JPMorgan Chase & Co., the world’s largest bank by market cap, is set to let institutional clients use Bitcoin (BTC) and Ether (ETH) as collateral for loans by the end of 2025.

The global program will use third-party custodians to safely hold the pledged crypto, according to people familiar with the plan.

It marks JPMorgan’s biggest move into digital assets since it announced in June 2025 that it would accept certain crypto ETFs as loan collateral.

From ‘Pet Rock’ to Legit Loan Collateral

JPMorgan CEO Jamie Dimon has long been a skeptic of Bitcoin, famously calling it a “hyped-up fraud” and even a “pet rock.”

Regardless of those comments, JPMorgan is now treating crypto the same way it treats stocks, bonds, or gold under Dimon’s leadership – that is, as legitimate collateral for institutional lending.

He has since taken a softer stance, saying: “I don’t think we should smoke, but I defend your right to smoke,” and “I defend your right to buy Bitcoin – go at it.”

JPMorgan Already Supports Crypto ETFs as Collateral

This new program builds on what JPMorgan already launched in mid-2025.

The bank currently lets clients borrow against Bitcoin ETFs, including BlackRock’s Bitcoin ETF (IBIT), Fidelity’s Wise Origin Bitcoin Fund (FBTC), and Grayscale’s Bitcoin Trust (GBTC).

Borrowers can draw up to 25% loan-to-value (LTV).

These ETF-backed loans give investors a compliant way to unlock liquidity without selling their crypto exposure.

Now, they’re taking it further by allowing clients to pledge the actual underlying Bitcoin or Ether themselves – held securely by an approved custodian.

Wall Street’s Accelerating Crypto Pivot

JPMorgan’s move comes as other major banks also continue to wade deeper into the digital asset space:

- Morgan Stanley plans to open Bitcoin and Ether trading to its E*Trade customers in early 2026.

- State Street and BNY Mellon are expanding crypto custody and settlement services.

- Fidelity continues to offer crypto trading and retirement-account access.

- BlackRock now allows investors to swap Bitcoin directly for ETF shares, thanks to updated SEC rules.

What started as quiet experiments among big banks has now turned into a mainstream institutional product line.

Why Does It Matter?

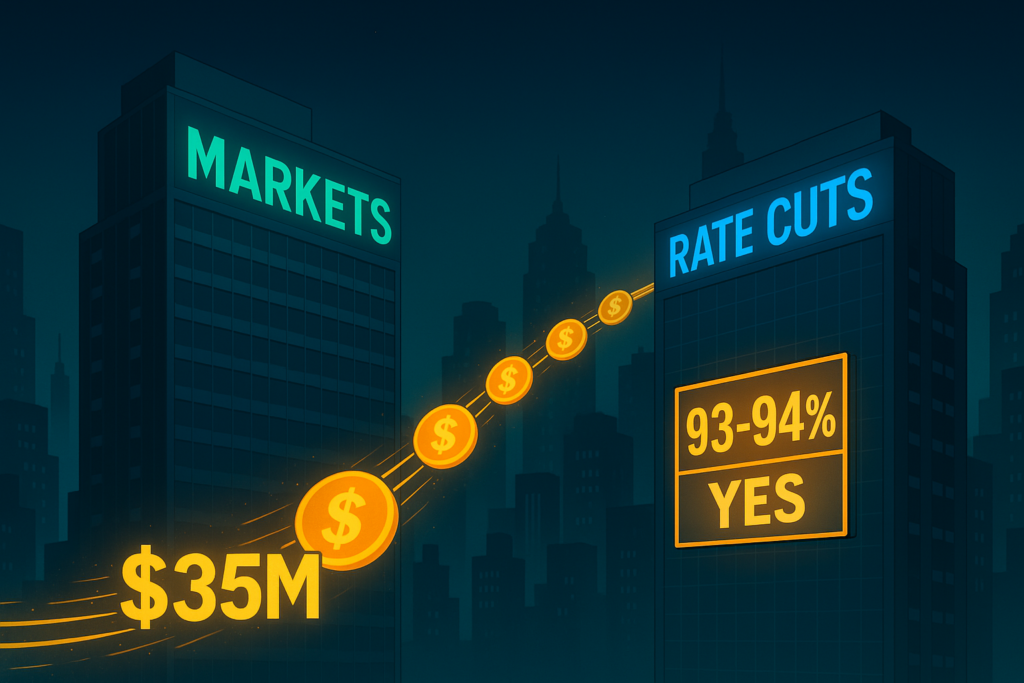

The shift shows how crypto is becoming part of the traditional financial system’s foundation.

Bitcoin – once seen as a risk or competitor – is now being used by banks to manage risk, free up capital, and meet client demand.

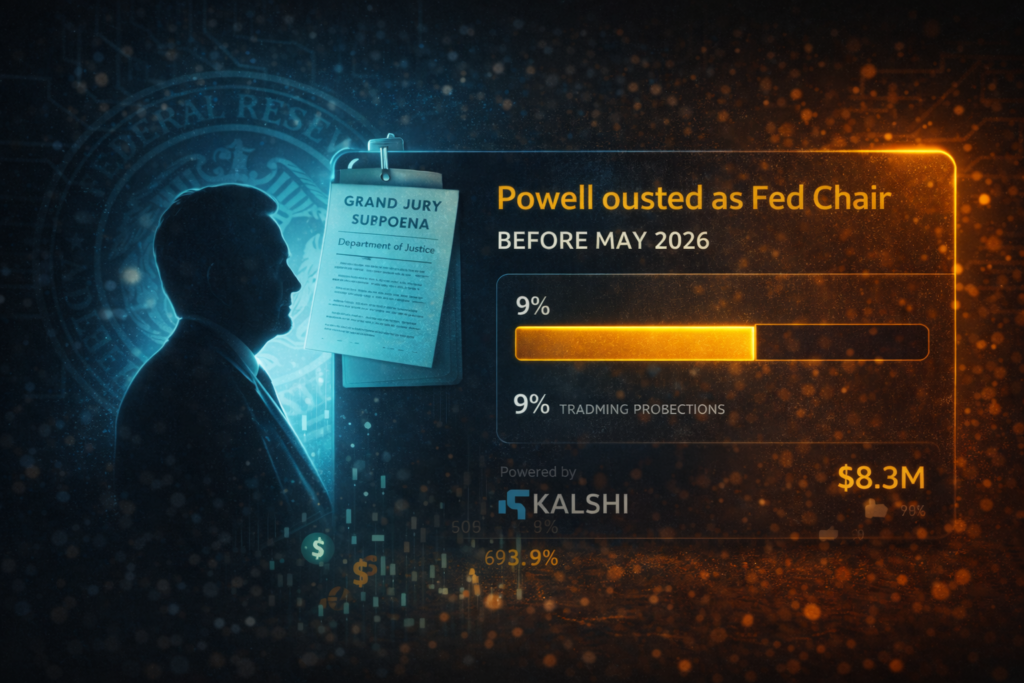

JPMorgan actually explored lending against Bitcoin back in 2022, but put that use case on the backburner due to unclear regulations.

Now, with rising client demand and more regulatory clarity, the idea is back – and they’re making it global.

Global Regulation Is Catching Up

Countries like those in the EU, Singapore, and the UAE already have clear rules for crypto custody and lending.

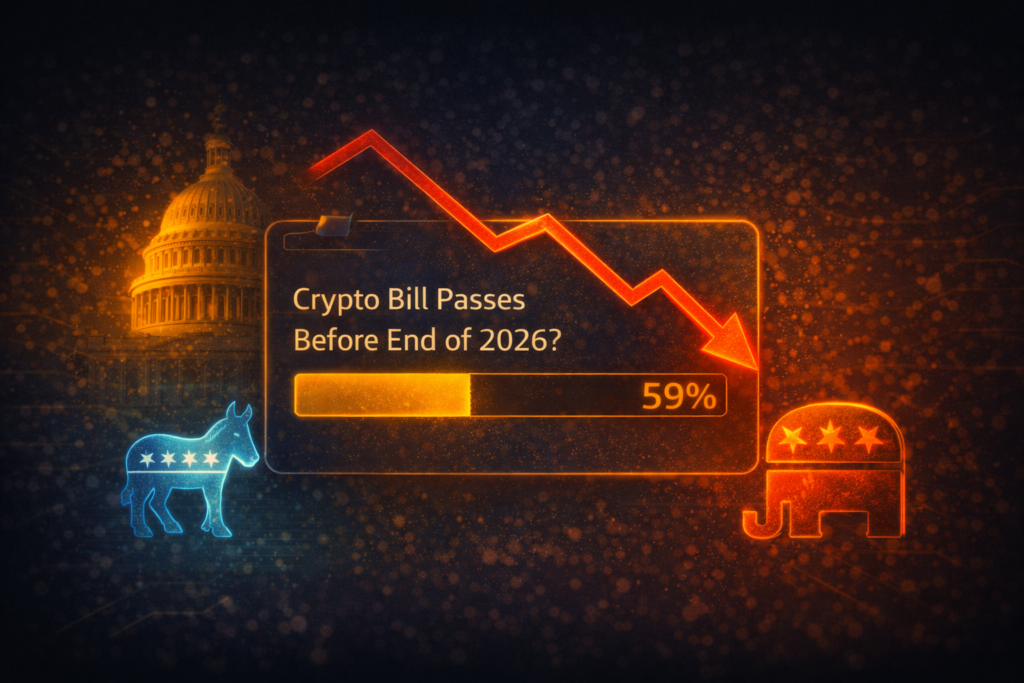

In the US, new legislation to reform the crypto market structure is moving through Congress, giving large banks more confidence to act.

A Major Milestone

JPMorgan’s crypto collateral program marks a major milestone in the synthesis of traditional finance and crypto, especially coming from America’s largest bank.

The move is cementing Bitcoin and Ether as true blue-chip assets, signaling that crypto has become part of the system rather than just an alternative.