DraftKings launched DraftKings Predictions today, bringing their sports event contracts to 38 states.

The standalone mobile app operates under Commodity Futures Trading Commission oversight through DraftKings’ wholly owned subsidiary, registered as a CFTC Introducing Broker and National Futures Association member. The platform launches initially with sports and finance contracts through CME Group’s exchange, with plans to expand into entertainment/culture markets and more.

“DraftKings Predictions is a significant milestone and reflects our ongoing commitment to delivering products that tap into the passion of our customers,” said Jason Robins, DraftKings CEO and co-founder, in the company’s announcement.

The DraftKings Predictions app will be available in 38 states—significantly broader than the 30 states where DraftKings Sportsbook currently operates. Notably, the expansion includes sports event contracts in California, Florida, Georgia, and Texas, states that lack legal sports betting.

CME partnership creates shared liquidity with FanDuel

Despite acquiring Railbird Exchange in October, DraftKings launched on CME Group’s infrastructure rather than its own exchange. Both DraftKings and FanDuel use CME’s exchange, meaning users of competing platforms will fill each other’s orders at identical prices.

“We will create an unparalleled customer experience, leveraging key strategic relationships like ESPN and NBCUniversal to provide an authentic, real-time product that moves at the speed of sports,” said Corey Gottlieb, DraftKings’ chief product officer.

DraftKings Predictions plans to connect to multiple exchanges, beginning with CME Group at launch, to give customers the greatest possible depth and breadth of markets. The company plans to integrate Railbird Exchange, LLC post-launch, which will broaden available markets, enable product innovation, and deliver advantaged economics over time.

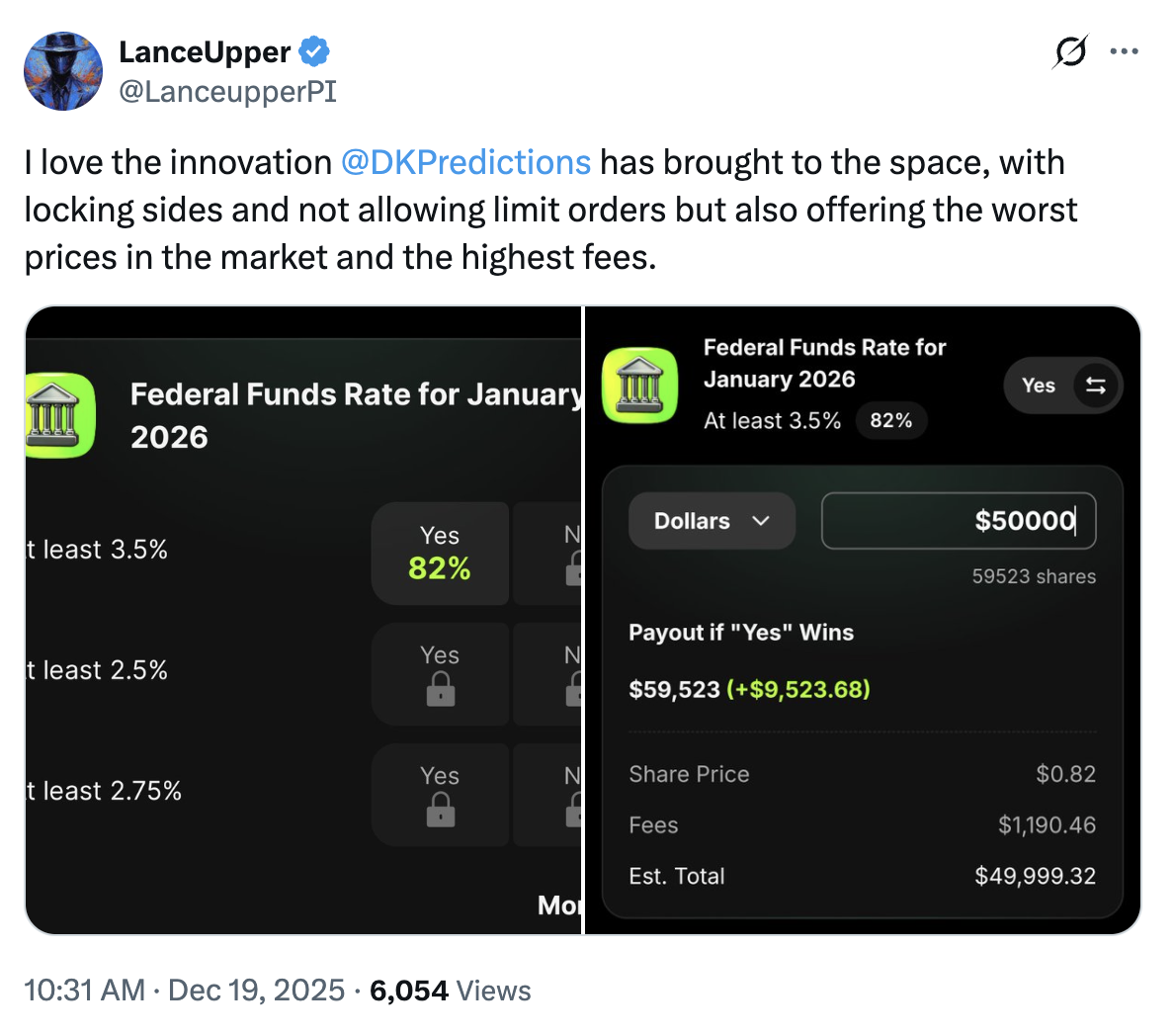

In a recent interview with CNBC, DraftKings CEO Jason Robins suggested the rising popularity of prediction markets isn’t hurting business and that traditional sports betting and prediction markets have very different offerings. If true, the product released today should have been better. It lacks the innovation that Kalshi and Polymarket have brought to the table.

Non-sports categories driving market growth

While sports accounts for about 85% of Kalshi’s notional volume, a new report from Keyrock and Dune shows non-sports categories are driving aggregate growth across prediction markets. Economics grew 905% to $112 million in combined monthly notional volumes from January 2024 to November 2025, while Tech & Science categories rose 1,637% to $123 million.

Politics remains the largest prediction market category at $1.2 billion in notional volume year-to-date. On Polymarket, politics outpaced sports by 400% in open interest during 2025. “On any given day, more resting capital sits in major categories outside of sports,” the report noted, suggesting prediction markets differ fundamentally from sportsbook models.

The report monitored Polymarket’s 95 million total trades and Kalshi’s 74 million trades over the period. Polymarket showed more balanced distribution with sports (39%), politics (34%), and crypto (18%) together driving over 90% of its notional volume activity. Polymarket recently re-launched in the US after having to exit that market in January 2022.

Navigating regulatory uncertainty

During DraftKings’ Q4 2024 earnings call in February, Robins acknowledged the nascent nature of prediction markets. “It’s early. We are watching it very actively. It’s certainly something that we have keen interest in seeing how it plays out,” he said when asked about the company’s stance on event contracts.

In a November interview, Robins elaborated on the regulatory uncertainty: “‘I don’t know’ is the easy answer to that. I don’t know how long-term it’s going to be. It’s anyone’s guess. It’s so new, and right now there are court cases and other things playing out… We have to make sure we don’t miss the boat and that we capitalize if the opportunity is there.”

The company has navigated state regulatory concerns through transparency. “We have really strong relationships with regulators, and we’ve been transparent. For example, when we were acquiring Railbird, we didn’t wait for them to read about it; we told everyone right away,” Robins told reporters. “Most of these states haven’t said, ‘You can’t do it anywhere.’ They’ve said, ‘We don’t want you partnering with someone who’s doing it illegally in our state.'”

Jordan Bender of Citizens noted the acquisition of Railbird “will help DraftKings fend off competitors and potentially double its market size by operating in states like California and Texas, where traditional sports betting is prohibited.”