As seen with Maker and the surrounding liquidity crunch, liquidity is everything. Without it, systems crumble. As a result, we’ve seen the realized potential for permissionless DEXs like Kyber and Uniswap. The ability for anyone to tap into their respective liquidity pools has allowed for both exchanges to experience unparalleled growth in recent months as they both break new record volume amid the coronavirus outbreak.

Kyber’s success may largely be due to its high potential for composability and ability for dApps and users to easily access liquidity with far lower slippage than on automated platforms. Regardless, despite the massive volatility in crypto markets, Kyber Network was able to handle the recent liquidity crunch while successfully reaching record highs in daily volume.

The growth in Kyber Network should not go unnoticed. Volumes in both USD and ETH terms, unique addresses, and other metrics have all reached new all-time highs. As such, we’ve decided to take some time to dive into the recent growth of one of DeFi’s leading liquidity protocols.

| Stat Box | Since Jan 1. 2019 |

| USD Volume | 2668.54% |

| ETH Volume | 1201.97% |

| Trades | 406.59% |

| Unique Addresses | 332.95% |

| First Trades | 323.72% |

Fundamental Growth

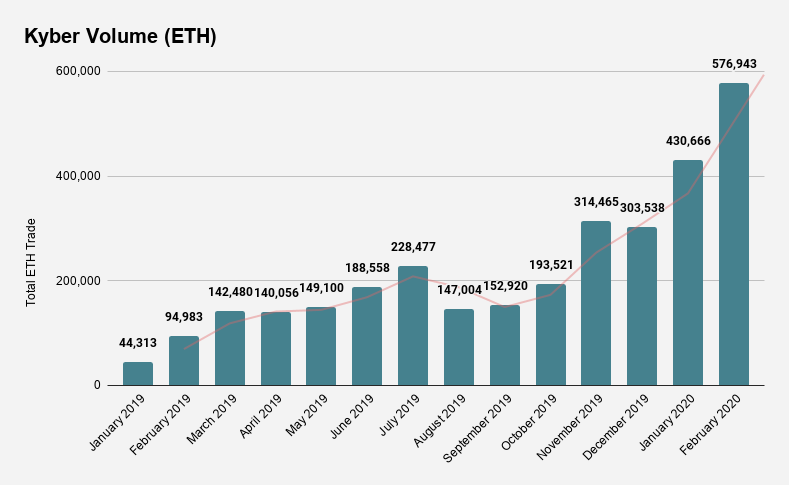

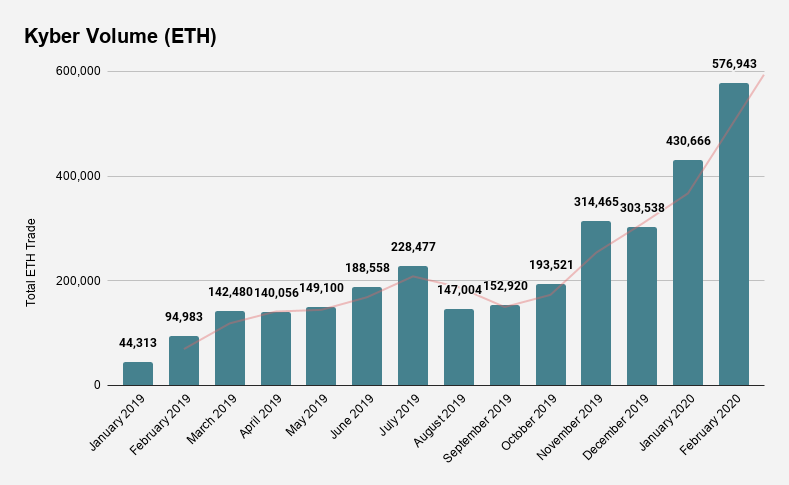

Looking at the numbers, Kyber has experienced significant growth across the board in almost every fundamental metric. In January 2019, monthly DEX volume reached around ~44,000 ETH. By February of 2020, the protocol processed over ~577,000 ETH in monthly volume, resulting in a 1,201% increase over 13 months. Despite the relatively stagnant price of ETH over the same time period, the volume has increased steadily in ETH terms.

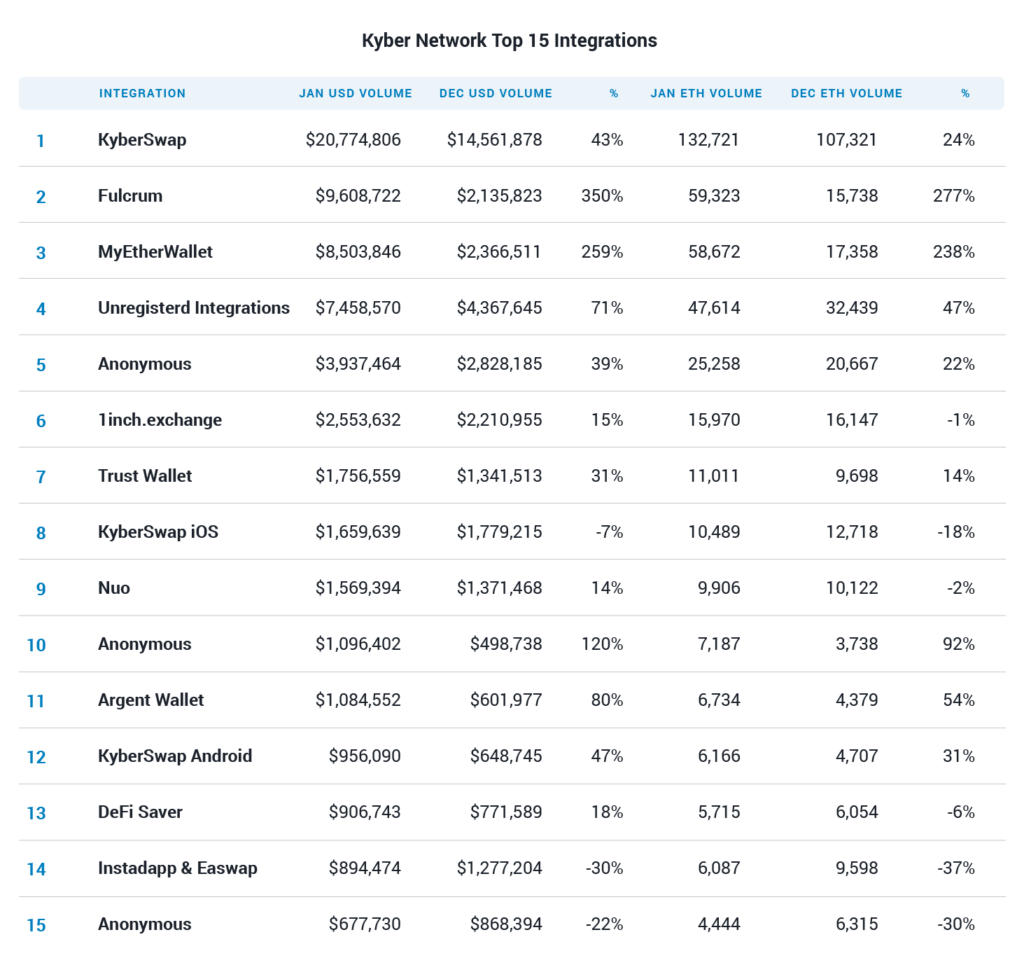

As reported in the last ecosystem report, many Kyber integrations have seen equally strong growth as Fulcrum and MyEtherWallet (MEW) reach 277% and 238% month-over-month volume growth, respectively. Another notable integration seeing a fair amount of growth was Argent.

The DeFi smart wallet reached over 54% month-over-month growth through its wallet application despite having restricted access. We can expect that as Argent continues to scale its user base, we should see a high uptick in overall volume as more users on-board the wallet and leverage its capabilities.

Table via Kyber Ecosystem Report #11

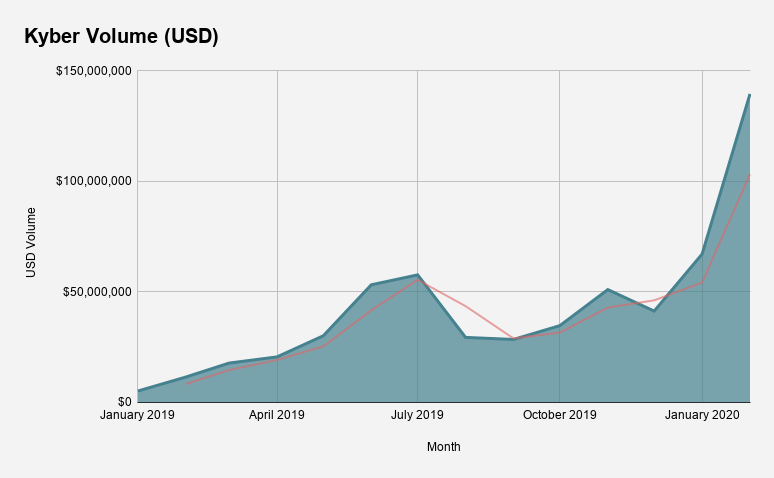

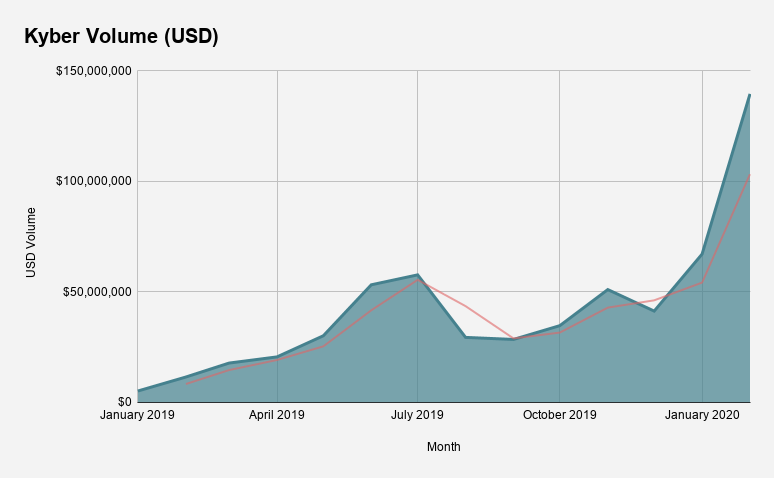

Looking at USD volumes, it’s apparent that the liquidity protocol continues to grow exponentially as we progress into the new year. While the protocol reached new ATHs in ETH volume, the near-parabolic spike in USD volume must also be attributed to Ether’s strong price performance in 2020.

With that in mind, Kyber’s monthly USD volume has seen the highest growth out of every other metric on the board – hitting 2,668% volume growth since January 2019. In the past three months, Kyber on average experienced over $82M in monthly volume compared to $11.3M in the first three months of 2019. As a result, the liquidity protocol has seen a 626% increase in average monthly volume between January – March 2019 and January – March 2020.

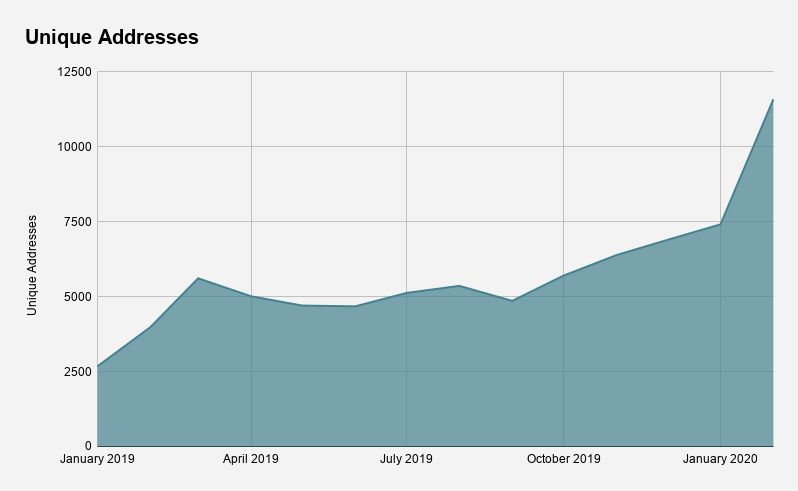

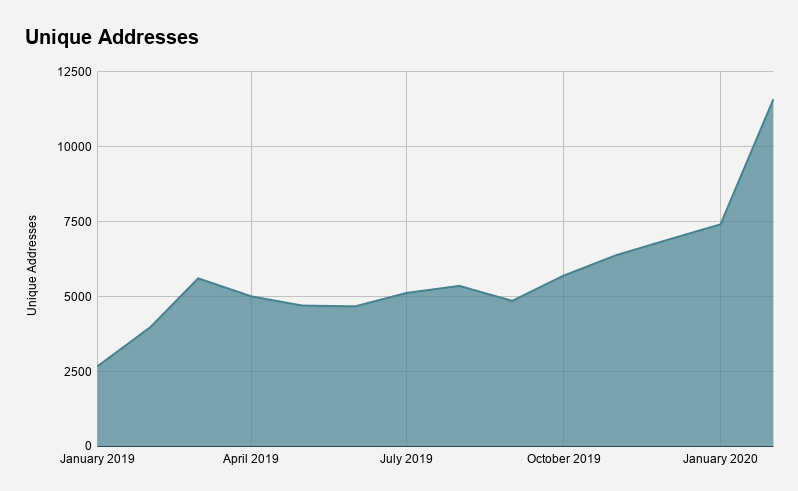

As volumes continue to trend upwards, it’s also important to look at how many unique addresses are interacting with the liquidity protocol. While this isn’t a perfect measure for active users (as the same user can have multiple addresses), it does give us a basic framework for how the protocol’s user base is growing over time.

In the month of January 2019, Kyber Network saw around 2,600 unique addresses interact with the protocol. Fast forward a year later and the liquidity protocol saw nearly 7,500 unique addresses leverage the liquidity protocol. Most recently in the month of February, Kyber Network’s user base reached new all-time-highs with over 11,500 unique addresses in the month alone.

More broadly speaking, between the time of January 2019 and February 2020, Kyber saw a 322.95% increase in unique addresses.

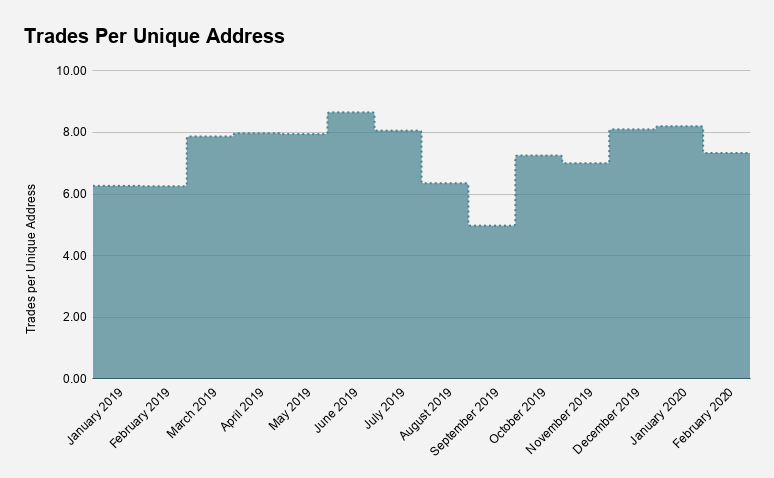

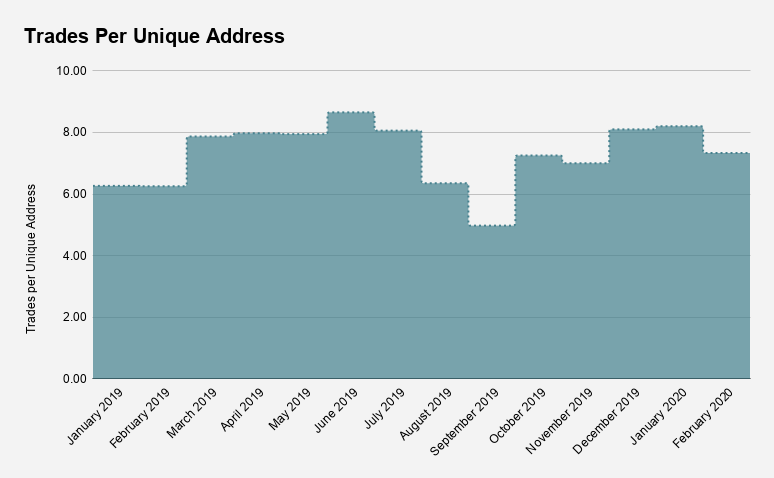

The question now becomes – how many times is each address using Kyber on a monthly basis?

Generally speaking, this statistic has stayed relatively steady over the past year as users continue to use the liquidity protocol. In January 2019, the average address interacted with Kyber 6.27 times per month. Traders per unique address saw a slight uptick to 7.33 over a year later – showing strong user retention for one of DeFi’s leading liquidity protocols.

Tokens & Fees with PE Ratios

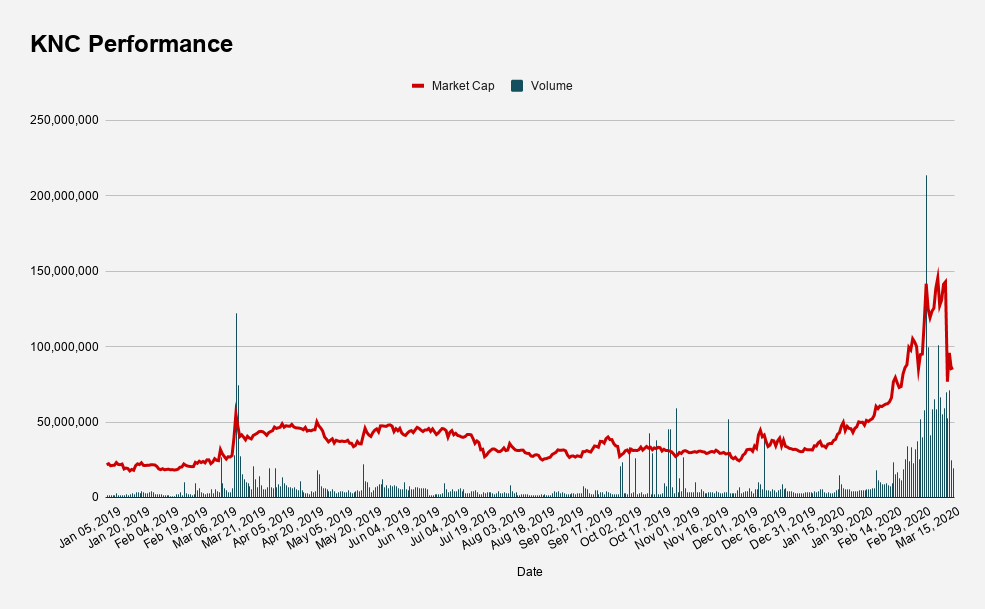

While all of this fundamental growth is exciting, it’s equally important to see if the fundamentals translate to value accrual for the protocol’s native token, KNC.

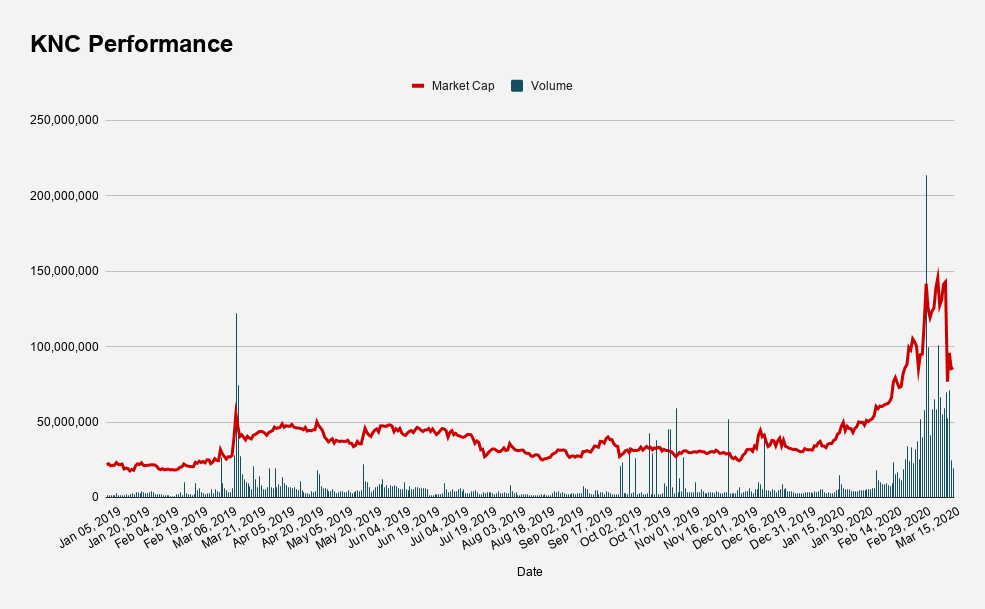

In 2020, KNC has been one of the best performing tokens on the market, increasing by 171% as of writing while reaching 358% increase YTD from its peak in early March. In addition, KNC’s trading volume has also surged in the past year. The average volume for KNC in the month of March reached ~$70M compared to ~$2M back in January 2019, resulting in a 3,518% increase in average daily trading volume.

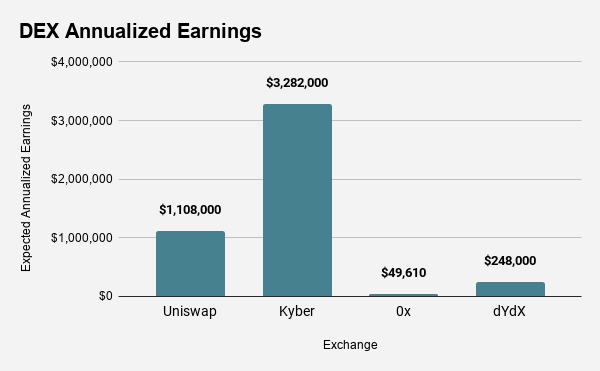

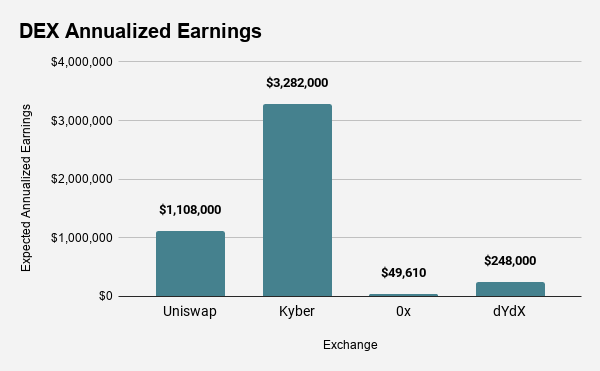

According to Token Terminal, Kyber Network is expected to generate around $3.2M in annualized revenues for its tokenholders. With that, the KNC token currently boasts a moderate PE ratio of 26.98 (Liquid Market Cap / Annualized Earnings). This is line with fair value for most traditional equities, a notable feat for Ethereum’s nascent money protocols. Compared to the rest of the DEX field, Kyber is expected to generate the most in annualized revenues. Naturally, the second-highest in forecasted annualized revenues is Uniswap.

However, unlike Kyber, Uniswap is untokenized and therefore does not have a mechanism in place to distribute the value across all ecosystem participants. This is one of the benefits to Kyber – anyone can capitalize on the potential value accrual for the liquidity protocol at large.

Other notable players in the DEX space include 0x and dYdX. The margin trading platform – dYdX – is beginning to see notable growth in volumes as is shown in the protocol’s earnings. Lastly, despite 0x being a rather prominent liquidity protocol (and the only other tokenized protocol), it’s struggling to garner any significant earnings for tokenholders.

Looking Forward – Katalyst

The recent growth in Kyber should not go unnoticed. The liquidity protocol is continuing to gain more and more traction within the rapidly growing DeFi space as all fundamental metrics show massive increases across the board.

One of the more notable things in the pipeline for Kyber is the new token economic rework, Katalyst. Kyber is implementing a new, dynamic token model where protocol earnings will be distributed through three main mechanisms:

- Burns

- Distribute to active token holders

- Accumulate profit in Liquidity Provider pool

Following the upgrade, KNC holders will be able to vote on how profits will be allocated across the ecosystem participants. Ultimately, this is a well-designed token model as tokens give the holders both economic and governance rights – an important dynamic found in traditional equities.

Given Kyber Network is one of the few tokenized DeFi protocols generating substantial earnings for its token holders, the Katalyst upgrade should provide the ecosystem with a clear-cut design for value capture in order to properly capitalize on the fundamental growth within the protocol at large.

Ultimately, the coming year is extremely exciting for one of DeFi’s leading DEXs. It will be interesting to see how Katalyst changes the dynamic for tokenholders and whether or not the protocol will continue on its path to “hockey stick growth” as seen with most successful, traditional start ups.

Where is Kyber Network Now?

Kyber Network has gone on to become a multi-chain crypto liquidity aggregator, combining liquidity from various DeFi exchanges and aggregators to provide the best trade rates.

Kyber Network homepage | Source: Kyber.network

The network continues to support 17+ chains and integrations with over 200 DeFi protocols, and has facilitated over $20 billion in trading volume to date.

Security Incidents and Financial Impact

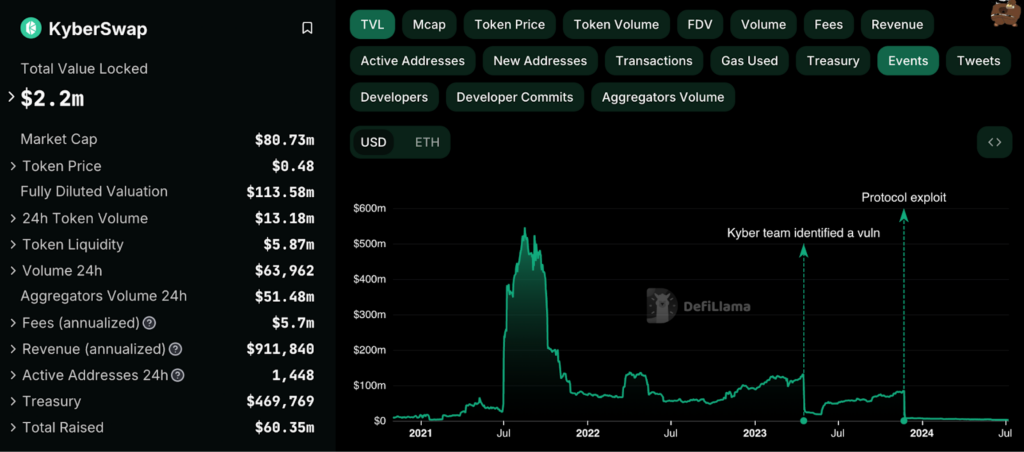

Unfortunately, following a pair of unfortunate events in 2023, the protocol’s total value locked (TVL) has dwindled to just $2.2 million at the time of writing.

It had peaked at a significant $530 million in August 2021, as shown below:

KyberSwap Total Value Locked (TVL) | Source: Defillama.com

April 2023 Vulnerability

Bear markets aside, the first artificial impact came in April 2023 when a vulnerability was found in KyberSwap Elastic’s contracts.

The project advised liquidity providers to withdraw their funds immediately as a precaution. No funds were lost, but farming rewards were temporarily suspended until a new smart contract was deployed.

November 2023 Exploit ($48M)

The drama didn’t stop there, however, as the protocol suffered a major hack on November 23, 2023.

An attacker used an “infinite money glitch” to drain nearly $49 million in digital assets. The hacker initially demanded negotiations, which included a $4.6 million bounty offer for returning 90% of the stolen funds.

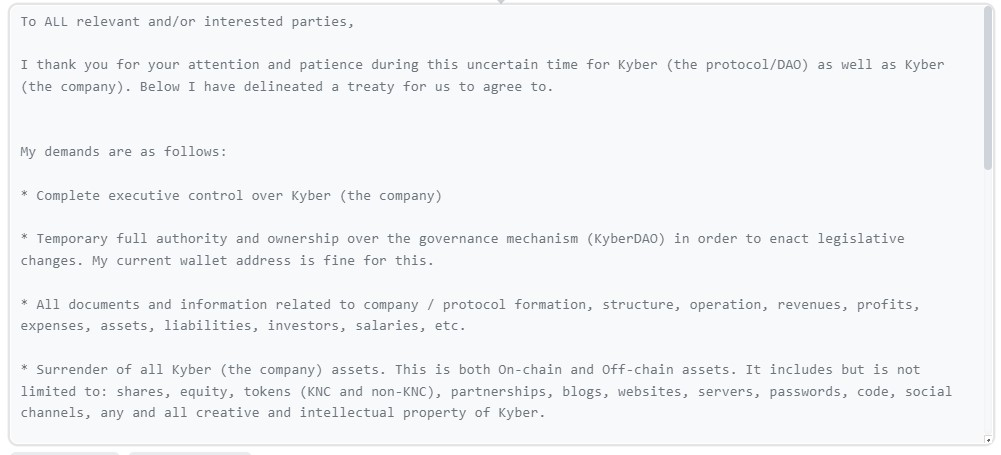

However, negotiations went sour, and the hacker escalated demands to total control over KyberSwap and KyberDAO.

Part of the attacker’s message to KyberSwap. | Source: Etherscan

Following these demands, KyberSwap decided to launch treasury grants for victims of the hack and was forced to cut half of its workforce in response to the incident.

Does Kyber Network Have a Future?

Despite the implosion, Kyber Network has outlined an ambitious product roadmap for 2024-2025.

The project is focusing on enhancing user experience, expanding the ecosystem, and increasing utility for KNC holders, with key developments including:

- Improvements to KyberSwap API, KyberSwap.com, and KyberDAO: Refining user experience, functionality, and governance.

- Smart Liquidity Pool Governance: Using statistical models to manage liquidity pools efficiently and save operational costs.

- Zap Technology: Introducing APIs and widgets to simplify adding liquidity and earning yield with a single transaction.

- Off-chain liquidity protocols: Developing systems to provide liquidity on an off-chain layer, reducing smart contract risks while maintaining user experience.

The roadmap highlights Kyber’s aim to match the user experience of centralized exchanges while maintaining decentralized security.

The team encourages community participation and feedback to refine and achieve these goals.

Kyber’s success may largely be due to its high potential for composability and ability for dApps and users to easily access liquidity with far lower slippage than on automated platforms. Regardless, despite the massive volatility in crypto markets, Kyber Network was able to handle the recent liquidity crunch while successfully reaching record highs in daily volume.

The growth in Kyber Network should not go unnoticed. Volumes in both USD and ETH terms, unique addresses, and other metrics have all reached new all-time highs. As such, we’ve decided to take some time to dive into the recent growth of one of DeFi’s leading liquidity protocols.

| Stat Box | Since Jan 1. 2019 |

| USD Volume | 2668.54% |

| ETH Volume | 1201.97% |

| Trades | 406.59% |

| Unique Addresses | 332.95% |

| First Trades | 323.72% |

Fundamental Growth

Looking at the numbers, Kyber has experienced significant growth across the board in almost every fundamental metric. In January 2019, monthly DEX volume reached around ~44,000 ETH. By February of 2020, the protocol processed over ~577,000 ETH in monthly volume, resulting in a 1,201% increase over 13 months. Despite the relatively stagnant price of ETH over the same time period, the volume has increased steadily in ETH terms.

As reported in the last ecosystem report, many Kyber integrations have seen equally strong growth as Fulcrum and MyEtherWallet (MEW) reach 277% and 238% month-over-month volume growth, respectively. Another notable integration seeing a fair amount of growth was Argent.

The DeFi smart wallet reached over 54% month-over-month growth through its wallet application despite having restricted access. We can expect that as Argent continues to scale its user base, we should see a high uptick in overall volume as more users on-board the wallet and leverage its capabilities.

Table via Kyber Ecosystem Report #11

Looking at USD volumes, it’s apparent that the liquidity protocol continues to grow exponentially as we progress into the new year. While the protocol reached new ATHs in ETH volume, the near-parabolic spike in USD volume must also be attributed to Ether’s strong price performance in 2020.

With that in mind, Kyber’s monthly USD volume has seen the highest growth out of every other metric on the board – hitting 2,668% volume growth since January 2019. In the past three months, Kyber on average experienced over $82M in monthly volume compared to $11.3M in the first three months of 2019. As a result, the liquidity protocol has seen a 626% increase in average monthly volume between January – March 2019 and January – March 2020.

As volumes continue to trend upwards, it’s also important to look at how many unique addresses are interacting with the liquidity protocol. While this isn’t a perfect measure for active users (as the same user can have multiple addresses), it does give us a basic framework for how the protocol’s user base is growing over time.

In the month of January 2019, Kyber Network saw around 2,600 unique addresses interact with the protocol. Fast forward a year later and the liquidity protocol saw nearly 7,500 unique addresses leverage the liquidity protocol. Most recently in the month of February, Kyber Network’s user base reached new all-time-highs with over 11,500 unique addresses in the month alone.

More broadly speaking, between the time of January 2019 and February 2020, Kyber saw a 322.95% increase in unique addresses.

The question now becomes – how many times is each address using Kyber on a monthly basis?

Generally speaking, this statistic has stayed relatively steady over the past year as users continue to use the liquidity protocol. In January 2019, the average address interacted with Kyber 6.27 times per month. Traders per unique address saw a slight uptick to 7.33 over a year later – showing strong user retention for one of DeFi’s leading liquidity protocols.

Tokens & Fees with PE Ratios

While all of this fundamental growth is exciting, it’s equally important to see if the fundamentals translate to value accrual for the protocol’s native token, KNC.

In 2020, KNC has been one of the best performing tokens on the market, increasing by 171% as of writing while reaching 358% increase YTD from its peak in early March. In addition, KNC’s trading volume has also surged in the past year. The average volume for KNC in the month of March reached ~$70M compared to ~$2M back in January 2019, resulting in a 3,518% increase in average daily trading volume.

According to Token Terminal, Kyber Network is expected to generate around $3.2M in annualized revenues for its tokenholders. With that, the KNC token currently boasts a moderate PE ratio of 26.98 (Liquid Market Cap / Annualized Earnings). This is line with fair value for most traditional equities, a notable feat for Ethereum’s nascent money protocols. Compared to the rest of the DEX field, Kyber is expected to generate the most in annualized revenues. Naturally, the second-highest in forecasted annualized revenues is Uniswap.

However, unlike Kyber, Uniswap is untokenized and therefore does not have a mechanism in place to distribute the value across all ecosystem participants. This is one of the benefits to Kyber – anyone can capitalize on the potential value accrual for the liquidity protocol at large.

Other notable players in the DEX space include 0x and dYdX. The margin trading platform – dYdX – is beginning to see notable growth in volumes as is shown in the protocol’s earnings. Lastly, despite 0x being a rather prominent liquidity protocol (and the only other tokenized protocol), it’s struggling to garner any significant earnings for tokenholders.

Looking Forward – Katalyst

The recent growth in Kyber should not go unnoticed. The liquidity protocol is continuing to gain more and more traction within the rapidly growing DeFi space as all fundamental metrics show massive increases across the board.

One of the more notable things in the pipeline for Kyber is the new token economic rework, Katalyst. Kyber is implementing a new, dynamic token model where protocol earnings will be distributed through three main mechanisms:

- Burns

- Distribute to active token holders

- Accumulate profit in Liquidity Provider pool

Following the upgrade, KNC holders will be able to vote on how profits will be allocated across the ecosystem participants. Ultimately, this is a well-designed token model as tokens give the holders both economic and governance rights – an important dynamic found in traditional equities.

Given Kyber Network is one of the few tokenized DeFi protocols generating substantial earnings for its token holders, the Katalyst upgrade should provide the ecosystem with a clear-cut design for value capture in order to properly capitalize on the fundamental growth within the protocol at large.

Ultimately, the coming year is extremely exciting for one of DeFi’s leading DEXs. It will be interesting to see how Katalyst changes the dynamic for tokenholders and whether or not the protocol will continue on its path to “hockey stick growth” as seen with most successful, traditional start ups.

Where is Kyber Network Now?

Kyber Network has gone on to become a multi-chain crypto liquidity aggregator, combining liquidity from various DeFi exchanges and aggregators to provide the best trade rates.

Kyber Network homepage | Source: Kyber.network

The network continues to support 17+ chains and integrations with over 200 DeFi protocols, and has facilitated over $20 billion in trading volume to date.

Security Incidents and Financial Impact

Unfortunately, following a pair of unfortunate events in 2023, the protocol’s total value locked (TVL) has dwindled to just $2.2 million at the time of writing.

It had peaked at a significant $530 million in August 2021, as shown below:

KyberSwap Total Value Locked (TVL) | Source: Defillama.com

April 2023 Vulnerability

Bear markets aside, the first artificial impact came in April 2023 when a vulnerability was found in KyberSwap Elastic’s contracts.

The project advised liquidity providers to withdraw their funds immediately as a precaution. No funds were lost, but farming rewards were temporarily suspended until a new smart contract was deployed.

November 2023 Exploit ($48M)

The drama didn’t stop there, however, as the protocol suffered a major hack on November 23, 2023.

An attacker used an “infinite money glitch” to drain nearly $49 million in digital assets. The hacker initially demanded negotiations, which included a $4.6 million bounty offer for returning 90% of the stolen funds.

However, negotiations went sour, and the hacker escalated demands to total control over KyberSwap and KyberDAO.

Part of the attacker’s message to KyberSwap. | Source: Etherscan

Following these demands, KyberSwap decided to launch treasury grants for victims of the hack and was forced to cut half of its workforce in response to the incident.

Does Kyber Network Have a Future?

Despite the implosion, Kyber Network has outlined an ambitious product roadmap for 2024-2025.

The project is focusing on enhancing user experience, expanding the ecosystem, and increasing utility for KNC holders, with key developments including:

- Improvements to KyberSwap API, KyberSwap.com, and KyberDAO: Refining user experience, functionality, and governance.

- Smart Liquidity Pool Governance: Using statistical models to manage liquidity pools efficiently and save operational costs.

- Zap Technology: Introducing APIs and widgets to simplify adding liquidity and earning yield with a single transaction.

- Off-chain liquidity protocols: Developing systems to provide liquidity on an off-chain layer, reducing smart contract risks while maintaining user experience.

The roadmap highlights Kyber’s aim to match the user experience of centralized exchanges while maintaining decentralized security.

The team encourages community participation and feedback to refine and achieve these goals.