What is Morpho?

Morpho is a DeFi protocol designed to make crypto lending and borrowing more efficient than what you get with platforms like Aave or Compound.

Traditional protocols rely on shared liquidity pools, which lump everyone’s funds together. Morpho takes a smarter approach to improve interest rates for its users.

Instead of routing everything through a pool, Morpho matches lenders and borrowers directly using a peer-to-peer (P2P) system. When a match is made, lenders earn more and borrowers pay less, since there’s no middle layer diluting the rates.

If no P2P match is available, Morpho doesn’t leave your funds sitting idle. It will either keep them in a pooled market within Morpho, or fall back to external platforms like Aave or Compound.

This ensures that your capital stays productive and liquid.

In this Morpho review, we’ll take a quick look at how the platform works, its security and risks, as well as how to use its basic functions.

Morpho Overview

| Supported Networks | Ethereum, Base, Polygon, Unichain |

| Unique Features | – Permissionless, non-custodial lending – Peer-to-peer matching for better rates – Customizable, isolated lending markets – Morpho Vaults for optimized yield |

| Governance Token | $MORPHO |

| Audits | 25+ including Trail of Bits, Spearbit, and others |

| Founded By | Paul Frambot (CEO), Mathis Gontier Delaunay, Merlin Egalite, Julien Thomas |

How Does Morpho Work?

The Morpho protocol is built around two main components: Morpho Blue and Morpho Vaults.

- Morpho Blue is where all the individual lending markets live. It lets users lend or borrow specific assets with customizable terms, like what kind of collateral is used or the loan-to-value ratio. These markets aim to match users directly (P2P), but they also come with their own liquidity pool and can fall back on Aave or Compound if needed.

- Morpho Vaults are a more hands-off way to earn yield. Think of them as smart strategies put together by third-party curators. When you deposit into a vault, the curator spreads your funds across different Morpho Blue markets. The goal is to get the best yield possible – starting with P2P matches, but rebalancing across pools or even other protocols depending on what the market’s doing.

In a nutshell, Morpho automates the search for the best lending or borrowing rates.

It prioritizes efficient peer-to-peer matching, but still keeps traditional protocols like Aave and Compound in the background as a fallback.

Maximizing User Control

Morpho gives users more control than most DeFi protocols.

You can choose which assets to lend or borrow, define your own risk exposure, and even customize how loans are managed.

Unlike the typical variable rates in DeFi, Morpho also offers fixed-rate, fixed-term loans – making it a rare option for users who want predictability.

It’s also super developer-friendly, letting builders create their own vaults and strategies. This opens the door for more creative ways to earn yield.

That flexibility has caught the attention of major players like Coinbase, which uses Morpho to power parts of its crypto lending business.

Morpho Founders

Paul Frambot (CEO), Mathis Gontier Delaunay, Merlin Egalite, and Julien Thomas founded Morpho in 2021.

Frambot comes from a strong blockchain engineering background and leads the project with a nonprofit mindset. He has previously stated that he would rather reinvest revenue back into the protocol than pay out to token holders.

That focus sets Morpho apart in DeFi, especially with its push for fixed-rate, fixed-term loans and its effort to bridge the gap between decentralized and traditional finance.

Morpho Funding

The team has raised almost $70 million from big-name backers like Ribbit Capital, a16z Crypto, Variant, Coinbase Ventures, and Pantera Capital.

Ribbit led a $50 million round in 2024 that brought in over 40 investors, showing strong support from across the industry.

Morpho’s long-term, infrastructure-first approach has earned it a solid reputation as one of the more credible and mission-driven projects in the space.

Governance

Morpho’s governance is powered by its MORPHO token and a DAO, giving token holders the ability to vote on protocol upgrades and key decisions.

Voting happens through Snapshot, and the DAO manages assets and proposals. This includes things like which markets to create, or how to allocate treasury assets.

In 2025, Morpho Labs officially became a subsidiary of the Morpho Association, a nonprofit controlled by the DAO. The move intends to shift power away from equity investors and toward the community.

On paper, it’s a setup built for decentralization. But in practice, it’s still a little centralized:

As of mid-2025, only a small number of wallets were actively voting, and one wallet held over half the voting power.

A lot of MORPHO tokens were still non-circulating, and major holders (like the founding team, early investors, or the Association) still controlled most of the supply.

That being said, Morpho is heading in the right direction. With a nonprofit model, an open protocol, and strong transparency, it’s laying the groundwork for more community-driven control.

Full decentralization will take time, as tokens get distributed more widely.

Security and Audits

Morpho has had at least 25 smart contract audits by well-known security companies like Trail of Bits, Spearbit, and OpenZeppelin.

These audits looked at everything from the main protocol to the token and app, showing they take safety seriously and keep getting reviewed as they grow.

Morpho App Review

Dashboard

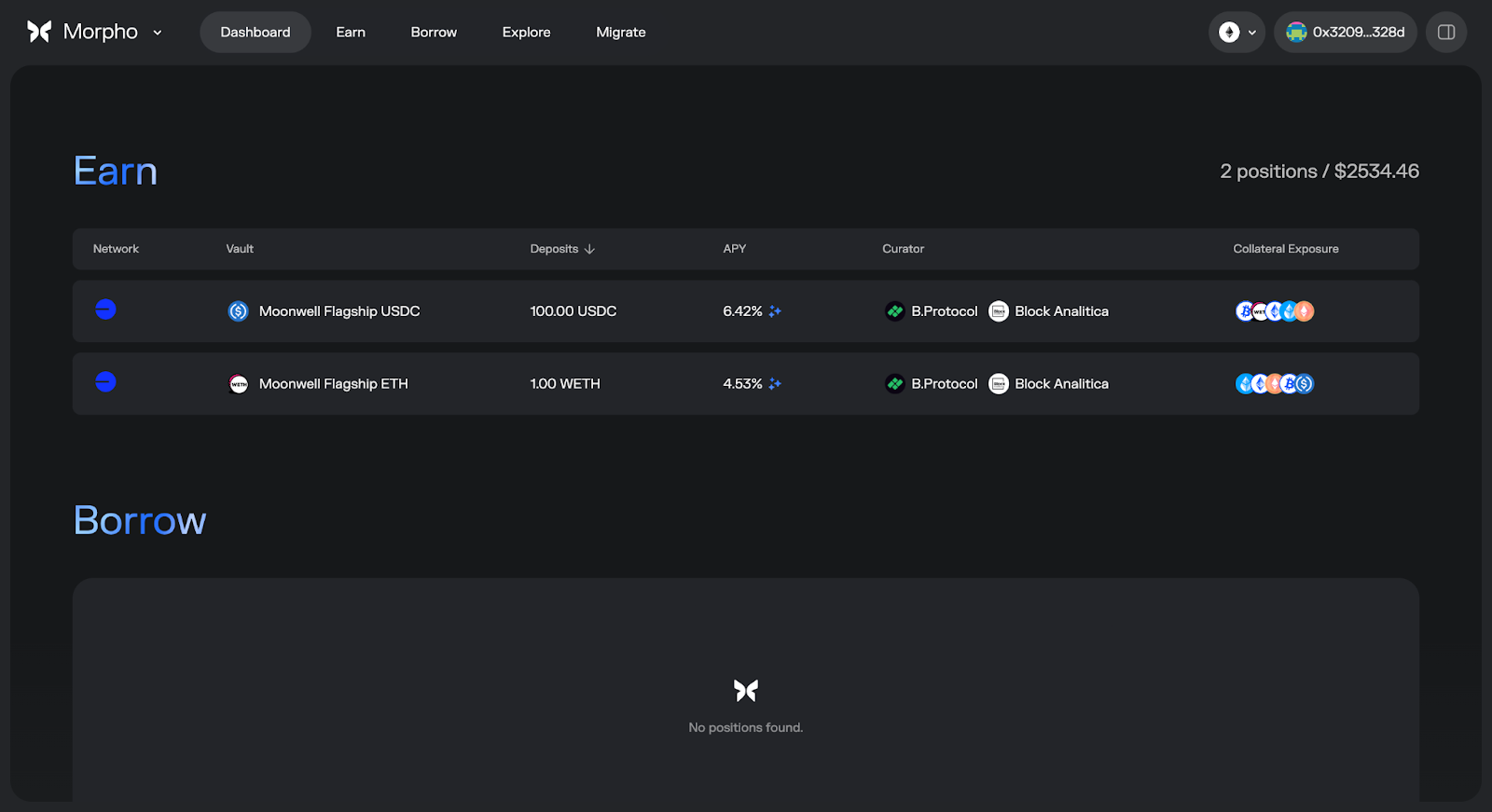

The Morpho app opens with a clean, all-in-one dashboard where you can easily see and manage all your positions, both for earning and borrowing.

Each position shows key details like the network it’s on, the specific vault, the asset you’ve deposited, the amount, the interest rate, and more – all in one place.

Earn Tab

“Earn” is your main hub for browsing and interacting with Morpho Vaults. This is where Morpho users can deposit funds into the protocol in order to earn an interest rate.

Right at the top of the Earn page, you get a quick snapshot of your current positions on the selected network. This is useful for checking the status of your positions if you’ve already made deposits.

Below that, you’ll see a full list of available vaults. These are sorted by total deposits, but you can easily filter or order the list by:

- The token you want to deposit (e.g. USDC, ETH)

- Your preferred curator (the wallet address managing the vault’s risk strategy and allocations).

Each vault listing also shows key info at a glance, including the Vault name, total amount deposited, the curator, accepted deposit assets, and current APY (the annual yield estimate).

Inside a Vault

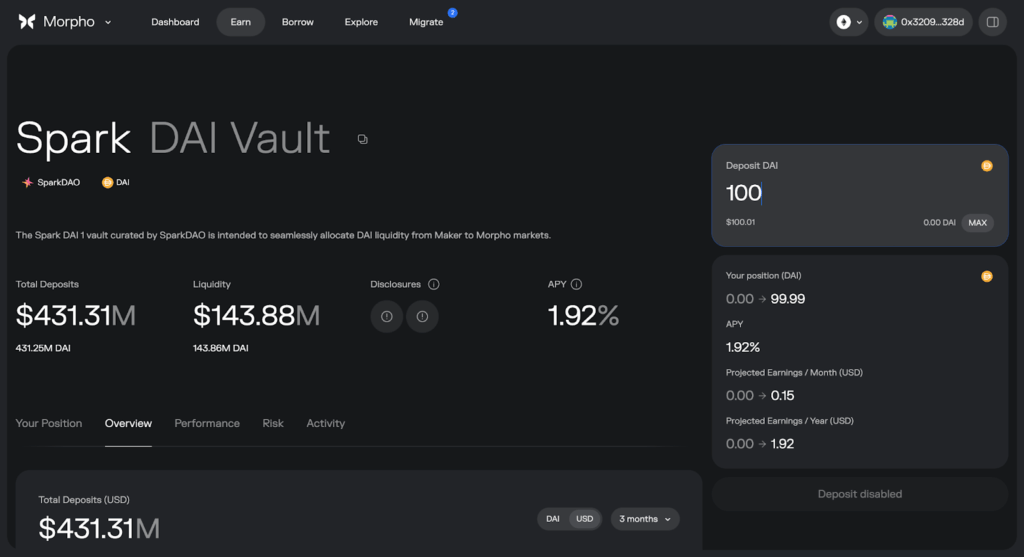

Clicking into a specific vault gives you a clear overview of everything you need to know.

You’ll see an input field to make a deposit, along with a simulated APY and your projected earnings (both monthly and yearly) shown in dollar terms.

It also shows total deposits, current liquidity, and any relevant disclosures for the vault.

Additional tabs let you track your own position (if you have one open), view the vault’s past performance, check the performance fees, and see where the vault is allocating funds (its current market exposure).

There’s also an activity tab that shows recent on-chain transactions going in and out of the vault.

Here’s how Earn works:

- Pick a Vault: Choose a vault that accepts your preferred asset (like USDC or ETH). Each one has a curator behind it who decides how and where the funds are allocated.

- Funds Flow Into Morpho Markets: Your deposit gets routed into specific Morpho Blue markets chosen by the curator – ideally into peer-to-peer matches first, which offer higher yields.

- Earn Yield Automatically: As borrowers use those markets, they pay interest. That interest flows back to you. All lending is overcollateralized, so borrowers have to put up more than they take out – helping manage risk.

Borrow Tab

Borrow is where Morpho users can pledge collateral and borrow against it – giving you access to liquidity without needing to sell your assets.

Just like in Earn, there’s a list view that shows all the key market details at a glance.

For Borrow, this includes the collateral asset, the asset you can borrow, loan-to-value ratio (LTV), total market size, available liquidity, borrowing rate, and which Vaults are currently using that market.

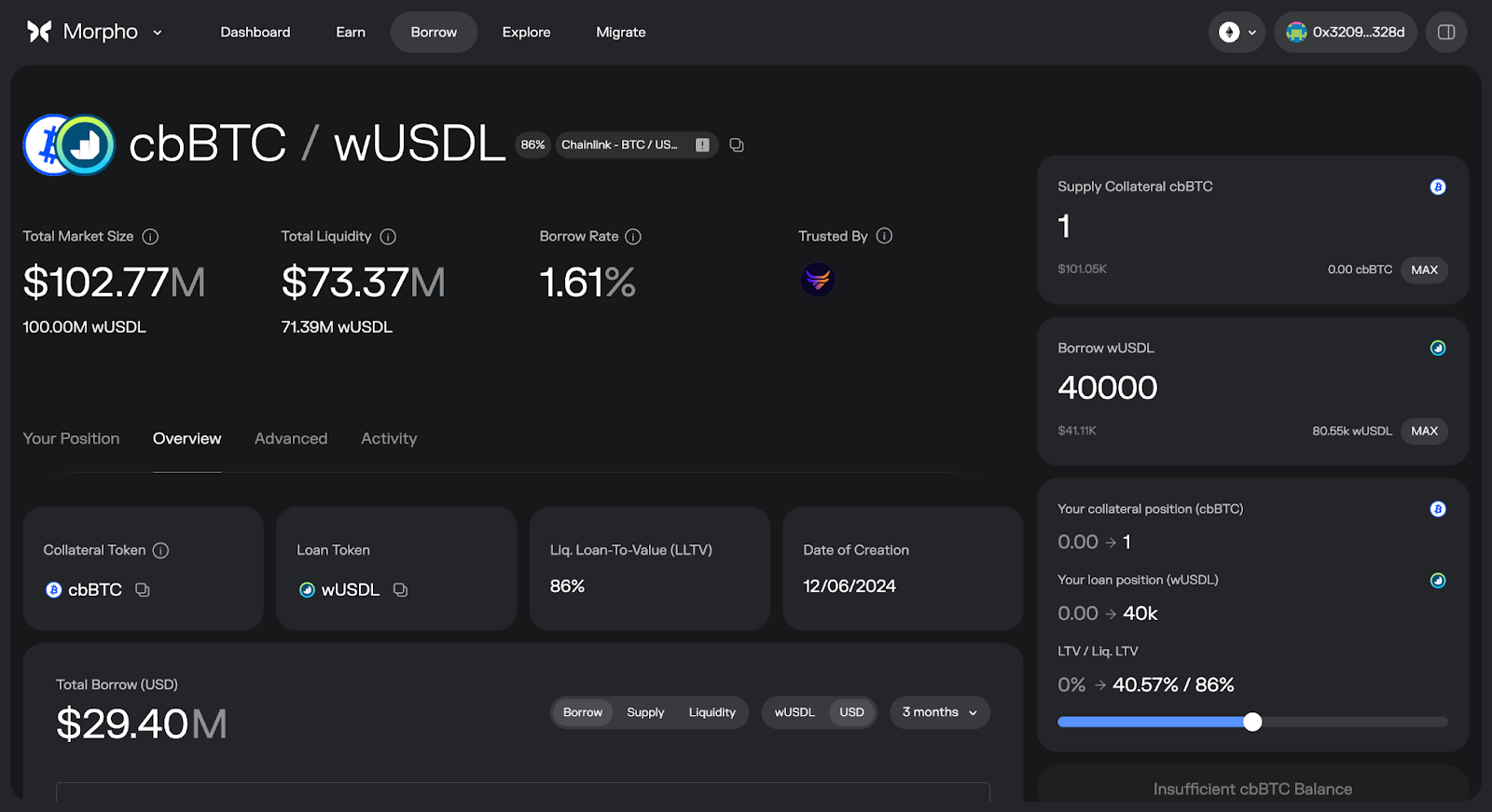

Clicking into a market brings up a familiar interface – but instead of depositing to earn, you’ll supply collateral and choose how much to borrow. You can adjust your LTV and see where your liquidation threshold sits, before opening a position.

You’ll also find detailed market stats, historical interest rates, and everything you need to make informed borrowing decisions.

Here’s how Borrow works:

- Provide Collateral: Deposit the asset you want to borrow against. You can only borrow from the market where you’ve supplied collateral, so if you want to borrow across multiple markets, you’ll need to deposit into each one separately.

- Borrow Liquidity: Once your collateral is in place, you can borrow up to a certain limit based on its value and the market’s available liquidity. Interest is charged at a variable rate set by the market’s interest rate model.

- Monitor Your Position: Keep an eye on your loan-to-value (LTV) ratio. If it climbs too high, your position becomes eligible for liquidation.

- Repay Debt: When you’re ready, repay what you borrowed along with any accrued interest to close out your position and unlock your collateral.

Explore Tab

Lastly, there’s the Explore tab (specifically, the “More on Morpho” section). This is your gateway to everything happening across the Morpho ecosystem.

It brings together aggregated data from all Morpho markets and chains, giving you a high-level view of activity, liquidity, and usage across the protocol.

More importantly, it also serves as a central hub for key protocol features and community tools.

From here, you can delegate your MORPHO tokens, participate in governance votes, access the Morpho forum, dive into technical documentation, and track your Morpho rewards.

Whether you’re a casual user or a protocol contributor, Explore is where you stay connected to the broader Morpho network.

Morpho Risks

As with any DeFi protocol, there are some risks to consider when using Morpho. These include the following:

- Curator Risk: A curator manages each Vault and chooses which markets to allocate funds to. If the curator makes poor decisions (bad strategy, poor timing, or misjudging risk) your deposited funds could earn less yield or be exposed to higher risk.

- Smart Contract Risk: As with any DeFi protocol, there’s always the risk of bugs or vulnerabilities in the code. Even though Morpho has undergone 25+ audits, exploits or unexpected interactions with other contracts could still occur.

- Stacked Complexity: Morpho builds additional layers on top of existing lending markets (like Morpho Blue). This means more moving parts on top of the base lending markets themselves. More complexity means more potential points of failure.

- Liquidation Risk (for borrowers): If you’re borrowing, your position can be liquidated if your LTV gets too high. While this is standard for overcollateralized lending, it still requires active monitoring, especially in volatile markets.

- Market Liquidity Risk: If liquidity in a specific market dries up or demand to borrow significantly changes, it might be harder to exit your position quickly or efficiently.

- Governance Risk: MORPHO token holders vote on protocol changes. Changes could negatively affect the protocol’s direction or safety if governance becomes concentrated in a few hands or proposals are poorly managed.

- Oracle Risk: LTV calculations, liquidations, or interest rate adjustments could be impacted if oracles providing price feeds to Morpho markets fail or are manipulated.

Morpho Review Summary

Morpho stands out by making lending and borrowing more efficient through peer-to-peer matching, customizable markets, and curated Vaults.

It gives users more control, better rates, and a clean, intuitive app experience.

While there are risks – like smart contract bugs, curator missteps, and governance centralization – the protocol has strong audits, solid backing, and a clear focus on long-term sustainability.

If you’re comfortable with DeFi and want more flexibility and performance than traditional lending pools offer, Morpho is well worth considering.