The US Federal Reserve lowered interest rates today by 0.25%, bringing them down to 3.75% to 4%.

The decision wasn’t unanimous, with 10 members voting in favor and two voting against. One of the disagreeing members favored a larger 0.50% increase, while the other objected to any increase at all.

Bitcoin (BTC) fell 2% following the decision, as Fed Chair Jerome Powell ruled out the certainty of a further rate cut in December.

Alongside that move, the Fed announced plans to end quantitative tightening (QT) by December.

It also seeks to restart Treasury purchases in a limited capacity to keep money flowing smoothly through financial markets.

Powell’s Balancing Act

The key takeaway from Wednesday’s meeting was Powell telling reporters that a December rate cut isn’t guaranteed, which disappointed traders hoping for a clear signal that more cuts were coming.

He followed up by stating, “risks are to the upside for inflation and downside for employment,” signaling that the Fed is walking a tightrope between fighting inflation and keeping the job market strong.

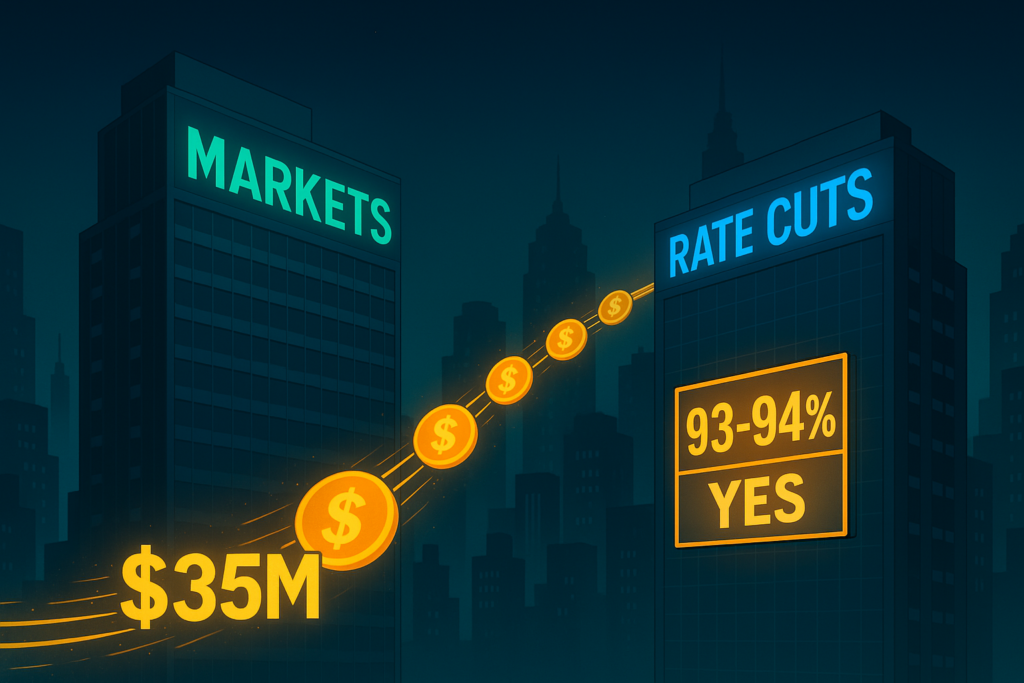

Despite Powell’s cautious statements, prediction market Polymarket still predicts a 66% chance of a 0.25% rate cut in December – falling from a 90% chance before Wednesday’s meeting.

The odds of no change in rates are sitting at 31%, while the market predicts a 2.7% chance of a larger rate cut.

Markets Take It in Stride

Markets reacted to the news cautiously, with small sell-offs across the board.

Bitcoin briefly fell about 2% on the news, as investors digested Powell’s cautious tone. It bounced back quickly, finding support at $109,400 – suggesting traders still see longer-term upside if rates keep trending down.

Ether took a 4% dive, but also saw a quick recovery, touching as low as $3,840 before bouncing back as high as $3,955.

Both of the major cryptocurrencies have been ranging following strong recoveries from the October 11 flash-crash, sparked by further Trump tariffs against China.

Turning to the broader market, stocks gave up early gains, with the S&P 500 seeing a small drawdown of around 0.3%, while bond yields ticked up.

The 10-year Treasury climbed to around 4.06%.

What Analysts Are Saying

The general takeaway has been that the Fed is shifting focus from inflation fears toward protecting jobs and market stability.

Analysts have called the rate cut an “insurance cut,” describing it as a small adjustment to steady the economy, rather than the start of a big rate-cutting cycle.

They expect the end of QT to help stabilize short-term lending markets, which have been showing signs of strain.

In past easing cycles, looser monetary conditions have tended to fuel risk appetite, including investment in digital assets. Regardless, the cautious tone might delay momentum for the near future.

With key data releases ahead – including November’s CPI and the December Fed meeting – traders will be bracing for volatility, as the market picture becomes clearer in the coming weeks.