The White House is turning up the pressure on crypto regulation – and this time, it’s setting a deadline. At a closed-door meeting on Monday between crypto companies, banks, and policy officials, the White House reportedly told both sides they need to reach a deal on stablecoin yield by the end of February.

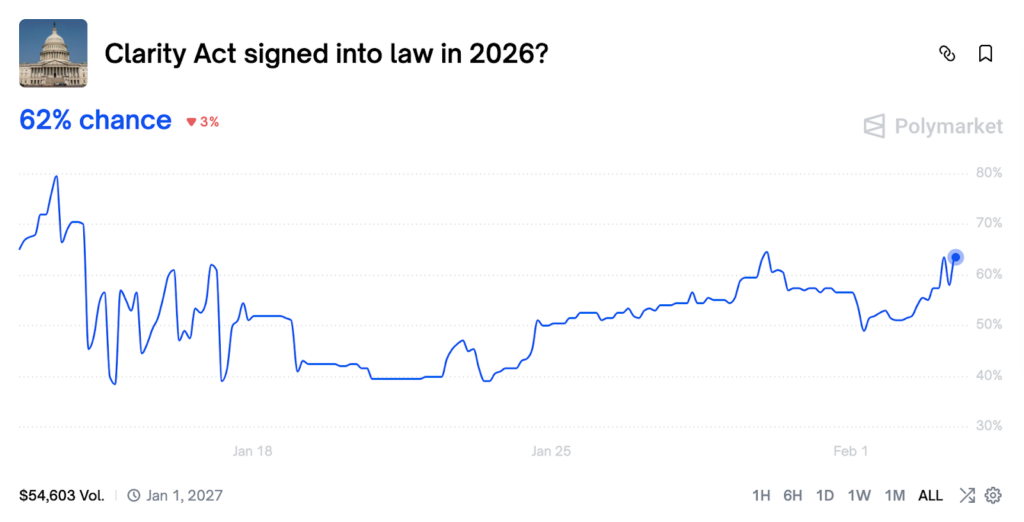

If they can’t come to terms, the broader Clarity Act (the main US crypto market structure bill) may any real chance of passing this year. Prediction markets currently put odds of the bill passing this year in the mid-50s to low-60s, down from a brief spike of 77% on Sunday evening.

That makes stablecoin yield the key issue standing between crypto and regulatory clarity.

Why stablecoin yield is the sticking point

The meeting brought together Coinbase, Circle, Ripple, Kraken, and major banking groups to address a single problem: Should crypto companies be allowed to offer rewards or interest on stablecoin balances?

Banks, of course, are strongly opposed – arguing that yield-bearing stablecoins would pull deposits out of the banking system. One estimate from Standard Chartered suggests as much as $500 billion could move from bank accounts into stablecoins if yield is allowed.

Crypto companies see it differently. Coinbase, in particular, has been clear that earning rewards on stablecoins is essential for competing globally and keeping users onshore.

Banking trade groups stand firm but still at the table

Sources described Monday’s meeting as professional and focused, but far from resolved.

After the meeting, five major banking trade groups – the American Bankers Association, Bank Policy Institute, Consumer Bankers Association, Financial Services Forum, and Independent Community Bankers of America – issued a joint statement. They thanked the administration for the “constructive conversation” and pledged to keep working on “thoughtful, effective policy around digital assets.”

Translation: no concessions yet.

The banks are holding firm on what they call “closing the loophole” – stopping companies like Coinbase from offering rewards on stablecoin holdings. Crypto firms say it’s not a loophole at all, but a basic feature of digital assets.

More meetings are already planned. They’re expected to be smaller and more technical, with fewer participants and a sharper focus on bill language. With the end-of-February deadline now set, both sides have limited time to move.

Regulators are lining up but the clock is ticking

Beyond the February deadline, the Senate Banking Committee will soon have its hands full with Kevin Warsh’s confirmation hearings – Trump’s pick to replace Jerome Powell as Fed chair. That process could take priority over crypto legislation.

The Clarity Act has already cleared the House and passed the Senate Agriculture Committee on a party-line 12-11 vote. But it still needs to get through Banking before reaching a full Senate vote. The longer that takes, the harder the path becomes.

At the same time, US regulators look like they’re coordinating more than ever. The SEC and CFTC have quietly ended their long-running fight over who controls what in crypto. They’re now working together to operate with shared definitions, coordinated rulemaking, and holding regular joint calls.

Early areas of focus include tokenized collateral, legal protections for software developers, and rules for leveraged crypto trading.

Markets are betting on resolution

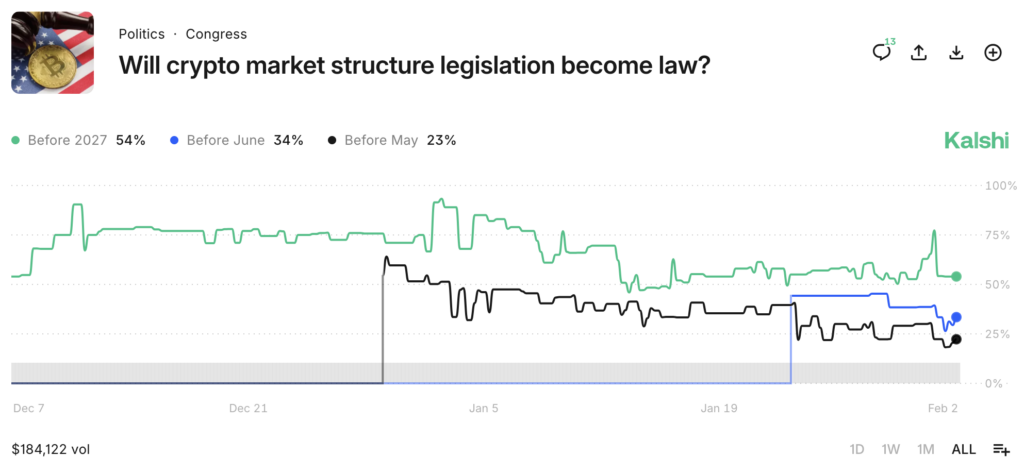

Prediction markets suggest growing confidence that some form of clarity is coming.

On Polymarket, the odds that the Clarity Act will become law in 2026 have been sitting around the low-60% range, even as crypto prices remain volatile.

On Kalshi, odds of crypto market structure legislation becoming law this year are hovering in the mid-50s. Markets are also pricing 23% and 34% implied odds of the bill passing before May or June.

Tokenization isn’t waiting

Whether the bill passes or not, tokenization is already scaling. Tokenized equities grew from $32 million to $963 million in the past year. Stablecoin payments are also expanding fast.

Visa is now settling billions of dollars a year using stablecoins, and Mastercard has said it’s ready to support them like any other currency.

Regulators are aligning, markets are moving, and the White House has made the deadline public. If the stablecoin yield issue isn’t resolved by the end of February, crypto regulation could slip again. If it is, the Clarity Act finally has a path forward.