DeFi lending platforms let investors unlock liquidity by borrowing against their crypto holdings—without needing to sell. Whether for trading, yield farming, or real-world expenses, it’s a flexible way to put your assets to work.

Compare crypto borrowing rates for February 2026

| Token | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

USDT Tether | 3.91%

TVL $6.5B3.91%

TVL $6.5B4.06%

TVL $7.3M | — | 3.60%

TVL $230.8M3.60%

TVL $230.8M | — | 3.49%

TVL $233.7M3.52%

TVL $208.9M3.61%

TVL $20.4M3.49%

TVL $4.4M | — | 5.36%

TVL $1.3M5.36%

TVL $1.3M | — | — | — |

USDT Borrow APY - 30 Day History | ||||||||||

USDC USD Coin | 3.93%

TVL $4.8B4.63%

TVL $4.2B4.85%

TVL $358.0M3.93%

TVL $293.6M4.09%

TVL $21.0M | 1.77%

TVL $65.5K1.77%

TVL $65.5K | 3.78%

TVL $50.0M3.78%

TVL $50.0M | — | 3.30%

TVL $415.4M3.61%

TVL $397.8M3.91%

TVL $12.9M3.30%

TVL $574.0K3.80%

TVL $4.2M | 0.29%

TVL $3.0M0.29%

TVL $3.0M | 5.69%

TVL $108.9M5.69%

TVL $108.7M6.62%

TVL $208.4K | — | — | — |

USDC Borrow APY - 30 Day History | ||||||||||

PYUSD PayPal USD | 3.36%

TVL $392.3M3.36%

TVL $392.3M | — | 4.45%

TVL $100.0M4.45%

TVL $100.0M | — | — | — | — | — | — | — |

PYUSD Borrow APY - 30 Day History | ||||||||||

DAI Dai | 3.93%

TVL $186.2M3.93%

TVL $180.2M4.51%

TVL $4.9M4.57%

TVL $1.1M | — | — | — | — | — | — | — | — | — |

DAI Borrow APY - 30 Day History | ||||||||||

WETH Wrapped Ether | 1.71%

TVL $8.8B2.26%

TVL $8.0B2.19%

TVL $270.7M2.19%

TVL $438.6M1.71%

TVL $25.9M | 0.25%

TVL $3.9M9.84%

TVL $151.2K0.25%

TVL $1.8M3.33%

TVL $81.4K3.58%

TVL $1.9M | 2.34%

TVL $679.4M2.34%

TVL $679.4M | 7.75%

TVL $810.7M7.75%

TVL $810.7M | 2.03%

TVL $13.7M2.18%

TVL $6.2M2.30%

TVL $3.3M2.03%

TVL $4.2M | — | 0.57%

TVL $61.1M0.57%

TVL $54.7M3.79%

TVL $6.4M | 1.50%

TVL $12.8M1.50%

TVL $12.8M | — | — |

WETH Borrow APY - 30 Day History | ||||||||||

WSTETH wstETH | 0.01%

TVL $4.5B0.05%

TVL $4.4B0.02%

TVL $55.6M0.01%

TVL $88.3M0.32%

TVL $26.9M | 0.43%

TVL $25.0M0.43%

TVL $2.5M1.94%

TVL $518.6K3.19%

TVL $19.5M3.63%

TVL $2.6M | <0.01%

TVL $1.4B<0.01%

TVL $1.4B | 8.75%

TVL $264.3M8.75%

TVL $264.3M | — | 2.30%

TVL $239.0M2.48%

TVL $216.4M2.30%

TVL $22.6M | 1.10%

TVL $349.7K1.10%

TVL $349.7K | 1.50%

TVL $1.3M1.50%

TVL $1.3M | — | 4.97%

TVL $1.3M4.97%

TVL $1.3M |

WSTETH Borrow APY - 30 Day History | ||||||||||

WEETH weETH | 1.00%

TVL $6.2B1.01%

TVL $5.9B1.00%

TVL $176.3M1.00%

TVL $158.6M | 1.97%

TVL $7.4M3.50%

TVL $1.4M1.97%

TVL $5.5M4.37%

TVL $431.2K | — | — | — | 0.08%

TVL $80.1M0.26%

TVL $80.0M0.08%

TVL $86.9K | — | — | — | — |

WEETH Borrow APY - 30 Day History | ||||||||||

CBBTC CBBTC | 0.38%

TVL $1.9B0.38%

TVL $1.7B1.05%

TVL $259.2M | 0.08%

TVL $1.4M2.00%

TVL $58.8K0.08%

TVL $1.3M | 0.05%

TVL $144.5M0.05%

TVL $144.5M | — | — | 4.17%

TVL $3.8M4.17%

TVL $3.8M | — | 1.90%

TVL $12.8M1.90%

TVL $12.8M | — | 4.97%

TVL $119.0K4.97%

TVL $119.0K |

CBBTC Borrow APY - 30 Day History | ||||||||||

WBTC Wrapped Bitcoin | 0.38%

TVL $3.5B0.38%

TVL $3.3B0.91%

TVL $203.9M0.75%

TVL $21.0M | 0.07%

TVL $19.3M0.07%

TVL $202.5K3.38%

TVL $2.8M2.61%

TVL $16.4M | — | 12.75%

TVL $6.0M12.75%

TVL $6.0M | — | 2.30%

TVL $459.1K2.48%

TVL $355.1K2.30%

TVL $103.9K | 0.03%

TVL $12.3M0.03%

TVL $2.0M3.10%

TVL $10.3M | 2.00%

TVL $5.1M2.00%

TVL $5.1M | — | 4.97%

TVL $586.8K4.97%

TVL $586.8K |

WBTC Borrow APY - 30 Day History | ||||||||||

USDE USDe | 3.07%

TVL $1.1B3.07%

TVL $1.1B | 0.45%

TVL $364.2K0.45%

TVL $364.2K | — | — | — | — | — | — | — | — |

USDE Borrow APY - 30 Day History | ||||||||||

Above are today’s best crypto borrowing rates. Use this table to see current APRs to borrow against your assets. Looking to earn yield instead? Compare live crypto lending rates.

Why do people borrow crypto?

Borrowing crypto is popular for several strategic reasons. These mostly boil down to two key concepts: Obtaining leverage and avoiding taxable events.

Obtaining leverage

Users can borrow against crypto holdings to create synthetic leveraged positions in the market.

For example, a user can borrow stablecoins against ETH, and use those stablecoins to purchase more ETH (or another asset) for greater exposure. This approach increases potential upside but also amplifies downside risk—similar to placing larger bets at a crypto casino, where the potential reward grows but so does the chance of significant loss

Conversely, a user could borrow ETH against stablecoins, to immediately short-sell on the open market. They can then buy back this ETH at a discount, pocketing the difference.

Avoiding taxable events

Borrowing against cryptocurrency holdings can provide a user with quick liquidity, without selling their assets outright.

This is useful because it avoids a taxable event from selling crypto, but still provides the borrower with liquid funds.

Some centralized platforms allow users to borrow fiat currency against their crypto holdings. These platforms are less common in 2026, following several centralized lenders going bankrupt in 2022.

DeFi borrowing protocols

1. Aave

Aave is a leading DeFi lending protocol on 14+ EVM chains, including Ethereum, Arbitrum, and Optimism. Users can borrow a range of stablecoins, ETH, LSTs, and DeFi tokens.

Borrowers deposit more collateral than they borrow, at interest rates that adjust based on market demand to keep costs flexible.

Flash loans allow uncollateralized borrowing within a single transaction for a 0.09% fee, and GHO (Aave’s stablecoin) is backed by overcollateralized assets.

Aave’s Umbrella module can earn variable APYs typically ranging from around 3% to over 10%, depending on the asset and vault liquidity

Aave uses a portion of protocol revenue, including interest paid by borrowers, to fund its DAO treasury and recently proposed a $50 million annual AAVE token buyback program to enhance treasury growth and token value.

It launched as ETHLend in 2017 and rebranded in 2018, with V4 set to improve speed and efficiency.

| Networks supported | 14+ EVM chains |

| Collateral Tokens | Wide range of stablecoins, ETH, LSTs, and popular DeFi tokens |

| Borrowable Tokens | GHO and all collateral tokens |

| Additional Features | Flash loans, GHO stablecoin, staking |

2. Sky Protocol (Formerly MakerDAO)

Sky Protocol is a stablecoin lending platform on Ethereum and Gnosis Chain, originally launched as MakerDAO in 2014 and rebranded in 2024.

Here is a fact-check and revision for the provided statements about Sky Protocol:

Partially correct. Borrowers now primarily mint USDS (successor to DAI) by locking various collateral including ETH, WBTC, LSTs, stablecoins, and real-world assets. Collateral ratios vary but generally fall in this range, depending on asset type and governance.

“Sky Protocol is a stablecoin lending platform on Ethereum and Gnosis Chain, originally launched as MakerDAO in 2014 and rebranded in 2024.”

Correct. MakerDAO rebranded to Sky Protocol in August 2024 and officially launched the new Sky ecosystem with USDS and SKY tokens in September 2024. It operates on Ethereum and Gnosis Chain.

“Borrowers can mint USDS or DAI by locking up collateral like ETH, WBTC, LSTs, stablecoins, or real-world assets with a 110–200% collateral ratio.”

USDS is pegged to the dollar and swappable 1:1 with DAI, with both stablecoins generated through overcollateralized smart contracts.

Borrowing in the Sky ecosystem is managed via a decentralized entity called Sky Stars. The interest rate (the ‘Stability Fee’) varies with the collateral type and governance decisions.

Sky.Money handles USDS and SKY token transactions, while users can stake USDS or DAI in the Sky Savings Rate (SSR) to earn interest.

Governance is driven by SKY holders, who vote on key settings like collateral types, borrowing rates, and the SSR.

| Networks supported | Ethereum, Base, Arbitrum |

| Collateral Tokens | ETH, LSTs, WBTC, stablecoins, DeFi tokens |

| Borrowable Tokens | USDS, DAI |

| Additional Features | Sky Savings Rate (SSR), Seal Engine |

3. Compound

Compound is a DeFi lending protocol on Ethereum and 10+ chains that lets users borrow stablecoins, ETH, and DeFi tokens by locking up collateral.

Loans are overcollateralized, with interest rates that adjust based on supply and demand, giving borrowers flexible and transparent costs.

Compound V3 organizes borrowing into separate markets, each allowing only one token (like USDC or ETH) to be borrowed – while accepting various tokens as collateral.

When you borrow, you receive cTokens that track your loan and can be used across other DeFi platforms. You can borrow directly through compound.finance or connected apps like MetaMask and other DeFi wallets.

Borrowers also earn COMP token rewards. COMP holders govern the protocol and vote on changes like asset listings and interest model updates.

| Networks supported | 10+ EVM chains |

| Collateral Tokens | ETH, LSTs, WBTC, stablecoins, DeFi tokens |

| Borrowable Tokens | ETH, LSTs, stablecoins, WBTC, some DeFi tokens |

| Additional Features | Single-borrow asset model |

4. Spark

Spark is a lending protocol on Ethereum and Gnosis Chain, built as the first ‘Star’ under Sky Protocol (formerly a MakerDAO SubDAO).

Through SparkLend, users can borrow USDS, DAI, and other major tokens (like ETH LSTs and WBTC) by locking up collateral such as sUSDS or stablecoins.

Loans are overcollateralized, and borrowing rates stay low thanks to Spark’s link with Sky’s Direct Deposit Dai Module (D3M). This adds liquidity from platforms like Compound and Aave.

Borrowers benefit from competitive rates and can earn SKY rewards through the Sky Savings Rate system.

The protocol is governed by SPK token holders, who vote on changes to improve borrowing terms and platform performance.

| Networks supported | Ethereum, Base, Arbitrum, Gnosis |

| Collateral Tokens | ETH, LSTs, WBTC, stablecoins, DeFi tokens |

| Borrowable Tokens | sUSUSDS, DAI, collateral tokens (except sUSDS) |

| Additional Features | Direct Deposit Dai Module (D3M), eMode |

5. Morpho

Morpho is a DeFi lending protocol on Ethereum and Base that lets users borrow assets like USDC, DAI, ETH, and WBTC through flexible, custom markets.

Its core product, Morpho Blue, supports over 190 markets with tailored terms, high loan-to-value ratios, and no protocol fees unless governance enables them.

Loans are overcollateralized, with a peer-to-peer layer for better rates and pooled liquidity for backup.

Borrowers can use MetaMorpho vaults for managed liquidity and take advantage of free flash loans for advanced strategies.

Governance is led by MORPHO holders, who vote on market parameters, while borrowing happens through morpho.org or integrations like Coinbase.

| Networks supported | Ethereum, Base, Arbitrum |

| Collateral Tokens | Any ERC20 on supported networks, via permissionless market creation |

| Borrowable Tokens | Any collateral token |

| Additional Features | Free flash loans, MetaMorpho layer |

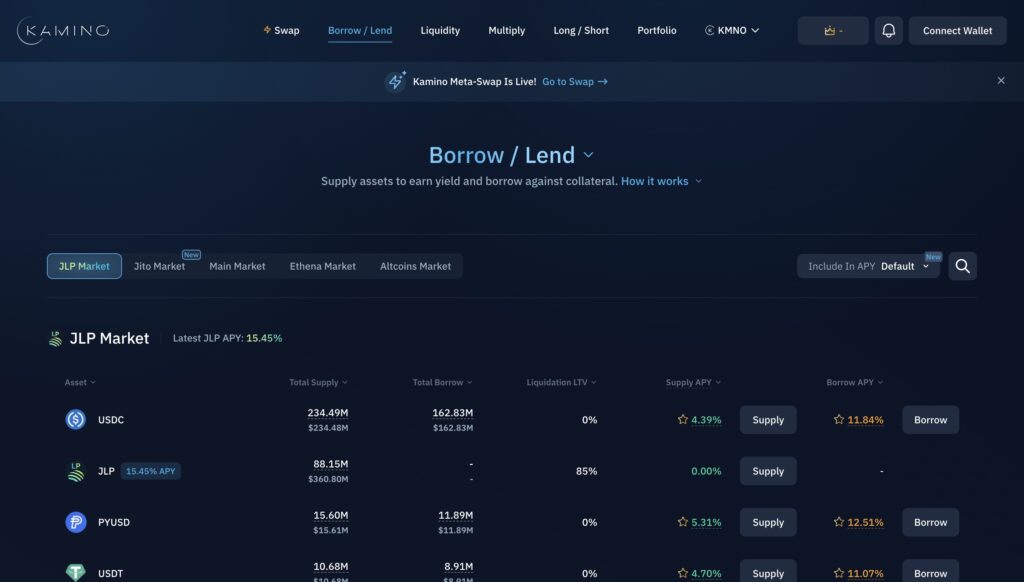

6. Kamino

Kamino is Solana’s top lending protocol. Users can supply or borrow assets like SOL, USDC, PYUSD, jitoSOL, mSOL, stablecoins, and kTokens.

As with other platforms, loans are overcollateralized and interest rates adjust dynamically across markets like Main, JLP, Ethena, and Altcoins. Each market offers different risk profiles and asset types.

Borrowers can access up to 95% LTV in eMode for correlated pairs like SOL/jitoSOL. Multiply Vaults enable up to 10x leverage using flash loans, while Long/Short Vaults support directional borrowing strategies for traders.

Built-in risk tools include auto-deleveraging, Scam Wick Protection, and dynamic liquidations.

KMNO holders govern the protocol, vote on settings, and earn rewards through borrowing-related points programs.

| Networks supported | Solana |

| Collateral Tokens | SOL, stablecoins, LSTs, LP tokens, memecoins, yield-bearing tokens (kTokens) |

| Borrowable Tokens | SOL, stablecoins, LSTs, LP tokens |

| Additional Features | Multiply Vaults, eMode, free flash loans |

How to a DeFi loan works

Getting a DeFi loan is simple, provided you already own some cryptocurrency. No identity verification is required.

Here’s how it works:

- Set up a web3 wallet: Ensure you have a Web3 wallet compatible with your blockchain network of interest.

- Visit a DeFi platform: Go to a DeFi borrowing app that supports the tokens you’re interested in.

- Provide collateral: Deposit a supported cryptocurrency as collateral.

- Borrow: Borrow your desired token against the deposited collateral.

And that’s it. You now have a DeFi loan.

Ensure you repay the loan as soon as you’re done with the funds, to avoid further interest payments or liquidation.

What type of leverage can you get on a DeFi loan?

The type of leverage you can get on a DeFi loan typically depends on the platform and the specific collateral you provide.

Most DeFi platforms require over-collateralization, meaning you must deposit more value in collateral than the amount you wish to borrow. Common collateralization ratios range from 110% to 200%, meaning for every $100 you borrow, you need to deposit $110 to $200 worth of collateral.

Another way the borrowable amount is commonly expressed is via “loan-to-value” (LTV) ratio – the inverse of the collateralization ratio above. A 60% LTV ratio means you can borrow up to 60% of the value of your collateral.

Overcollateralization is important since it ensures the loan can be repaid in full, even in a volatile market.

What are flash loans?

- Collateral required: None

- Conditions: Funds must be fully repaid within the same block

- Fees: Typically 0% to 0.05%.

Flash loans are a type of unsecured DeFi loan where users can borrow money and return it within a single block.

If the loan doesn’t return the entirety of the funds within a single transaction, the entire transaction is reversed – ensuring no risk to the lender. Due to this absence of repayment risk, no collateral is required for a flash loan.

On the other hand, using a flash loan typically requires smart contract writing ability. The loan and the subsequent use of funds must be programmed to complete complex operations within one transaction.

Flash loans are popular for arbitrage, collateral swapping, and refinancing without the need for traditional collateral.

What are the risks of DeFi borrowing?

Liquidation risk

Liquidation risk comes from the volatility of collateral assets. If the value of your collateral drops significantly, especially during a market downturn, your assets may be automatically sold off to repay the loan.

Smart contract risk and exploits

Smart contract risk involves the potential for bugs or vulnerabilities in the code of the DeFi protocol.

Any vulnerabilities can cause malfunctions on their own, but are sometimes also maliciously exploited – in other words, hacked. These can result in the loss of user funds, fraudulent access to protocol treasuries and governance, and other undesirable outcomes.

Major protocols perform smart contract audits and carry out bug bounty programs to minimize these risks.

Oracle and price feed risk

Oracle risks in DeFi borrowing occur when the external data sources that provide asset prices malfunction or get manipulated.

This is a common attack vector used for hacks and exploits. A faulty oracle can lead to incorrect pricing information, resulting in unfair liquidations or under-collateralized loans.

Largest DeFi borrowing hacks

Several billions of dollars have been lost in DeFi exploits to date, commonly leveraging flash loans to fund the attacks.

Although these have assisted in exposing holes in smart contracts and improving coding standards, it’s been a costly learning curve.

Here’s a look at the largest DeFi lending platform hacks so far:

- Beanstalk: $182 Million: In April 2022, Beanstalk was attacked using a flash loan. The attacker gained control of governance and passed proposals to transfer $182 million worth of funds.

- Compound: $150 Million: In October 2021, Compound faced a critical issue due to a protocol bug. This bug led to the distribution of excess COMP tokens, putting $150 million in tokens at risk.

- Cream Finance: $130 Million: Also in October 2021, Cream Finance suffered a flash loan attack. The attacker exploited a pricing vulnerability, causing a loss of $130 million in deposits in the third attack on the protocol.

- Mango Markets: $116 Million: In October 2022, Solana-based Mango Markets was exploited via price manipulation. A trader manipulated the price of MNGO using low liquidity and took out overcollateralized loans, draining $116 million from the protocol.

- bZx: $55 Million: In November 2021, bZx was compromised due to a private key breach. This resulted in a loss of $55 million in funds deployed on Binance Smart Chain and Polygon.

- Vee Finance: $35 Million: In September 2021, Vee Finance (Avalanche) was exploited through its leveraged trading feature. The attacker created trading pairs on decentralized exchange Pangolin, draining $35 million through leveraged trades.

Borrowing FAQ

A DeFi loan is a loan that users can take out by providing cryptocurrency as collateral on a DeFi lending platform. These loans are typically overcollateralized to protect lenders.

DeFi lending carries risks such as liquidation risk from collateral volatility, smart contract exploits, and Oracle risks, which vary depending on the platform and assets involved.

The vast majority of DeFi loans are overcollateralized. This means that the value of the funds borrowed must be less than the value of the funds provided as collateral.

Typical collateralization ratios range from 110% to 200%.

DeFi borrowing is decentralized, using smart contracts on blockchain platforms to facilitate cryptocurrency loans without intermediaries. Traditional loans involve fiat currency and financial institutions as intermediaries, with more rigorous processes.

DeFi borrowing typically involves digital assets only, whereas traditional loans focus on fiat currency.

You can borrow crypto with no money via flash loans. These are unsecured and must be repaid within a single transaction.

Flash loans typically require smart contract writing ability, to code specific operations within one block.