You can earn interest on your crypto, just like a savings account. Or, you can take out a loan against your crypto – just like you can borrow against a house or car.

Here’s a look at the top lending protocols and what you should consider before getting started.

| Token | Aave V3 | MakerDao | Compound | Spark |

|---|---|---|---|---|

| USDC | 3.68% | 0% | 4.26% | 4.64% |

| USDT | 3.91% | - | 3.9% | 4.85% |

| DAI | 3.19% | 6% | - | 6.41% |

| USDE | 2.34% | - | - | - |

| ETH | 0.48% | - | 3.14% | - |

| WETH | 0.57% | 0% | 5.98% | 2.28% |

| WSETH | - | - | - | - |

| WEETH | 0.093540% | - | 0% | 0% |

| RETH | 0.087700% | 0% | 0% | 0.000770% |

| BTC/WBTC | 0.087050% | 0% | 0% | 0.025030% |

| MKR | 0.000260% | - | - | - |

| GHO | 18.07% | - | - | - |

| BAT | - | 0% | - | - |

| LINK | 0.005860% | 0% | 0% | - |

What is Crypto Lending?

Crypto lending is a financial service in which crypto holders lend their tokens to borrowers in exchange for interest payments.

This is also usually accompanied by the ability to borrow against this cryptocurrency as collateral.

Crypto lending and borrowing is usually facilitated in one of two ways:

- Centralized lending: A company acts as a trusted intermediary by holding funds, lending them to borrowers, and managing interest payments.

- Decentralized lending: A smart contract on the blockchain acts as the intermediary. It holds funds, lends them to borrowers, and manages interest payments, in an automated fashion.

Some newer platforms, such as Maple, provide a hybrid of these two systems. Each system carries its own set of benefits and risks, catering to different types of lenders and borrowers.

DeFi Lending Protocols for 2024

Decentralized lending is part of decentralized finance (DeFi). This platform type is almost entirely automated and relies on smart contract code to perform its functions.

Decisions on the DeFi lending protocols are typically made by holders of the platform’s native token, which is used for voting rights.

Here are some of the top DeFi lending protocols on the market today:

1. Aave

Aave is a DeFi lending protocol deployed on 12+ blockchains, that allows users to lend and borrow a wide range of cryptocurrencies.

Interest rates are variable and algorithmic, adjusting automatically according to supply and demand. The Aave protocol also has its stablecoin, GHO, backed by assets in Aave V3.

Its native governance token, AAVE, enables holders to vote on proposals affecting the protocol’s direction. AAVE can also be staked, serving as a safety mechanism to protect against liquidity shortages in return for interest.

Aave began as a lending-only platform called ETHLend. It rebranded to Aave in 2018, as it looked to expand its scope beyond just lending.

| Launch Date | May 2017 |

| Founded by | Stani Kulechov |

| Audited by | Trail of Bits, Certora, OpenZepplin, Sigma Prime, PeckShield, and ABDK |

| Hacks & Controversy | No major hacks to date. Encountered a “failed short attack” in 2022, and a small impact on an old version of the protocol (V1) in 2023. |

2. MakerDao

MakerDAO was one of the first projects designed for Ethereum, founded in 2014. It manages the stablecoin DAI, which launched in 2017.

DAI is pegged to the US dollar and backed by crypto collateral. Users lock cryptocurrencies in the MakerDAO smart contract to generate DAI.

MKR token holders, who vote on proposals, control the protocol’s governance. They also control factors such as the whitelisting of collateral assets and the Dai Savings Rate (DSR)—a fixed interest rate that distributes revenue from Maker to DAI holders.

The most popular user interface for using MakerDAO is Summer.Fi, previously known as Oasis.

MakerDAO announced “subDAOs” in 2021, to improve governance and efficiency. SubDAOs are additional, smaller protocols built on top of the main platform.

| Launch Date | December 2017 |

| Founded by | Rune Christensen |

| Audited by | Trail of Bits, PeckShield, and Runtime Verification |

| Hacks & Controversy | No hacks to date. Controversy surrounding the addition of USDC as collateral in 2020, leading to centralization concerns. |

3. Compound

Compound is a specialized platform that lets users borrow and lend assets against collateral, with interest rates determined by supply and demand.

Users can access Compound through various interfaces, tools, and custodians, and participate in its governance with COMP tokens. Compound was one of the first DeFi projects to fully hand over protocol decision-making to the community through this governance system.

Unlike many competing protocols, Compound has strictly focused on lending, borrowing, and governance without any additional features.

| Launch Date | August 2017 |

| Founded by | Geoffrey Hayes and Robert Leshner |

| Audited by | OpenZepplin, Trail of Bits, Certora, and Gauntlet. |

| Hacks & Controversy | $80 million exploit in October 2021, due to a bug in the Comptroller Contract. |

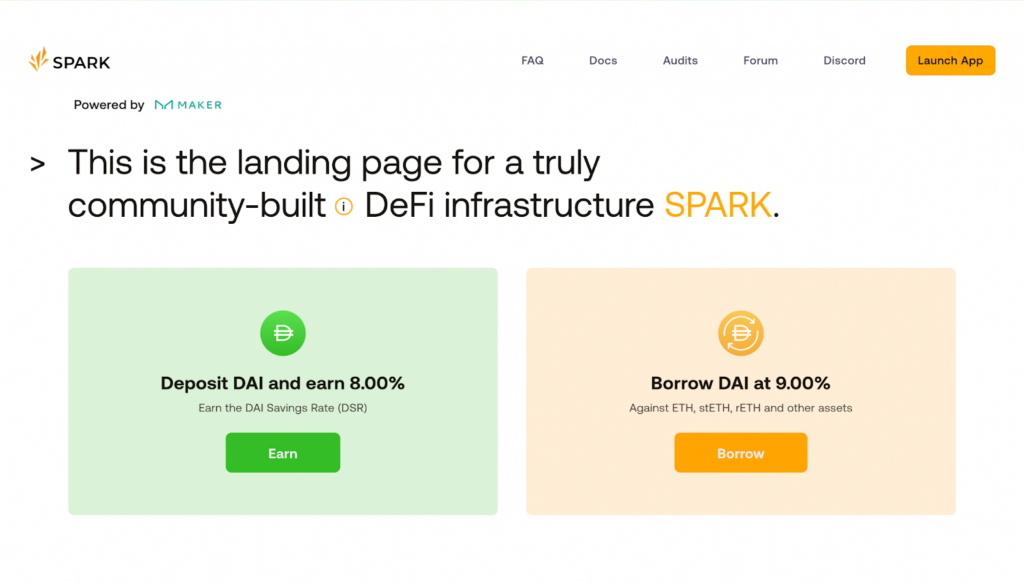

4. Spark

Spark is the First SubDAO on MakerDAO. It’s based on the Aave v3 codebase and lets users supply and borrow cryptocurrencies, with a focus on DAI.

The Spark protocol is integrated with Maker’s Direct Deposit Dai Module (D3M), a tool that adds DAI directly into other lending platforms, such as Compound and Aave.

This helps keep borrowing rates low and stable, making it cheaper to borrow DAI and earning MakerDAO extra income from the interest.

| Launch Date | May 2023 |

| Founded by | MakerDao |

| Audited by | ChainSecurity |

| Hacks & Controversy | No hacks to date. |

Risks and Considerations for Crypto Lending

DeFi lending is a different ballgame from centralized lending, each with a distinct set of risks and considerations.

Here are some of the main points you’ll want to think about when choosing a crypto lending service:

| DeFi Lending | Centralized Lending | |

|---|---|---|

| Relies on | Smart contract code | Business and legal processes |

| Primary Risks | Smart contract hacks, oracles | Human error, bankruptcy, default |

| Collateral Type | Crypto only | None |

| Fiat Loans | No | Yes |

| Interest Rates | Typically Variable | Typically Fixed |

| KYC | No | Yes |

| Customer Support | Minimal | Yes |

Risks and Trust

The most crucial difference between centralized and decentralized crypto lending platforms lies in who (or what) we trust.

DeFi lending platforms rely almost exclusively on computer code to manage funds and transactions. This introduces risks from hacks, malicious code, or faulty systems and oracles.

In contrast, centralized platforms require us to rely on a company to manage our crypto, ensure safe storage and transfers, and vet borrowers. This can lead to risks like loan defaults, bankruptcy, and human error.

Supported Asset Types

Centralized and decentralized crypto lending platforms also differ in the types of assets they handle.

Centralized platforms can interface with traditional finance systems. This allows features like US dollar loans secured by crypto collateral and unsecured loans backed by legal enforcement.

On the other hand, DeFi platforms are limited to crypto only. They’ll also rarely offer unsecured loans.

Interest Rates

Interest rates on DeFi platforms are algorithmically managed by smart contracts.

These adjust rates based on supply, demand, and risk factors like collateralization ratios and liquidation thresholds. This can lead to rapid changes in rates.

Centralized platforms typically offer more stable and predictable interest rates set by the company.

Know-Your-Customer (KYC)

Another advantage of DeFi lending is that it typically doesn’t require Know-Your-Customer (KYC) verification.

This increases efficiency and broadens access, regardless of geographical location, bank account access, or residency status. Anyone with internet access and a crypto wallet can participate.

Conversely, centralized platforms require thorough KYC checks, especially when dealing with fiat currencies.

Customer Support

Centralized lending platforms offer more human intervention and customer service, although this isn’t always guaranteed.

Customer support for DeFi lending protocols is often limited, as operations are automated by computer code, and sometimes, there isn’t even an identified developer or team available.

What Happened to Centralized Lending Platforms like Celsius, BlockFi, and Others?

In 2022, Terra’s stablecoin UST and its sister coin LUNA collapsed due to poorly designed mechanisms. This also sparked a wider crypto market crash.

The crash revealed significant holes in several centralized platforms, including FTX and lending platforms Celsius, BlockFi, Voyager, and Genesis. Each of the affected companies was shown to have major shortcomings in its processes and risk management—and, in some cases, fraud.

Here’s what happened to some of the major centralized crypto lending giants from that period:

Celsius Network

Summary: Filed for Chapter 11 bankruptcy in July, 2022. Executives charged with fraud.

In 2022, a bank run was triggered on Celsius customer deposits. This happened in response to a company liquidity crisis, made worse by the collapse of the Terra ecosystem.

Celsius froze customer withdrawals, swaps, and transfers to keep its ship from sinking. The company eventually filed for Chapter 11 bankruptcy on July 13, 2022. The filings revealed a $1.3 billion hole in its balance sheet, showing significant financial mismanagement.

In 2023, the FTC reached a settlement with Celsius, banning it from handling consumer assets.

Its former executives were charged with misleading consumers and misusing billions in deposits, falsely claiming it had sufficient assets before filing for bankruptcy.

The company emerged from bankruptcy at the beginning of 2024, and began distributing over $3 billion in cryptocurrency and fiat to its creditors. It also created a new Bitcoin mining company, Ionic Digital, which will continue to deliver recoveries to creditors.

BlockFi

Summary: Filed for Chapter 11 bankruptcy in November, 2022.

BlockFi grew rapidly by offering high-interest crypto deposits and raising venture capital, but faced regulatory issues in mid-2021.

This resulted in a $100 million settlement with the SEC in February 2022 for failing to register its offering of BlockFi Interest Accounts.

BlockFi’s problems worsened with substantial loans to Three Arrows Capital, which also went bankrupt in July 2022, and the ultimate collapse of FTX. This left BlockFi unable to continue its operations.

The company went bankrupt in November 2022 after FTX’s collapse, which froze $355 million of its assets and cut off a critical credit line.

BlockFi eventually reached an $874.5 million in-principle settlement with FTX and Alameda Research in March 2024 to help distribute funds to customers.

The settlement included a guaranteed $250 million payment to BlockFi, with the remaining amount depending on FTX’s efforts to repay its customers and creditors. Read More

Voyager Digital

Summary: Filed for Chapter 11 bankruptcy in July, 2022. CEO charged with fraud.

Voyager Digital’s financial troubles were triggered by the default of a $650 million loan to Three Arrows Capital and made worse by the wider market decline.

The company froze withdrawals, swaps, and transfers, leading to a small-scale bank run.

Voyager Digital filed for bankruptcy in July 2022 after the cryptocurrency market crashed. The filing revealed it had between $1 billion and $10 billion in assets and liabilities, with over 100,000 creditors.

U.S. regulators charged former Voyager Digital CEO Steve Ehrlich with fraud and making false claims about customer protections, leading to Voyager’s bankruptcy and significant customer losses.

2023 court filings showed creditors were estimated only to return around 36% of their money.

Genesis Global Capital

Summary: Filed for Chapter 11 bankruptcy in January, 2023.

Genesis’ crypto lending unit froze customer withdrawals in November 2022 due to liquidity issues exacerbated by the collapse of major crypto firms.

This greatly impacted the users of the interest-earning product Gemini Earn, who made up the majority of creditors.

Genesis Global Capital filed for bankruptcy on January 20, 2023, owing creditors $3.4 billion. Filings showed that Genesis had over 100,000 creditors and estimated its assets at $5.3 billion against $5.1 billion in debts.

The company agreed to pay $21 million to settle SEC charges related to its involvement with the now-defunct Gemini Earn program.

In May 2024, a bankruptcy judge approved Genesis Global’s plan to distribute approximately $3 billion in cryptocurrency and cash to its creditors.

Gemini

Gemini Earn was the investment program run by U.S. crypto exchange Gemini, in partnership with Genesis Global Capital.

Like the other programs, Gemini locked users out of their accounts following troubles with Genesis, who were the primary borrowers of Gemini Earn deposits.

In May 2024, More than $2 billion in crypto was returned to 232,000 Gemini Earn customers, providing a 242% return on assets locked up since January 2023. Unlike other bankrupt crypto companies, Genesis returned customers’ crypto directly, rather than liquidating the assets and paying in cash.

According to the New York Attorney General, Gemini had misled customers about the risks associated with the program. This led to a settlement of a further $50 million in crypto to be returned to Gemini Earn investors in June 2024.

FAQ

DeFi platforms typically set interest rates using algorithms that automatically adjust based on supply and demand.

If more funds are borrowed, rates go up to attract more deposits. If fewer funds are borrowed, rates go down.

These interest rates also consider risk factors to keep the platform stable.

Using a DeFi dapp is easier than ever. All you need to do is:

- Load a web3 wallet with cryptocurrency

- Connect it to the DeFi app in your browser

- Select the asset and amount you wish to lend

- Approve the transaction to lend the funds to the app.

Interest payments will accrue automatically, and no identity verification is required.

Taxes on crypto lending interest vary by country. Generally, you will owe taxes on any interest earned through both DeFi and CeFi platforms.

On the other hand, borrowing against your crypto lets you get money without selling your assets. This may avoid a taxable event.

At the time of writing, Aave is the most popular crypto lending app with a total value locked (TVL) of $10.76 billion on Ethereum.

Maker comes in second, with a TVL of $8.02 billion.

Staking involves locking up crypto to support blockchain operations and earn rewards.

Meanwhile, lending involves depositing cryptocurrencies into a DeFi platform to earn interest from borrowers.