BlockFi Bankruptcy: Everything You Need To Know

BlockFi Bankruptcy And Timeline

THE BOTTOM LINE:

Shortly after the bankruptcy filing of FTX, BlockFi, a well-known crypto lending company with financial ties to FTX, also filed for Chapter 11 bankruptcy in a New Jersey court. The November 28, 2022, BlockFi filing leaves some 100,000 creditors without an immediate way to access funds. The largest of these creditors is owed a reported $729 million. Following the filing, BlockFi had $256.9 million in cash on hand. While the bankruptcy leads current headlines, at least part of the trouble for embattled crypto-lender BlockFi dates back to trades initiated in 2020.

How BlockFi Went Bankrupt

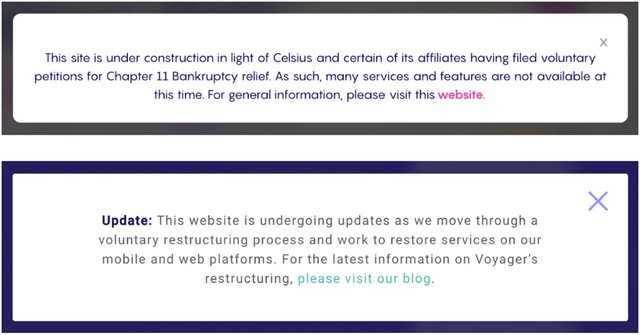

June and July 2022 were tough months in the crypto industry, following the collapse of Terra Luna in May, which in part led to the fall of Three Arrows Capital (3AC), a crypto hedge fund, as well as Celsius Network and Voyager Digital, both BlockFi competitors. BlockFi temporarily escaped the fallout through support from FTX, a collaboration that later proved calamitous. Ultimately, a $680 million loan default by Alameda, sister company to FTX, played a key role in BlockFi’s insolvency, as detailed in BlockFi’s bankruptcy filing.

Four primary factors led BlockFi to this position.

- GBTC arbitrage

- Three Arrows Capital loan default

- FTX collapse

- Alameda loan default

GBTC Arbitrage

Several events contributed to a weakening financial position for BlockFi, beginning with an arbitrage gambit in 2020 in which BlockFi and other institutional players like Three Arrows Capital deposited BTC into the Grayscale Bitcoin Trust (GBTC), later selling their GBTC shares after the six-month lockup period expired. At the time, GBTC traded at a premium to the fund’s BTC asset value. BlockFi paid 5% to 6% to customers who lent their Bitcoin to the platform and paid 2% in management fees to Grayscale, but the fund was trading as high as 20% above its net asset value. The arbitrage trade drove considerable profits for BlockFi and other institutions.

Then, the tides turned.

By February 2021 shares in the GBTC fund began to trade at a discount to net asset value. Arbitrage players got caught upside down in the trade and were unable to sell their GBTC shares due to the lockup period as the discount grew larger. Unconfirmed estimates point to BlockFi losses tied to GTBC trades as high as $64 million based on 2020 trades and $220 million in 2021. Today, GBTC trades at a 48% discount to the fund’s asset value. Although reportedly owning as much as 5% of the fund previously, BlockFi has since severed ties with GBTC and announced it was unwinding loans that use GBTC as collateral.

Three Arrows Capital Strikes Again

Like others in the CeFi lending industry, like now-shuttered Celsius and Voyager, BlockFi lent to Three Arrows Capital. The lending decision ended badly for both Celsius and Voyager, with both lenders now in bankruptcy proceedings.

BlockFi faces reported losses of up to $80 million on a defaulted $270 million loan made to Three Arrows Capital (also in bankruptcy), after liquidating 3AC’s collateral, part of which was GBTC shares.

FTX, once heralded by some as a white knight within the crypto space, agreed to a plan that could patch the hole in BlockFi’s sinking balance sheet. The July agreement provided a $400 million credit line to BlockFi with an option for FTX to acquire BlockFi for up to $240 million, depending on performance metrics. BlockFi’s bankruptcy filing lists FTX as an unsecured creditor, with BlockFi owing FTX $275 million borrowed from the $400 million line of credit.

FTX Collapse Ends BlockFi Liquidity

The well-publicized fall of FTX Trading and associated businesses Alameda Research and FTX.us brought an end to BlockFi’s credit facility. Reportedly, BlockFi attempted to access the remaining $125 million on November 8th but didn’t receive the funds. FTX CEO Sam Bankman-Fried filed bankruptcy petitions for FTX, Alameda, and FTX.us on November 11th.

In BlockFi’s bankruptcy hearing, an attorney for BlockFi revealed that the crypto lender still had $355 million in trading assets frozen on FTX.

Alameda Defaults On $680 Million Loan

BlockFi’s own bankruptcy petition from November 28th points to a $680 million loan made to Alameda, which is now in default as Alameda is also in bankruptcy.

In a possibly related event, BlockFi has sued Emergent Fidelity Technologies, a holding company owned by Bankman-Fried, over collateral pledged for a loan to an unnamed borrower. BlockFi’s complaint alleges that it never received the collateral, speculated to be about $400 million in shares in the stock and crypto trading platform Robinhood, a company in which Bankman-Fried has a large stake. BlockFi also named ED&F Man Capital Markets as the company holding the collateral.

BlockFi Files For Bankruptcy In New Jersey Court

After a series of financial hits, FTX’s collapse led to increased withdrawals at BlockFi as customers rushed to remove funds from the FTX-affiliated lender.

In a tweet thread dated November 8th, BlockFi founder and COO Flori Marquez reassured the market, indicating that the company was fully operational, then going on to detail risk management and discuss transparency.

By November 10th, BlockFi paused client withdrawals, marking the moment in a now-famous tweet citing the lack of clarity surrounding the status of FTX and FTX-related companies.

On November 28th, Jersey City-based BlockFi filed for Chapter 11 bankruptcy in a New Jersey court, indicating more than 100,000 creditors. Estimated assets and liabilities were each declared to be between $1 billion and $10 billion. Several BlockFi entities under BlockFi, Inc. are listed in the bankruptcy petition.

Who Was Involved?

Much of BlockFi’s recent storyline detailed above revolves around the big names found in headlines throughout 2021 and 2022. Three Arrows Capital’s loan default set the snowball rolling. FTX and Alameda Research played roles as well. FTX provided temporary liquidity before later freezing trading assets belonging to BlockFi. Simultaneously, Alameda defaulted on a $680 million loan from BlockFi as the Bankman-Fried crypto empire collapsed in a matter of days.

Grayscale Bitcoin Trust, while a vehicle used for arbitrage, didn’t contribute directly to BlockFi’s downfall through any actions on the part of the trust or its parent company, Digital Currency Group (DCG). (Although DCG is navigating a crisis of its own, with its lending company Genesis Trading also suspending withdrawals following the FTX collapse.)

BlockFi’s leadership team managing the crisis includes:

Zac Prince – CEO & Founder

Flori Marquez – COO & Founder

Amit Cheela – Chief Financial Officer

Yuri Mushkin – Chief Risk Officer

Rob Loban – Chief Accounting Officer

What Happened To BlockFi Users And Their Money?

BlockFi customers with outstanding deposits or assets held on the platform are now among over 100,000 unsecured creditors disclosed in BlockFi’s recent bankruptcy filing. The crypto lender owes over $1 billion to the top four unsecured creditors combined:

- Ankura Trust: $729 million

- FTX: $275 million

- Undisclosed: $48 million

- US Securities and Exchange Commission (SEC): $30 million

BlockFi’s bankruptcy petition lists another 40+ unsecured creditors with balances ranging from $1 million to $28 million. Other smaller creditors remain unnamed.

A Chapter 11 bankruptcy petition is a reorganization rather than a permanent closure and liquidation of assets. This means BlockFi hopes to emerge from bankruptcy and resume business in some form after restructuring. Chapter 11 petitions typically involve the petition itself, which asks for relief from the court, and a reorganization plan, which details the company’s proposals to emerge from bankruptcy.

Chapter 11 creditors are not required to file a proof of claim if the amount owed is scheduled, meaning that the company has detailed its obligations to creditors in court documents. However, if BlockFi later converts its bankruptcy case to Chapter 7 bankruptcy (closure and liquidation), creditors would need to file proof of claim with the court.

If there’s a ray of hope for BlockFi creditors, it’s that BlockFi immediately submitted a bankruptcy plan, whereas BlockFi competitor Celsius has yet to submit a plan following its July bankruptcy filing.

Who gets paid, what amounts will be paid, and when payments can be made still remain to be seen. Part of the resolution depends on third parties, such as FTX, Alameda, and Three Arrows Capital, and the results of their own bankruptcy cases. If BlockFi is able to collect money allegedly owed by other parties, that may help the situation considerably. However, it could take months or even years to untangle the complicated web of claims, counterclaims, and counterparties.

Cryptocurrencies still fall into a legislative gray area, with only limited regulatory oversight. As such, the US federal government does not provide an insurance fund for crypto investors or depositors, such as SIPC insurance for stock investors or FDIC insurance for bank depositors.

In the interim, BlockFi is maintaining an FAQ page regarding the bankruptcy and providing updates on the situation in blog posts on the site.

BlockFi History

Zac Prince (CEO) and Flori Marquez (COO) founded BlockFi in August 2017, the same year competitors Celsius and Voyager Digital launched. February of 2018 brought the first round of funding, giving the new company $1.5 million of operating cash. Later funding rounds involving big names like Peter Thiel, Winklevoss Capital, and Morgan Creek Digital gave BlockFi a strong start in the competitive new niche of crypto lending and credit services.

Over the next several years, BlockFi sought to “redefine banking” by offering secure storage, crypto-backed loans, and yield-earning opportunities. However, the latter was later abandoned in some jurisdictions, following an SEC fine of $50 million, $30 million of which is still among BlockFi’s unsecured debt obligations. The settlement included an additional $50 million to be paid to 32 individual US states.

Reports put BlockFi’s loan book at $7.5 billion in 2021, with customer deposits of up to $20 billion. The company was valued at $3 billion in March of 2021, followed by a $1 billion valuation during a 2022 funding round.

BlockFi’s Downfall: A Historical Timeline

March 2019: BlockFi launches yield products. BlockFi enabled customers to deposit crypto assets in exchange for a yield that varied by asset type, sometimes with yields as high as 6% APY.

October 2020: BlockFi makes GBTC trades. In an arbitrage move that later proved difficult to exit, BlockFi began depositing BTC from customers participating in the company’s yield product into the Grayscale Bitcoin Trust. At the time, the fund was trading at a sizable premium to the assets held by the fund.

July 2021: NJ bans BlockFi interest-bearing accounts. New Jersey was first, followed by 31 other states that deemed BlockFi’s interest-bearing product to be unregistered securities.

February 2022: BlockFi fined $100 million. Following issues with New Jersey and other states, the SEC levied a hefty fine. In the final settlement, BlockFi owed $50 million to the SEC, with another $50 million split between the states that filed cease and desist orders.

May 2022: Terra Luna collapses: In a widely reported event that shook the crypto world, Terra Luna’s algorithmic stablecoin lost its $1 peg, eventually trading down to $0.02. Many in the crypto community held the coin in the Anchor protocol, which paid yields approaching 20% APY.

July 2022: Three Arrows Capital files for bankruptcy. Singapore-based Three Arrows Capital filed for bankruptcy following the Luna collapse. BlockFi was among several high-profile creditors to the crypto hedge fund. BlockFi’s losses on the $270 million loan reportedly reached $80 million.

July 2022: FTX offers financial help. FTX and BlockFi inked an agreement that extended a $400 million credit line to BlockFi, also giving FTX the option to purchase BlockFi for an amount ranging from $25 million up to $240 million, depending on performance.

November 2022: FTX collapses. In early November 2022, FTX suffered a liquidity crunch amid a spate of withdrawals. The mass exodus followed a revelation that the balance sheet for its sister company, Alameda Research, was largely filled with FTX-minted FTT tokens of dubious value. In a matter of days, FTX CEO Sam Bankman-Fried filed for bankruptcy on behalf of FTX, Alameda, and FTX.us. Carnage from the collapse included $355 million in BlockFi trading funds trapped in FTX accounts and a default on a $680 million loan made to Alameda by BlockFi, according to court hearings.

November 2022: BlockFi pauses withdrawals. Customers with deposits on BlockFi were unable to withdraw following a wave of withdrawals in the preceding days.

November 2022: BlockFi files Chapter 11. BlockFi filed a bankruptcy petition in a New Jersey court, accompanied by a bankruptcy plan detailing possible ways to emerge from bankruptcy.

November 2022: BlockFi sues Sam Bankman-Fried’s holding company. In an attempt to recover collateral for a loan to an unnamed borrower, BlockFi filed a lawsuit against Emergent Fidelity Technologies, another company owned by Bankman-Fried. Reportedly the collateral comprises shares in Robinhood, of which Sam Bankman Fried owns 7.6 percent.

To Sum It Up

Similar situations at Celsius and Voyager Digital haven’t gone well for creditors thus far, but bankruptcies can take months or years to reach conclusion. Add in the complexity of so many companies with intertwined liabilities and BlockFi’s situation becomes more challenging. BlockFi’s attorneys have told the court that the company’s priority is to maximize client recoveries.

Frequently Asked Questions

Yes. While it’s still unknown how much BlockFi owes relative to the company’s assets, BlockFi has filed a bankruptcy petition for relief from creditors while the company works on a reorganization plan.

In February 2022, BlockFi settled a case with the SEC in which BlockFi agreed to pay $50 million in fines to the SEC and another $50 million to US states that took issue with BlockFi’s business practices. The legal troubles stemmed from BlockFi’s interest-bearing crypto accounts, which dozens of US states and the SEC deemed to be unregistered securities.

BlockFi is a privately owned company, but Coinbase Ventures, Coinbase’s venture capital arm, participated in a $4 million funding round for BlockFi in 2019.