Instead of directly purchasing Ethereum, investors can buy shares of the ETF through a traditional brokerage. This simplifies the process and increases accessibility by eliminating the need to personally handle and store the coins.

Ethereum ETFs allow investors to gain exposure to Ethereum, without the complexities involved in managing the cryptocurrency itself.

Ethereum ETF Tracker March 2026

Spot vs. Futures ETFs

There are two different types of Ethereum ETFs:

- Spot Ethereum ETFs: These ETFs hold real Ethereum, mirroring its market price in real-time. Investors get exposure to Ethereum without managing the coins themselves.

- Ethereum Futures ETFs: These invest in futures contracts, which follow Ethereum’s anticipated price movements. They carry extra risks like contract rollover costs.

Overall, Ethereum ETFs allow investors to purchase shares that represent Ethereum. They’re traded on traditional stock exchanges, simplifying the process of investing in the asset.

Ethereum ETF History

The journey of Ethereum ETFs began in late 2021 when VanEck filed with the SEC for the first Ethereum Futures ETF, followed by ProShares in May 2022.

Despite the initial excitement, these early applications did not get approved right away. However, progress was made in 2023, and VanEck’s Ethereum Strategy ETF (EFUT) was launched on October 2nd.

The momentum continued into early 2024, when the SEC approved the first spot Bitcoin ETFs in January. This sparked further interest in the sector and major asset managers like Bitwise, BlackRock, and Fidelity filed for Ethereum Spot ETFs in March. The SEC approved the sale of spot Ethereum ETFs in May 2024, after ensuring that proper measures were in place to prevent fraud, manipulation, and protect investors.

The final breakthrough came in July 2024 when the SEC approved several spot Ethereum ETFs simultaneously, leading to the launch of products from multiple firms on July 23, 2024.

This marked a major step towards making Ethereum investment more accessible through traditional stock exchanges.

Popular Ethereum ETFs

1. iShares Ethereum Trust (ETHA)

BlackRock’s iShares Ethereum Trust, trading under the ticker ETHA on NASDAQ, is the leading spot Ethereum ETF in the market

With an expense ratio of 0.25%, it offers a discounted rate of 0.12% for the first 12 months or until its assets under management reach $2.5 billion.

ETHA builds on the success of BlackRock’s iShares Bitcoin Trust and has its underlying assets stored with Coinbase Custody.

| Ticker | ETHA |

| Trades on | NASDAQ |

| Expense ratio (Fees) | 0.25% |

| Custodian | Coinbase Prime |

| Administered by | BlackRock |

2. Grayscale Ethereum Trust (ETHE)

The Grayscale Ethereum Trust (ETHE), launched in December 2017, is the oldest Ethereum investment vehicle on the market.

It was initially a traditional investment product, similar to Grayscale’s Bitcoin Trust, and later converted into an ETF. With a management fee of 2.50%, it is ten times more expensive than its competitors. ETHE is administered by BNY Mellon and the underlying Ethereum is managed by Coinbase Prime.

To offer a more affordable option, Grayscale has introduced a “Mini” Ethereum Trust, which includes a portion of ETHE’s assets and has a significantly lower expense ratio.

| Ticker | ETHE |

| Trades on | NYSE ARCA |

| Expense ratio (Fees) | 2.50% |

| Custodian | Coinbase Prime |

| Administered by | Bank of New York Mellon |

3. Grayscale Ethereum Mini Trust (ETH)

Grayscale’s Ethereum Mini Trust is a more cost-effective ETF option for investing in Ethereum, trading under the ticker ETH.

It has the lowest expense ratio of all major spot Ethereum ETFs, at just 0.15%. This is just a fraction of the 2.5% fee charged by the original Grayscale Ethereum Trust (ETHE).

ETHE holders can seamlessly transition their investments to the Mini Trust, without incurring a taxable event.

| Ticker | ETH |

| Trades on | NYSE ARCA |

| Expense ratio (Fees) | 0.15% |

| Custodian | Coinbase Prime |

| Administered by | Bank of New York Mellon |

4. Fidelity Ethereum ETF (FETH)

Fidelity, the world’s third-largest asset manager, has been involved in blockchain technology since 2014 and offers various financial products and services, including mutual funds, retirement planning, and brokerage services.

Its Fidelity Ethereum ETF, trading under the ticker FETH on the CBOE, is custodied by subsidiary Fidelity Digital Asset Services.

FETH has an expense ratio of 0.25%, but the fee is waived entirely until the end of 2024.

| Ticker | FETH |

| Trades on | CBOE BZX |

| Expense ratio (Fees) | 0.25% |

| Custodian | Fidelity Digital Asset Services |

| Administered by | Fidelity Digital Asset Services |

5. Bitwise Ethereum ETF (ETHW)

Cryptocurrency asset management firm Bitwise is known for its early efforts to launch a Bitcoin ETF, beginning in 2019.

Its Bitwise Ethereum ETF, trading under the ticker ETHW on the NYSE Arca, offers a competitive expense ratio of 0.20%. This fee is waived for the first six months or until the fund reaches $500 million in assets under management.

ETHW is administered by BNY Mellon, with the underlying Ethereum held by Coinbase Prime.

Bitwise donates 10% of its profits from ETHW to Ethereum open-source development.

| Ticker | ETHW |

| Trades on | NYSE ARCA |

| Expense ratio (Fees) | 0.20% |

| Custodian | Coinbase Prime |

| Administered by | Bank of New York Mellon |

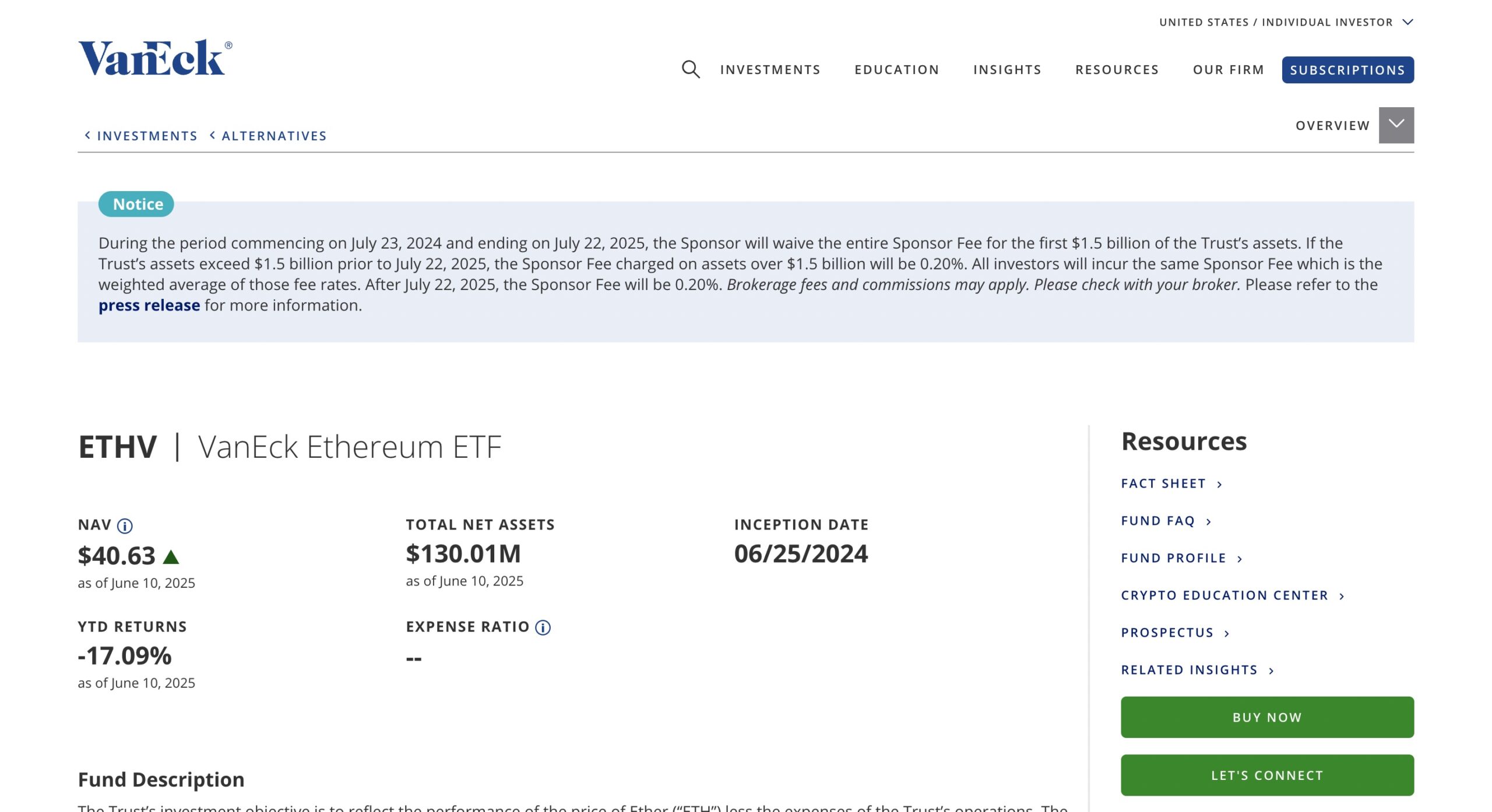

6. VanEck Ethereum Trust (ETHV)

VanEck, a global investment management firm and pioneer in the ETF industry, offers the VanEck Ethereum Trust, trading under the ticker ETHV on the CBOE.

This ETF has a management fee of 0.20%, with the underlying Ether managed by Gemini Custody.

VanEck also offers an actively-managed Ethereum futures ETF (EFUT), which was the first of its kind, launched in October 2023.

| Ticker | ETHV |

| Trades on | CBOE BZX |

| Expense ratio (Fees) | 0.20% |

| Custodian | Gemini Custody |

| Administered by | VanEck Digital Assets |

7. ProShares ETF (EETH)

The ProShares Ether ETF (ticker EETH) is a futures-based ETF, rather than a spot one.

That means instead of holding actual Ether, it invests in Ethereum futures contracts. This gives you regulated exposure to Ether, without directly owning the crypto.

It trades on the NYSE Arca and has an expense ratio of 0.95%.

| Ticker | EETH |

| Trades on | NYSE |

| Expense ratio (Fees) | 0.95% |

| Custodian | None (Futures product) |

| Administered by | ProShares |

8. Invesco Galaxy Ethereum ETF (QETH)

The Invesco Galaxy Ethereum ETF is a collaboration between Invesco and Galaxy Digital.

Invesco is best-known for its Invesco QQQ Trust, which is one of the most-traded ETFs around the world.

The fund trades under the ticker QETH on the CBOE, with an expense ratio of 0.25%.

The underlying assets are managed by Coinbase Prime and the fund is administered by BNY Mellon.

| Ticker | QETH |

| Trades on | CBOE BZX |

| Expense ratio (Fees) | 0.25% |

| Custodian | Coinbase Prime |

| Administered by | Bank of New York Mellon |

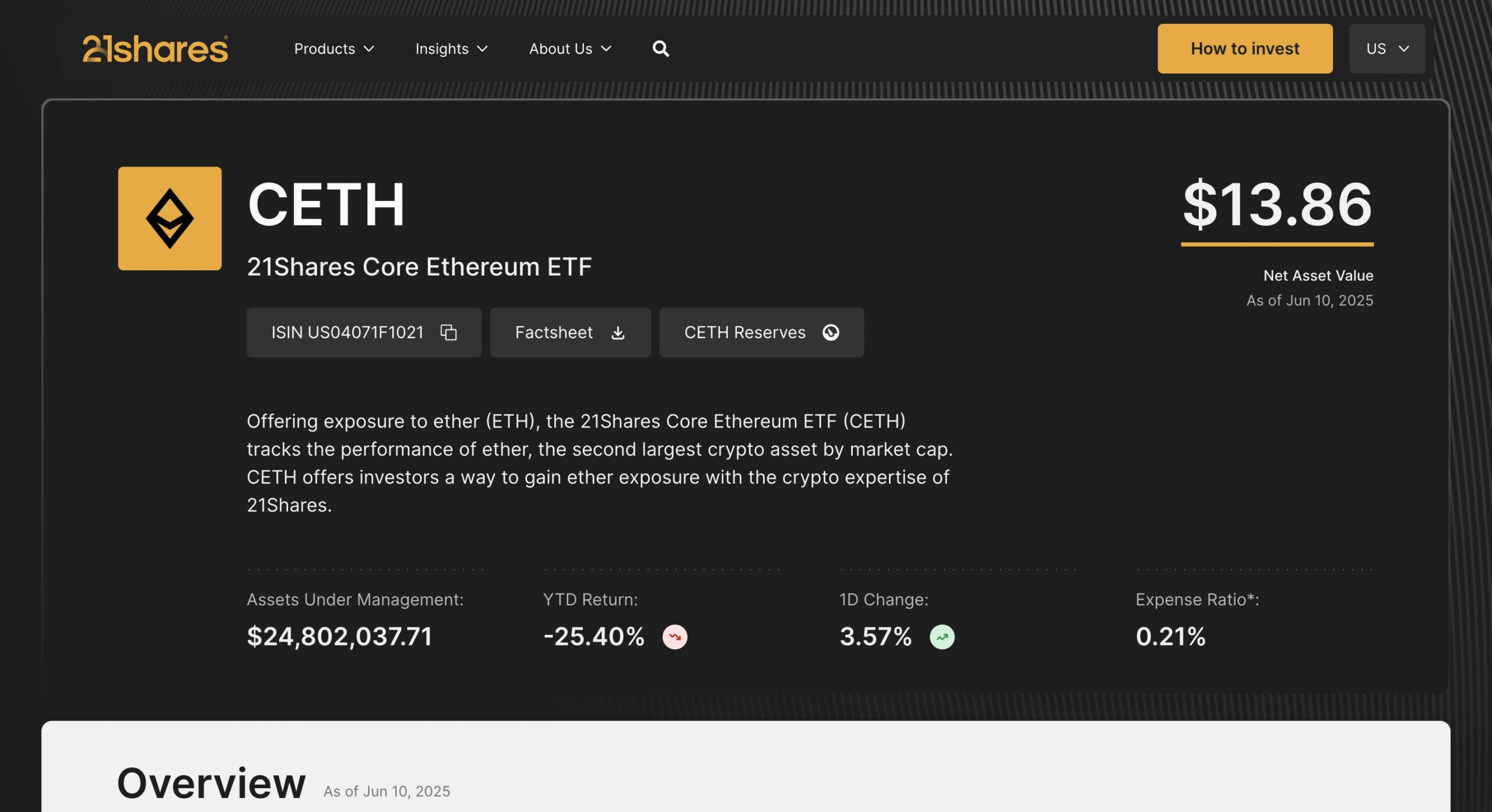

9. 21Shares Core Ethereum ETF (CETH)

The 21Shares Core Ethereum ETF, initially planned as a collaboration between 21Shares and Ark Invest, is now managed solely by 21Shares.

Trading under the ticker CETH on the CBOE, this ETF features an expense ratio of 0.21%.

CETH is administered by BNY Mellon and custodied by Coinbase Prime.

| Ticker | CETH |

| Trades on | CBOE BZX |

| Expense ratio (Fees) | 0.21% |

| Custodian | Coinbase Prime |

| Administered by | Bank of New York Mellon |

10. Franklin Ethereum Trust (EZET)

The Franklin Ethereum Trust is Franklin Templeton’s spot Ethereum ETF, trading under the ticker EZET on the CBOE.

Franklin Templeton is a global investment manager founded in 1947, recognized for its expertise in active management.

EZET has a very competitive expense ratio at just 0.19%. BNY Mellon administers the fund, while Coinbase Prime manages the underlying Ethereum.

| Ticker | EZET |

| Trades on | CBOE BZX |

| Expense ratio (Fees) | 0.19% |

| Custodian | Coinbase Prime |

| Administered by | Bank of New York Mellon |

Why Ethereum ETFs?

Ethereum ETFs offer a regulated and easy way for investors to gain exposure to Ethereum without the need to directly buy, store, and secure the cryptocurrency.

This is particularly beneficial for large financial institutions, hedge funds, pension funds, and diversified portfolio managers. Here are some key benefits:

- Regulatory Compliance: Ethereum ETFs follow strict regulations, providing a safer investment alternative compared to directly holding Ethereum.

- Ease of Access: ETFs trade on regular stock exchanges, making it simple to buy through standard brokerage accounts and avoiding the complexities of crypto-only exchanges.

- Third-Party Custody: A trusted and qualified custodian holds the underlying Ethereum for the ETF, eliminating the need for investors to manage the storage of coins themselves.

- Institutional Demand: Ethereum ETFs cater to institutional investors by fitting within traditional investment structures and regulations. This makes it easier for these investors to include Ethereum in their portfolios.

- Diversification: By adding Ethereum ETFs to their portfolios, investors can gain exposure to Ethereum without directly holding it, helping to diversify their investments and manage risk.

ETFs vs Buying Spot Ethereum

Ethereum ETFs provide a straightforward and regulated way for traditional investors to gain exposure to Ethereum through their brokerage accounts. This eliminates the need to handle the security and storage of the cryptocurrency, though it does involve management and trading fees.

On the other hand, buying Ethereum directly allows investors to own and control their Ethereum, move it between wallets, and trade at any time – often with lower fees. However, this approach requires a deeper understanding of crypto and wallet management.

| Feature | Ethereum ETF | Buying Spot Ethereum |

| Accessibility | Via traditional brokerage accounts | Via crypto exchange |

| What do Investors Own? | Shares of the ETF, not Ethereum directly | Actual Ethereum |

| Custody and Security | Held by a professional custodian | Self-custody |

| Fees | Management fee (expense ratio) and trading fees | Exchange fees |

| Market Hours | Market hours only | 24/7 |

| Ease of Use | Simple for traditional investors | Requires crypto and crypto wallet knowledge |

| Minimum Investment Amount | Dependent on ETF broker | No minimum investment |

| Withdrawable ETH? | No | Yes |

ETF Risks and Considerations

Although ETFs operate in a traditionally regulated environment, they come with a new set of risks. These could include:

- Management Fees: Ethereum ETFs have management fees that can reduce overall returns compared to directly holding Ethereum.

- Trading Hours: ETFs are limited to stock exchange trading hours, while Ethereum trades 24/7, potentially missing significant market moves.

- Custody: The ETF’s Ethereum is held by a custodian, not by you, so you don’t control your coins, even if the custodian is highly trusted.

- Non-Redeemable: Most Ethereum ETFs can’t be redeemed for the actual Ethereum, so you can’t move the coins yourself.

- Market Volatility: Ethereum’s price can be very volatile, and this volatility will be reflected in the ETF’s value despite the formal trading environment.

FAQ

An Ethereum ETF provides an easier and more regulated way to invest in Ether without dealing with the hassle of purchasing and storing it yourself.

You can purchase shares of an Ethereum ETF through a regular brokerage account, just like you would with any other stock or ETF.

Grayscale Ethereum Mini Trust (ETH) has the lowest expense ratio out of the currently available spot Ethereum ETFs, charging 0.15%.

Yes, Ethereum ETFs come with risks such as limited trading hours, third-party custody, management fees, regulations, and the inability to redeem the underlying Ethereum.

Yes, when investors buy Ethereum ETFs, it can increase demand and potentially raise Ethereum prices. This is because these ETF purchases are backed by actual Ether, bought on the open market.

Spot Ethereum ETFs hold actual Ethereum and track its market price, giving investors exposure without directly owning the cryptocurrency.

On the other hand, Ethereum Futures ETFs invest in contracts that predict Ethereum’s future price, carrying additional risks such as the costs associated with rolling over these contracts.