Hours before Spotify announced its 2025 Wrapped results, the odds on The Weeknd finishing third on Polymarket’s contract surged from 40% to 99%.

Polymarket shared the news on X, framing it as proof that prediction markets work. But embedded in its own post was a contradiction: @FhantomBets called it a ‘leak,’ compared it to the Nobel Prize incident in October, and described it as ‘the same trick.'”

BREAKING: Polymarket traders discovered Spotify top 10 artists of 2025 — 24 hours before the announcement was set to take place. https://t.co/9RWjTg3a69

— Polymarket (@Polymarket) December 2, 2025

Not crowdsourced, an endpoint was found

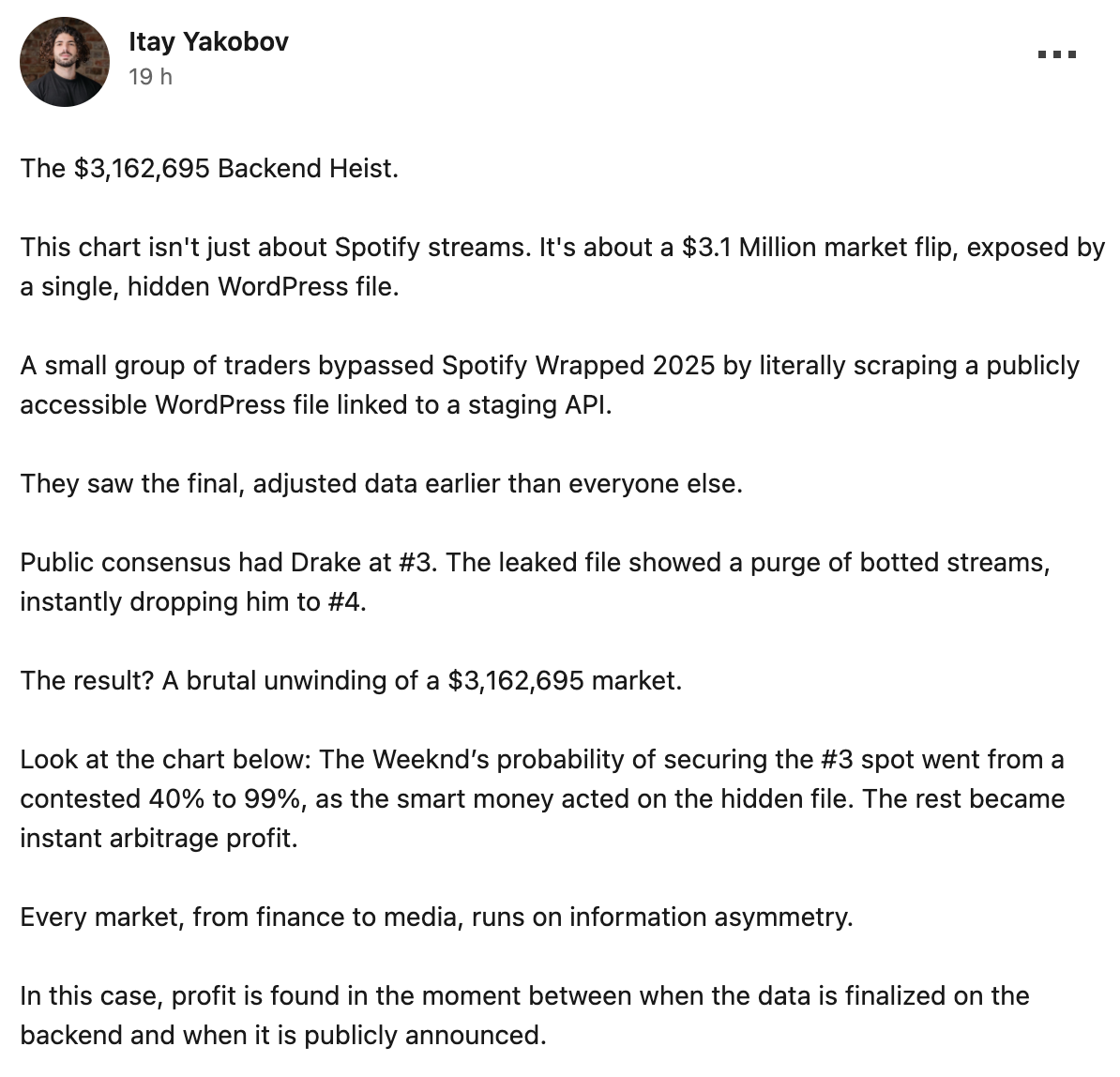

Itay Yakobov, commenting on the episode on LinkedIn, described what he called “The $3,162,695 Backend Heist.” According to Yakobov, traders “scraped a publicly accessible WordPress file linked to a staging API” on Spotify’s newsroom site. The data showed that Drake had dropped from third to fourth after Spotify purged what he described as bot streams—elevating The Weeknd.

Polymarket is calling this a ‘discovery’

Yakobov’s account aligned with details shared by@IwqanBJZ, known as Suhaan on Z. “Polymarket is calling this a ‘discovery’ like they crowdsourced some brilliant insight,” the trader wrote. “No – someone found an exposed endpoint.”

@IwqanBJZ shared a screenshot from Fireplace Pro, a third-party Polymarket analytics tool, showing that one account had bought shares in The Weeknd market at 3.64 cents. According to the screenshot, the account made more than $12,000 in profit.

The screenshot also showed other accounts with substantial gains, including +$21,565 and +$17,163. The timing raised questions about how traders knew the outcome before Spotify’s public announcement.

Gpoly

— Suhaan (@IwqanBJZ) December 4, 2025

Yesterday,@Polymarket outsmarted Spotify Wrapped.

Public data showed Drake at #3 but a few sharp traders dug into Spotify’s WordPress-run newsroom blog, scraped it, and discovered the real #3 was The Weeknd.

A brand new account bought $800 of shares at 3 and PRINTED.… pic.twitter.com/sUZ3tFf3nN

Spotify’s newsroom does run on WordPress, as confirmed by publicly visible references to a Google Cloud Storage bucket labeled “pr-newsroom-wp.” Whether the specific endpoint described in these posts existed, and whether it contained the data traders claim it did, couldn’t be verified. Spotify didn’t respond to a request for comment.

Prediction markets continue to raise questions of integrity

Prediction markets have faced persistent questions about where crowd wisdom ends and insider access begins. Polymarket is no exception. The platform drew attention from investors and policymakers after its markets on the 2024 U.S. presidential election were widely cited by media outlets as more accurate than traditional polls.

A study by Columbia University researchers published last month found that roughly 25% of trading volume on the platform showed signs of wash trading – artificial transactions designed to inflate activity. The study found the suspicious trading peaked at nearly 60% of weekly volume in December 2024, and that sports markets were particularly affected, with 45% of historical volume flagged.

In October, the Norwegian Nobel Institute launched an investigation after trading on Polymarket’s Nobel Peace Prize market surged hours before the winner was announced. One wallet, identified only as “6741,” placed a $50,000 bet in a single trade on a newly created account with no prior history. Norwegian officials described the activity as a potential confidentiality breach.

The Spotify case raises a different set of questions. Prediction markets, in theory, derive their value from aggregating dispersed information – the “wisdom of crowds” that proponents often cite. But when the information advantage comes from technical reconnaissance rather than genuine market insight, the line between price discovery and information arbitrage becomes harder to draw.

Disclosure: DeFi Rate reached out to Spotify to comment on staging access and purging of bot traffic. Trading data referenced in this article was obtained from screenshots shared on social media and third-party analytics tools, not directly from Polymarket.