Advertising during the Big Game is big business, and now, viewers at home can place real money on which brands will air ads for Super Bowl 60. But, should they?

Super Bowl commercial markets at top prediction market exchanges Polymarket and Kalshi have already attracted a combined $2.1 million in trading volume with less than a week to go. Despite their popularity, who will run a Super Bowl ad is a prime example of a prediction market that is prone to information leaks and potential manipulation.

Betting on what companies will invest in a Super Bowl ad may be a fun way for viewers to engage even further, beyond Super Bowl game predictions, but it’s wise to understand the nature of the market before you invest.

What to know about Super Bowl ad prediction markets

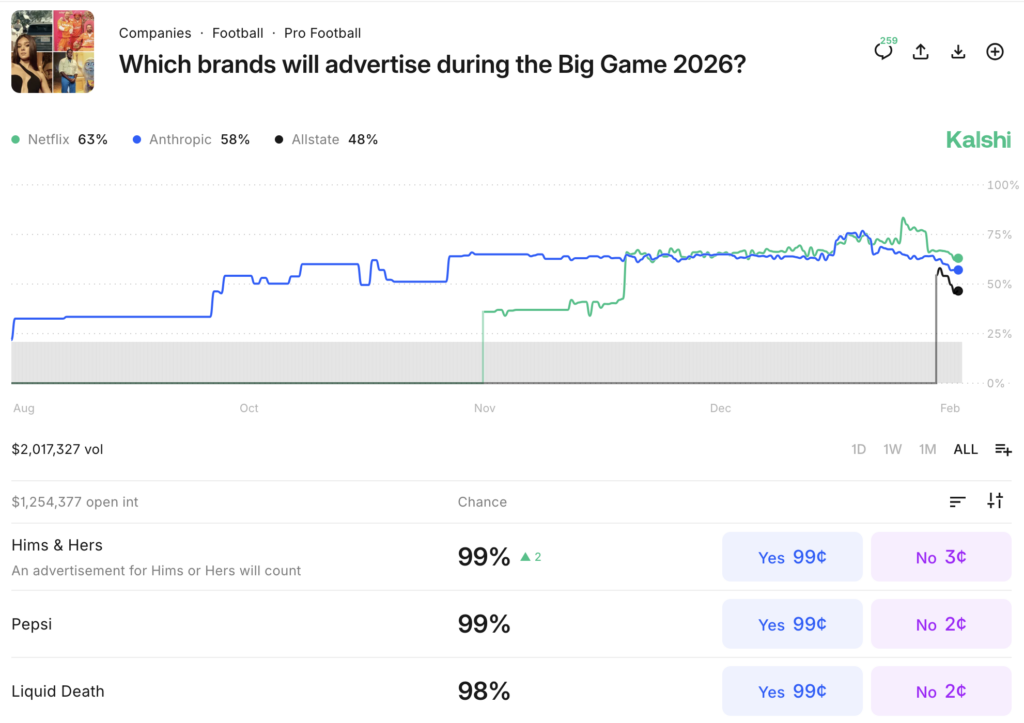

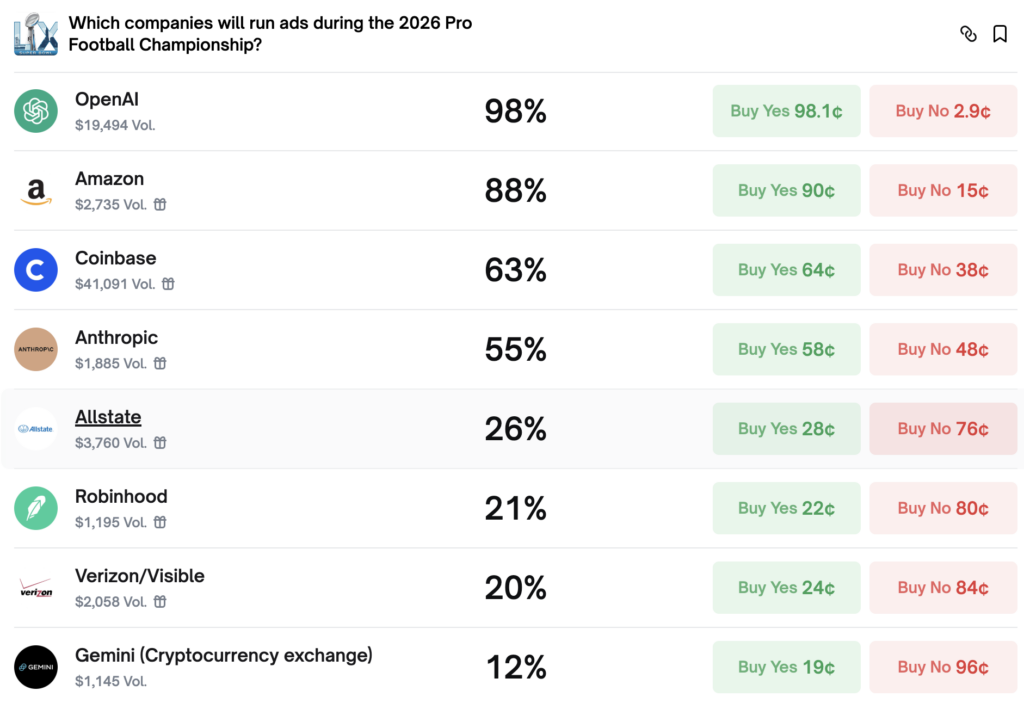

Both Kalshi and Polymarket have markets asking “Which brands will advertise during the Big Game 2026?” Kalshi’s market has over $2.0 million in trading volume so far while Polymarket’s total volume is over $119,000. The two platforms offer different options (called “strikes”) to trade on, but both include popular ones like OpenAI, Coinbase, Allstate, Anthropic, Perplexity and Nvidia.

Traders will lean on a number of strategies for predicting which brands will run ads, including studying past Super Bowl advertising trends and publicly released data or company insights for this year. And there are plenty of public clues out there already.

CNBC reported that NBC has sold out all of its ad spots, selling at an average of $8 million per 30-second commercial. Mark Marshall, NBC’s chairman of global advertising and partnerships, said that technology companies bought the most spots this year, though the channel has a broad definition of “tech”: for example, Uber Eats is considered a tech company. He also said that 40% of advertisers this year are first-time Super Bowl advertisers.

Unlike other elements of the Super Bowl like who will win or how many rushing yards a player or team will have, some of the ad spots are already public knowledge. Complicating this market even further, nearly all brands release their commercials in advance, usually to drum up interest. That means if you do choose to trade in this market, it’s critical that you are up on the latest information from reliable industry sources.

Both Adweek and Ad Age have ongoing coverage of every Super Bowl ad and any brand that opts out. Some brands have already confirmed Big Game advertising plans. For example, Adweek reports that Google has confirmed it will advertise during the Super Bowl; thus, Google’s odds have spiked to 99% at Polymarket.

The Wall Street Journal reported that OpenAI will advertise during the Super Bowl, which explains why it’s trading at 97% on Kalshi and 98% on Polymarket. Liquid Death has also confirmed to Adweek that it will advertise during Super Bowl 60, resulting in 99% odds on Kalshi.

These markets won’t pay out until Feb. 8 after the ad actually airs, but they appear all but a sure thing at this point. In prediction market trading, these trades are referred to as “bonds,” bets that require a large investment for a small payout, but are as close to a sure thing as you can get in prediction trading. But remember, all trades involve risk, and it’s not a done deal until the market resolves in your favor. For many, the payoff is not worth the high investment.

Insider trading questions in Super Bowl ad markets

Meanwhile, markets for brands that haven’t publicly confirmed plans carry inherent risk of their own — namely, potential for insider trading.

Hundreds, if not thousands, of people know a commercial will air during the Super Bowl before it airs. A Super Bowl ad just doesn’t happen by chance: a marketing executive needs to okay the budget, creative advertising agencies need to mock up the spot, film companies need to shoot it, and television broadcasters need to approve it.

Consider the web of individuals that may be aware of a commercial to air during the Super Bowl: Unrelated workers at Pepsi overhear that there’s going to be a Super Bowl commercial; people shooting the actual ad know it’s for the Big Game; people at NBC, home of Super Bowl 60, also know that Pepsi is going to air a spot because they need to make room for it in the broadcast. On top of that, the media knows, often to promote items, cluing these outlets to watch (i.e. cover) the commercial. Any one person aware of the ad plans could share that knowledge with friends, family or others, and so on.

The problem of policing insider trading prohibitions

Given that many already know the outcome, these markets are far more likely to have some amount of trading based on insider knowledge. In and of itself, trading on information that is not public knowledge is not against the law (or against CFTC regulations) in prediction markets.

However, exchanges like Kalshi contain internal prohibitions against insider trading, but the policing of these rules is not publicly documented. From Kalshi’s Rulebook:

- “If a Trader is an Insider that has access to material non-public information that is the subject of an Underlying of any Contract or that has the ability to exert any influence on the subject of an Underlying of any Contract, that Trader is prohibited from attempting to enter into any trade or entering into any trade, either directly or indirectly, on the market in such Contracts. An “Insider” means any person who has access to or is in a position to have access to material nonpublic information before such information is made publicly available. A Trader who is an employee or affiliate of a Source Agency for any Contract is prohibited from attempting to enter into any trade or entering into any trade, either directly or indirectly, on the market in such Contracts.”

- “If a Trader is a decision maker, either directly or indirectly, or has any influence, either directly or indirectly, no matter the scale and importance of the influence, on the outcome of the Underlying (event) of any Contract, that Trader is prohibited from attempting to enter into any trade or entering into any trade, either directly or indirectly, on the market in such Contracts.”

In the case of Super Bowl ads, these restrictions would likely be extremely difficult to police considering the high number of people potentially privy to company plans. On Polymarket’s global exchange, which is where traders can bet on the ad spot markets, there are no insider trading prohibitions and traders’ identities are anonymous, not public with no KYC requirements. Unlike Kalshi, Polymarket’s non-US exchange does not operate under CFTC regulations and is built on the blockchain.

Other potential market manipulation also possible

Because these markets are prone to insider trading, a fact that many market participants are aware of, they are also subject to another form of potential market manipulation.

Economist Rajiv Sethi wrote in a Substack post about a prediction market manipulation tactic called “spoofing,” that can take place due to awareness of the potential of insider trading. He noted that “there is money to be made by generating such patterns [of insider trading] in the expectation that one’s trades will be aggressively copied.”

“If you can lead others to believe that you are trading on inside information, and this causes them to mimic your behavior, price movements can be amplified in ways that let you make substantial gains,” writes Sethi. “This doesn’t require you to possess any inside information at all. The strategy relies only on a presumption among other market participants that insider trading is widespread on the platform.”

The potential for spoofing creates another potential form of manipulation that could work against traders who aren’t sure if odds are spiking based on actual (insider) knowledge or something else. Another good reason to take caution in trading these markets.

Prediction markets banned from advertising

Despite the many NFL championship-related prediction markets available for trading, prediction market platforms are banned from advertising during Super Bowl 60. While some leagues such as the NHL, MLS, and UFC have embraced them, the NFL remains skeptical.

NFL EVP Jeff Miller said back in December that the league thinks prediction markets lack “safeguards,” including “information-sharing requirements, integrity monitoring, prohibitions on easily manipulated markets, official league data requirements, know-your-customer protocols, and problem gambling resources.”

So, they won’t be part of Super Bowl LX or any broadcast. Front Office Sports confirmed that prediction markets are on the NFL’s “prohibited list,” disqualifying them from advertising during its games. Sports betting brands are fair game, though. DraftKings and FanDuel, for example, will have an advertising presence for Super Bowl LX, though they cannot advertise their recently launched prediction market products during the Big Game.

Just remember, if you do decide to get skin in the game on what brands will or won’t advertise during the Super Bowl, you are doing so at your own risk.

Note: Valerie Cross also contributed to this article.