Koinly Review 2024: Pricing, Plans, & Tax Features

Our Take On Koinly

THE BOTTOM LINE:

Koinly is excellent for users who don’t trade in large volumes and for those who deal internationally. The free edition helps you to get an overview of your taxes, but the platform will produce no reports unless you opt for a paid plan. It is compatible with all well-known DeFi protocols. Also, it facilitates the automatic import of NFT trades for Ethereum Virtual Machine (EVM)-based blockchains, including ETH, Polygon, BSC, and Chronos. Although automatic support for Solana and other less well-known chains is still pending, you can always manually input your NFT trades. In general, it outperforms most of its rivals regarding support for other countries. However, it falls short regarding tax-loss harvesting.

Pros

Pros

- Localized tax reports from more than 100 countries

- You can invite your accountant to handle the tax filing for you

- App has a free edition

- Accommodates 350 exchanges and more than 6000 cryptocurrencies

- Very easy to use

Cons

Cons

- Doesn’t accept cryptocurrency as payment

- Expensive for traders with large annual trade volumes

Koinly is an online platform for crypto taxes that allows you to track all your transactions and generate reports that comply with all applicable regulations. Koinly makes it easier to do this by integrating your wallets and enabling you to track trades, mining, staking, lending, and airdrops.

Koinly Overview

| Pricing | Integrations | DeFi Support | NFT Support | Tax Loss Harvesting | Tax Integrations | Blockchains Supported |

|---|---|---|---|---|---|---|

| $49-$179/year | eToro Accointing.com, YouHodler BitGo ZenGo Nexo, CoinSmart +More | Yes | Yes, primarily for EVM-based blockchains | None | 350+ wallets and exchanges | Binance Bitcoin Ethereum Polygon +More |

What Is Koinly?

Koinly is a cryptocurrency tax calculator and software for tax reporting based on your trading, mining, staking, and airdrop activity. It is useful for individual traders or investors as well as corporate or professional accountants who serve crypto investors.

The Koinly app takes a hands-off approach — all you need to do is link your exchanges, wallets, or other services using API keys, and it will take care of the rest.

Your transactions will be automatically imported. It will also calculate all market prices when you trade, match transfers within your wallets (so you won’t pay taxes on these transfers), determine your crypto gains and losses, and generate your cryptocurrency tax reports.

How Does Koinly Work?

Koinly is similar to an augmented Excel spreadsheet. It is quick and accurate in performing many calculations.

The first step is to import your transactions into the app. Next is collecting your API keys from your wallet and adding them to Koinly. You can also export the CSV file from your wallet to extract the data on Koinly.

The next step is to check that everything has been correctly imported. Again, this summary is available to you for free. Look at this as a traditional portfolio tracker app that allows you to keep tabs on all of your cryptocurrency investments across various platforms and services.

To file your taxes, either manually or with tax preparation software like TurboTax, you must export all of the Koinly-generated tax reports (you must purchase one of the available packages to do this). Forms such as Form 8949 and Schedule D can be produced by Koinly. Koinly can also create completed IRS tax forms if you are filing in the US.

Koinly Features

As one of the prominent participants in the crypto tax software market, Koinly offers several features that differentiate it from the competition.

Tax Reporting Tools

When preparing a crypto tax report, Koinly provides a variety of tools to assist you in identifying issues with your transactions and making them as precise as possible. A few of these tools are:

Deleted Transactions: Highlights issues that result in negative account balances, such as erroneous imports or missing transactions

Verification of Auto Import: use API to automatically verify your wallets to ensure all of the data was accurately imported.

Variety Of Options For Users

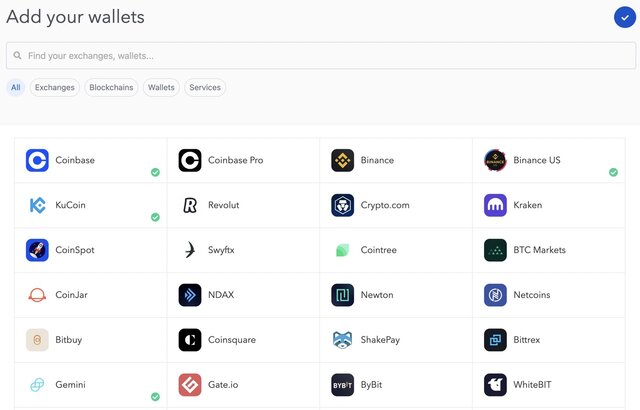

One of Koinly’s primary advantages is that it supports more than 6,000 cryptocurrencies, more than 350 exchanges, and 50 wallets — more than most of its rivals do. As a result, users may link all of their accounts to Koinly and access a comprehensive summary of their cryptocurrency holdings and transactions in one location.

Portfolio Tracking

The ability to track your portfolio is another major feature of Koinly. Using this tool, you may monitor your realized and unrealized gains while tracking the value of your crypto holdings over time.

Tax Loss Harvesting

Tax loss harvesting is easy with this platform. Koinly searches your data for opportunities to realize losses on crypto or NFTs that can be carried forward or utilized to offset gains in other parts of your portfolio, saving you money on your total tax bill.

Data Import

It also has a handy automated data import tool that lets you import transaction data from well-known exchanges — no manual data entry. This simplifies your account management and helps you to keep track of your trades.

Is Koinly Free?

Anyone can use Koinly for free, but the paid plans give you access to many services that aren’t available to free users, like access to other tax report formats (like Form 8949 and Schedule D) and custom file format imports.

Koinly Pricing And Plans

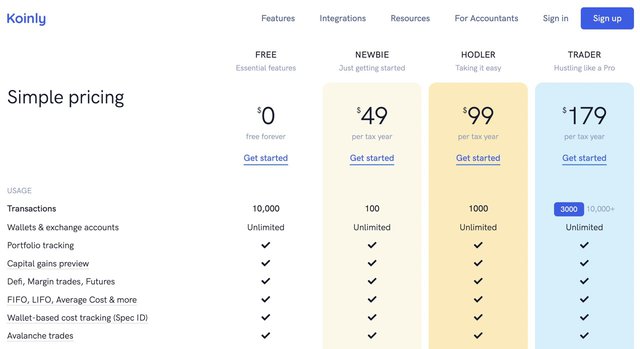

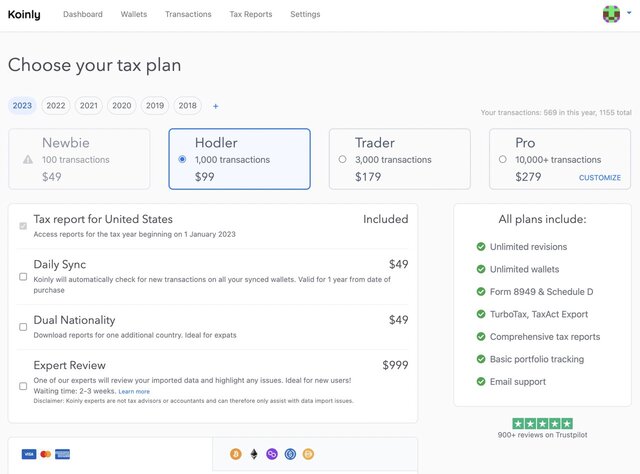

One free and three paid options are available for this program that tracks crypto portfolios and reports tax information.

Free Plan: Comes with essential features, including tracking the value of your portfolio, unlimited wallets and exchange accounts, capital gains preview, DeFi, margin trades, futures, avalanche trades, and 10,000 transactions that you may calculate

Newbie Plan: the $49 annual fee for this plan offers features including overseas tax reports, Form 8949, Schedule D, a thorough audit report, and one hundred transactions you can file and include in your account

Hodler Plan: This plan costs $99 annually and includes 1,000 transactions in addition to everything in the Newbie plan, is the next rung up.

Trader Plan: can be reviewed by experienced traders who want to get the most out of Koinly. This package, designed for professional traders, costs $179 annually. All the features from the first two plans are present, along with the ability to process up to 3,000 transactions and expert email assistance. You can also pay $279 for over 10,000 transactions if you require more.

All things considered, Koinly is an effective tax filing platform with a variety of features. It is ideal for people searching for a simple solution to manage their taxes and keep track of their portfolios.

Koinly Fees

Koinly has several plans to choose from if you want to upgrade from the free plan.

| Newbie Plan | Hodler Plan | Trader Plan |

|---|---|---|

| $49 per year | $99 per year | $179 per year |

What Countries Are Supported?

Koinly says its tax tracking program can be used by most cryptocurrency traders worldwide. The website lists support for the following countries:

| United States Canada Australia New Zealand United Kingdom Germany Sweden Denmark Finland Norway Netherlands France | Spain Italy Austria Lichtenstein Poland Czech Republic Estonia Malta Japan South Korea Singapore |

What Exchanges Are Supported?

Koinly supports more than 350 exchanges, including the following:

- Binance

- Bittrex

- Coinbase

- CoinSpot

- Crypto.com

- Gemini

- Luxor

- Phemex

You can manually enter your transactions or import your transaction history as a CSV or Excel file if Koinly does not support your exchange or wallet.

What Wallets Are Supported?

Koinly supports most wallets, including:

What Blockchains Are Supported?

Along with support for over 6000 cryptocurrencies through CSV import and manual entry, Koinly also offers automatic import for 14 blockchains, including Bitcoin, Ethereum, Litecoin, NEO, Avalanche, Polygon, Binance chain, and EOS.

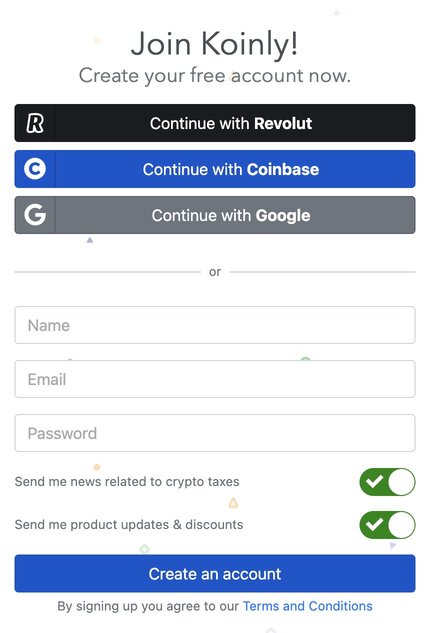

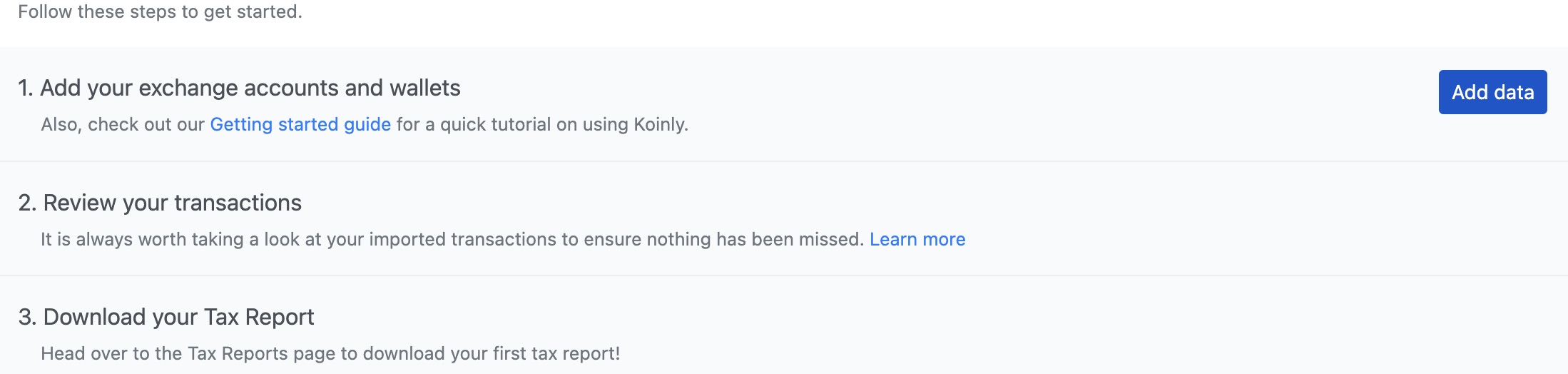

How To Sign Up For Koinly

Open a Koinly account by following these five steps:

Step 1: Visit Koinly’s website and click “Sign up.”

Step 2: Choose a password and enter your name and email. Then select “Open a profile.”

Step 3: Choose your home country and base currency from the drop-down menus. Then pick “Continue.”

Step 4: Add your wallets and import your info by auto-syncing or uploading your transaction history.

Step 5: Select “Plans” from the dropdown menu at the top-right corner to upgrade your account.

How To Upload Transaction Data With A CSV File

To upload your transaction data from another account to your Koinly account, follow these six steps:

Step 1: Go to the Wallets page.

Step2: Locate your wallet and click the three dots to open a little menu.

Step 4: Click “Import file.”

Step 5: Drag the file into the file box and then click “Browse.”

Step 6: Click “Import.”

How To Add Your CPA To Your Koinly Account

You might want to add your accountant to your Koinly account. Here’s how:

Step 1: Go to settings at the top right corner of your Koinly account after logging in.

Step 2: On the left side, select “Team.”

Step 3: Add the email address, then click “Invite” and “Send Invite.”

Koinly Security Features

Koinly is a transaction tracking service, not a trading platform. Because of that, you must set up your account as read-only — with no trading or withdrawal rights — even if you’re setting up automatic connections to your exchange accounts.

If you don’t, there is a chance that someone could compromise Koinly or gain access to your Koinly account and do serious harm.

Koinly has manuals for each of its integrations to walk you through the process of generating and integrating APIs. You can also contact Koinly support if you’re not familiar with APIs.

All API and blockchain keys you use to link your wallets and exchanges to the software are encrypted with AES-256-GCM by Koinly to protect your money. Furthermore, Koinly will never request access to your private keys (which you should never give out anyway).

Koinly Compared To Other Crypto Tax Software

Choosing the best crypto taxation platform can be tricky because so many options are available. Although Koinly is a well-liked choice, it’s not the only one. So let’s see how it stacks up against some of its biggest rivals.

| Price | Transaction Limit | Exchange Integrations | Tax Software Integrations | DeFi/NFT Support | |

|---|---|---|---|---|---|

| Koinly | $49 to $279 per year | 10,000+ | CEX/DEX | TurboTax, TaxAct, and H&R Block | Yes, primarily for EVM-based blockchains |

| TokenTax | $65–$3,499 per year | 30,000 | CEX/DEX | TurboTax only | Yes, at higher plans |

| TaxBit | $49–$299 per year | Unlimited | CEX/DEX) | TurboTax, TaxAct, H&R Block desktop, TaxSlayer | DeFi only |

| CoinTracker | $0–$199 per year | Unlimited | CEX only | TurboTax, TaxAct | DeFi at higher plans |

| ZenLedger | $49 to $999 per year | Unlimited | CEX/DEX | TurboTax | Yes |

Koinly Vs. CoinTracker

Another well-known cryptocurrency tax software application with several features comparable to Koinly is CoinTacker. While both provide some excellent tools, there are some significant distinctions between them.

While CoinTracker offers a more complete feature set, Koinly is made explicitly for tax-related uses. Both websites provide a tax calculator, portfolio tracking, and multilingual help. CoinTracker does not, however, currently offer a tax filing service.

The other difference between these two alternatives is the price. Koinly and CoinTracker each have a free plan, but Koinly’s permits 10,000 transactions, while CoinTracker’s free program only includes 25. In addition, Koinly does not offer tax reports as part of its free plan, but CoinTracker does.

For paid plans, Koinly’s start at $49 per year for the basic plan, while CoinTracker’s basic plan starts at $59 per year.

Koinly Vs. ZenLedger

ZenLedger supports over 400 cryptocurrencies, making it useful for those who buy and sell digital coins on multiple exchanges. ZenLedger can also produce a range of tax reports.

Koinly and ZenLedger provide comparable services, making it simple for cryptocurrency investors to file their taxes. They each also offer a free trial to test them out before choosing.

Additionally, both can import from all major exchanges, provide tax reports, and automatically compute capital gains using the FIFO, LIFO, and HIFO tax accounting methodologies.

There are some significant differences in their pricing structure. ZenLedger offers a Platinum plan that permits limitless transactions for an annual cost of $999, while Koinly tops out at 10,000+ transactions.

ZenLedger’s premium subscriptions also support a higher number of transactions. For example, you can analyze up to 5,000 transactions with ZenLedger’s $149 premium plan but only 1,000 transactions annually with Koinly’s most comparable plan that costs $119 annually.

Koinly Vs. TaxBit

TaxBit is another platform that lets you calculate taxes on your crypto transactions. It has integrations with over 500 centralized or decentralized exchanges, including Gemini, BlockFi, Coinbase, and more.

A big difference between Koinly and TaxBit is that the latter offers tools to help cryptocurrency companies (exchanges, marketplaces, et al) calculate taxes for their end users– it’s akin to reselling its platform to other users. In contrast, Koinly is focused on individual users.

Yet, TaxBit still offers tools for individual users to file taxes on their crypto transactions and has similar pricing to Koinly save for its highest Pro plan, which costs $500 per year.

Koinly Vs. TokenTax

TokenTax is one of leading crypto tax filing platforms globally. You can import your transaction data from multiple crypto exchanges and wallets, and TokenTax will calculate the appropriate taxes for you. This platform has integrations with hundreds of exchanges, including popular ones like Binance, BitMex, Coinbase, Kraken, etc.

TokenTax is a significantly more expensive tool than Koinly. Its lowest plan costs $65 annually, compared to $49 for Koinly, and its highest plan costs $3,499 annually, a far cry from Koinly’s $279.

Final Thoughts On Koinly

By gathering all pertinent data, computing it, and presenting it in an orderly, transparent, and IRS-ready way, Koinly is great for streamlining your cryptocurrency tax activities.

The sheer number of supported exchanges and wallets, as well as newer cryptocurrency services like lending or cloud mining platforms, separates it from its primary competitors.

Prices are a little higher than the competition. Still, this software offers excellent value, especially if you engage in advanced crypto activities like margin trading or borrowing/lending.

Frequently Asked Questions

Koinly has a free plan, which gives you limited access to its services. However, you can upgrade to the paid plans if you need access to more features.

No, Koinly doesn’t report to the IRS but provides you with data you can use for your tax reporting.

Yes, it is safe. The API function grants Koinly read-only access so it can import your transactions and the interest you’ve earned by lending, staking, or conserving crypto assets. However, it does not grant Koinly the ability to move or trade on your behalf.

Yes, you can safely connect Koinly to Coinbase or any other exchange since Koinly only has read-only API rights.

Yes, Koinly is entirely functional in Canada.

Koinly supports TurboTax, and you can import data directly from the Koinly website. However, remember that Turbotax only allows a total of 1,000 transactions.