reported Polymarket’s decision not to resolve the exchange, notes that at least one trader would have scored a huge payday, with “positions on that contract worth nearly half a million dollars.”

Ambiguous resolution criteria strikes another Polymarket

Many traders thought that Maduro’s capture would qualify as an “invasion,” especially since one trader netted over $400k over predicting the timing of his capture (which sparked controversy of its own in the form of allegations of insider trading). However, Polymarket clarified that the contract will be resolved as Yes only if the U.S. “commences a military offensive intended to establish control over any portion of Venezuela.”

Polymarket also stated that the resolution source for the market will be “a consensus of credible sources,” most likely mainstream news sources (or if U.S. President Donald Trump announces a full-scale invasion of the South American country). They further clarified by adding an Additional Context note:

This market refers to U.S. military operations intended to establish control. President Trump’s statement that they will “run” Venezuela while referencing ongoing talks with the Venezuelan government does not alone qualify the snatch-and-extract mission to capture Maduro as an invasion.

Traders irate over handling of Venezuela invasion market

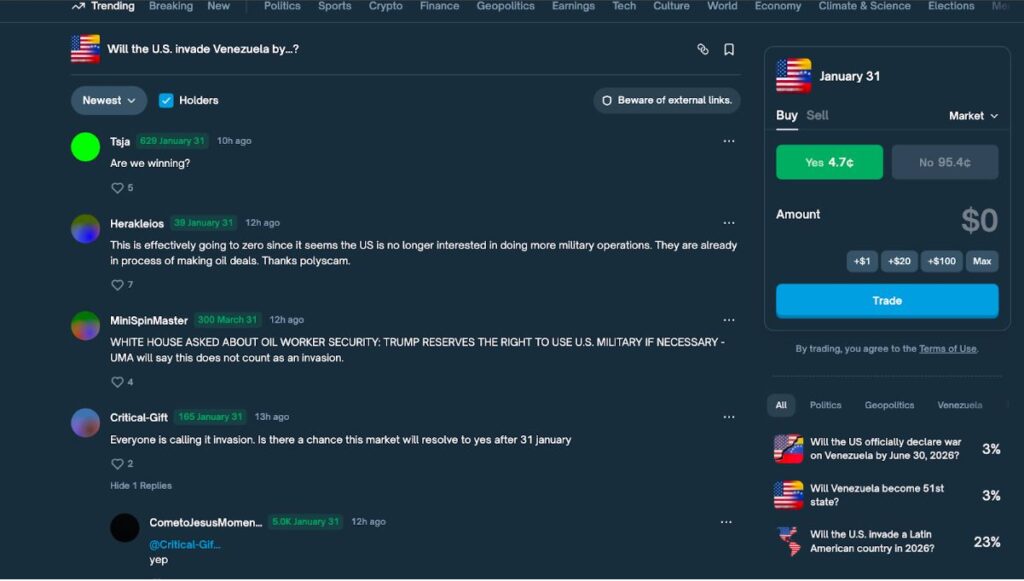

The decision didn’t go over well with many of Polymarket’s traders, who vented their frustrations on social media:

- “This is effectively going to zero since it seems the US is no longer interested in doing more military operations. They are already in the process of making oil deals. Thanks, polyscam.”

- “Sue Polymarket. Class action lawsuit. Financial fraud. Make a new market called ‘Will Polymarket get sued by…?’”

- “Polymarket has descended into sheer arbitrariness. Words are redefined at will, detached from any recognized meaning, and facts are simply ignored. That a military incursion, the kidnapping of a head of state, and the takeover of a country are not classified as an invasion is plainly absurd.”

- “Snatching the leader away and saying they will ‘run’ Venezuela should qualify as an “invasion.”

The “Will the U.S. invade Venezuela by…?” market is closing in on $11 million in volume, with $6.24M just on a January 31 deadline. Previously, $2.7M was traded on whether it would happen by Dec. 31, 2025.

While most Polymarket markets have more clear-cut resolutions (like those over the next Fed interest rate decision or the 2028 U.S. presidential election winner), this recent exchange fracas shows that nuance (and ambiguity) can prevent a market from going a trader’s way.

Venezuela causing more headaches for Polymarket

This is not Polymarket’s first controversy surrounding the Venezuela raid. Chatter of “insider trading” arose when an anonymous user created an account on Dec. 26 and placed a series of wagers on four markets related to the U.S.’s actions in Venezuela.

This user bet more than $32k that Maduro would be removed from power by the end of January. At the time, the “yes” position was trading at an average of 7 cents, implying a 7% likelihood. It was, essentially, a long shot, but one that paid off. After Maduro’s capture, Polymarket paid out the trader more than $400k profit.

The timing of the bet raised some eyebrows, including those of New York Representative Ritchie Torres, who introduced a bill on Jan. 5 titled the Public Integrity in Financial Prediction Markets Act of 2026. The legislation would ban government employees from using prediction markets when they have access to nonpublic information.

Polymarket doesn’t have restrictions against insider trading; CEO Shayne Coplan has argued that the platform “creates this financial incentive for people to go and divulge the information” to the public and that any restrictions against it would do more harm than good. However, Polymarket’s biggest competitor, Kalshi, does list insider trading prohibitions on a per-market basis.