Best DeFi Exchanges 2024

What Is A Decentralized Exchange (DEX)?

A decentralized exchange is a trading platform that lets you swap cryptocurrencies offered by other traders. Sounds like a regular exchange, right? Not quite. Decentralized exchanges run as apps on the blockchain rather than being run by a centralized company.

Traders like you provide tokens to what’s called a liquidity pool, allowing you as a trader to swap Token A for Token B from the pool’s supply. Cool. And all this happens from the security of your own crypto wallet. That’s right. You don’t have to transfer your crypto onto a centralized exchange to trade. Also cool.

Decentralized exchanges don’t have withdrawal fees, withdrawal limits, or pesky trading rules that benefit the exchange rather than the traders. You know—by the people, for the people. But DEXs also come with a learning curve. Don’t worry. We’ll help you find your way around the developing DEX world in typical Milk Road style. Onward, and bring your adventure hat.

Top DeFi Exchanges For April 2024

- Uniswap: Best For Token Selection

- ParaSwap: Best For Low-Cost Swaps (Outside US)

- CoW Swap: Best For Peer-To-Peer Swaps

- Firebird Finance: Best For DEX Newbies

- OpenOcean: Best For cross-Chain Swaps

- 1inch: Best For Large Swaps (Outside US)

| DEX | Fees | Availability | Supported Blockchains |

|---|---|---|---|

| Uniswap | 0.3% | Worldwide | Ethereum Polygon Optimism Arbitrum Celo |

| ParaSwap | Varies | Outside US | Ethereum Polygon BSC Avalanche Fantom Arbitrum Optimism |

| CoW Swap | VariesFree limit orders | Worldwide | Ethereum Gnosis |

| Firebird Finance | Varies | Worldwide | Ethereum Fantom Cronos BSC Avalanche Arbitrum Optimism Canto |

| OpenOcean | Varies | Worldwide | 20 total, including: Ethereum BSC Arbitrum Polygon Solana Tron |

| 1inch | Varies | Outside US | Ethereum BSC Polygon Optimism Arbitrum Gnosis Avalanche Fantom Klaytn Aurora |

Uniswap

Uniswap is the largest DEX by trading volume, bringing a wider range of tokens and deeper liquidity pools. The DEX combines an easy-to-use interface with easy-to-understand fees. Uniswap’s new Auto Router helps you get the best price by using multiple pools if needed.

Pros

- Wide selection of tokens

- Helps users avoid scams with warnings when purchasing rarely traded tokens

- Simple fee structure

Cons

- Fees higher than some competitors

- Limited blockchains

- No limit orders

Want a DEX that’s so easy to use that you can recommend it to Mom? That’s Uniswap. But you might have to explain crypto wallets and ETH gas fees first. Uniswap has a massive user base, with about 5 million users to date and a huge selection of tokens. Quoted prices include both USD values and token values, removing the cost mystery you might find on other DEXs.

- People who want to keep things simple: DEXs can be as daunting as drunken Jenga, but Uniswap makes DEX swaps simple. You’ll find one box in the middle of the screen. No endless endless tables or complicated charts. Just enter your trade, and you’re swapping like a pro.

- People who need a larger selection of tokens: As the grandaddy of DEXs, Uniswap attracts hordes of eager traders, which also attracts liquidity providers hungry for yield. Whether it’s a common token or something new, there’s a good chance you’ll find it on Uniswap.

- CoW Swap: If you live in the ETH world, your ETH is more valuable than gold. CoW Swap lets you save your precious ETH by paying for any fees with the tokens you’re selling.

- OpenOcean: OpenOcean is a DEX aggregator that helps you find the best swap rates on 20 supported blockchains. You can even do cross-blockchain swaps. (More on that later.)

ParaSwap

Pros

- Supports limit orders

- No fee for limit orders

- Automatically selects the best choice, but lets you compare

Cons

- US traders blocked from transactions

- Fees for outside DEXs not displayed

In a word: limit orders. Okay, two words. Other DEXs offer similar routing for swaps, choosing the most efficient swap out there. But many don’t support limit orders that let you choose an exact buy or sell price for your swap. The caveat: If you choose a limit price outside the trading range, your order might sit there until the end of time. Be sure to set a date for expiry.

- People who want to use limit orders: Due to automated market makers (we discuss those in a bit), DEX pricing isn’t exactly a precise tool. If you’re an exacting type of trader. You can set the price you want with a limit order.

- People who want peer-to-peer orders: Struck up a deal with someone to swap some crypto? Use Paraswap’s OTC feature to set up a peer-to-peer transaction that’s safe. Your funds stay in your wallet until the trade is executed for both parties.

- 1inch: Both ParaSwap and 1inch are available to non-US traders. 1inch can break up large swaps into smaller batches to help you get the most tokens for your trade.

- OpenOcean: If you need support for more blockchains, OpenOcean has you covered. In total, this DEX aggregator supports 20 blockchains ranging from Ethereum and layer 2 networks to Solana and Tron.

CoW Swap

Pros

- No charge for failed transactions

- No fee for limit orders

- Peer-to-peer swaps

- Prevents frontrunning

Cons

- Limited blockchain support

CoW Swaps does something different: The CoW protocol helps prevent frontrunning, which is a common occurrence that quietly costs traders money every day. Bots run around the internet looking for profitable trades that haven’t been validated yet. Then, these diabolical bots duplicate the trade with a higher gas fee, jumping ahead in line. The result: a sub-optimal trade for you — and profits for the bot. It’s called Maximal Extractable Value (MEV), and CoW prevents this from happening by executing peer-to-peer trades as well as using batch auctions.

- Ethereum users: For now, CoW Swap is mostly an Ethereum thing. Gnosis is also supported, but Abritrum, Polygon, and Optimism users have to swap elsewhere. Mooo.

- People who want to use limit orders: The feature is still in Beta (read: might be broken), but limit orders are live on CoW Swap. And they’re free. CoW Swap executes the limit order trade with a small spread, giving you an exact-price swap without fees.

Firebird Finance

Pros

- Compare swap price to outside market

- Automatically cancels the trade if the price changes unfavorably

- Earn FBA tokens for trades

Cons

- Easy-to-miss slippage settings

- Doesn’t display DEX choices for swaps

- Limited tokens

Firebird Finance rewards users with tokens you can stake to earn a percentage of earnings from the protocol. And with nine popular blockchains supported, those earnings create passive income as the platform grows. The Firebird interface is pleasant to use and shows the routing for your trade. A handy price chart helps you understand the price direction before you click the swap button.

- People who want a passive yield: Buy or earn FBA tokens you can stake to earn a percentage of the protocol’s earnings.

- Traders on Cronos or Fantom blockchains: Ethereum and Abitrum DEX aggregators are easy to find. But for still-growing blockchains like Cronos (17 DEXs) or Fantom (16 DEXs), Firebird Finance can be a lifesaver, allowing you to find the best prices on swaps.

OpenOcean

Pros

- Cross-chain swaps

- Limit orders

- 20 blockchains supported

Cons

- Doesn’t always detect tokens in wallet

- Confusing for newbies

- Minimum trade amounts

Swaps, limit orders, cross-chain swaps, leveraged perpetual swaps — what’s not to like? The main downside to using OpenOcean is that maybe it does too much. This isn’t the place to send your buddy from work who wants to learn how to DeFi. But if you’ve got a bit of crypto experience under your belt, OpenOcean gives you plenty of toys to play with and a suite of tools to maximize your trading profits.

- People who use multiple blockchains: Remember when you got to the register at a store and then realized you left your wallet in the car? Crypto is like that. Sometimes the funds you need are somewhere else, sitting on another blockchain. OpenOcean is like sending your buddy out to the car to get your wallet. Problem solved. Now you can use your funds. OpenOcean lets you swap tokens like a superhero, leaping across blockchains. And you only have to wait a few minutes.

- People who use limit orders: OpenOcean aggregates the liquidity pool inventory of more DEXs than you can count, but sometimes you want a specific price point. OpenOcean lets you create limit orders at a specific price point, which can be handy in a volatile market.

- Firebird Finance: Both OpenOcean and Firebird Finance expand their list of supported networks to include BSC (BNB Smart Chain), Cronos, and others, as well as Ethereum and popular compatible layer 2’s (Abitrum, Optimism).

- ParaSwap: If you live outside the US, ParaSwap is another powerful DEX aggregator with a simpler interface.

1inch

Pros

- Simple-yet-powerful interface

- Limit orders

- Peer-to-peer trades

Cons

- Not available in the US

Price impact is one of the most challenging parts of using DEXs. Basically, as you buy more from the pool, the price increases — sometimes by a lot. 1inch automatically splits your swap between several pools if needed to minimize the price impact and get the tokens you need at the best price possible.

- People outside the US: 1inch is one of our favorite DEX aggregators, but you can’t use it in the US. Rats. It’s really good.

- People who want peer-to-peer transfers: Want a secure way to trade tokens once you’ve struck up a deal? 1inch lets you set up the swap and copy a link to the online trade. Nice and safe. Similarly, you can also set up limit orders on 1inch.

- OpenOcean: If you need a more powerful set of tools, Give OpenOcean a look-see. You’ll still get limit orders for precise trades, but you’ll also get the ability to do cross-blockchain swaps (but you can’t do both at once).

- CoW Swap: Ethereum peeps will love CoW Swap, the DEX that lets you keep your ETH. Many trades can even be done without using a DEX through CoW Swap’s peer-to-peer trades.

How Do DEXs Work?

A DEX holds a pool of tokens that traders can swap. Sometimes the pool holds just two types of crypto, like ETH and GMX, or sometimes they hold several types of tokens. If you had ETH and wanted to buy GMX, you could swap your ETH for GMX and vice versa.

Where do these pool tokens come from? Well, they come from other traders who want to earn a yield by providing liquidity to the pool. Liquidity just means the ability to trade. Without a pool, there’s nothing to trade, and what fun is that? Liquidity providers are key to the system.

Some DEXs take a cut of the swap fees generated by the DEX, with the bulk of earnings going to the liquidity providers. But this doesn’t mean DEX fees are high. Uniswap, the top DEX by volume, charges a 0.3% fee on swaps. That’s less than you’ll pay to trade on Coinbase, and you don’t have to move your tokens onto a third-party platform to trade. Your tokens never leave your comfy crypto wallet until you confirm the swap in your wallet.

Another benefit: DEXs have hard–to–find tokens that haven’t made it onto major exchanges yet.

How Do DEXs Make Money?

Some DEXs take a cut of the fees collected on the platform—but not all DEXs. For example, Uniswap doesn’t take a cut of fees. The 0.3% fee collected on Uniswap goes to the liquidity providers.

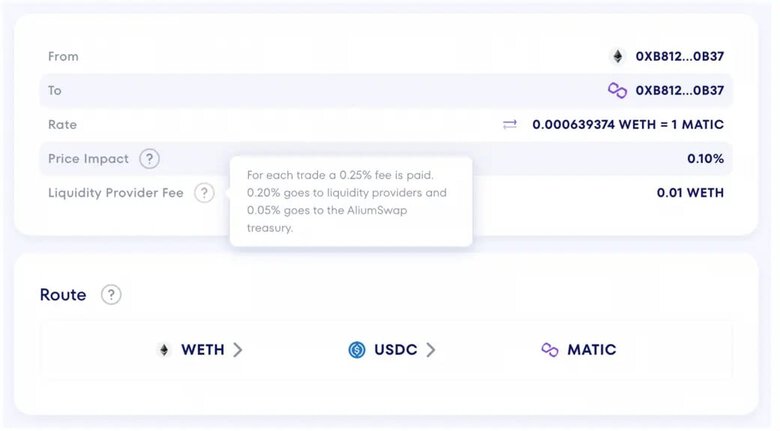

By contrast, Alium Finance takes a sliver of the fees for the treasury.

DEXs work on a governance model, meaning that people who hold governance tokens can vote on future changes to the DEX. If the community votes for the DEX to keep a percentage of fees, the developers make it happen.

In other cases, like limit orders on CoW Swap, the trade executes with a small price buffer. The exchange or treasury keeps the spare change.

In general, the bulk of earnings typically goes to the liquidity providers, who are just traders like the rest of us. It’s a much different model compared to centralized exchanges, where the exchange keeps 100% of trading fees.

Automated Market Makers

Most DEXs use a mechanism called automated market makers (AMMs) to calculate the swap exchange rate. The goal of an AMM is to keep the pool balanced. If the trade volume only went one way, the pool would quickly be drained of one of its tokens. For instance, in an ETH/GMX pair, the GMX tokens would go to zero while ETH piles up. No more trades for you. And no reason for liquidity providers to fund pools.

Automated market makers are designed to always provide liquidity (at any price). They do this by increasing or decreasing the price of swapped tokens based on demand in the pool. Under the hood, there’s a constant product formula at work that calculates the exchange rate for each swap.

Let’s say you have a pool with ETH and MANA, the token for the Decentraland metaverse. Most DEXs require liquidity providers to fund the pool with a 50/50 split. Based on current prices, that would be 1 ETH to 2775.36 MANA.

As traders swap ETH to load up on MANA, the price of MANA in the pool increases and the price of ETH decreases to keep the pool value balanced. The creeping price of MANA in this example is called price impact, a price variance compared to the starting value. It’s something to watch out for on DEXs. Smaller pools can see a BIG difference in price as you buy more of a token from the pool.

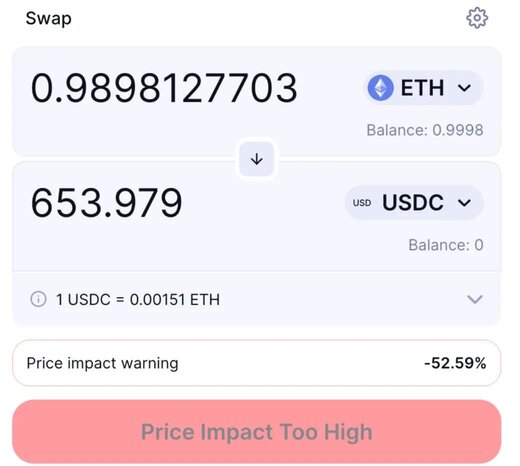

Here’s an example from Uniswap where the swap would have caused a HUGE price impact.

Currently, ETH is at $1,776, which means the swap should yield about 1,723 USDC (a stablecoin pegged to $1) after the 0.3% fee. Instead, we get only $653 USDC. Why? Because the swap is draining the small supply of USDC — and the AMM is raising the price of each additional USDC token. Liquidity at any price, remember?

Just like in diving, deeper pools are better—and be careful about (price) impacts.

This is an extreme example, but the price for swaps can get a bit slushy compared to precise price limit orders on centralized exchanges that use order books.

Remember, others are trading from the same liquidity pool, so prices can change for that reason as well. (The AMM adjusts prices to keep the pool balanced.) Most DEXs let you set the slippage, which helps keep your trade value closer to the DEX price quote when your trade executes. If the slippage value isn’t set, there’s no telling how much you’ll pay. Who likes surprises? But if you set the slippage too low, the transaction might fail — leaving you with nothing but the tokens you started with and a pile of fees.

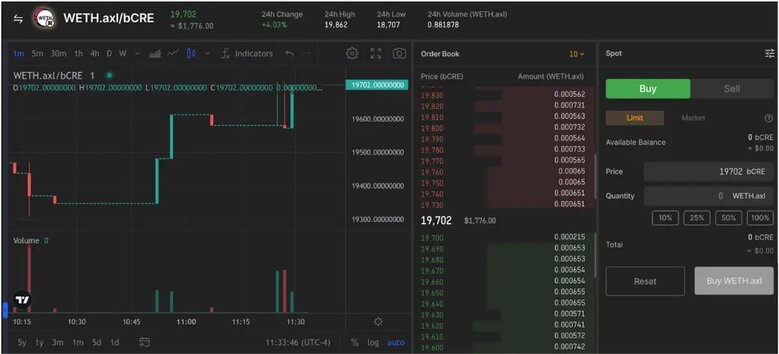

Some DEXs use order books instead of AMMs. Let’s have a look.

Order Book DEXs

Fixed prices on a DEX? How does that even work? It’s possible, and here’s how: Buyers and sellers submit orders to the DEX. Essentially, the orders are contracts to buy or sell a fixed quantity of tokens at a fixed price. This creates a book of orders. Sellers on the top, buyers on the bottom. If you’ve traded stocks or traded crypto on an advanced trading platform, it should look pretty familiar.

With a book of open orders, traders can trade with more precision. At a glance, you can see the open orders and available quantities.

- A market order fills your order from the existing orders on the exchange’s order book.

- A limit order adds your order to the book.

If your limit order is within the trading range, there’s a good chance that market order traders will take some or all of your position, Or, your order might be matched up with another limit order on the other side of the trade. Awesome. There’s also a chance it might sit there forever, unmatched, like a shy teen at a high school dance. Yeah, that can happen if the trading range moves.

Trading book DEXs are shiny, new stuff. The largest DEXs still use AMMs to manage swaps, which means you might not find less common tokens on order book DEXs, at least not yet. There just aren’t as many buyers and sellers. But that’s likely to change over time, giving traders the option of using either type of DEX (AMM or Order Book).

You may not need to use an order book DEX to get a precise trade. ParaSwap, OpenOcean, and CoW Swap are just a few DEXs that offer limit orders so you can set your own price.

DEX Aggregators

Remember when we talked about price impact and the effect AAMs can have on prices? It’d be cool if someone came up with a way to just find the best deal. Cool indeed, and that’s what DEX aggregators do.

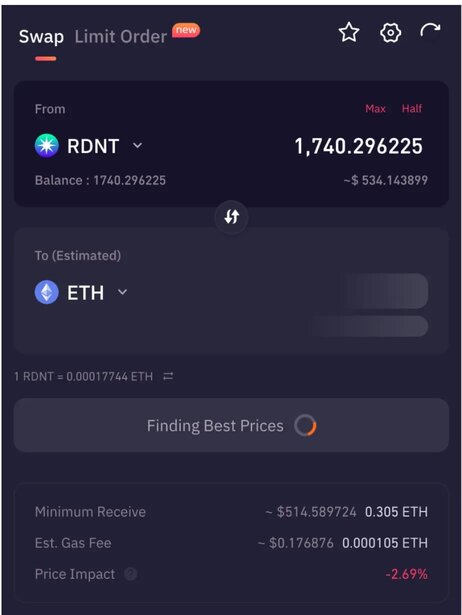

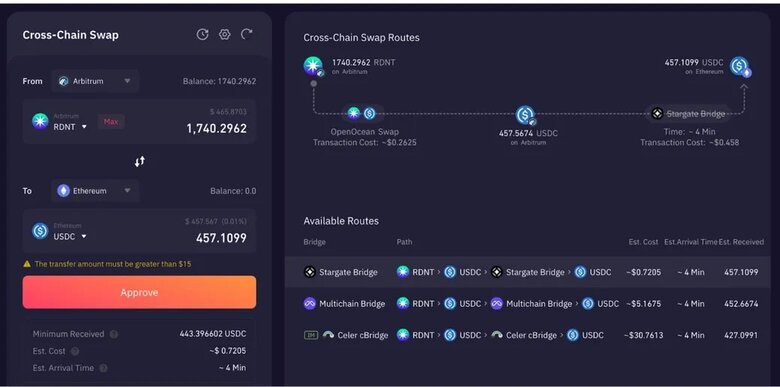

Here’s OpenOcean searching for the best deal on RDNT to ETH.

DEX aggregators query the DEXs scattered all over the internet, so you don’t have to try the trade on each one manually. Some DEX aggregators show you a list of options. Others, like OpenOcean and 1inch, just show you the best swap available.

Multichain DEXs/Layer 2 Support

It’s a big multichain crypto world out there, and DEXs can help you make swaps on multiple blockchains.

- Layer 2 Support: Most of the larger DEXs support multiple blockchains, meaning you can make swaps on Ethereum, Polygon, Abitrum, or others. Layer 2 blockchain chains offer faster and cheaper transactions compared to Ethereum. But what if you have tokens on Network A that you want to swap for tokens on Network B? That’s where Cross-chain DEXs come in.

- Cross-Chain DEXs: These DEXs can bridge tokens across blockchains and perform swaps at the same time. Be sure to check the exchange rate before you start clicking buttons, though. Cross-chain DEXs make several hops, so it can be a bumpy ride. But some cross-chain swaps work out great.

Here’s a cross-chain swap on OpenOcean, Bridging RDNT on the Abitrum network to USDC on the Ethereum network.

The cost in this example is cheaper than doing an RDNT to USDC swap on Abitrum and then using a crypto bridge to move the USDC to Ethereum. Faster too.

Benefits Of A DEX

- Cheap Transactions: DEX swap fees are less costly than trading on most exchanges. Typically, you’ll pay about 0.25% to 0.3% in swap fees. By comparison, Coinbase Advanced charges 0.4% for limit orders and 0.6% for market orders.

- Better Token Selection: DEXs have more tokens than your typical exchange. Also, new tokens typically make their debut on DEXs or through airdrops. If you’re looking for the next 100x, the odds are probably better that you’ll find it trading on DEXs than on centralized exchanges.

- Trade Directly From Your Crypto Wallet: DEX swaps don’t require you to transfer your crypto to an exchange to trade (and hope it’s not the next exchange to crash). You trade directly from your wallet. Nice and secure.

DEX Risks

- Slippage/Price Impact: DEXs that use AMMs (most of the DEX world) can lead to paying more than you expected for a swap. As you buy more, the price goes up. But this is less of an issue with larger pools. Always check the price against the outside market to be sure you’re still in the box.

- Smart Contract Risk: DEXs run on smart contracts, which are just computer programs. Once you get past about one line of code, the chances of bugs or exploits increase. Smart contract risk is likely a bigger threat to liquidity providers than to traders, but you never know.

- Centralization: What if your decentralized exchange isn’t so decentralized at all? What’s to stop the developers from changing the code on the fly? Nothing, really. Word will get out quickly, but not before the damage is done.

- Rug Pulls: Not too long ago, the ArbiSwap DEX enticed users to buy and stake the ARBI token. Then, the developers pulled the liquidity from the ARBI pool. This same type of rug pull can happen with any scammy token. For example, someone can create a token, hype it as the next big thing on social media, sell a bunch through a DEX for valuable crypto (like ETH), and then pull the liquidity. The rug pullers now have ETH, and buyers have worthless tokens. Boooo.

- Fake Tokens: Anyone and their pet poodle can make an ERC-20 Ethereum-compatible token. And they can name it anything they want, including names similar to the token you want to buy. Some DEXs, like Uniswap, flash a warning message if a token you’re swapping to isn’t traded on major exchanges. That’s your cue to double-check your work before clicking any buttons.

How To Pick A Decentralized Exchange

There are more DEXs out there than you can shake a stick at these days, and that’s a good thing. But too many choices can be overwhelming. Chances are that you’ll choose one or two as your main squeezes — but you won’t need twenty. Before you start connecting wallets like Tim Taylor rewiring home appliances, there are a few things to consider.

- Ease Of Use: Uniswap is still the top DEX for three reasons. It’s easy to use, it has A LOT of tokens, and everyone likes unicorns. Ease of use is what makes it sticky, though. Life’s hard enough. Why choose a difficult DEX?

- Blockchain Support: We really like Cow Swap, but it only supports Ethereum and Gnosis. If that’s enough for you, give it a try. Many of us need more options. The table at the top gives you a breakdown of supported networks. OpenOcean is particularly strong in this regard, with 20 supported blockchains.

- Fees: Most DEXs charge 0.25% to 0.3% for swaps. Others offer some free options, like no charge limit orders. A better way to look at it is to examine how many tokens you get for your trade, fees included. That’s what really matters. DEX aggregators like OpenOcean are great at this.

- Security: Visit the about page or the project page on GitHub and look for information on audits. DEXs run on smart contracts, and many projects use third-party audit firms to ensure the code is secure.

- Additional Features: If all you’re doing is basic swaps, a well-established DEX like Uniswap or a DEX aggregator like 1inch will do the trick. But if you need limit orders or cross-chain swaps, you might want to consider OpenOcean.

To Sum It Up

Centralized exchanges are a common onramp for crypto buyers, but once you have some crypto, the DEX world is your oyster. DEXs can even be a less costly way to trade, but you’ll want to learn the ropes first. Try some test trades without completing the swap. Like everything in crypto, once you get the hang of it, you’ll wonder why you waited so long.

Frequently Asked Questions

Some DeFi Exchanges, like CoW Swap, offer free limit orders. Most standard swaps range from 2.5% to 0.3% in swap fees. Fees are only part of the equation, though. Examine how many tokens you receive in exchange for your swap after fees. That’s what really matters.

Mobile wallets like Coinbase Wallet or MetaMask have built-in swaps. But you’ll have more control over the transaction when using a web app like Uniswap or OpenOcean.

The real way to measure what’s cheapest is to compare how many tokens you’ll get in exchange when making a swap. Fees play a smaller role in this than you might think. Instead, it often comes down to how many tokens are in the liquidity pool you’re using with the exchange. Apps like Uniswap can use multiple pools to help ensure you get the most value for your swap.

No. Binance is a centralized exchange with a management team making day-to-day decisions for users on the platform. A decentralized exchange runs on the blockchain using programs called smart contracts. Decisions for decentralized exchanges are made by the community through a voting process.