With the largest smart contracts platforms running proof-of-stake consensus mechanisms, staking has become a cornerstone activity in DeFi.

Staking allows crypto holders to earn rewards by participating in network security. However, this involves locking up assets, limiting their liquidity and usability.

This is where liquid staking comes in.

Liquid staking unlocks the value of your staked assets by issuing tradable tokens that represent your stake—allowing you to earn staking rewards while maintaining liquidity and flexibility across DeFi ecosystems.

How Does Liquid Staking Work?

Liquid staking requires a staking pool provider to issue tokens when users contribute to their staking pool. This is known as a liquid staking token, or LST.

LSTs represent your claim on that provider’s pool of the staked asset. These tokens are valuable because they can be redeemed for that underlying asset and any accrued interest.

Due to this inherent value, LSTs can be used within the rest of the DeFi ecosystem in various ways. You can borrow against your staked assets, sell your stake, swap it, or earn additional yield from other protocols – all without unstaking or missing out on staking rewards.

On the other hand, if you sell or lose your liquid staking tokens, you’ve given up your ownership of your claim of the underlying assets.

Liquid Staking Process

Liquid staking takes a few more steps than traditional staking, however you won’t need much technical expertise.

Here’s what the liquid staking process generally looks like:

- Staking: Users deposit their tokens into a staking pool to earn rewards through network maintenance tasks.

- Issuance: Users receive derivative tokens (LSTs) representing their staked assets, allowing them to maintain liquidity.

- Utilization of tokens: These LSTs can be traded, used in DeFi protocols, or transferred, providing flexibility and additional earning potential.

- Redemption: Users can redeem derivative tokens to receive their original staked assets and any accumulated rewards after the applicable unstaking period.

The liquid staking provider you use is completely up to you. In the next section, we’ll look at some of the most well-established contenders.

Top Liquid Staking Protocols 2026

1. Lido (stETH)

Lido is the original Ethereum liquid staking solution, launching its liquid staking token stETH in December 2020.

Users can stake their Ether with no minimum limit and receive stETH at a 1:1 ratio, representing the staked ETH and accrued staking rewards. The token is widely adopted throughout the Ethereum DeFi ecosystem and is integrated across more than 100 dApps.

stETH remains the largest Ethereum LST today, making up more than two-thirds of all staked ETH at the time of writing. This dominance has led to some concerns around centralization, due to the power Lido has over staked ETH.

Lido operates with a decentralized governance structure through its DAO. Lido’s native token, LDO, facilitates governance and rewards within the ecosystem. It charges a 10% fee on staking rewards, splitting it between Lido node operators and the DAO treasury.

The Lido protocol previously supported liquid staking for Solana, Polkadot, and Kusama; however, it has since cut its offering to just Ethereum and Polygon.

| LSTs | stETH, stMATIC |

| APR % | 3.00% |

| Fees | 10% of staking rewards |

| Launch date | December 2020 |

| Founded by | Konstantin Lomashuk, Vasiliy Shapovalov, Jordan “Cobie” Fish. |

| Audited by | Ackee, Certora, ChainSecurity, Hexens, MixBytes, Oxorio, Pessimistic, Quantstamp, Sigma Prime, Statemind. |

2. Binance (WBETH)

Binance is currently the largest centralized liquid staking provider. It launched its first liquid staking token, BETH, in December 2020.

In April 2023, Binance introduced WBETH, its dominant liquid staking token today. WBETH is designed for use both within Binance and in external DeFi applications. Users create WBETH by depositing BETH into the BETH wrapper, with each WBETH representing 1 BETH plus all accrued staking rewards.

WBETH is governed entirely by Binance and requires KYC to be issued. Binance’s standard service fee for ETH staking is 10%

| LSTs | WBETH, BETH |

| APR % | 2.71% |

| Fees | 10% of staking rewards |

| Launch date | December 2020 (BETH), April 2023 (WBETH) |

| Founded by | Changpeng Zhao (commonly known as CZ) and Yi He. |

| Audited by | Peckshield, SlowMist, Supremacy |

3. Rocket Pool (rETH)

Rocket Pool launched in October 2021 and is Ethereum’s second-largest decentralized liquid staking platform. It provides rETH tokens in exchange for staked ETH, usable across various DeFi protocols while earning staking rewards.

Rocket Pool emphasizes decentralization, allowing users to become node operators with just 8 ETH. It also features “Minipool” Validators, which enable smaller staking pools with a minimum of 16 ETH. Validators pool funds with rETH token holders, sharing both rewards and risks.

Users can stake as little as 0.01 ETH, with a 14% commission allocated to node operators only. RPL token holders propose and vote on protocol changes via a DAO.

In 2021, a vulnerability reported by StakeWise delayed Rocket Pool’s launch, but the issue was fixed, and no further problems have occurred since.

| LSTs | rETH |

| APR % | 2.54% |

| Fees | 14% of staking rewards |

| Launch date | October 2021 |

| Founded by | David Rugendyke |

| Audited by | Sigma Prime, ConsenSys Diligence, ChainSafe, Trail of Bits |

4. mETH Protocol (mETH)

mETH Protocol, formerly known as Mantle LSP, is an Ethereum Layer-2 network that spun out from BitDAO in 2023, inheriting BitDAO’s $4B treasury and governance functions.

The project launched its DeFi Liquid Staking Protocol in December 2023 on Ethereum Layer 1. Users stake ETH on mETH Protocol and receive mETH tokens, which represent staked ETH plus accrued rewards.

The protocol aims to enhance mETH’s utility and yield by integrating it across its ecosystem, including its L2 network and core partners.

mETH Protocol has a minimum stake limit of 0.02 ETH and charges a 10% fee on rewards, sharing a portion with Node Operators. The platform is governed by COOK token holders via a DAO.

| LSTs | mETH |

| APR % | 2.73% |

| Fees | 10% of staking rewards |

| Launch date | December 2023 |

| Founded by | Mantle Network (Funded by BitDAO) |

| Audited by | Quantstamp, Blocksec, Hexens, MixBytes, Secure3, Verilog |

5. Coinbase (cbETH)

Publicly-traded exchange Coinbase launched its liquid staking token, cbETH, in August 2022.

cBETH allows users to benefit from ETH staking while maintaining liquidity. The value of cbETH reflects the price of the underlying staked ETH plus any accrued rewards.

Users can trade, transfer, or use cbETH in various DeFi applications outside Coinbase, providing flexibility and earning potential. Users can unwrap the token at any time to redeem their staked ETH.

Coinbase doesn’t charge fees for wrapping staked ETH, but charges a 35% commission on the staking rewards.

| LSTs | cbETH |

| APR % | 2.14% |

| Fees | 35% of staking rewards |

| Launch date | August 2022 |

| Founded by | Brian Armstrong and Fred Ehrsam. |

| Audited by | OpenZeppelin |

6. Jito (JitoSOL)

Jito launched its liquid staking protocol for Solana in November 2022, following the collapse of FTX.

Built on the Stake Pool program by Solana Labs, Jito allows users to stake their SOL and receive JitoSOL tokens. JitoSOL is the leading LST for Solana, with integrations across various DeFi applications on the network.

Initially, Jito used MEV strategies to boost rewards, offering higher yields than traditional staking. However, in March 2024, it disabled MEV functionality on its validator client due to a negative impact on Solana users, especially from ‘sandwich attacks.’

JTO token holders govern the protocol, participating in decision-making through proposals and votes. JitoSOL charges an annual management fee of 4% of total rewards, as well as a 0.1% fee on the total withdrawal value.

| LSTs | JitoSOL |

| APR % | 8.12% |

| Fees | 4% of staking rewards + 0.1% of withdrawal value |

| Launch date | November 2022 |

| Founded by | Lucas Nuzzi |

| Audited by | Quantstamp, Neodyme, Kudelski (Stake Pool audit). |

Comparison table:

| Protocol | APR | Fees on Rewards | Launch Date | Founders |

|---|---|---|---|---|

| Lido (stETH) | 3.00% | 10% | December 2020 | Konstantin Lomashuk, Vasiliy Shapovalov, Jordan “Cobie” Fish |

| Binance (WBETH) | 2.71% | 10% | December 2020 (BETH), April 2023 (WBETH) | Changpeng Zhao (CZ) and Yi He |

| Rocket Pool (rETH) | 2.54% | 14% | October 2021 | David Rugendyke |

| Mantle LSP (mETH) | 2.73% | 10% | December 2023 | Mantle Network (Funded by BitDAO) |

| Coinbase (cbETH) | 2.14% | 35% | August 2022 | Brian Armstrong and Fred Ehrsam |

| Jito (JitoSOL) | 8.12% | 4% + 0.1% withdrawal fee | November 2022 | Lucas Nuzzi |

Liquid Staking vs Pool Staking vs Traditional Staking

The three main types of staking are liquid staking, pool staking, and traditional staking.

Each approach has different implications for key factors such as minimum stake requirements, liquidity, reward distribution, management, and participation.

Traditional Staking

Traditional staking involves users locking up their coins directly in a blockchain network to help secure and maintain it.

This often requires a minimum number of coins and a degree of technological expertise. For example, staking on Ethereum requires at least 32 ETH to set up a validator node.

In return for securing the network, stakers earn rewards. However, their assets are locked up for a specific period, making them illiquid and unavailable for other uses.

Traditional staking helps ensure network security, but limits the liquidity of the staked assets.

Pool Staking

Pool staking lets users combine their crypto in a shared pool to boost their chances of earning rewards. This way, even those without the minimum amount of coins required for staking can participate.

Each person earns rewards based on their contribution, and the pool is either managed by a central entity (CeFi) or collectively by the participants (through a DAO).

Overall, pool staking makes joining easier and increases the chances of earning rewards compared to staking alone. However, the staked crypto is still locked up and can’t be used elsewhere.

Liquid Staking

Liquid staking lets users stake their coins and get derivative tokens (LSTs) representing the staked assets and any rewards.

This is often built on top of pooled staking, so there’s no minimum limit, and rewards are shared based on your contribution. Even though the original stake is locked up, you can freely use these LSTs on the open market. You can trade, transfer, or use them in DeFi applications while still earning staking rewards.

In short, liquid staking offers the benefits of pooled staking and the flexibility to use your assets anywhere.

| Feature | Traditional Staking | Pool Staking | Liquid Staking |

|---|---|---|---|

| Minimum Stake | High | Low | Low |

| Liquidity | Locked | Locked | Liquid (via LSTs) |

| Reward Distribution | Direct from network | Shared proportionally | Shared proportionally via LSTs |

| Management | Individual setup | Centralized (CeFi) or collective (DAO) | Centralized (CeFi) or collective (DAO) |

| Participation | Requires technical knowledge | Low barrier, no technical knowledge needed | Low barrier, no technical knowledge needed, flexible use of staked assets |

Risks of Liquid Staking

Like any investment, liquid staking carries its own set of risks that you should carefully consider before getting involved.

These include, but are not limited to:

- Counterparty Risk: The risks from entities managing the staking process. High centralization can lead to a single point of failure, and legal issues could interfere with the security and stability of your staked assets.

- Governance Risks: Poor governance decisions by a DAO or other governing bodies could negatively impact the protocol, affecting your staked assets and rewards.

- Liquidity and Volatility Risks: If there’s low demand for your LSTs, it may become hard to trade or use them effectively. Issues such as large withdrawal requests for the underlying asset could cause delays and affect the LST’s stability.

- Slashing Risks: Slashing is a penalty for validators’ poor performance or misbehavior. It could reduce the total amount staked and the value of your LSTs.

- Technology Risk: The security of smart contracts and the reliability of external systems like oracles. Bugs or failures in these systems can put your staked assets at risk.

It is important to choose platforms with strong track records, audited smart contracts, and reliable governance to mitigate these risks as much as possible.

ETH holders looking for different risk/reward profiles can also speculate on price movements through crypto prediction markets, which offer binary contracts on price thresholds rather than yield-based returns.

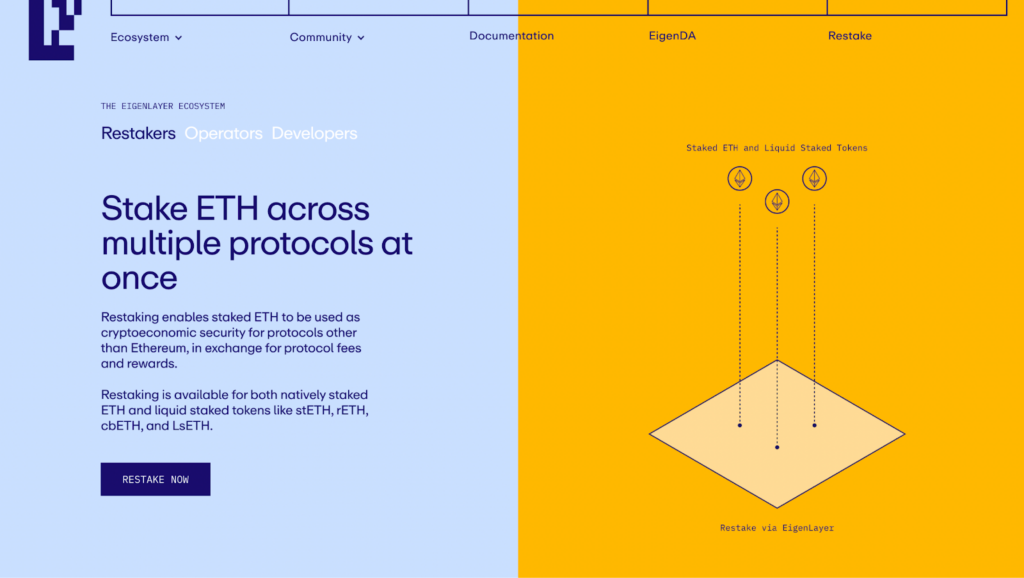

What is Restaking?

Restaking is liquid staking taken one step further. Users already using liquid staking tokens can stake them once more, to generate additional yield.

Protocols like Eigenlayer use staked LSTs to secure smaller blockchain apps. This allows them to benefit from Ethereum’s staked assets and its network of validators, allowing developers to create new and innovative blockchain applications.

These applications include systems for data storage, transaction processing, bridge verification, and price feeds – all secured by the restaked ETH.

Liquid restaking services such as Puffer, Ether.Fi and Renzo shortcut this staking process, and provide users with liquid restaking tokens.

FAQ

Liquid staking still makes up less than half of all staked ETH, at the time of writing.

However, it’s gaining popularity thanks to its added liquidity benefits, with platforms like Lido and Rocket Pool leading the way.

Liquid staking rewards are distributed by increasing the value of liquid staking tokens (LSTs) that users hold, reflecting the rewards earned by the underlying staked assets.

This allows users to trade, transfer, or use the LSTs in DeFi apps while still earning staking rewards.

Like any investment, liquid staking has risks you should consider, including issues with platform management, governance decisions, liquidity, slashing penalties, and technology reliability.

Choose platforms with good reputations, audited smart contracts, and solid governance to minimize these risks.

Native tokens of major proof-of-stake networks, like Ether (ETH) and Solana (SOL), typically support liquid staking through third-party platforms.

Other tokens with liquid staking include Avalanche (AVAX), Polygon (MATIC), Cosmos (ATOM), Aptos (APT), Polkadot (DOT) and several others.

Liquid staking can have tax implications that vary by jurisdiction.

Generally, receiving liquid staking tokens, earning staking rewards, and any transactions involving these tokens can be considered taxable events.

If you’re liquid staking, keep transaction records and consult a tax professional.

No. Although yield farming involves locking up tokens to provide liquidity to DeFi protocols and earn rewards, these protocols aren’t vital to maintaining the network.