With crypto lending, you can put your digital assets to work—earning interest like a savings account or borrowing against them just like you’d use a house or car as collateral. It’s a powerful way to access liquidity without selling your crypto.

Here’s a look at the top lending protocols and what you should consider before starting.

Current Crypto Lending Yields Across Top Protocols

| Token | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

USDC USD Coin | 3.96%

TVL $87.0M3.96%

TVL $4.3M3.29%

TVL $75.1M1.77%

TVL $784.7K1.91%

TVL $6.9M | — | —

TVL $1.4B—

TVL $1.1B—

TVL $223.0M—

TVL $553.0K—

TVL $18.1M | — | — | — | — | 4.57%

TVL $3.2B4.57%

TVL $3.2B | — | — |

USDC Supply APY - 30 Day History | ||||||||||

USDT Tether | 2.15%

TVL $2.1B1.94%

TVL $2.1B2.15%

TVL $2.0M | — | —

TVL $356.0M—

TVL $355.9M—

TVL $89.8K | — | — | — | — | 4.42%

TVL $1.4B4.42%

TVL $1.4B | — | — |

USDT Supply APY - 30 Day History | ||||||||||

PYUSD PayPal USD | 1.65%

TVL $189.3M1.65%

TVL $189.3M | — | —

TVL $444.3M—

TVL $444.3M | — | — | — | — | — | — | — |

PYUSD Supply APY - 30 Day History | ||||||||||

DAI Dai | 2.16%

TVL $49.3M1.94%

TVL $47.8M2.15%

TVL $1.3M2.16%

TVL $260.4K | — | —

TVL $65.4K—

TVL $65.4K | — | 1.25%

TVL $226.2M1.25%

TVL $226.2M | — | — | — | — | — |

DAI Supply APY - 30 Day History | ||||||||||

STETH stETH | — | 2.36%

TVL $18.8B2.36%

TVL $18.8B | —

TVL $4.2M—

TVL $4.2M | — | — | — | — | — | — | — |

STETH Supply APY - 30 Day History | ||||||||||

WEETH weETH | —

TVL $5.0B—

TVL $4.7B—

TVL $168.9M—

TVL $133.5M | — | —

TVL $178.6K—

TVL $178.6K | —

TVL $47.8M—

TVL $43.8M—

TVL $3.5M—

TVL $390.7K | — | — | 2.53%

TVL $6.1B2.53%

TVL $6.1B | — | — | — |

WEETH Supply APY - 30 Day History | ||||||||||

WBETH wBETH | — | — | — | — | — | 2.64%

TVL $6.9B2.64%

TVL $6.9B | — | — | — | — |

WBETH Supply APY - 30 Day History | ||||||||||

WSTETH wstETH | 0.06%

TVL $309.2M0.06%

TVL $172.3M—

TVL $42.4M—

TVL $71.5M<0.01%

TVL $23.0M | — | —

TVL $2.5M—

TVL $564.1K—

TVL $1.8M—

TVL $147.4K | —

TVL $154.0M—

TVL $119.1M—

TVL $14.5M—

TVL $19.7M—

TVL $698.2K | —

TVL $219.8M—

TVL $219.8M | — | — | — | — | — |

WSTETH Supply APY - 30 Day History | ||||||||||

SUSDS SUSDS | — | — | —

TVL $111.4K—

TVL $111.4K | —

TVL $120.4M—

TVL $110.5M—

TVL $9.9M | 4.00%

TVL $5.7B4.00%

TVL $5.3B4.00%

TVL $356.5M | — | — | — | — | — |

SUSDS Supply APY - 30 Day History | ||||||||||

SUSDE SUSDE | —

TVL $955.2M—

TVL $955.2M | — | — | —

TVL $72.1M—

TVL $72.1M | — | — | — | — | 3.57%

TVL $3.5B3.57%

TVL $3.5B | — |

SUSDE Supply APY - 30 Day History | ||||||||||

Above are today’s best crypto lending rates. Use this table to see what you can earn by supplying assets. Prefer to borrow? Compare live crypto borrowing rates.

What is Crypto Lending?

Crypto lending is a financial service in which crypto holders lend their tokens to borrowers in exchange for interest payments.

This is also usually accompanied by the ability to borrow against this cryptocurrency as collateral.

Crypto lending and borrowing is usually facilitated in one of two ways:

- Centralized lending: A company acts as a trusted intermediary by holding funds, lending them to borrowers, and managing interest payments.

- Decentralized lending: A smart contract on the blockchain acts as the intermediary. It holds funds, lends them to borrowers, and manages interest payments, in an automated fashion.

Some newer platforms, such as Maple, provide a hybrid of these two systems. Each system carries its own set of benefits and risks, catering to different types of lenders and borrowers.

DeFi Lending Protocols for 2026

| Rank | Protocol | Supplied | Borrowed | Utilization ⓘ | 7d Δ | 30d Δ |

|---|---|---|---|---|---|---|

| 1 | $43.0B | $16.6B |

38.6% | ▲+0.1% | ▼-18.2% | |

| 2 | $9.3B | $3.5B |

37.3% | ▲+3.2% | ▼-11.2% | |

| 3 | $3.3B | $204.4M |

6.1% | ▲+0.5% | ▼-14.5% | |

| 4 | $3.6B | $1.3B |

34.5% | ▲+1.2% | ▼-33.0% | |

| 5 | $3.8B | $1.8B |

46.9% | ▼-2.0% | ▼-22.1% | |

| 6 | $2.9B | $1.1B |

37.1% | ▲+3.9% | ▼-9.6% | |

| 7 | $1.9B | $556.9M |

30.0% | ▲+4.6% | ▼-16.6% | |

| 8 | $1.8B | $534.2M |

29.2% | ▼-2.9% | ▼-15.6% | |

| 9 | $1.7B | $573.5M |

34.0% | ▲+0.7% | ▲+20.6% | |

| 10 | $1.9B | $862.5M |

44.9% | ▲+1.5% | ▼-32.3% |

Protocol Comparison

Decentralized lending is part of decentralized finance (DeFi). This platform type is almost entirely automated and relies on smart contract code to perform its functions.

Decisions on the DeFi lending protocols are typically made by holders of the platform’s native token, which grants voting rights. In some cases, these tokens also benefit from protocol fees and revenue.

Here are some of the top DeFi lending protocols on the market today:

| Protocol | Number of Chains Supported | Fees | Audits | Unique Features | Platform Token | Fee Allocations |

| Aave | 14+ | • Interest: ~10-20% spread • Flash loans: historically around 0.05–0.09% | Trail of Bits, OpenZeppelin, Others Bug bounty | Flash loans, eMode, GHO stablecoin, aTokens | AAVE | Fees to DAO Staking Some burned |

| Sky Protocol (formerly MakerDAO) | 3 (Ethereum, Base, Arbitrum) | Stability fee: 1-5% | Trail of Bits, PeckShield, Others Bug bounty | DAI remains live; USDS is the 1:1 upgrade path via Sky Money; both coexist during migration | MKR | Under Maker: surplus = MKR buy/burn. Under Sky: adopts ‘Smart Burn Engine’ to buy/burn SKY. |

| Compound | 10+ | Interest: ~10% | OpenZeppelin, Trail of Bits, Bug bounty | cTokens, Yield farming, Simple UI | COMP | Fees to reserves |

| Spark | 4 (Ethereum, Base, Arbitrum, Gnosis) | • Interest: ~10-20% spread • Flash loans: 0.09% | OpenZeppelin, Inherits Aave audits | Aave V3 fork, USDS integration, sUSDS rate | None yet | Fees to Spark DAO. Spark DAO deployed ≈$100 M DAI liquidity via Morpho Blue (2024) to support USDe/sUSDe markets. |

| Morpho | 2 (Ethereum, Base) | P2P: Small spread | Trail of Bits, OpenZeppelin, Bug bounty | P2P lending, Aave/Compound integration, Optimizers | MORPHO | Does not yet collect fees |

| Kamino (Solana) | 1 (Solana only) | • Interest spread • Swaps: ~0.3% | Offside Labs, OtterSec, Sec3, Certora, RX, Bug bounty | Concentrated liquidity, Multiply Vaults, Elevation Mode | None | Fees to protocol |

1. Aave

Aave is one of the top DeFi lending platforms, running on 14+ blockchains, with a focus on Ethereum and Layer-2 networks.

It gives people a simple way to lend and borrow a wide range of tokens, with interest rates that automatically adjust based on supply and demand.

Aave has also launched its own stablecoin, GHO, which is backed by assets from Aave V3.

The platform is governed by the AAVE token, letting holders vote on proposals, stake in the Safety Module, and earn around 5–7% APY plus extra rewards. Only GHO borrowers receive discounts when staking AAVE (stkAAVE); no general borrow-fee discounts.

To support its growth, Aave routes a reserve factor (≈10–35%) of borrower interest to the DAO treasury; varies by asset.

Aave originally launched as ETHLend in 2017, but rebranded to Aave in 2018. Its upcoming V4 aims to make lending even faster and more efficient.

| Launch Date | May 2017 |

| Founded by | Stani Kulechov |

| Audited by | Trail of Bits, Certora, OpenZeppelin, Sigma Prime, PeckShield, ABDK, Halborn, MixBytes. $1M bug bounty on Immunefi |

| Hacks & Controversy | No full-protocol hacks, but a failed short attack in 2022 caused ~$1.6 M in bad debt on Aave V2; later resolved. |

2. Sky Protocol (Formerly MakerDAO)

Sky Protocol, originally known as MakerDAO, is one of the earliest DeFi platforms on Ethereum. MakerDAO was founded in 2014, launched DAI stablecoin Dec 2017 and then rebranded to Sky Protocol (Aug 2024).

Sky is built around USDS, a stablecoin that’s pegged to the US dollar and backed by crypto collateral, designed to offer steady returns for lenders.

Users can create USDS by locking supported tokens into Sky’s smart contracts, and can earn interest on it through the Sky Savings Rate (SSR). It can always be swapped at a 1:1 ratio with DAI.

Governance runs through the SKY token, MKR through SKY at 1:24,000 conversion under 2024 rebrand. SKY holders vote on key decisions, like which collateral types the system accepts and how much the Sky Savings Rate (SSR) pays out.

Users mainly interact with Sky through Summer.Fi, while Sky.Money handles USDS and SKY transactions.

| Launch Date | December 2017, rebranded August 2024 |

| Founded by | Rune Christensen |

| Audited by | Trail of Bits, PeckShield, and Runtime Verification |

| Hacks & Controversy | No hacks to date. Controversy surrounding the addition of USDC as collateral in 2020, leading to centralization concerns. |

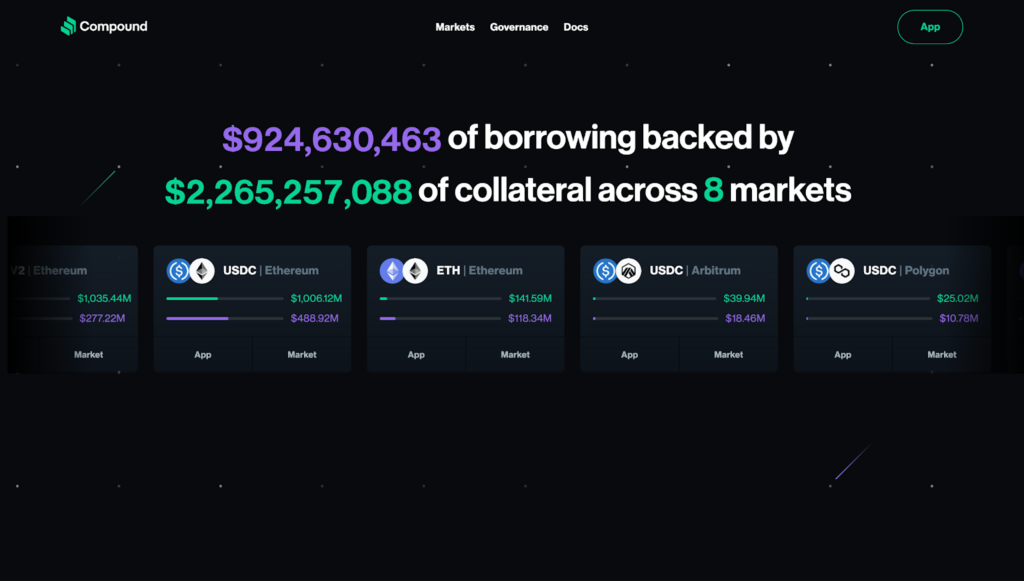

3. Compound

Compound is a DeFi lending platform built on Ethereum that lets users lend and borrow assets by locking up collateral.

Interest rates adjust algorithmically based on supply and demand, keeping borrowing costs flexible. Lenders earn interest through special tokens called “cTokens” that also make it easy to plug into other DeFi apps.

Users can access Compound not only through its official compound.finance interface, but also various integrations into popular apps, exchanges, and wallets such as MetaMask.

Compound’s governance is driven by its COMP token, with holders voting on dozens of upgrades over the years to refine how the platform works. Instead of sharing platform revenue directly with users, Compound rewards lenders and borrowers with new COMP tokens.

Unlike many competing protocols, Compound has strictly focused on lending, borrowing, and governance without any additional features.

| Launch Date | August 2017 |

| Founded by | Geoffrey Hayes and Robert Leshner |

| Audited by | OpenZepplin, Trail of Bits, Certora, and Gauntlet. |

| Hacks & Controversy | Comptroller contract bug caused ~$80 M in erroneous COMP distributions (not a fund drain). |

4. Spark

Spark is the first “Star” under Sky Protocol, originally launched as a SubDAO on MakerDAO.

It’s built on Aave V3’s codebase and focuses on letting users supply and borrow stablecoins like USDS and DAI at competitive rates.

Spark connects directly to Sky’s Direct Deposit Dai Module (D3M), a tool that feeds liquidity into other lending platforms like Compound and Aave. By using D3M, Spark helps keep borrowing rates low and stable, making it cheaper for users to borrow and generating extra income for Sky Protocol.

Users can also earn extra rewards through the Sky Savings Rate and SKY tokens when lending through Spark.

| Launch Date | May 2023 |

| Founded by | MakerDao |

| Audited by | Audited by ChainSecurity; built on Aave V3 codebase and Maker’s D3M liquidity module connection |

| Hacks & Controversy | No hacks to date. |

5. Morpho

Morpho is a DeFi lending platform that launched in 2022 to make lending and borrowing crypto faster and more efficient.

It improves rates by adding a peer-to-peer (P2P) layer on top of protocols like Aave and Compound, matching lenders directly with borrowers instead of relying only on big lending pools.

Morpho runs on Ethereum and Layer 2 networks. Its major innovation is Morpho Blue, which lets users build their own custom lending markets with flexible collateral and risk settings.

Governance is powered by the MORPHO token, giving holders a say over protocol updates and risk rules.

Morpho also works together with Sky Protocol, using $100 million in DAI liquidity to make it easier and cheaper for users to borrow USDS.

Read our Morpho Review

| Launch Date | July 2022 |

| Founded by | Paul Frambot |

| Audited by | Trail of Bits, Spearbit, Code4rena |

| Hacks & Controversy | No hacks. Some 2023 concerns about centralization of governance, but MORPHO ownership has since been distributed. |

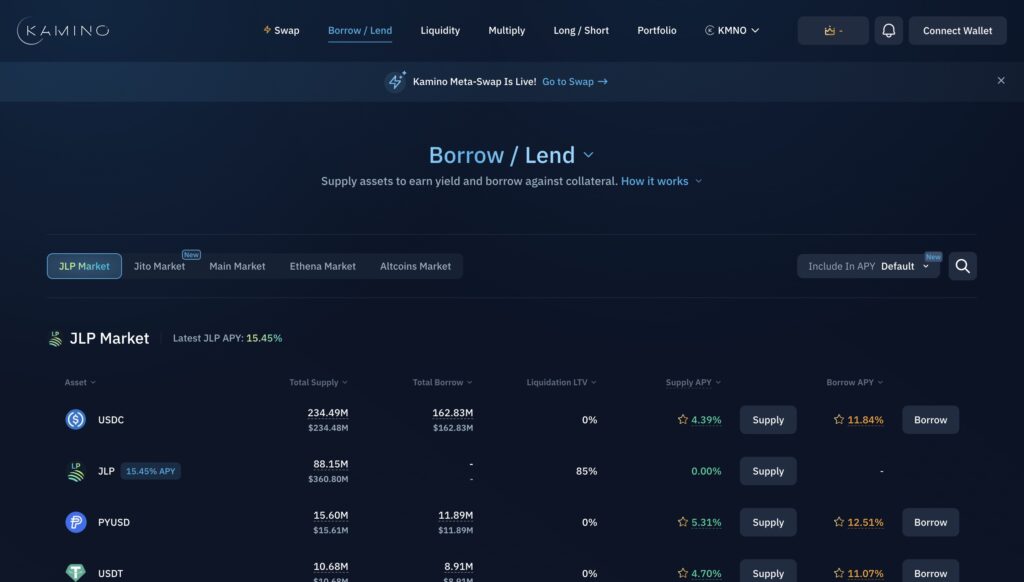

6. Kamino

Kamino is Solana’s largest Defi lending platform by TVL. It combines lending, borrowing, and liquidity provision into one easy-to-use system.

Its lending feature, Kamino Lend, lets users earn interest by lending assets like SOL or stablecoins, or borrow against their collateral with loan-to-value ratios as high as 95% in its eMode.

It also offers Automated Liquidity Vaults, which automatically compound yields and issue kTokens that users can use as collateral to boost their borrowing power.

Kamino has become a favorite thanks to its sleek user interface, Solana’s low transaction fees, and strong risk management tools like auto-deleveraging and reliable price oracles.

Its KMNO token powers governance and gives users access to staking rewards.

| Launch Date | August 2022 |

| Founded by | Marius Ciubotariu and Mark Hull |

| Audited by | Offside Labs, OtterSec, Sec3, Certora, RX. $0.5M Bug bounty paid in KMNO |

| Hacks & Controversy | No hacks to date. Concerns surrounding multisig with few signers, but provides ongoing audits. |

Risks and Considerations for Crypto Lending

DeFi lending is a different ballgame from centralized lending, each with a distinct set of risks and considerations.

Here are some of the main points you’ll want to think about when choosing a crypto lending service:

| DeFi Lending | Centralized Lending | |

|---|---|---|

| Relies on | Smart contract code | Business and legal processes |

| Primary Risks | Smart contract hacks, oracles | Human error, bankruptcy, default |

| Collateral Type | Crypto only | None |

| Fiat Loans | No | Yes |

| Interest Rates | Typically Variable | Typically Fixed |

| KYC | No | Yes |

| Customer Support | Minimal | Yes |

Risks and Trust

The most crucial difference between centralized and decentralized crypto lending platforms lies in who (or what) we trust.

DeFi lending platforms rely almost exclusively on computer code to manage funds and transactions. This introduces risks from hacks, malicious code, or faulty systems and oracles.

In contrast, centralized platforms require us to rely on a company to manage our crypto, ensure safe storage and transfers, and vet borrowers. This can lead to risks like loan defaults, bankruptcy, and human error.

Supported Asset Types

Centralized and decentralized crypto lending platforms also differ in the types of assets they handle.

Centralized platforms can interface with traditional finance systems. This enables features such as US dollar loans secured by cryptocurrency collateral and unsecured loans backed by legal enforcement.

On the other hand, DeFi platforms are limited to crypto only. They’ll also rarely offer unsecured loans.

Interest Rates

Interest rates on DeFi platforms are algorithmically managed by smart contracts.

These adjust rates based on supply, demand, and risk factors like collateralization ratios and liquidation thresholds. This can lead to rapid changes in rates.

Centralized platforms typically offer more stable and predictable interest rates set by the company.

Know-Your-Customer (KYC)

Another advantage of DeFi lending is that it typically doesn’t require Know-Your-Customer (KYC) verification, which banks, crypto centralized exchanges, and casinos are required to adhere to by law.

This increases efficiency and broadens access, regardless of geographical location, bank account access, or residency status. Anyone with internet access and a crypto wallet can participate.

Conversely, centralized platforms require thorough KYC checks, especially when dealing with fiat currencies.

Customer Support

Centralized lending platforms offer more human intervention and customer service, although this isn’t always guaranteed.

Customer support for DeFi lending protocols is often limited, as operations are automated by computer code, and sometimes, there isn’t even an identified developer or team available.

Centralized (CeFi) Lending Protocols for 2026

1. Nexo

Nexo is a centralized platform that gives users a way to earn passive income by lending crypto like Bitcoin, Ethereum, and stablecoins.

Users deposit assets into Nexo’s custodial wallets, and the platform lends them to retail and institutional borrowers, while still allowing flexible withdrawals.

With a user-friendly app and a crypto-backed credit card, Nexo makes it easy for users to access their funds and earn daily interest.

The platform is regulated in multiple jurisdictions and offers strong security measures, including insurance coverage through trusted custodians, making it a reliable option for cautious lenders.

| Launch Date | April 2018 |

| Founded by | Antoni Trenchev, Kosta Kantchev |

| Audited by | Armanino LLP, Deloitte |

| Hacks & Controversy | No hacks. Faced scrutiny in 2022 for halting XRP lending in the U.S. due to SEC regulations, but resolved with compliance measures. |

2. Ledn

Ledn is a CeFi platform built for transparency and security, offering users a way to earn interest on Bitcoin, stablecoins, and Ethereum.

Lenders deposit assets into Growth Accounts, which fund over-collateralized loans to retail and institutional borrowers.

Borrowers put up collateral at conservative loan-to-value ratios, and lenders earn interest from borrower repayments, with no lockups and instant access to their funds. They’ve facilitated over $9 billion worth of loans to date.

Ledn offers a no-rehypothecation option for lenders who want full control over their assets, and provides biannual Proof of Reserves audits through independent firms.

Known for surviving major industry crashes and maintaining lender security, Ledn has built a reputation as a reliable choice for those seeking steady crypto returns without DeFi exposure.

| Launch Date | January 2018 |

| Founded by | Adam Reeds, Mauricio Di Bartolomeo |

| Audited by | Armanino LLP (Proof of Reserves) |

| Hacks & Controversy | No hacks to date. Limited asset support and lower BTC APYs draw minor criticism, but transparency and zero losses during 2022 solidify its reputation. |

What Happened to Celsius, BlockFi, and Others?

In 2022, Terra’s stablecoin UST and its sister coin LUNA collapsed due to poorly designed mechanisms. This also sparked a wider crypto market crash.

The crash revealed significant holes in several centralized platforms, including FTX and lending platforms Celsius, BlockFi, Voyager, and Genesis. Each of the affected companies was shown to have major shortcomings in its processes and risk management—and, in some cases, fraud.

Several years down the line, some creditors are still in the process of being paid out via bankruptcy proceedings.

Here’s what happened to some of the major centralized crypto lending giants from that period:

Celsius Network

Summary: Filed for Chapter 11 bankruptcy in July, 2022. Executives charged with fraud.

In 2022, a bank run was triggered on Celsius customer deposits. This happened in response to a company liquidity crisis, made worse by the collapse of the Terra ecosystem.

Celsius froze customer withdrawals, swaps, and transfers to keep its ship from sinking. The company eventually filed for Chapter 11 bankruptcy on July 13, 2022. The filings revealed a $1.3 billion hole in its balance sheet, showing significant financial mismanagement.

In 2023, the FTC reached a settlement with Celsius, banning it from handling consumer assets.

Its former executives were charged with misleading consumers and misusing billions in deposits, falsely claiming it had sufficient assets before filing for bankruptcy.

The company emerged from bankruptcy at the beginning of 2024, and began distributing over $3 billion in cryptocurrency and fiat to its creditors. It also created a new Bitcoin mining company, Ionic Digital, which continues to deliver recoveries to creditors.

Celsius has distributed $2.53 billion to creditors by August 2024, with additional distributions planned but not fully confirmed.

BlockFi

Summary: Filed for Chapter 11 bankruptcy in November, 2022.

BlockFi grew rapidly by offering high-interest crypto deposits and raising venture capital, but faced regulatory issues in mid-2021.

This resulted in a $100 million settlement with the SEC in February 2022 for failing to register its offering of BlockFi Interest Accounts.

BlockFi’s problems worsened with substantial loans to Three Arrows Capital, which also went bankrupt in July 2022, and the ultimate collapse of FTX. This left BlockFi unable to continue its operations.

The company went bankrupt in November 2022 after FTX’s collapse, which froze $355 million of its assets and cut off a critical credit line.

BlockFi eventually reached an $874.5 million in-principle settlement with FTX and Alameda Research in March 2024 to help distribute funds to customers.

The settlement included a guaranteed $250 million payment to BlockFi, with the remaining amount depending on FTX’s efforts to repay its customers and creditors. Read More

Voyager Digital

Summary: Filed for Chapter 11 bankruptcy in July, 2022. CEO charged with fraud.

Voyager Digital’s financial troubles were triggered by the default of a $650 million loan to Three Arrows Capital and made worse by the wider market decline.

The company froze withdrawals, swaps, and transfers, leading to a small-scale bank run.

Voyager Digital filed for bankruptcy in July 2022 after the cryptocurrency market crashed. The filing revealed it had between $1 billion and $10 billion in assets and liabilities, with over 100,000 creditors.

U.S. regulators charged former Voyager Digital CEO Steve Ehrlich with fraud and making false claims about customer protections, leading to Voyager’s bankruptcy and significant customer losses.

2023 court filings showed creditors were estimated only to return around 36% of their money.

Voyager has distributed $620 million, just over a 35% total repayment to most creditors, and 70% of the court-approved amount. Full repayment was hampered by a $670 million Three Arrows Capital default.

Genesis Global Capital

Summary: Filed for Chapter 11 bankruptcy in January, 2023.

Genesis’ crypto lending unit froze customer withdrawals in November 2022 due to liquidity issues exacerbated by the collapse of major crypto firms.

This greatly impacted the users of the interest-earning product Gemini Earn, who made up the majority of creditors.

Genesis Global Capital filed for bankruptcy on January 20, 2023, owing creditors $3.4 billion. Filings showed that Genesis had over 100,000 creditors and estimated its assets at $5.3 billion against $5.1 billion in debts.

The company agreed to pay $21 million to settle SEC charges related to its involvement with the now-defunct Gemini Earn program.

In May 2024, a bankruptcy judge approved Genesis Global’s plan to distribute approximately $3 billion in cryptocurrency and cash to its creditors.

Although part of this repayment appears to have been prepared, there has not yet been confirmation of it being distributed.

Gemini

Gemini Earn was the investment program run by U.S. crypto exchange Gemini, in partnership with Genesis Global Capital.

Like the other programs, Gemini locked users out of their accounts following troubles with Genesis, who were the primary borrowers of Gemini Earn deposits.

In May 2024, More than $2 billion in crypto was returned to 232,000 Gemini Earn customers, providing a 242% return on assets locked up since January 2023. Unlike other bankrupt crypto companies, Genesis returned customers’ crypto directly, rather than liquidating the assets and paying in cash.

According to the New York Attorney General, Gemini had misled customers about the risks associated with the program. This led to a settlement of a further $50 million in crypto to be returned to Gemini Earn investors in June 2024.

The SEC and Gemini have requested a 60-day pause in their lawsuit over the Earn program to explore a settlement.

FAQ

DeFi platforms typically set interest rates using algorithms that automatically adjust based on supply and demand.

If more funds are borrowed, rates go up to attract more deposits. If fewer funds are borrowed, rates go down.

These interest rates also consider risk factors to keep the platform stable.

Using a DeFi dapp is easier than ever. All you need to do is:

- Load a web3 wallet with cryptocurrency

- Connect it to the DeFi app in your browser

- Select the asset and amount you wish to lend

- Approve the transaction to lend the funds to the app.

Interest payments will accrue automatically, and no identity verification is required.

Taxes on crypto lending interest vary by country. Generally, you will owe taxes on any interest earned through both DeFi and CeFi platforms.

On the other hand, borrowing against your crypto lets you get money without selling your assets. This may avoid a taxable event.

At the time of writing, Aave is the most popular crypto lending app with a total value locked (TVL) of $10.76 billion on Ethereum.

Maker comes in second, with a TVL of $8.02 billion.

Staking involves locking up crypto to support blockchain operations and earn rewards.

Meanwhile, lending involves depositing cryptocurrencies into a DeFi platform to earn interest from borrowers.