| Rank | DEX | 24h Volume | Market Share | 7d Trend | 7d Δ | 30d Δ |

|---|---|---|---|---|---|---|

| 1 | $892.5M |

12.3% | ▲+981.9% | ▲+1,504.0% | ||

| 2 | $845.7M |

11.7% | ▲+63.5% | ▲+24.9% | ||

| 3 | $774.5M |

10.7% | ▼-40.9% | ▼-11.1% | ||

| 4 | $429.7M |

5.9% | ▼-35.7% | ▼-57.2% | ||

| 5 | $346.5M |

4.8% | ▼-81.9% | ▼-8.2% | ||

| 6 | $313.3M |

4.3% | ▲+40.7% | ▲+417.6% | ||

| 7 | $261.4M |

3.6% | ▲+66.6% | ▲+170.6% | ||

| 8 | $245.2M |

3.4% | ▲+24.8% | ▼-5.9% | ||

| 9 | $241.5M |

3.3% | ▼-21.2% | ▲+129.4% | ||

| 10 | $215.9M |

3.0% | ▲+13.6% | ▲+3.1% |

Protocol Comparison

Why use a decentralized exchange?

DEXes, or decentralized exchanges, are platforms that allow users to trade crypto directly with each other without intermediaries.

They use smart contracts to automate the exchange process, ensuring security and transparency. Users keep control of their funds throughout the transaction, from start to finish.All that’s needed is an internet connection and a DeFi wallet.

Instead of relying on a central company or third-party individuals to safeguard funds, DEXes utilize smart contracts—self-executing code designed to minimize risks like bankruptcy, human error, or theft, provided they’re properly coded and functioning as intended.

Moreover, DeFi bridges empower users to effortlessly go multichain, moving assets across multiple blockchains to unlock new markets and opportunities.

Our Favorite DEX Exchange Apps for 2026

1. MilkRoad Swap (AMM on Ethereum & Solana)

Milk Road Swap (swap.milkroad.com) is an intuitive cryptocurrency exchange platform designed to simplify the process of swapping digital assets. Launched in March 2025, this platform was introduced by Milk Road, known widely for its popular cryptocurrency newsletter and community-driven insights into the crypto and blockchain space.

Milk Road Swap leverages the Radium Protocol and Cow Swap to power its innovative trading features, setting it apart as one of the few decentralized exchanges (DEXs) that natively supports both the Solana and Ethereum networks.

Milk Road Swap provides users with a seamless trading experience, enabling them to quickly and securely exchange a wide variety of cryptocurrencies. Built to cater both to seasoned traders and beginners, it emphasizes simplicity and transparency, reducing the complexity often associated with crypto trading. The platform features a user-friendly interface, competitive swap rates, and clear, straightforward transaction processes.

| Launch date | March 2025 |

| Powered by | Cow Swap & Raydium Protocol |

| Supported chains | Ethereum, Solana, Base, Arbitrum |

| Flagship feature(s) | Ethereum & Solana DEX in one simple interface. |

| Governance token | None |

2. Uniswap (AMM on Ethereum)

Uniswap (https://app.uniswap.org/) introduced the AMM model in 2018 and remains today’s largest decentralized exchange. It’s based on Ethereum and has been deployed on over 20 different EVM networks.

The latest version of its protocol uses concentrated liquidity pools, which let liquidity providers choose specific price ranges for their contributions. This system increases liquidity, reduces slippage, and enhances the trading experience for everyone involved.

Uniswap’s native governance token, UNI, allows users to vote on proposals and influence the future direction of the exchange.

| Launch date | November 2018 |

| Founded by | Hayden Adams |

| Supported chains | 20+ EVM chains including Ethereum, Arbitrum, Base, Polygon, and others |

| Flagship feature(s) | Largest DEX, concentrated liquidity pools |

| Governance Token | UNI |

3. Curve (Stablecoin-Focused AMM)

Curve is an AMM on Ethereum and several other EVM chains, specializing in efficient stablecoin trading.

It offers traders extremely low-slippage trades between stablecoins, while liquidity providers benefit from relatively low risk. Additional income is generated by supplying the liquidity pool to protocols like Compound and yearn.finance.

Curve pioneered the vote-locking model, allowing users to lock up its native CRV governance token for voting rights in the form of veCRV. The longer the CRV is locked, the more voting power users gain.

veCRV holders influence how much CRV each liquidity pool receives, affecting the distribution of liquidity rewards. They also earn a portion of platform fees and receive up to 2.5x boosted rewards compared to non-veCRV holders.

| Launch date | January 2020 |

| Founded by | Michael Egorov |

| Supported chains | 15+ EVM chains including Ethereum, Arbitrum, Polygon, & others. |

| Flagship feature(s) | Efficient stablecoin swaps, vote-locking system |

| Governance token | CRV |

4. Aerodrome (AMM on Base)

Aerodrome is an AMM on Layer 2 scaling network, Base. It is a fork of Velodrome, a closely related exchange on Optimism.

The exchange takes inspiration from Uniswap, Curve and Convex, combining core principles of each into a single protocol. This includes Uniswap’s concentrated liquidity pools, Curve’s stablecoin AMM, and Curve’s famous vote-locking mechanisms.

Holders of Aerodrome’s native AERO token can lock up their tokens to vote on reward distributions and to earn a share of platform fees. Rewards are auto-compounded and automatically optimized for liquidity providers.

| Launch date | June 2023 |

| Founded by | Alexander Cutler (core Velodrome team member) |

| Supported chains | Base L2, Velodrome on Optimism |

| Flagship feature(s) | Concentrated liquidity, stablecoin swaps, vote-locking |

| Governance token | AERO |

5. dYdX (Derivatives)

dYdX is the leading decentralized derivatives exchange. Launched on Ethereum in 2019, it has since moved to the Cosmos ecosystem as a highly customized app chain.

The exchange allows users to trade perpetual futures contracts for major cryptocurrencies, from Bitcoin to DeFi governance tokens, and even meme coins.

dYdX is known for offering a user experience comparable to centralized exchanges in terms of speed and latency, a notable achievement for a decentralized platform.

The platform provides a mobile app for iOS and Android, enhancing accessibility for its users.

| Launch date | April 2019 |

| Founded by | Antonio Juliano |

| Supported chains | Ethereum, Cosmos |

| Flagship feature(s) | Perpetual futures trading |

| Governance token | DYDX |

6. 1inch (Aggregator)

1inch was created during the ETHGlobal hackathon in New York in 2019, and is now the most popular DEX aggregator on Ethereum and EVM networks.

By aggregating liquidity from various DEXes, 1inch minimizes slippage and ensures users get the best rates on their trades. It also supports limit orders, which aren’t typically available on the individual DEXes it connects.

1inch has a native token, 1INCH, used for governance and staking rewards.

| Launch date | May 2019 |

| Founded by | Sergej Kunz and Anton Bukov |

| Supported chains | 10+ EVM chains including Ethereum, Arbitrum, BNB Chain, Polygon, & others |

| Flagship feature(s) | Aggregator, wallet. |

| Governance token | 1INCH |

7. Raydium (Solana AMM)

Raydium is the most popular DEX on Solana, combining AMM features with order books from Serum – a high-speed liquidity protocol. It provides efficient and low-fee trading, performing similarly to Ethereum Layer 2s.

Raydium liquidity providers can earn rewards in RAY tokens, which can be used to stake for further rewards. RAY tokens are also used to govern decisions for the exchange.

Charts are readily available for each market within the user interface, making trading decisions easier for users.

| Launch date | February 2021 |

| Founded by | Pseudonymous team: Alpha Ray, XRay, and GammaRay |

| Supported chains | Solana |

| Flagship feature(s) | Largest AMM on Solana |

| Governance token | RAY |

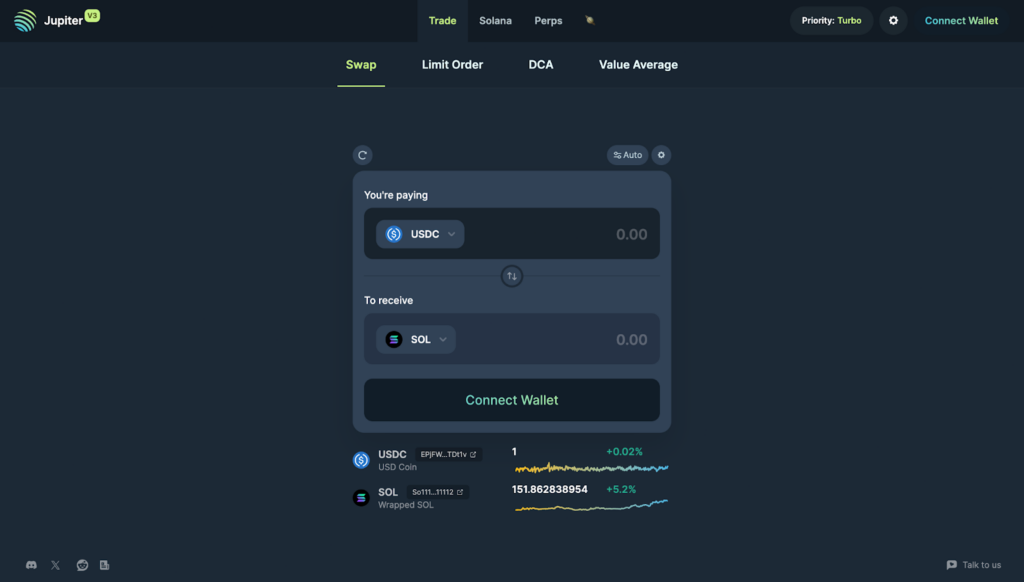

8. Jupiter (Aggregator on Solana)

Jupiter is a DEX aggregator on Solana that helps users find the best prices for their trades, by connecting to multiple DEXes.

It offers advanced features like limit orders and dollar-cost averaging (DCA), allowing users to make periodic purchases. Jupiter also supports perpetual futures trading with high leverage, bridging between blockchains, and even has a launchpad for new Solana projects.

Jupiter’s native token is JUP, which is used for governance, to incentivize user engagement, and to provide rewards within its ecosystem.

| Launch date | October 2021 |

| Founded by | Pseudonymous developer “Meow” |

| Supported chains | Solana |

| Flagship feature(s) | Aggregator, perpetual futures, token launchpad |

| Governance token | JUP |

9. ThorSwap (Cross-chain)

Unlike traditional DEXes that only support trading within the same blockchain, THORSwap enables users to trade crypto across different chains.

It uses the THORChain network to connect several blockchains, letting users swap those chains’ native assets like BTC, ETH, and others directly with each other.

The platform leverages THORChain’s RUNE token to secure the network, provide liquidity, and facilitate transactions. Users can hold and stake RUNE to participate in the network’s governance and earn rewards.

| Launch date | July 2021 |

| Founded by | THORChain community |

| Supported chains | 11+ chains including Bitcoin, Ethereum, Doge, BSC, Cosmos, and others |

| Flagship feature(s) | Cross-chain native asset swaps |

| Governance token | RUNE |

10. PancakeSwap (AMM on Binance Smart Chain)

PancakeSwap is the leading DEX on Binance Smart Chain (BSC), also deployed on 8+ other EVM blockchains.

The exchange was highly popular during the 2020-2021 bull run, serving as a user-friendly DEX for mainstream onboarding efforts thanks to its low fees and user-friendly interface.

PancakeSwap”s native token is CAKE, which is used for staking, yield farming, and participating in new token offerings. It also allows holders to vote on governance proposals and pay transaction fees on PancakeSwap.

| Launch date | September 2020 |

| Founded by | Anonymous developers |

| Supported chains | 9+ chains including Binance Smart Chain, Ethereum, Aptos, and others |

| Flagship feature(s) | Largest DEX on BSC |

| Governance token | CAKE |

11. Lyra (Options)

Lyra is a DEX best known for options trading. It lets users trade European calls and puts for Ethereum and Bitcoin.

Originally launched on Layer 2 scaling platform, Optimism, the platform has now launched its own network, Lyra Chain – a customized version of Optimism for fast, low-cost transactions.

Governance and fees are managed by the Lyra DAO and its LDX token, with fees contributing to an insurance fund for the exchange.

Version 2 of the protocol also offers perpetual futures trading and yield opportunities on derivatives and ETH restaking tokens.

| Launch date | June 2021 |

| Founded by | Michael Spain, Nick Foster |

| Supported chains | Lyra Chain and deposits from Ethereum, Arbitrum, Base, and Optimism. |

| Flagship feature(s) | Options trading |

| Governance Token | LDX |

Full list of decentralized exchanges in 2026

| DEX | 24h Volume (USD) | Fee Structure (Maker/Taker) | Supported Blockchains | # of Pairs | Launch Year | Native Token | Security Features | Unique Features / Strengths |

|---|---|---|---|---|---|---|---|---|

| dYdX (dydx.exchange) | ~$2–3 B (perpetuals volume, often top derivative DEX) | Tiered maker-taker fees (e.g. < $1M vol: 0.02% maker / 0.05% taker; higher tiers reduce to 0%/0.03%) | dYdX Layer-2 (StarkEx on Ethereum); migrating to dYdX Chain (Cosmos SDK in 2023) | ~200 markets (only derivatives, e.g. BTC-PERP, ETH-PERP) | 2019 | DYDX | Utilizes rigorously audited smart contracts with robust insurance reserves and zk-proofs ensuring fund integrity, complemented by reward-driven vulnerability testing. | Pioneers a hybrid trading experience blending CEX-like features with decentralized control, delivering high leverage perpetuals and an innovative order-book system. |

| Uniswap (uniswap.org) | ~$1–3 B (highly liquid; Dec ’24 peak ~$3.5B/day) | 0.3% swap fee (v2); v3 offers 0.05%, 0.30% or 1% tiers (no separate maker/taker) | Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, Base, Celo, Avalanche | 1,000+ (thousands across networks) | 2018 | UNI | Leverages extensively audited, open-source smart contracts with continuous bug bounty programs to ensure decentralized fund control. | Renowned as the trailblazer in automated market making, it offers multi-chain liquidity with innovative concentrated liquidity strategies and permissionless asset listings. |

| Milk Road Swap (swap.milkroad.com | N/A | .15% swap fee | Ethereum, Solana, Base, Arbitrum. | Any ERC-20 or SOL 5,300 pairs | 2025 | N/A | Security features inherited from integrations with Cow Swap and Raydium, including audited smart contracts. | Mev protection, Solana and Ethereum in one interface, cheap fees. |

| GMX (gmx.io) | ~$300–600 M (perpetual swaps; high during volatility) | 0.1% to open/close a position (perpetuals); 0.2%–0.8% swap fee (dynamic based on pool asset utilization) | Arbitrum, Avalanche | ~8 major assets (BTC, ETH, AVAX, etc. for perpetuals & swaps) | 2021 | GMX | Contracts are independently audited and secured with a multi-million dollar bounty program alongside an insurance fund that mitigates oracle-related risks. | Provides a seamless decentralized perpetuals trading experience with a proprietary multi-asset liquidity pool and user-friendly leverage tools. |

| Curve Finance (curve.fi) | ~$100–500 M (mostly stablecoin volume) | ~0.04% on stable swaps, ~0.4% on volatile pairs | Ethereum, Polygon, Fantom, Avalanche, Arbitrum, Optimism, Gnosis, etc. (many EVM) | ~100+ pools (focused on stablecoins & wrapped assets) | 2020 | CRV | Employs comprehensive audits and secure, time-locked pool configurations to minimize risk, ensuring stability for low-slippage stablecoin trades. | Specializes in optimized stablecoin trading with extremely low fees and slippage, while offering innovative vote-escrow governance that influences reward distribution. |

| 1inch (1inch.io) | ~$200–500 M (aggregated across sources; varies) | No additional taker fee (uses underlying DEX fees; 1inch liquidity pools charge ~0.3%) | Ethereum, BNB Chain, Polygon, Avalanche, Optimism, Arbitrum, Gnosis, Fantom, Klaytn, Aurora, etc. (12+ chains) | N/A (routes virtually any token pair available on underlying DEXs) | 2019 | 1INCH | Boasts multi-layer security with rigorous audits and a secure off-chain routing algorithm, reinforced by significant bug bounty incentives. | Acts as an intelligent DEX aggregator that optimizes trades by splitting orders across multiple platforms, also offering unique limit-order functionalities. |

| PancakeSwap (pancakeswap.finance) | ~$200+ M on BSC v3 (often 2nd by volume); multi-chain total higher | 0.25% swap fee (0.17% LPs/0.03% burn) on v2; v3 has 0.01%, 0.05%, 0.25%, 1% tiers | BNB Smart Chain, Ethereum, Polygon zkEVM, zkSync Era, Linea, Base, Arbitrum, Aptos, opBNB | ~1,800 on BSC (v3); 2,000+ total | 2020 | CAKE | Secured by reputable audits, enhanced with bug bounty programs and multisignature treasury controls, backed by a vigilant community. | Recognized for its rapid transactions and low fees on BSC, it offers a rich suite of DeFi and NFT features combined with an intuitive design. |

| KyberSwap (kyberswap.com) | ~$150+ M (aggregated trading volume daily) | For swaps via aggregator: no extra fee (users pay underlying DEX fee); For Kyber pools: dynamic fees ~0.008%–0.3% | Ethereum, Polygon, BNB Chain, Avalanche, Arbitrum, Optimism, Cronos, Fantom, Aurora, Base, etc. (14 chains) | N/A (aggregator across many DEX pools) | 2018 | KNC | Maintains a strong security legacy with consistent audits, dynamic routing to reduce slippage and MEV, and a proactive bug bounty system. | Integrates liquidity across multiple chains with innovative stable swap pools and advanced trading tools, delivering competitive pricing and a robust aggregation system. |

| Trader Joe (traderjoexyz.com) | ~$50–150 M (Avalanche; plus growing on Arbitrum) | 0.30% on v1 AMM; Liquidity Book v2 uses dynamic fees (volatile pairs auto-adjust fee ~0.0–0.3%) | Avalanche, Arbitrum, BNB Chain | ~500+ (across chains) | 2021 | JOE | Undergoes thorough third-party audits and incorporates proactive bounty programs, ensuring a resilient security posture with no significant breaches. | Serves as a comprehensive DeFi hub on Avalanche, combining innovative AMM mechanisms with integrated lending and NFT services, now extending to multiple chains. |

| THORChain (thorchain.org) | ~$50–100 M | Slip-based fee (dynamic % of trade size to mitigate IL) + network fee; roughly ~0.3% on moderate swaps | Native THORChain network connecting Bitcoin, Ethereum, Binance Chain (BEP2), Litecoin, Bitcoin Cash, Dogecoin, Cosmos Hub, etc. | ~10 primary pools (each external asset paired with RUNE) | 2021 | RUNE | Features ongoing security evaluations and rigorous bug bounties, with a robust bonding mechanism that ensures economic security for all native asset swaps. | Enables native cross-chain swaps without wrapped tokens, offering secure liquidity solutions along with innovative savings and synthetic asset features. |

| Raydium (raydium.io) | ~$100+ M (during Solana peaks; ~$50M typical) | 0.25% swap fee (0.22% to LPs, 0.03% to RAY staking) | Solana | ~5,300 (integrated with Serum order book) | 2021 | RAY | Underwent rigorous audits with enhanced safeguards post-incident, integrating decentralized order matching to maintain robust platform security. | Combines the benefits of AMM and order book trading on Solana, delivering rapid, low-cost trades and a launchpad for emerging projects. |

| SunSwap (sun.io) | ~$50–100 M | 0.30% swap fee (0.25% to LPs, 0.05% to SUN buyback) | TRON | ~100+ | 2020 | SUN | Leverages robust audits and bug bounty schemes while benefiting from Tron’s high-throughput, secure blockchain architecture. | Dominates the Tron ecosystem with ultra-low fees and speedy confirmations, offering a seamless, account-free trading experience integrated with staking and mining options. |

| CoW Swap (cow.fi) | ~$30–80 M | No direct fees for users – charges a small fee from trade surplus; users pay only the on-chain settlement cost | Ethereum (mainnet) + Gnosis Chain; beta on Arbitrum | N/A (any ERC-20 to ERC-20 trade) | 2021 | COW | Ensures security via comprehensive audits and innovative batch auction mechanisms that counteract MEV risks, with rapid resolution of minor vulnerabilities. | Revolutionizes trade execution through batch auctions that optimize order matching, eliminating slippage and MEV risks, all within an exceptionally user-friendly interface. |

| Hashflow (hashflow.com) | ~$25–70 M | 0% taker fee (quotes are off-chain RFQs with all costs baked into the price) | Ethereum, BNB, Polygon, Avalanche, Arbitrum, Optimism, and Solana (integrated via Hashflow 2.0) | ~150 (RFQ markets for major assets across chains) | 2021 | HFT | Adopts state-of-the-art security audits and a unique RFQ model that enforces pre-agreed pricing, with cryptographic measures for secure cross-chain transfers. | Offers a distinctive RFQ trading model that delivers fixed prices and minimal slippage, streamlining cross-chain swaps with seamless cryptographic validation. |

| Balancer (balancer.fi) | ~$20–50 M (across all pools) | Flexible fees set by pool creators (typically 0.1%–1%); no maker/taker distinction | Ethereum, Polygon, Arbitrum, Optimism, Gnosis, zkSync Era | ~100+ (flexible multi-token pools) | 2020 | BAL | Employs a multi-layered security strategy with periodic audits, emergency stop mechanisms, and multisignature controls to safeguard funds. | Enables fully customizable multi-token pools with flexible weightings, serving as dynamic index funds with innovative features like boosted rewards. |

| Osmosis (osmosis.zone) | ~$20–50 M | ~0.2–0.3% swap fee (varies by pool; set by governance, goes to LPs) | Osmosis blockchain (Cosmos SDK app-chain); connects via IBC to Cosmos Hub, Cronos, Secret, etc. | ~125 pools (ATOM, OSMO, stablecoins, etc.) | 2021 | OSMO | Secured by rigorous chain audits and a validator consensus mechanism, with proactive bug bounties and rapid incident response protocols. | Facilitates seamless IBC-enabled swaps within the Cosmos ecosystem, offering dynamic liquidity mining incentives and strong community governance. |

| Orca (orca.so) | ~$20–50 M | 0.30% swap fee (0.25% to LPs, 0.05% to ORCA treasury) | Solana | ~1,000+ | 2021 | ORCA | Undergoes strict third-party audits and bug bounty programs with DAO-led control for protocol upgrades to ensure secure operations. | Combines an intuitive trading interface with concentrated liquidity pools and eco-friendly initiatives, making it a standout DEX on Solana. |

| QuickSwap (quickswap.exchange) | ~$20–50 M (was much higher during 2021 peak) | 0.30% swap fee (0.25% to LPs, 0.05% to QUICK staking) | Polygon (Ethereum L2) | ~700+ | 2021 | QUICK | Benefits from robust third-party audits and bug bounty programs, leveraging Polygon’s secure architecture for additional protection. | A pioneering DEX on Polygon that delivers rapid, cost-effective swaps, with innovative limit order support and dual mining rewards to boost DeFi adoption. |

| Aerodrome (aerodrome.finance) | ~$20–40 M | 0.02% stable / 0.2% volatile (Solidly-style tiers) | Base (Ethereum L2) | ~200 | 2023 | AERO | Built on a securely audited Velodrome codebase, Aerodrome emphasizes rigorous security protocols and stable operational performance. | Emerging as Base’s premier DEX, it quickly captures liquidity through aggressive incentives and innovative deployment of a secure, Velodrome-derived framework. |

| Velodrome (velodrome.finance) | ~$10–30 M | 0.02% on stable pairs / 0.2% on volatile pairs (defaults; adjustable) | Optimism | ~80+ pools | 2022 | VELO | Secured through intensive audits, a substantial bug bounty program, and multi-signature community oversight, with an impeccable track record. | Optimism’s own AMM that incentivizes community participation through innovative reward locking, creating a robust liquidity mining environment. |

| DODO (dodoex.io) | ~$10–20 M | 0.30% flat swap fee (typical across pools) | Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, Avalanche, Aurora, OKChain, Moonriver, etc. (11+ chains) | ~400+ | 2020 | DODO | Features comprehensive audits and active bug bounty initiatives, with an adaptive pricing algorithm that has evolved post-incident to minimize risks. | Utilizes an innovative market-making algorithm for minimal slippage and efficient capital use, supporting flexible token addition and smart trading tools, ideal for both retail and institutional participants. |

| SpookySwap (spooky.fi) | ~$10–20 M | 0.20% swap fee (0.17% to LPs, 0.03% to xBOO holders) | Fantom Opera | ~200+ | 2021 | BOO | Maintains a high security standard through thorough audits and proactive safety tools designed to protect against common DeFi threats. | Fantom’s flagship DEX, offering ultra-low fees, built-in limit orders, and integrated cross-chain bridging, driving substantial growth in the Fantom DeFi space. |

| Minswap (minswap.org) | ~$8–15 M | 0.30% swap fee (fully to liquidity providers; adjustable via governance) | Cardano | ~100+ | 2022 | MIN | Powered by thoroughly audited Plutus contracts and Cardano’s secure eUTxO model, complemented by active bug bounty initiatives. | Dominates Cardano’s DEX landscape with fair launch principles, offering innovative liquidity concentration and dynamic fee adjustments tailored for low-cost trading. |

| Bancor (bancor.network) | ~$5–10 M (Bancor v3 post-IL-protection pause) | 0.20% typical swap fee (varies per pool; shared with BNT stakers) | Ethereum (Bancor v3), previously on EOS as well | ~100 | 2017 | BNT | As a pioneer in AMM protocols, Bancor is secured through extensive audits and a vigilant bug bounty program, with mechanisms designed to mitigate impermanent loss. | Introduced revolutionary single-asset liquidity and impermanent loss protection, simplifying token conversion through BNT and pioneering auto-compounding yield strategies. |

| HydraDX (hydradx.io) | ~$1–5 M | ~0.20% base swap fee (Omnipool dynamic pricing; all swaps route via HDX) | Polkadot (HydraDX parachain) | N/A (one Omnipool holds many assets; all pairs swap through it) | 2023 | HDX | Utilizes securely audited Rust-based contracts and leverages Polkadot’s robust validator network, featuring adaptive fees that reduce impermanent loss risks. | Features a groundbreaking Omnipool that consolidates assets for one-hop swaps, maximizing capital efficiency while harnessing Polkadot’s cross-chain security. |

| SushiSwap (sushi.com) | ~$1–5 M (across chains; lower than Uniswap) | 0.3% swap fee (0.25% to LPs, 0.05% to SUSHI stakers) | Ethereum, Polygon, Arbitrum, Optimism, Fantom, BNB Chain, Avalanche, more | ~300–500 (multi-chain combined) | 2020 | SUSHI | Ensures safety through consistent contract audits, robust timelock governance, and multi-signature controls to safeguard protocol updates. | Offers a versatile multi-chain platform with integrated yield farming and staking mechanisms, driven by strong community governance and innovation. |

| Loopring Exchange (loopring.io) | ~$1–3 M (spot trading on L2; higher during bull markets) | Orderbook: 0% maker / 0.1% taker (approx, tiered by LRC holding); AMM pools: ~0.25% swap fee | Ethereum (zkRollup Layer-2) | ~20 (major pairs on orderbook; plus some L2 AMM pools) | 2020 | LRC | Leverages zkRollup technology for rapid and secure fund withdrawals, underpinned by comprehensive audits and a proactive bug bounty approach. | A trailblazer in zkRollup-based trading, delivering high-speed, gas-free transactions and a hybrid order-book/AMM model, with a focus on user-controlled security. |

Different types of DEXes

Automated Market Makers (AMMs)

Automated Market Makers (AMMs) allow you to trade cryptocurrencies directly from a pool of tokens provided by users who earn fees for their contributions. Instead of matching buy and sell orders, AMMs use algorithms to set token prices based on the pool’s supply. This system ensures continuous trading and easy access to liquidity for everyone.

Examples: Uniswap, Curve, SushiSwap, Raydium.

DEX Aggregators

DEX aggregators are platforms that automatically find the best prices for trading crypto, by searching multiple decentralized exchanges at once. They combine the liquidity from various exchanges to ensure you get the most favorable rates and lower trading costs. This makes trading more efficient, saving you time and money.

Examples: 1inch, Jupiter, Matcha, Paraswap.

Cross-Chain DEXes

Most DEXes are traditionally single-chain, meaning you can only swap assets within the same blockchain network. Cross-chain DEXes are designed to enable users to swap between assets between different blockchains. When you swap tokens, the platform locks your tokens in one blockchain and releases the equivalent value of tokens on the other blockchain.

Examples: THORSwap, Synapse.

Derivatives DEXes

Derivatives DEXes are decentralized exchanges where you can trade financial products like futures and options that derive value from underlying assets. They allow you to bet on the future price movements of cryptocurrencies, often using leverage to increase potential profits. This provides a way to hedge investments or speculate on price changes without owning the actual asset.

Examples: dYdX, Lyra, GMX.

| AMMs | Aggregators | Cross-Chain | Derivatives | |

| Type of Trading | Same-chain token swaps | Same-chain token swaps | Token swaps across different chains | Contracts speculating on asset prices |

| Source of Liquidity | User-deposited pools earning fees | Pools from other exchanges, often AMMs | Locked tokens across different chains | Order book from users trading products |

| Benefit | Easy, permissionless trading | Finds best prices efficiently | Swap native assets between chains | Trade without owning the asset |

| Example Platforms | Uniswap, Curve, SushiSwap, Raydium | 1inch, Jupiter, Matcha, Paraswap | THORSwap, Jumper, Synapse | dYdX, Lyra, GMX |

What are the risks with a decentralized exchange?

Decentralized exchanges are still new and improving platforms, which aren’t yet perfect. Even though they eliminate a lot of human error, it’s important that you understand the risks involved in using these evolving protocols.

KyberSwap was a DEX hacked for $48 million in 2023. | Source: CoinDesk.com

Here are some DEX-specific risks that you should look out for:

- Smart Contract Bugs: DEXes rely on smart contracts. Any bugs or vulnerabilities found in the code could be exploited by hackers, leading to a loss of funds.

- Impermanent Loss: Providing liquidity to DEX pools can result in impermanent loss, where the value of your assets is lower than if you had just held them, due to market volatility.

- Scam Tokens: Many DEXes are permissionless, allowing anyone to add a token for trading without a vetting process. Some tokens may impersonate legitimate projects or have hidden features like taxes or whitelists to scam buyers.

- Rug Pulls: Some projects traded on DEXes can have dishonest leadership, who could withdraw all their liquidity from the exchange. This is commonly known as a “rug pull.”

- Complexity and User Errors: Some DEXes can be complicated to use. Mistakes in transactions or interacting with smart contracts can lead to the loss of funds.

- Lack of Support: DEXes require users to be more independent, and limited customer support for issues can result in unresolved problems.

To minimize these risks, stick to trusted and well-audited decentralized exchanges (DEXs), conduct thorough research, and manage your assets carefully. Always double-check the contract address of the tokens you are trading or choose assets from a DEX-approved list.

Conclusion

Decentralized exchanges come in various forms, creating more open and secure versions of traditional financial platforms – from spot trading to derivatives markets.

By eliminating intermediaries and human error, DEXes allow users to take advantage of new and exciting financial products while maintaining full control over their funds.

As the technology continues to evolve, DEXes are set to play a key part in the wider financial world, making markets more accessible and inclusive for everyone.

FAQ

With most DEXes, you always retain complete custody of your funds. When you sell tokens from your wallet, they are sent within the same transaction that you receive the tokens you are purchasing.

The few exceptions to this are derivatives DEXes and liquidity provision, which require you to deposit funds into a smart contract.

In either case, no company or human ever has custody of your funds. Smart contracts entirely manage the process.

Using a DEX is easier than ever. All you need to do is:

- Load a DeFi wallet with cryptocurrency

- Connect it to the DEX app in your browser

- Select the asset and quantity you wish to buy, and the asset you wish to sell

- Approve the transaction(s) to execute the swap.

The purchased tokens will be sent directly to your wallet, with no other steps required.

| DEX | 24h Volume (USD) | Fee Structure (Maker/Taker) | Supported Blockchains | # of Pairs | Launch Year | Native Token | Security Features | Unique Features / Strengths |

|---|---|---|---|---|---|---|---|---|

| dYdX (dydx.exchange) | ~$2–3 B (perpetuals volume, often top derivative DEX) | Tiered maker-taker fees (e.g. < $1M vol: 0.02% maker / 0.05% taker; higher tiers reduce to 0%/0.03%) | dYdX Layer-2 (StarkEx on Ethereum); migrating to dYdX Chain (Cosmos SDK in 2023) | ~200 markets (only derivatives, e.g. BTC-PERP, ETH-PERP) | 2019 | DYDX | Utilizes rigorously audited smart contracts with robust insurance reserves and zk-proofs ensuring fund integrity, complemented by reward-driven vulnerability testing. | Pioneers a hybrid trading experience blending CEX-like features with decentralized control, delivering high leverage perpetuals and an innovative order-book system. |

| Uniswap (uniswap.org) | ~$1–3 B (highly liquid; Dec ’24 peak ~$3.5B/day) | 0.3% swap fee (v2); v3 offers 0.05%, 0.30% or 1% tiers (no separate maker/taker) | Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, Base, Celo, Avalanche | 1,000+ (thousands across networks) | 2018 | UNI | Leverages extensively audited, open-source smart contracts with continuous bug bounty programs to ensure decentralized fund control. | Renowned as the trailblazer in automated market making, it offers multi-chain liquidity with innovative concentrated liquidity strategies and permissionless asset listings. |

| Milk Road Swap (swap.milkroad.com | N/A | .15% swap fee | Ethereum, Solana, Base, Arbitrum. | Any ERC-20 or SOL 5,300 pairs | 2025 | N/A | Security features inherited from integrations with Cow Swap and Raydium, including audited smart contracts. | Mev protection, Solana and Ethereum in one interface, cheap fees. |

| GMX (gmx.io) | ~$300–600 M (perpetual swaps; high during volatility) | 0.1% to open/close a position (perpetuals); 0.2%–0.8% swap fee (dynamic based on pool asset utilization) | Arbitrum, Avalanche | ~8 major assets (BTC, ETH, AVAX, etc. for perpetuals & swaps) | 2021 | GMX | Contracts are independently audited and secured with a multi-million dollar bounty program alongside an insurance fund that mitigates oracle-related risks. | Provides a seamless decentralized perpetuals trading experience with a proprietary multi-asset liquidity pool and user-friendly leverage tools. |

| Curve Finance (curve.fi) | ~$100–500 M (mostly stablecoin volume) | ~0.04% on stable swaps, ~0.4% on volatile pairs | Ethereum, Polygon, Fantom, Avalanche, Arbitrum, Optimism, Gnosis, etc. (many EVM) | ~100+ pools (focused on stablecoins & wrapped assets) | 2020 | CRV | Employs comprehensive audits and secure, time-locked pool configurations to minimize risk, ensuring stability for low-slippage stablecoin trades. | Specializes in optimized stablecoin trading with extremely low fees and slippage, while offering innovative vote-escrow governance that influences reward distribution. |

| 1inch (1inch.io) | ~$200–500 M (aggregated across sources; varies) | No additional taker fee (uses underlying DEX fees; 1inch liquidity pools charge ~0.3%) | Ethereum, BNB Chain, Polygon, Avalanche, Optimism, Arbitrum, Gnosis, Fantom, Klaytn, Aurora, etc. (12+ chains) | N/A (routes virtually any token pair available on underlying DEXs) | 2019 | 1INCH | Boasts multi-layer security with rigorous audits and a secure off-chain routing algorithm, reinforced by significant bug bounty incentives. | Acts as an intelligent DEX aggregator that optimizes trades by splitting orders across multiple platforms, also offering unique limit-order functionalities. |

| PancakeSwap (pancakeswap.finance) | ~$200+ M on BSC v3 (often 2nd by volume); multi-chain total higher | 0.25% swap fee (0.17% LPs/0.03% burn) on v2; v3 has 0.01%, 0.05%, 0.25%, 1% tiers | BNB Smart Chain, Ethereum, Polygon zkEVM, zkSync Era, Linea, Base, Arbitrum, Aptos, opBNB | ~1,800 on BSC (v3); 2,000+ total | 2020 | CAKE | Secured by reputable audits, enhanced with bug bounty programs and multisignature treasury controls, backed by a vigilant community. | Recognized for its rapid transactions and low fees on BSC, it offers a rich suite of DeFi and NFT features combined with an intuitive design. |

| KyberSwap (kyberswap.com) | ~$150+ M (aggregated trading volume daily) | For swaps via aggregator: no extra fee (users pay underlying DEX fee); For Kyber pools: dynamic fees ~0.008%–0.3% | Ethereum, Polygon, BNB Chain, Avalanche, Arbitrum, Optimism, Cronos, Fantom, Aurora, Base, etc. (14 chains) | N/A (aggregator across many DEX pools) | 2018 | KNC | Maintains a strong security legacy with consistent audits, dynamic routing to reduce slippage and MEV, and a proactive bug bounty system. | Integrates liquidity across multiple chains with innovative stable swap pools and advanced trading tools, delivering competitive pricing and a robust aggregation system. |

| Trader Joe (traderjoexyz.com) | ~$50–150 M (Avalanche; plus growing on Arbitrum) | 0.30% on v1 AMM; Liquidity Book v2 uses dynamic fees (volatile pairs auto-adjust fee ~0.0–0.3%) | Avalanche, Arbitrum, BNB Chain | ~500+ (across chains) | 2021 | JOE | Undergoes thorough third-party audits and incorporates proactive bounty programs, ensuring a resilient security posture with no significant breaches. | Serves as a comprehensive DeFi hub on Avalanche, combining innovative AMM mechanisms with integrated lending and NFT services, now extending to multiple chains. |

| THORChain (thorchain.org) | ~$50–100 M | Slip-based fee (dynamic % of trade size to mitigate IL) + network fee; roughly ~0.3% on moderate swaps | Native THORChain network connecting Bitcoin, Ethereum, Binance Chain (BEP2), Litecoin, Bitcoin Cash, Dogecoin, Cosmos Hub, etc. | ~10 primary pools (each external asset paired with RUNE) | 2021 | RUNE | Features ongoing security evaluations and rigorous bug bounties, with a robust bonding mechanism that ensures economic security for all native asset swaps. | Enables native cross-chain swaps without wrapped tokens, offering secure liquidity solutions along with innovative savings and synthetic asset features. |

| Raydium (raydium.io) | ~$100+ M (during Solana peaks; ~$50M typical) | 0.25% swap fee (0.22% to LPs, 0.03% to RAY staking) | Solana | ~5,300 (integrated with Serum order book) | 2021 | RAY | Underwent rigorous audits with enhanced safeguards post-incident, integrating decentralized order matching to maintain robust platform security. | Combines the benefits of AMM and order book trading on Solana, delivering rapid, low-cost trades and a launchpad for emerging projects. |

| SunSwap (sun.io) | ~$50–100 M | 0.30% swap fee (0.25% to LPs, 0.05% to SUN buyback) | TRON | ~100+ | 2020 | SUN | Leverages robust audits and bug bounty schemes while benefiting from Tron’s high-throughput, secure blockchain architecture. | Dominates the Tron ecosystem with ultra-low fees and speedy confirmations, offering a seamless, account-free trading experience integrated with staking and mining options. |

| CoW Swap (cow.fi) | ~$30–80 M | No direct fees for users – charges a small fee from trade surplus; users pay only the on-chain settlement cost | Ethereum (mainnet) + Gnosis Chain; beta on Arbitrum | N/A (any ERC-20 to ERC-20 trade) | 2021 | COW | Ensures security via comprehensive audits and innovative batch auction mechanisms that counteract MEV risks, with rapid resolution of minor vulnerabilities. | Revolutionizes trade execution through batch auctions that optimize order matching, eliminating slippage and MEV risks, all within an exceptionally user-friendly interface. |

| Hashflow (hashflow.com) | ~$25–70 M | 0% taker fee (quotes are off-chain RFQs with all costs baked into the price) | Ethereum, BNB, Polygon, Avalanche, Arbitrum, Optimism, and Solana (integrated via Hashflow 2.0) | ~150 (RFQ markets for major assets across chains) | 2021 | HFT | Adopts state-of-the-art security audits and a unique RFQ model that enforces pre-agreed pricing, with cryptographic measures for secure cross-chain transfers. | Offers a distinctive RFQ trading model that delivers fixed prices and minimal slippage, streamlining cross-chain swaps with seamless cryptographic validation. |

| Balancer (balancer.fi) | ~$20–50 M (across all pools) | Flexible fees set by pool creators (typically 0.1%–1%); no maker/taker distinction | Ethereum, Polygon, Arbitrum, Optimism, Gnosis, zkSync Era | ~100+ (flexible multi-token pools) | 2020 | BAL | Employs a multi-layered security strategy with periodic audits, emergency stop mechanisms, and multisignature controls to safeguard funds. | Enables fully customizable multi-token pools with flexible weightings, serving as dynamic index funds with innovative features like boosted rewards. |

| Osmosis (osmosis.zone) | ~$20–50 M | ~0.2–0.3% swap fee (varies by pool; set by governance, goes to LPs) | Osmosis blockchain (Cosmos SDK app-chain); connects via IBC to Cosmos Hub, Cronos, Secret, etc. | ~125 pools (ATOM, OSMO, stablecoins, etc.) | 2021 | OSMO | Secured by rigorous chain audits and a validator consensus mechanism, with proactive bug bounties and rapid incident response protocols. | Facilitates seamless IBC-enabled swaps within the Cosmos ecosystem, offering dynamic liquidity mining incentives and strong community governance. |

| Orca (orca.so) | ~$20–50 M | 0.30% swap fee (0.25% to LPs, 0.05% to ORCA treasury) | Solana | ~1,000+ | 2021 | ORCA | Undergoes strict third-party audits and bug bounty programs with DAO-led control for protocol upgrades to ensure secure operations. | Combines an intuitive trading interface with concentrated liquidity pools and eco-friendly initiatives, making it a standout DEX on Solana. |

| QuickSwap (quickswap.exchange) | ~$20–50 M (was much higher during 2021 peak) | 0.30% swap fee (0.25% to LPs, 0.05% to QUICK staking) | Polygon (Ethereum L2) | ~700+ | 2021 | QUICK | Benefits from robust third-party audits and bug bounty programs, leveraging Polygon’s secure architecture for additional protection. | A pioneering DEX on Polygon that delivers rapid, cost-effective swaps, with innovative limit order support and dual mining rewards to boost DeFi adoption. |

| Aerodrome (aerodrome.finance) | ~$20–40 M | 0.02% stable / 0.2% volatile (Solidly-style tiers) | Base (Ethereum L2) | ~200 | 2023 | AERO | Built on a securely audited Velodrome codebase, Aerodrome emphasizes rigorous security protocols and stable operational performance. | Emerging as Base’s premier DEX, it quickly captures liquidity through aggressive incentives and innovative deployment of a secure, Velodrome-derived framework. |

| Velodrome (velodrome.finance) | ~$10–30 M | 0.02% on stable pairs / 0.2% on volatile pairs (defaults; adjustable) | Optimism | ~80+ pools | 2022 | VELO | Secured through intensive audits, a substantial bug bounty program, and multi-signature community oversight, with an impeccable track record. | Optimism’s own AMM that incentivizes community participation through innovative reward locking, creating a robust liquidity mining environment. |

| DODO (dodoex.io) | ~$10–20 M | 0.30% flat swap fee (typical across pools) | Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, Avalanche, Aurora, OKChain, Moonriver, etc. (11+ chains) | ~400+ | 2020 | DODO | Features comprehensive audits and active bug bounty initiatives, with an adaptive pricing algorithm that has evolved post-incident to minimize risks. | Utilizes an innovative market-making algorithm for minimal slippage and efficient capital use, supporting flexible token addition and smart trading tools, ideal for both retail and institutional participants. |

| SpookySwap (spooky.fi) | ~$10–20 M | 0.20% swap fee (0.17% to LPs, 0.03% to xBOO holders) | Fantom Opera | ~200+ | 2021 | BOO | Maintains a high security standard through thorough audits and proactive safety tools designed to protect against common DeFi threats. | Fantom’s flagship DEX, offering ultra-low fees, built-in limit orders, and integrated cross-chain bridging, driving substantial growth in the Fantom DeFi space. |

| Minswap (minswap.org) | ~$8–15 M | 0.30% swap fee (fully to liquidity providers; adjustable via governance) | Cardano | ~100+ | 2022 | MIN | Powered by thoroughly audited Plutus contracts and Cardano’s secure eUTxO model, complemented by active bug bounty initiatives. | Dominates Cardano’s DEX landscape with fair launch principles, offering innovative liquidity concentration and dynamic fee adjustments tailored for low-cost trading. |

| Bancor (bancor.network) | ~$5–10 M (Bancor v3 post-IL-protection pause) | 0.20% typical swap fee (varies per pool; shared with BNT stakers) | Ethereum (Bancor v3), previously on EOS as well | ~100 | 2017 | BNT | As a pioneer in AMM protocols, Bancor is secured through extensive audits and a vigilant bug bounty program, with mechanisms designed to mitigate impermanent loss. | Introduced revolutionary single-asset liquidity and impermanent loss protection, simplifying token conversion through BNT and pioneering auto-compounding yield strategies. |

| HydraDX (hydradx.io) | ~$1–5 M | ~0.20% base swap fee (Omnipool dynamic pricing; all swaps route via HDX) | Polkadot (HydraDX parachain) | N/A (one Omnipool holds many assets; all pairs swap through it) | 2023 | HDX | Utilizes securely audited Rust-based contracts and leverages Polkadot’s robust validator network, featuring adaptive fees that reduce impermanent loss risks. | Features a groundbreaking Omnipool that consolidates assets for one-hop swaps, maximizing capital efficiency while harnessing Polkadot’s cross-chain security. |

| SushiSwap (sushi.com) | ~$1–5 M (across chains; lower than Uniswap) | 0.3% swap fee (0.25% to LPs, 0.05% to SUSHI stakers) | Ethereum, Polygon, Arbitrum, Optimism, Fantom, BNB Chain, Avalanche, more | ~300–500 (multi-chain combined) | 2020 | SUSHI | Ensures safety through consistent contract audits, robust timelock governance, and multi-signature controls to safeguard protocol updates. | Offers a versatile multi-chain platform with integrated yield farming and staking mechanisms, driven by strong community governance and innovation. |

| Loopring Exchange (loopring.io) | ~$1–3 M (spot trading on L2; higher during bull markets) | Orderbook: 0% maker / 0.1% taker (approx, tiered by LRC holding); AMM pools: ~0.25% swap fee | Ethereum (zkRollup Layer-2) | ~20 (major pairs on orderbook; plus some L2 AMM pools) | 2020 | LRC | Leverages zkRollup technology for rapid and secure fund withdrawals, underpinned by comprehensive audits and a proactive bug bounty approach. | A trailblazer in zkRollup-based trading, delivering high-speed, gas-free transactions and a hybrid order-book/AMM model, with a focus on user-controlled security. |

According to DeFiLlama, Uniswap is the most popular DEX at the time of writing, with $5.59 billion in total value locked (TVL) across all chains.

Curve comes in second, with a TVL of $2.17 billion.i

tDEXes are generally safe to use, as they allow you to retain control of your funds and reduce the risk of human error. However, they rely on smart contracts, which can have bugs or vulnerabilities that hackers might exploit.

Using well-audited and reputable DEXes is important, and sticking to trading trusted assets.

Yes, you will likely owe taxes on DEX trades. Buying and selling crypto, including on DEXes, is typically subject to capital gains tax.

It’s important to keep records of your trades and consult with a tax professional to ensure you comply with tax regulations.

Crypto casinos typically accept specific cryptocurrencies that your usual centralized exchange (CEX) might not support directly. If your current exchange doesn’t offer the required token, you can use a DEX to quickly swap mainstream cryptocurrencies like ETH into the exact token your chosen gambling site accepts. This seamless conversion makes DEXs an ideal bridge between popular on-ramps and the cryptocurrencies supported by your favorite crypto casinos.

| Rank | DEX | 24h Volume | Market Share | 7d Trend | 7d Δ | 30d Δ |

|---|---|---|---|---|---|---|

| 1 | PumpSwap | $892.5M | 12.3% | ▲+981.9% | ▲+1,504.0% | |

| 2 | Uniswap V3 | $845.7M | 11.7% | ▲+63.5% | ▲+24.9% | |

| 3 | PancakeSwap AMM V3 | $774.5M | 10.7% | ▼-40.9% | ▼-11.1% | |

| 4 | HumidiFi | $429.7M | 5.9% | ▼-35.7% | ▼-57.2% | |

| 5 | Uniswap V4 | $346.5M | 4.8% | ▼-81.9% | ▼-8.2% | |

| 6 | PancakeSwap Infinity | $313.3M | 4.3% | ▲+40.7% | ▲+417.6% | |

| 7 | Meteora DLMM | $261.4M | 3.6% | ▲+66.6% | ▲+170.6% | |

| 8 | Raydium AMM | $245.2M | 3.4% | ▲+24.8% | ▼-5.9% | |

| 9 | BisonFi | $241.5M | 3.3% | ▼-21.2% | ▲+129.4% | |

| 10 | Aerodrome Slipstream | $215.9M | 3.0% | ▲+13.6% | ▲+3.1% |

Protocol Comparison