As prediction markets rise in prominence, Polymarket CEO Shayne Coplan and Kalshi’s Tarek Mansour represented a new generation of financial exchanges on Monday’s SEC-CFTC joint roundtable in Washington, DC.

Despite these companies’ ascent being largely driven by the sports markets they offer, sports event contracts were not discussed during an hour and 15-minute discussion, the second of the day’s three panels.

Instead, moderators and panelists stuck mainly to the theme of “Regulatory Harmonization Efforts” between the two agencies, and the presence of Coplan and Mansour served to reinforce their claim that the contracts they offer are bona fide financial products.

“It is really refreshing and inspiring to see how far we’ve come in terms of regulators willing to have us here, willing to have us engage,” Mansour said in his opening remarks.

Update: A day after the roundtable, the CFTC publicly acknowledged sports prediction markets for the first time. In an advisory note to staff, the CFTC warns that prediction market participants should be aware of potential legal and regulatory action by states (h/t Sportico’s Dan Bernstein). In a footnote, the agency says it “has not, to date, made a determination regarding whether [self-certified sports] contracts involve an activity enumerated or prohibited” under the Commodity Exchange Act.

Kalshi, Polymarket fans of self-certification

In addition to allowing prediction markets to offer what states, tribes, and many others in the gambling industry believe is too close to sports betting to be distinguished from it, another criticism of the CFTC is its self-certification process.

The two are clearly related.

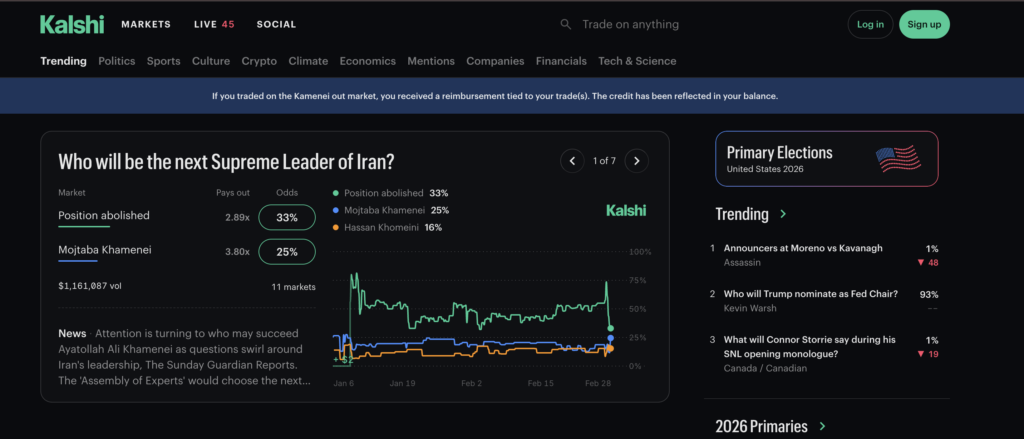

As a designated contract market (DCM), for example, Kalshi files a self-certification letter when it wants to offer a new product. Unless the agency objects, the company can list the product in 24 hours. We’ve seen this play out as Kalshi has added football point spreads, over/under totals, player props, and parlays to its platform.

Mansour trumpeted prediction markets as a new category of financial instruments that are going mainstream among retail investors. Kalshi offers the most markets in the industry, per Mansour, on pace for around 2,000 this year.

A cumbersome approval process like the SEC’s would hamper such innovation, he suggested.

“Retail is asking for increasingly more dynamic products,” Mansour stressed. “They want things on a monthly, weekly, sometimes daily, sometimes even hourly basis. … The world is evolving, and in some ways, we need some of these rules to evolve. So we are obviously big fans of self-certification.”

Kalshi and Polymarket disagree on plenty of things, but Mansour and Coplan are on the same page regarding self-certification.

“Once you build something on a blockchain, it’s very difficult to map that to the existing regulatory matrix, and I think that’s where exemptive authority comes in,” said Coplan, whose platform is a crypto-based exchange.

“The innovators know about, ‘OK, how can we go and build this, how can we go and implement a smart contract that provides investor protection,’ a lot better than any regulator is gonna know, obviously.

“I think that puts the onus on players like us and other players in the space to go and get inventive, do what we do best, be innovative, and come up with solutions that both embody the sort of spirit of the rules that you see in traditional financial regulation, whether that be with the CFTC [or] the SEC, with what’s capable of the technology.”

Incumbents want level playing field

CME Group chairman Terry Duffy was among the panelists pushing back on the difference in the SEC’s treatment of incumbents like himself, compared to the path of little resistance the CFTC lays out for the innovators.

“I’d really like to understand why [innovation] would be exempt, [when they are] essentially the same products that core institutions have been trading for years,” Duffy probed.

“I appreciate the innovation up on this panel, and I think it’s critical to the future, but you cannot have a double standard whether it’s in derivatives or securities. You have to have a single standard.”

Duffy recalled pulling an application that sat in front of the SEC for six years after he filed it in 2016, a sharp contrast to the CFTC’s 24-hour self-certification process.

“When we talk about these innovation exemptions, a lot of them are the exact same products that are being traded today under a different name, under a different regulatory regime. Maybe you can’t make it fit on the blockchain, but that’s not the problem of the core institutions.”

If the panel brushed up against sports betting at all, it was when Duffy noted CME’s joint venture with FanDuel. The announcement of the partnership in August made no mention of sports, but it would be difficult to convince most gambling industry observers that sports is not on the companies’ radar.

“I love innovation. Love it. Can’t go forward [without it]. I just did the deal with FanDuel, as you know, I’m all in on this stuff,” Duffy continued. “At the same time, you can’t exclude incumbent players in a different way.”

Countered Coplan, “If you want young entrepreneurs to pursue the American dream, to innovate in American finance, and build products that can be competitive on a global scale as well as in America, it’s net negative from a regulatory perspective to drive that offshore.”

Duffy likes Kalshi, except for the fees

Regulatory inconsistencies aside, incumbents on the panel lauded the energy and innovation being injected into finance.

“It’s really wonderful to have folks like yourselves up here and participating in the discussion about how we go forward,” Duffy said to Mansour, Coplan, and Arjun Sethi, co-CEO of crypto exchange Kraken.

“I am massively excited about the future, massively excited,” Duffy exclaimed.

He even shared an anecdote about himself, a Kalshi user, likening – inadvertently perhaps – the prediction market to gambling.

“I was on Tarek’s market all week, and like a junkie – I was in Las Vegas with a bunch of clients – the casino never saw me because I was on his platform the whole time screwing around.”

Mansour asked if Duffy made money trading on Kalshi.

“You made money. I broke even. A lot of fees over there, buddy,” Duffy responded light-heartedly. “People bitch at me all the time about the fees, I gotta take the opportunity. A lot of fees on that Kalshi thing.”

That’s a complaint about Kalshi growing louder from the sports betting crowd, too.