Polymarket has relaunched in a limited beta in the U.S., announcing that it is letting a small number of American users trade contracts on outcomes for sports, politics, pop culture, and more.

Founder Shayne Coplan confirmed the news at Cantor Fitzgerald’s Crypto and AI Infrastructure Conference in Miami, calling the U.S. exchange “live and operational.” Bloomberg later reported that the company began onboarding select accounts as part of a compliance-monitored testing phase.

While only a sliver of users currently have access, the relaunch represents a pivotal moment for prediction markets in the U.S.

A Regulated Return After a Rocky Exit

Polymarket’s path back to the U.S. has been anything but smooth.

In 2022, the Commodity Futures Trading Commission (CFTC) fined the company $1.4 million for operating an unregistered event-based derivatives exchange. As part of the settlement, the platform shut off American access and moved operations offshore.

That could’ve been the end of the story. Instead, Polymarket spent the past two years restructuring and working toward a compliant re-entry. The CFTC later issued no-action relief, effectively allowing the company to restart operations through its regulated subsidiaries.

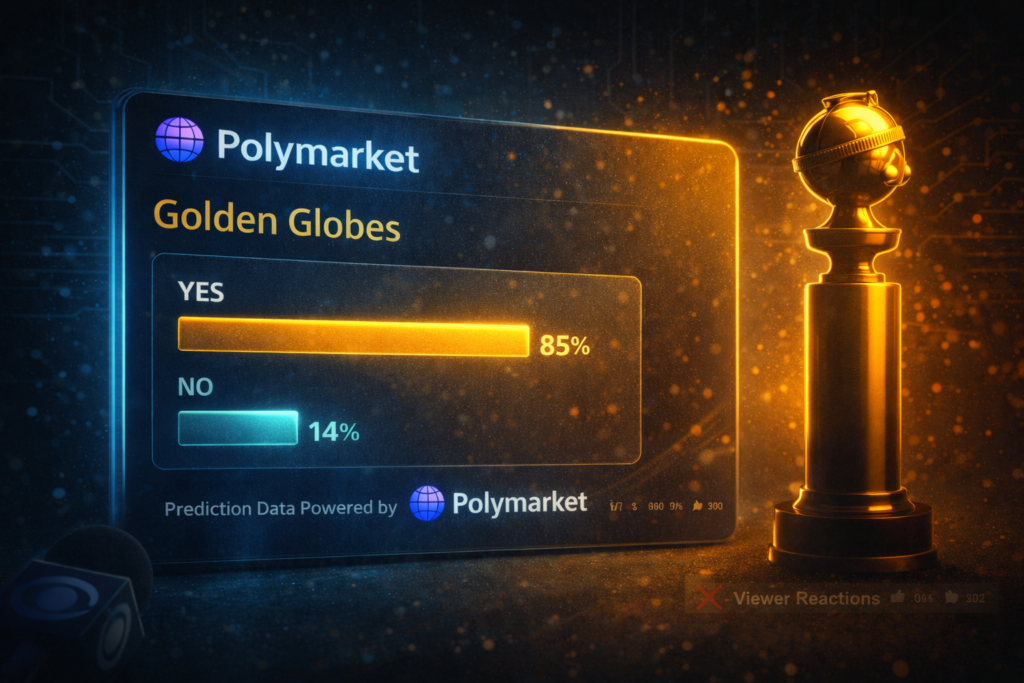

The company’s new architecture gives it the infrastructure to offer event contracts legally within U.S. borders. That means trades on outcomes like “Top Spotify Artist 2025” or “Who will Donald Trump pardon?” can now clear under an approved derivatives framework rather than the gray-area mechanics of offshore crypto markets.

It’s a subtle but significant distinction that could decide how prediction markets evolve in the U.S. over the next few years.

The Competitive Landscape Is Heating Up

Whenever Polymarket does launch (there’s a 94% chance it will happen this year, according to Polymarket), the U.S. prediction market space will look very different.

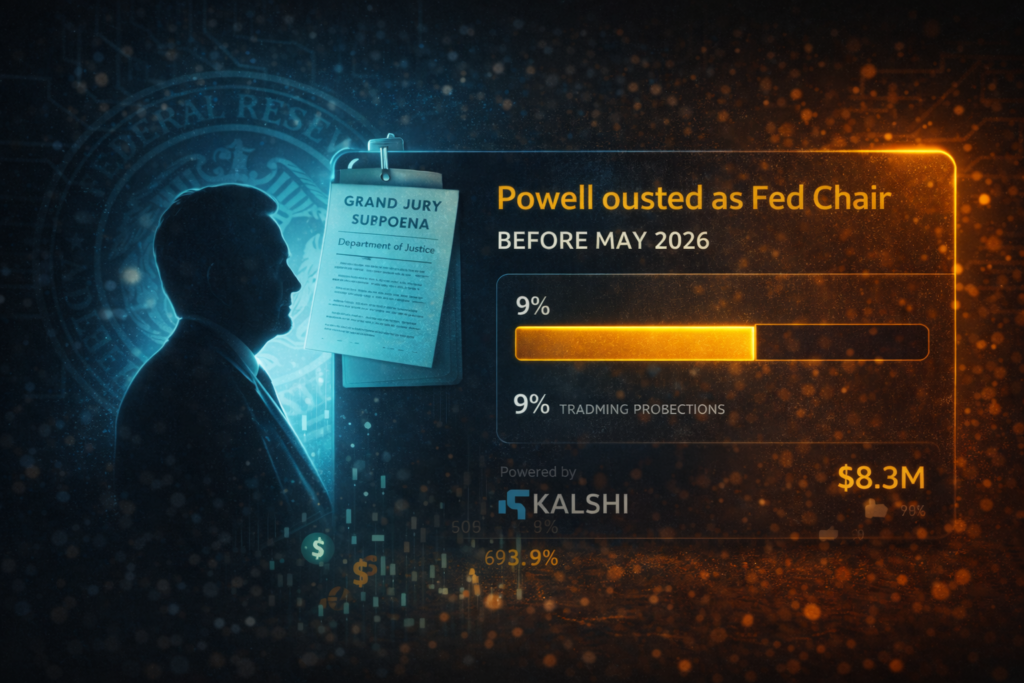

Kalshi has established a strong foothold as the CFTC’s flagship exchange for event contracts. FanDuel plans to roll out a federally compliant “Predictions” product this winter. DraftKings has confirmed it’s building something similar. Even Trump Media has entered the fray through a partnership with Crypto.com, launching “Truth Predict.”

ProphetX, a sports-first platform, filed for dual CFTC registration as both a Designated Contract Market and Derivatives Clearing Organization, a move that could let it operate nationwide.

By the time Polymarket fully reopens, it will be rejoining an ecosystem that has evolved rapidly. It is now a space where sports and politics are no longer separate verticals but converging pillars of the same prediction economy.

The Road Ahead

Polymarket’s current holdup appears to be a result of the federal government running out of money.

According to a Front Office Sports report, the platform’s long-awaited U.S. relaunch was effectively frozen by the federal shutdown, which began just one day after Polymarket filed its self-certification of event contracts with the CFTC on Sept. 30. The shutdown ended on Wednesday, but it could take some time before everything is operating normally again.

Still, Polymarket appears unfazed. While it rolls out its beta product for testing and approval, the company continues to market aggressively, touting partnerships with Google, Yahoo Finance, PrizePicks and the NHL, and reminding followers that it operates in more than 180 countries. The company’s waitlist still reads “coming soon,” but the debut could happen quickly once the CFTC clock restarts.